The Average Directional Index (ADX), created by J. Welles Wilder in 1978, measures trend strength on a 0–100 scale without showing direction. Traders apply ADX to confirm trends, filter trade entries, and avoid range-bound markets, making it a key tool for assessing market momentum.

While understanding ADX Indicator is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What Is the ADX Indicator?

The Average Directional Index (ADX) is a technical indicator that measures the strength of a trend, regardless of direction. It helps traders determine whether the market is trending or consolidating.

Since ADX builds on foundational trading concepts, beginners may benefit from first exploring our Forex beginner’s guide before applying it in live markets.

ADX is a non-directional oscillator, meaning it only measures the magnitude of the trend, not whether it’s bullish or bearish. A high ADX value can signify a strong uptrend or a strong downtrend.

To determine the trend’s direction, ADX is plotted with two other lines from the same system:

- Positive Directional Indicator (+DI): Measures upward price movement.

- Negative Directional Indicator (−DI): Measures downward price movement.

This indicator is versatile and applied across all asset classes. While the default setting is typically a 14-period lookback, traders can adjust this parameter to fit their strategy.

How to Read ADX Indicator?

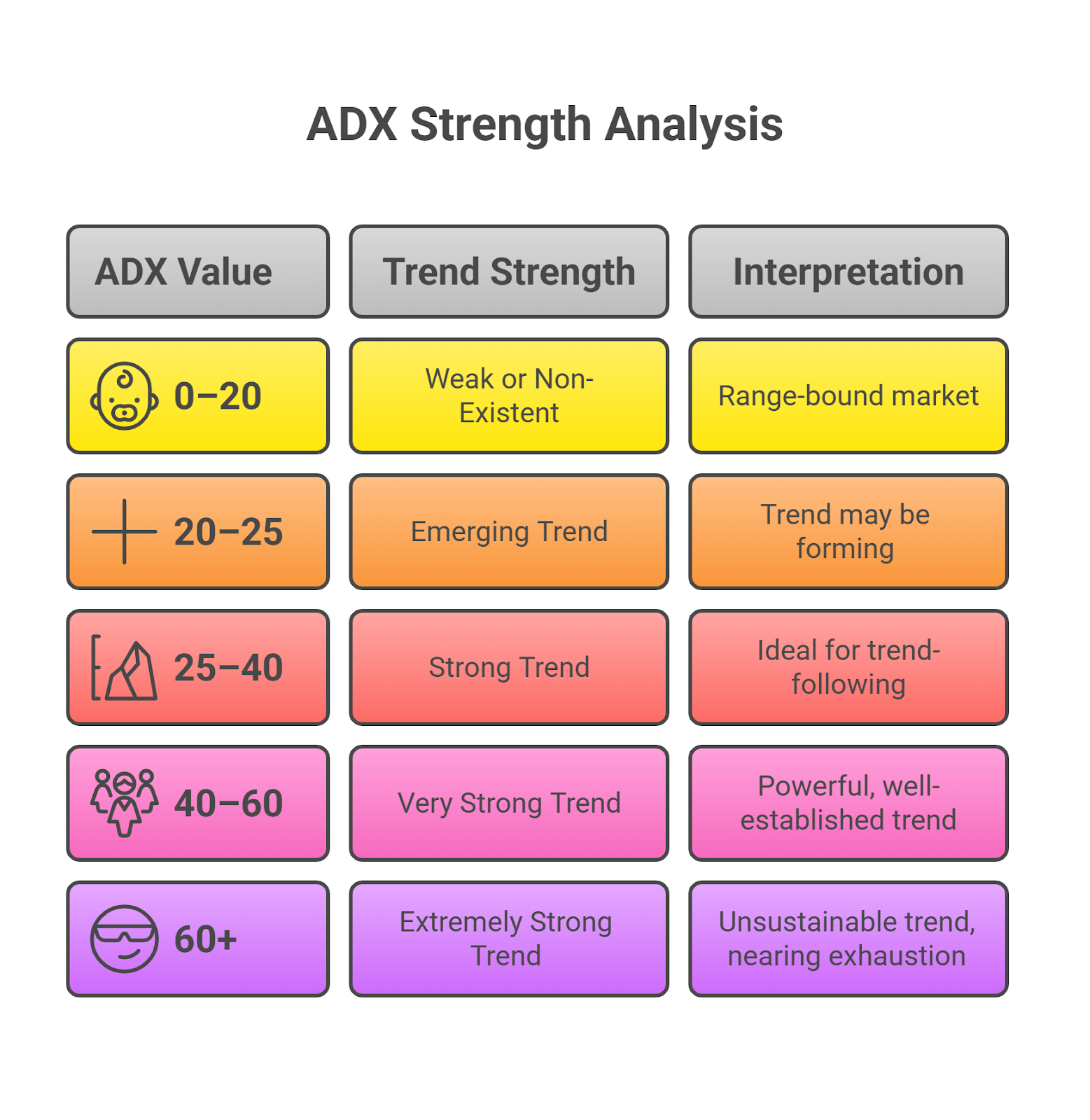

Interpreting ADX values requires understanding specific thresholds that signal the strength of a trend. The slope of the ADX line is also important; a rising slope indicates a strengthening trend, while a falling slope suggests a weakening trend.

