An Islamic forex account is a Sharia-compliant trading account that enables the trading of global currencies without violating core Islamic finance principles, but just like choosing a Forex broker in general, the right decision determines your safety and success.

It is designed for Muslim traders by ensuring that all transactions are free from interest (Riba) and align with ethical guidelines. Profits are generated exclusively from changes in asset value, allowing traders to participate in financial markets while adhering to their faith.

Let’s take a look at the best islamic forex brokers that combine profitability with faith-friendly trading conditions.

Key Takeaways

- Halal forex trading requires a Sharia-compliant, swap-free account to avoid interest (Riba).

- Trading must be interest-free, instantly settled, based on analysis (not gambling), and involve only halal assets.

- “Swap-free” doesn’t mean cost-free; brokers replace interest with fixed administrative fees or wider spreads.

- The best broker depends on your needs; for example, Fusion Markets is noted for low costs while IC Markets is suitable for active day trading.

- Your top priority should be choosing a broker regulated by a top-tier authority like the FCA or ASIC for financial security.

- Always use a risk-free demo account to test a broker’s platform and conditions before depositing real money.

Is Forex Trading Halal in Islam?

Yes, forex trading is considered halal, if it is conducted under strict conditions that eliminate interest, excessive uncertainty, and transactions involving prohibited assets. While conventional forex trading is often debated due to the presence of Riba and Gharar, modern Islamic accounts are structured to resolve these issues.

For trading to be halal, the following conditions must be met:

- Use a Swap-Free Account: The account must not charge or pay overnight interest (swap).

- Ensure Immediate Execution: Trades must be executed and settled instantly.

- Trade Halal Assets: Only trade currency pairs and other assets not linked to prohibited industries.

- Base Decisions on Analysis: Trading must be based on a clear strategy, not on gambling.

What Makes a Forex Account Sharia-Compliant (Islamic)?

A forex account is Sharia-compliant when it adheres to four key principles: the prohibition of interest (Riba), immediate settlement of transactions, the avoidance of excessive uncertainty (Gharar), and the trading of permissible (halal) assets only. A broker must integrate all these features for an account to be considered truly Islamic.

- Prohibition of Riba (Interest). Islamic law forbids earning or paying interest. In forex, this is addressed with swap-free accounts, where the standard overnight interest fee for holding a position is eliminated. Instead, brokers may charge a fixed administrative fee for positions held open for a specific number of days.

- Immediate Transaction Settlement. Trades must be settled without delay to reflect a direct exchange of assets. Modern electronic trading platforms facilitate this “hand-to-hand” exchange instantly, satisfying this condition.

- Avoidance of Uncertainty (Gharar) and Gambling (Maysir). Sharia-compliant trading requires that decisions be based on sound technical or fundamental analysis. Trades cannot be based on pure speculation or guesswork, which would be equivalent to gambling.

- Trading of Halal Assets. The account must restrict trading to permissible assets. This includes major and minor currency pairs and commodities like gold and silver. It excludes assets tied to industries prohibited in Islam, such as alcohol or gambling.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTop 7 Brokers that offer Sharia-Compliant Islamic Accounts

Here are the top islamic brokers that provide halal broker accounts, each with distinct features:

- Fusion Markets: Offers a low-cost trading environment with competitive commissions and fast execution speeds.

- IC Markets: Provides competitive raw spreads from 0.0 pips and allows scalping, making it suitable for active traders.

- Pepperstone: Known for its deep liquidity and fast trade execution, supporting automated trading with Expert Advisors (EAs).

- FP Markets: Features a 5-day grace period before administrative fees are applied on many instruments.

- VT Markets: Offers competitive spreads on its RAW ECN account and is structured to be suitable for long-term trades.

- Vantage: Features no inactivity or deposit fees, making it a cost-effective option for traders with varying activity levels.

- Moneta Markets: Provides a 10-day grace period on some assets before applying admin fees and offers high maximum leverage.

