Candlestick charts are the language of the financial markets. Whether you’re trading stocks, forex, or crypto, they provide a rich, visual story of price action. Unlike a simple line on a graph, each candle reveals a battle between buyers and sellers, showing not just the price but the trading psychology—the fear and greed—behind it.

This guide is designed for beginners. You will learn the fundamentals of reading a candlestick chart, how to identify core patterns, and how to apply actionable trading strategies used by professionals.

While understanding How to Read Candlestick Charts is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- Candlestick charts show four price points: open, high, low, and close.

- Green candles signal buying pressure, while red candles signal selling pressure.

- Candle body size reflects momentum; wicks reveal volatility and rejection.

- Always read candles in context with trend, support/resistance, and volume.

- Short timeframes show quick market moves, while daily charts highlight bigger trends.

- Actionable setups include Bull Flags, Flat-Top Breakouts, and ABCD patterns.

- Use confirmations like VWAP, moving averages, and volume to improve accuracy.

What is a Candlestick Chart?

A candlestick chart is a type of financial chart that displays the high, low, open, and closing (OHLC) prices of an asset for a specific period. Each “candle” represents a single time period (like a day or an hour) and visually shows the price movement and momentum within that timeframe.

This charting method originated in 18th-century Japan, where rice merchants used it to track market prices. It provides a more detailed and visually intuitive view of price action compared to other chart types. Beyond standard charts, many traders also turn to Heikin Ashi candlesticks for smoother trend analysis, since they filter noise and highlight momentum more clearly.

Candlesticks vs. Other Chart Types

| Chart Type | What It Shows | Best For |

| Candlestick Chart | Open, High, Low, Close (OHLC) + Price Direction/Momentum | Detailed analysis of market psychology and patterns. |

| Bar Chart | Open, High, Low, Close (OHLC) | Similar data to candlesticks but less visually intuitive. |

| Line Chart | Only the Closing Price | Seeing the “big picture” trend over a long period. |

How to Read a Candlestick (Step-by-Step Framework)

Reading a candlestick is a simple, five-step process. Each part of the candle gives you a clue about the market’s behavior.

- Identify the Body Color

- Green (or White) Candle: The closing price was higher than the opening price. This is a bullish candle, indicating buying pressure.

- Red (or Black) Candle: The closing price was lower than the opening price. This is a bearish candle, indicating selling pressure.

- Compare the Open and Close The top and bottom of the solid part, called the real body, represent the opening and closing prices. For a green candle, the bottom is the open and the top is the close. For a red candle, the top is the open and the bottom is the close.

- Measure the Body Size

- Long Body: Shows strong momentum and conviction in the direction of the trend.

- Short Body: Shows little price movement and indecision.

- Read the Wicks (Shadows) The lines extending above and below the body are called wicks or shadows. They represent the highest and lowest prices reached during the period.

- Long Upper Wick: Buyers tried to push the price up, but sellers pushed it back down. This is a sign of selling pressure or “wick rejection.”

- Long Lower Wick: Sellers tried to push the price down, but buyers pushed it back up. This is a sign of buying pressure.

- Confirm with Context A single candle is just one piece of data. Always analyze candlestick clusters and their position within the broader market structure.

- Trend: Is the candle forming higher highs and higher lows (uptrend) or lower lows and lower highs (downtrend)?

- Support/Resistance: Did the candle form at a key price level or liquidity zone?

- Volume: Was there high or low trading volume? High volume adds significance to a pattern.

Timeframes & Context

Candlesticks can represent any timeframe, from one minute to one week. A single daily candle contains all the price action of that day’s trading session. For example, in a standard 6.5-hour stock trading session, there are 78 five-minute candles that make up the single daily candle.

- Intraday Charts (e.g., 1-min, 5-min): Used by day traders and scalpers for short-term moves.

- Swing Charts (e.g., 4-hour, Daily): Used by swing traders to capture moves that last several days or weeks.

Analyzing the same asset on different timeframes provides a more complete picture of the market trend.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesCore Candlestick Patterns Beginners Must Know

Candlestick patterns are formations that can signal a potential sentiment shift. Here are five essential patterns for beginners.