| ADX Value | Trend Strength | Interpretation |

| 0–20 | Weak or Non-Existent | The market is range-bound or “choppy.” Trend-following strategies are unlikely to work well. |

| 20–25 | Emerging Trend | A trend may be starting to form. This is a gray area requiring confirmation. |

| 25–40 | Strong Trend | A clear and strong trend is in place. This is an ideal condition for trend-following strategies. |

| 40–60 | Very Strong Trend | The trend is powerful and well-established. |

| 60+ | Extremely Strong Trend | These levels are rare and often indicate an unsustainable trend that may be nearing exhaustion. |

Combining Strength and Direction with +DI/-DI

Once the ADX confirms a strong trend (typically above 25), you use the DI lines to trade with it.

- Bullish Crossover (Uptrend): When the +DI line crosses above the −DI line, it signals a potential start to an uptrend. If ADX is above 25, this confirms bullish momentum.

- Bearish Crossover (Downtrend): When the −DI line crosses above the +DI line, it signals a potential start to a downtrend. If ADX is above 25, this confirms bearish momentum.

Think of the ADX line as a filter: DI crossovers that occur when ADX is below 20 are often unreliable and can lead to false signals in choppy markets. This is why many traders filter signals with ADX before executing entries.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTop 5 ADX Trading Strategies

Here are five practical ADX trading strategies for different market conditions.

1. DI Crossover + ADX Filter

This is the classic trend-following strategy.

- Entry:

- Buy: Enter a long position when +DI crosses above −DI and the ADX is above 25.

- Sell: Enter a short position when −DI crosses above +DI and the ADX is above 25.

- Exit: Exit when the DI lines cross back or when the ADX line turns down, signaling a weakening trend.

2. Breakout Confirmation

ADX is excellent for validating breakouts from consolidation patterns.

- Entry: After a price breakout from a range, wait for the ADX to rise above 25. This confirms the breakout has momentum. Enter in the direction of the breakout.

- Exit: Exit if the ADX starts to decline, suggesting momentum is fading.

3. Trend Pullback Entry

This strategy aims to enter an established trend during a temporary pullback.

- Entry: Confirm a strong trend with an ADX reading above 25. Identify a pullback to a key moving average (e.g., 20 or 50 EMA) and enter in the direction of the trend once the price bounces.

- Exit: Exit if the price closes decisively on the other side of the moving average.

4. Divergence for Trend Weakness

Divergence between price and ADX can signal that a trend is losing momentum.

- Setup: The price makes a new high, but the ADX line fails to make a new high (and may be falling).

- Action: This is not an entry signal. Use it as a warning to tighten stops or look for an exit, as the trend is weakening.

5. Range Trading with Low ADX

When the ADX is below 20, it signals a range-bound market, ideal for oscillators.

- Setup: Confirm the ADX is below 20 and identify a clear support and resistance range.

- Entry: Use an oscillator like RSI to buy at support when oversold and sell at resistance when overbought.

Best ADX Settings for Forex, Stocks, and Crypto

While the default 14-period setting works well for most swing trading, you can optimize it for different markets and trading styles.

| Market Type | Recommended Setting | Rationale |

| Forex | 14-period (Default) | Major currency pairs are less volatile than stocks or crypto, making the default setting a balanced choice for daily and 4-hour charts. |

| Stocks | 12 to 18-period | Stock trends can be persistent. A slightly longer setting (e.g., 18) can help filter out noise on daily charts for position traders. |

| Crypto | 18 to 21-period | The crypto market is known for high volatility. A longer period helps smooth the ADX line, reducing false signals from sharp, brief price spikes. |

| Day Trading | 7 to 10-period | A shorter setting makes the ADX more sensitive to price changes, which is necessary for identifying momentum shifts on lower timeframes (e.g., 5-min, 15-min). |

Pros and Cons of the ADX Indicator

Like any tool, the ADX has strengths and weaknesses.

- Excellent at Measuring Trend Strength: Its primary job is to tell you if a market is trending or ranging, which helps in choosing the right strategy.

- Filters Out Choppy Markets: A low ADX reading (<20) is a clear signal to avoid trend-following strategies, saving you from frustrating trades.

- Versatile Across Markets: It can be applied to forex, stocks, crypto, and commodities on various timeframes.

- Lagging Indicator: It confirms a trend after it has already started, which can lead to late entries.

- Non-Directional: It only tells you if a trend is strong, not if it’s up or down. You must use the +DI/-DI lines for direction.