Fusion Markets

Fusion Markets offers a cost-effective Islamic account characterized by its ultra-low commissions and a minimum deposit of just $1. The broker replaces swap fees with an administrative fee, such as a $4.50 round-turn charge per lot on its Zero Account. Regulated by ASIC and the VFSC, Fusion Markets provides access to forex, metals, and commodities on the MT4 and MT5 platforms with leverage up to 500:1.

- Pros

- Features ultra-low commissions.

- Provides fast trade execution and copy trading support.

- Maintains responsive customer support.

- Cons

- The provided data does not list any specific cons for this broker.

IC Markets

IC Markets provides a high-performance Islamic account suitable for active traders, featuring a 5-day grace period on most symbols before a flat-rate holding fee is applied to overnight positions. This structure allows for strategies like scalping, supported by competitive raw spreads starting from 0.0 pips. The broker is regulated by ASIC and CySEC and supports the MT4, MT5, and cTrader platforms with leverage up to 1:500.

- Pros

- Offers a high-performance trading platform with rapid execution.

- Provides highly competitive spreads from 0.0 pips on its Raw Spread account.

- Allows active trading strategies, including scalping.

- Cons

- The provided data does not list any specific cons for this broker.

Pepperstone

Pepperstone offers a No Dealing Desk (NDD) Islamic account with no minimum deposit requirement and broad platform support that includes TradingView. This account is structured for short-term trading, as it remains swap-free for five days on forex and precious metals before an administrative fee of $100 per lot applies. Pepperstone is regulated by top-tier authorities, including the FCA, ASIC, and CySEC.

- Pros

- Provides an excellent choice of platforms, including MT4, MT5, cTrader, and TradingView.

- Supports social trading via third-party services like DupliTrade and Signal Start.

- Offers superb trade execution and API trading capabilities.

- Cons

- Demo accounts have a 60-day time limit.

FP Markets

FP Markets offers an ECN/STP Islamic account that combines high leverage up to 1:500 with a low minimum deposit requirement of $100. Regulated by ASIC and CySEC, the broker’s Islamic account features a 5-night grace period on selected instruments before administrative fees are applied per lot per night.

- Pros

- Supports multiple platforms, including MT4, MT5, and cTrader.

- Features a competitive cost structure and a wide asset selection.

- Combines a low minimum deposit with high leverage.

- Regulated by multiple top-tier authorities.

- Cons

- The Iress trading platform has geographical restrictions on its availability.

VT Markets

VT Markets structures its Islamic account to be suitable for long-term trades by replacing swaps with a simple administrative fee and supporting the TradingView platform. Regulated by the FSCA, the broker requires a $100 minimum deposit and offers competitive spreads from 0.0 pips on its RAW ECN account. Maximum leverage is available up to 1:500.

- Pros

- The fee structure is ideal for holding long-term trades.

- Provides competitive spreads on its RAW ECN account.

- Offers trading bonuses to clients.

- Cons

- The provided data does not list any specific cons for this broker.

Vantage

Vantage provides a cost-effective Islamic account with a low $50 minimum deposit and no inactivity or deposit fees. Regulated by ASIC and the FCA, the broker replaces overnight swap charges with either wider spreads or daily administrative fees, depending on the position. It supports various strategies, including hedging and day trading, on its MT4, MT5, and proprietary platforms.

- Pros

- Features low foreign exchange trading fees.

- Charges no fees for inactivity or deposits.

- Allows for a wide range of trading strategies, including scalping and hedging.

- Cons

- The availability of cryptocurrency CFDs is not always guaranteed.

Moneta Markets

Moneta Markets features an Islamic account with a 10-day grace period on certain assets before admin fees apply and offers exceptionally high maximum leverage of up to 1:1000. Regulated by the FSCA and a subsidiary of a UK FCA-regulated company, it requires a $50 minimum deposit. The broker provides access to over 1000 instruments on platforms including MT4, MT5, and its proprietary AppTrader.

- Pros

- Offers a wide range of over 1000 trading instruments.

- Provides very high leverage options.

- The platform caters specifically to religious beliefs through its account structure.

- Cons

- The provided data does not list any specific cons for this broker.

Islamic (Halal) Forex Broker Features Comparison

| Broker Name | Minimum Deposit | Key Regulators | Islamic Account Fee Structure | Noteworthy Assets for Islamic Accounts | Platforms Supported | Max Leverage | Key Advantages for Islamic Traders |

| Fusion Markets | $1 | ASIC, VFSC, FSA (Seychelles) | Admin fees may apply, $4.50 round turn per lot (Zero Account) | Forex, Metals, Indices, Energy & Soft Commodities, Cryptocurrencies, US Share CFDs | MT4, MT5, Fusion+ | 30:1 (ASIC), 500:1 (VFSC) | Ultra-low commissions, fast execution, copy trading, responsive support |

| IC Markets | Not specified (low for standard) | FSA (Seychelles), ASIC, CySEC | Flat-rate holding fee for overnight positions; 5-day grace period for most symbols (XNGUSD no grace) | 90+ instruments: Forex, Commodities, Global Indices | MT4, MT5, cTrader | 1:500 | High-performance platform, rapid execution, competitive spreads (0.0 pips Raw Spread), scalping allowed |

| Pepperstone | AUD$200 | FCA (UK), ASIC, DFSA, CySEC, CMA, SCB (Bahamas) | Admin charge of $100 per lot for FX/Precious Metals after 5 days | FX, Precious Metals (broader assets on other accounts) | MT4, MT5, cTrader | 1:200 | Cutting-edge technology, deep liquidity, allows scalping, EAs, hedging |

| FP Markets | US$100 | ASIC, CySEC, FSCA, FSC (Mauritius), SCB (Bahamas), CMA | Admin fees per lot/night; 5-night grace period on selected instruments (many 0-night) | Forex, Metals, Indices, Commodities, Shares, Digital Currencies | MT4, MT5, cTrader | 1:500 | Zero interest/swap charges, 5-day admin fee grace, fast execution, wide strategy compatibility |

| VT Markets | $100 | FSCA (South Africa), UAE SCA, FSC (Mauritius) | Admin fee instead of swap fee | Forex, Indices, Commodities, Precious Metals, Soft Commodities, ETFs, CFD Shares, CFD Bonds | MT4, MT5, TradingView | 1:500 | Ideal for long-term trades, competitive spreads (0.0 pips RAW ECN), fast execution, trading bonuses |

| Vantage | $50 | Vanuatu, ASIC, FCA (UK), Cayman Islands | Wider spreads and/or admin fees for overnight positions (daily, may include weekends) | Forex, CFDs (cryptocurrencies not always available) | MT4, MT5, Proprietary | 1:500 | Low FX fees, no inactivity/deposit fees, demo account, allows day trading, scalping, hedging |

| Moneta Markets | $50 | FSCA (South Africa), Saint Lucia, UAE SCA (IB), FCA (UK subsidiary) | Daily admin fee after 10-day grace period for some assets; some FX pairs incur fees from day one | 1000+ instruments: Forex, Commodities, Indices, Share CFDs, ETFs, Bonds | MT4, MT5, Pro Trader, AppTrader, CopyTrader | 1:1000 | Caters to religious beliefs, wide range of instruments, high leverage |

Who is the Winner among these Islamic Forex Brokers?

Well, there is no single “winner” among these platforms. The best broker depends entirely on a trader’s individual priorities, strategy, and risk tolerance.

However, we have categorized brokers based on their unique strengths to help you determine which one is the best fit for you:

- For the trader focused on the lowest costs: Fusion Markets stands out with its low commission structure and $1 minimum deposit, while Vantage is a strong option for its $50 minimum deposit and lack of inactivity or deposit fees.

- For the active day trader or scalper: IC Markets is highly suitable due to its raw spreads from 0.0 pips and explicit support for scalping. Pepperstone is also a top contender with its No Dealing Desk (NDD) execution and deep liquidity, which are critical for high-frequency trading.

- For the trader seeking maximum leverage and flexibility: Moneta Markets offers the highest maximum leverage at 1:1000 and features the longest swap-free grace period (10 days on some assets), providing significant flexibility.

- For the trader who prioritizes platform variety: Pepperstone offers the most extensive choice, with support for MT4, MT5, cTrader, and TradingView, accommodating a wide range of technical analysis needs.