- Can Be “Whipsawed”: In markets that are transitioning from range to trend, the ADX can fluctuate around the 25 level, giving unclear signals.

ADX Variations and Alternatives

While Wilder’s original ADX is the standard, several variations have been developed to address its limitations, particularly its lag.

- Adaptive ADX: This version automatically adjusts its period length based on market volatility, aiming to be more responsive in fast-moving markets and smoother in calm ones.

- Vortex Indicator (VI): Similar to the ADX, the Vortex Indicator uses two oscillating lines (VI+ and VI-) to identify the start of a new trend and confirm its direction. Some traders find it provides earlier signals than the DI crossover.

For the Math Enthusiasts: The Detailed ADX Calculation

For those who want to understand the mechanics, here is the step-by-step formula.

- Calculate Directional Movement (+DM, -DM) and True Range (TR).

- <code>+DM = Current High – Previous High</code>

- −DM = Previous Low – Current Low

- True Range (TR) is the greatest of: (Current High – Current Low), |Current High – Previous Close|, or |Current Low – Previous Close|.

- Smooth the values using Wilder’s 14-period technique.

- This creates the Smoothed +DM, Smoothed -DM, and Average True Range (ATR).

- Calculate the Directional Indicators (+DI & −DI).

- +DI = 100 * (Smoothed +DM / ATR)

- −DI = 100 * (Smoothed -DM / ATR)

- Calculate the Directional Movement Index (DX).

- DX = 100 * ( |(+DI) – (-DI)| / ((+DI) + (-DI)) )

- Calculate the ADX.

- The ADX is a 14-period smoothed moving average of the DX value.

Combining ADX with Other Indicators (Comparison Table)

ADX works best as part of a comprehensive trading system. Combining it with other indicators can provide confluence and improve signal quality.

| Indicator | How It Complements ADX |

| Moving Averages (MA) | MAs help identify trend direction and potential support/resistance levels. Use ADX to confirm the trend’s strength before taking a signal from an MA crossover or bounce. |

| RSI / Stochastics | These oscillators identify overbought/oversold conditions. They are most effective in ranging markets (ADX < 20). In a strong trend (ADX > 25), overbought/oversold signals can be misleading. |

| MACD | The MACD is a momentum indicator that can also show trend direction. A bullish MACD crossover combined with a rising ADX > 25 is a strong confirmation signal. |

| Bollinger Bands | Bollinger Bands measure volatility. When bands widen and price “walks the band,” a rising ADX can confirm the trend’s strength. When bands are narrow and ADX is low, it confirms a range. |

| Fibonacci Retracement | Use ADX to confirm a trend is strong before drawing Fibonacci levels. A pullback to the 38.2% or 50% level during a high-ADX environment is a high-probability entry setup. |

When to Use ADX vs RSI vs MACD

| Indicator | What It Measures | Best Use Case | When to Use | Limitations |

| ADX (Average Directional Index) | Trend strength (0–100 scale), not direction | Confirming whether a market is trending or ranging | Use when deciding if trend-following strategies (e.g., moving averages, breakouts) are valid | Lagging indicator; does not show overbought/oversold |

| RSI (Relative Strength Index) | Momentum and overbought/oversold levels (0–100) | Identifying potential reversals or exhaustion points in ranges | Use in range-bound markets (ADX < 20) or to spot divergences | Can give false signals in strong trends (stays overbought/oversold) |

| MACD (Moving Average Convergence Divergence) | Relationship between two moving averages (trend + momentum) | Spotting trend direction shifts and momentum crossovers | Use when ADX confirms strong trend; MACD helps with entries/exits | Lags during sideways markets; prone to whipsaws without ADX filter |

Traders don’t need to choose one indicator exclusively. ADX excels at measuring trend strength, RSI identifies overbought/oversold zones, and MACD highlights momentum shifts. Combining them often produces the most reliable trading signals

Limitations & Common Mistakes

Despite its usefulness, ADX has limitations and is often misused.

- Lagging Nature: ADX is a lagging indicator because its calculation relies on past price data and moving averages. It will confirm a trend after it has already begun, potentially leading to later entries.

- Non-Directional: The most common mistake is assuming a rising ADX means a bullish trend. ADX does not indicate direction; it only measures strength. A market crashing in a strong downtrend will have a high and rising ADX.

- False Signals in Low-ADX Environments: DI crossovers are unreliable when the ADX is below 20 or 25. Acting on these signals without the ADX filter is a frequent error.

- Slope Misinterpretation: A falling ADX does not mean the trend is reversing. It only means the trend’s momentum is weakening. The trend may continue, but with less force.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The Average Directional Index (ADX) is a valuable tool for gauging trend strength. Its core purpose is to help you decide whether to use a trend-following strategy. By combining the ADX line with the +DI and –DI indicators, you can build a robust trading system that assesses both the strength and direction of a trend. Remember to always use it as part of a complete plan that includes sound risk management.