The most effective approach is to identify your primary trading need and then use the detailed analysis to select the broker that best matches that requirement.

Why Choose an FCA-Regulated Broker?

For UK-based traders, choosing a broker with FCA regulation is not just a suggestion—it’s a critical safety measure. FCA-regulated brokers are required to:

- Segregate Client Funds: Keep client money in separate bank accounts from the firm’s own capital, ensuring your money is safe even if the broker goes out of business.

- Adhere to Strict Standards: Follow a comprehensive set of rules and standards designed to protect consumers.

- Offer Investor Protection: Provide access to the Financial Services Compensation Scheme (FSCS), which can compensate you for up to £85,000 if the firm fails.

When looking for an Islamic forex broker in the UK, always verify the broker’s FCA registration number on the official FCA register to ensure you are trading with a genuine and protected entity.

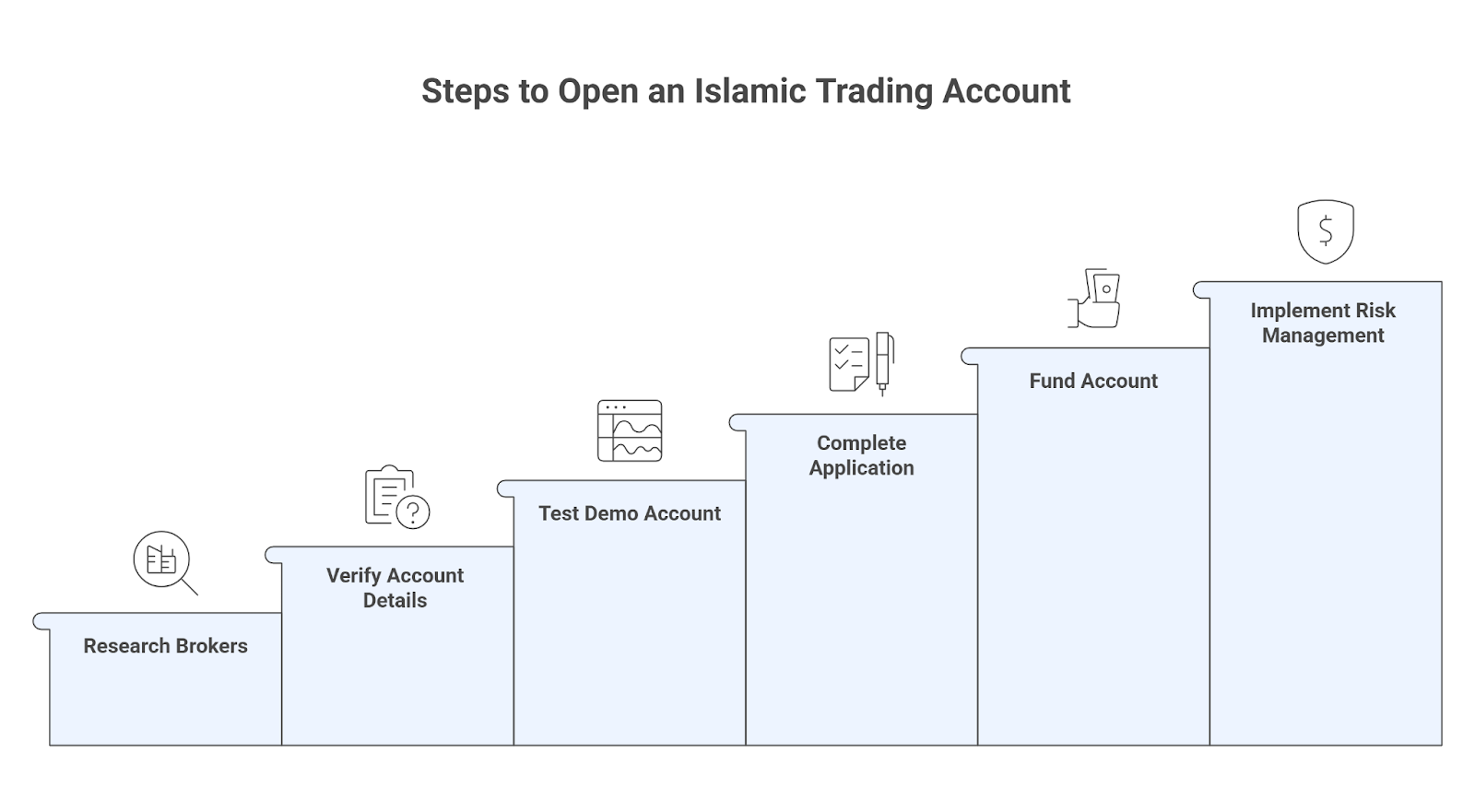

How to Open an Islamic Trading Account?

Opening an Islamic trading account involves a multi-step process of researching and selecting a regulated broker, verifying the account’s specific terms, funding the account, and executing trades. Following a structured approach ensures the chosen broker aligns with both Sharia principles and your trading strategy.

- Research and Select Brokers. Shortlist potential brokers and examine the specific terms of their Islamic accounts, including administrative fees, spreads, and any asset restrictions.

- Verify Account Details. Contact the broker’s customer support to confirm how they replace swap fees and if any trading styles, such as swing trading, are restricted under their swap-free policy.

- Test with a Demo Account. Use a demo account to test the broker’s platform, execution speeds, and overall trading conditions without financial risk.

- Complete the Application. Submit the online application with the required documents, which typically include a government-issued ID and a recent proof of residency. Some brokers may also request verification of faith.

- Fund the Account. Fund the Account. Deposit at least the minimum required amount using one of the broker’s supported payment methods — just as you would when you open a trading account with a standard broker.

- Implement Risk Management. Before executing any live trades, establish a clear risk management strategy, including the use of stop-loss orders and proper position sizing.

Key Strategies for Trading with an Islamic Account

Successful trading with an Islamic account requires aligning the chosen trading strategy with the account’s fee structure, particularly its swap-free time limits, and implementing strict risk management. The absence of swap fees can be advantageous, but traders must be aware of alternative costs.

- Review the Account’s Terms. Determine the exact number of swap-free days the broker grants before administrative fees are applied to overnight positions.

- Utilize Longer-Term Strategies. If the account offers unlimited swap-free days, longer-term strategies like swing or position trading become more cost-effective.

- Focus on Intraday Strategies. If the account has a time limit on its swap-free status, prioritize intraday strategies like scalping or day trading to avoid overnight fees.

- Manage Overnight Exposure. Close leveraged positions before the end of the trading session to avoid the financial risks associated with unexpected overnight market events.

- Adjust Risk for Overnight Trades. When holding positions overnight, adjust risk management settings by using tighter stop-loss orders or partially closing positions to decrease financial exposure.

How to Choose an Islamic Forex Account?

A trader should choose an Islamic forex account by verifying its fee structure, regulatory compliance, and asset availability to ensure it aligns with both Sharia principles and their personal trading strategy. The following steps provide a clear path for making an informed decision.

- Verify the Fee Structure. Confirm how the broker replaces swap fees. Some apply a daily administrative charge, while others may widen the spread. Choose the model that best fits your trading frequency and style.

- Confirm Regulatory Compliance. Prioritize brokers regulated by top-tier authorities like the FCA (UK) or ASIC (Australia). These bodies enforce strict standards, including the segregation of client funds, which provides a higher level of financial security.

- Check Asset Availability. Ensure the broker offers a sufficient range of halal assets, such as major forex pairs and precious metals. Confirm that prohibited assets are not part of the available instruments.

- Evaluate Trading Platforms. Test the broker’s platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), using a demo account. This helps evaluate execution speed, tools, and overall user experience.

- Review Support and Deposit Options. Look for brokers with responsive, multilingual customer support. Additionally, check for convenient and low-cost deposit and withdrawal methods.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The key to halal forex trading is performing careful due diligence to select a regulated broker whose Islamic account structure transparently eliminates interest (Riba) and fully aligns with all Sharia principles. To trade ethically, a trader must prioritize brokers that operate under stringent regulatory oversight.