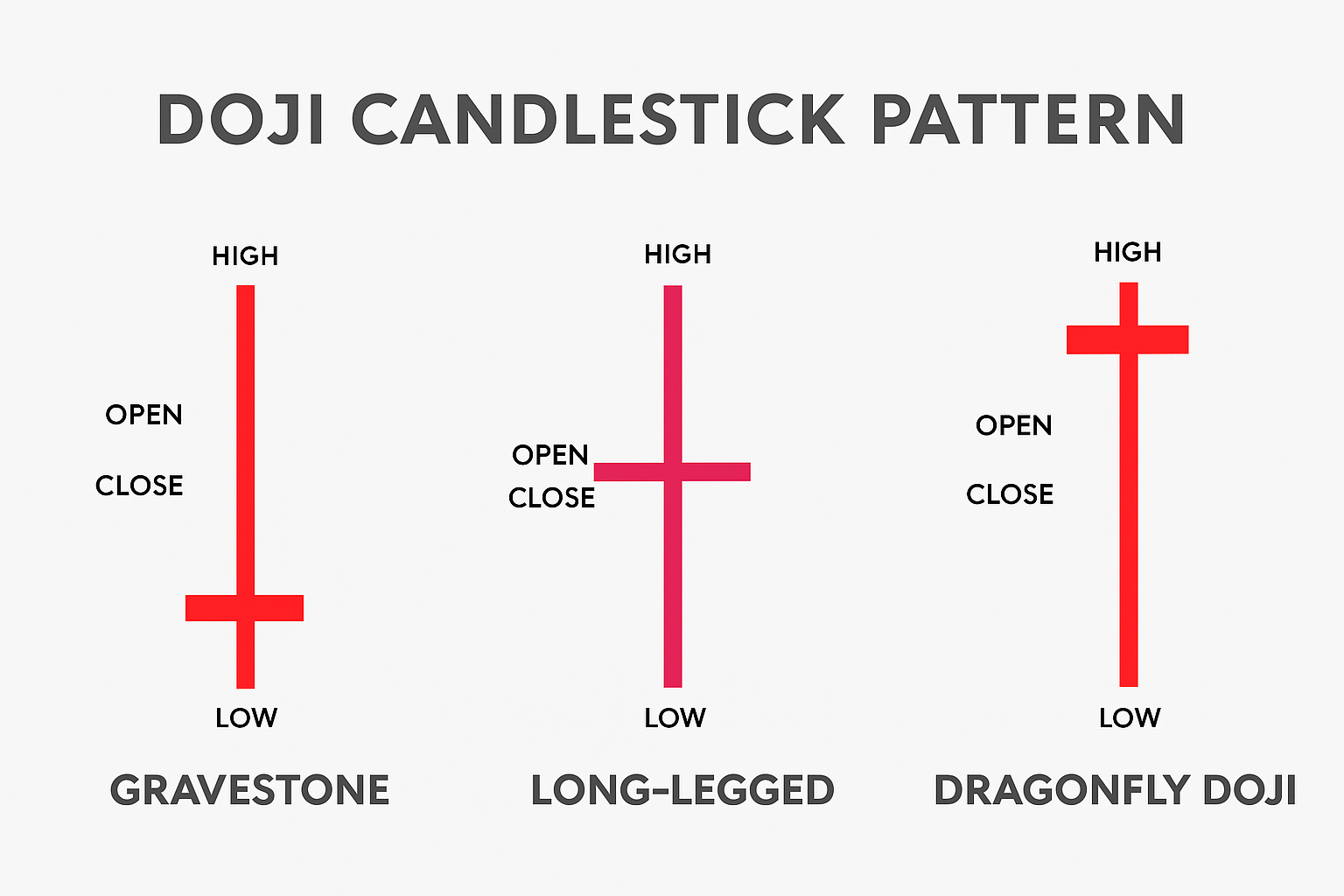

Doji

A Doji is the ultimate indecision candle. It has a very small body, showing that the open and close prices were nearly identical. It reflects a perfect balance between buyers (greed) and sellers (fear).

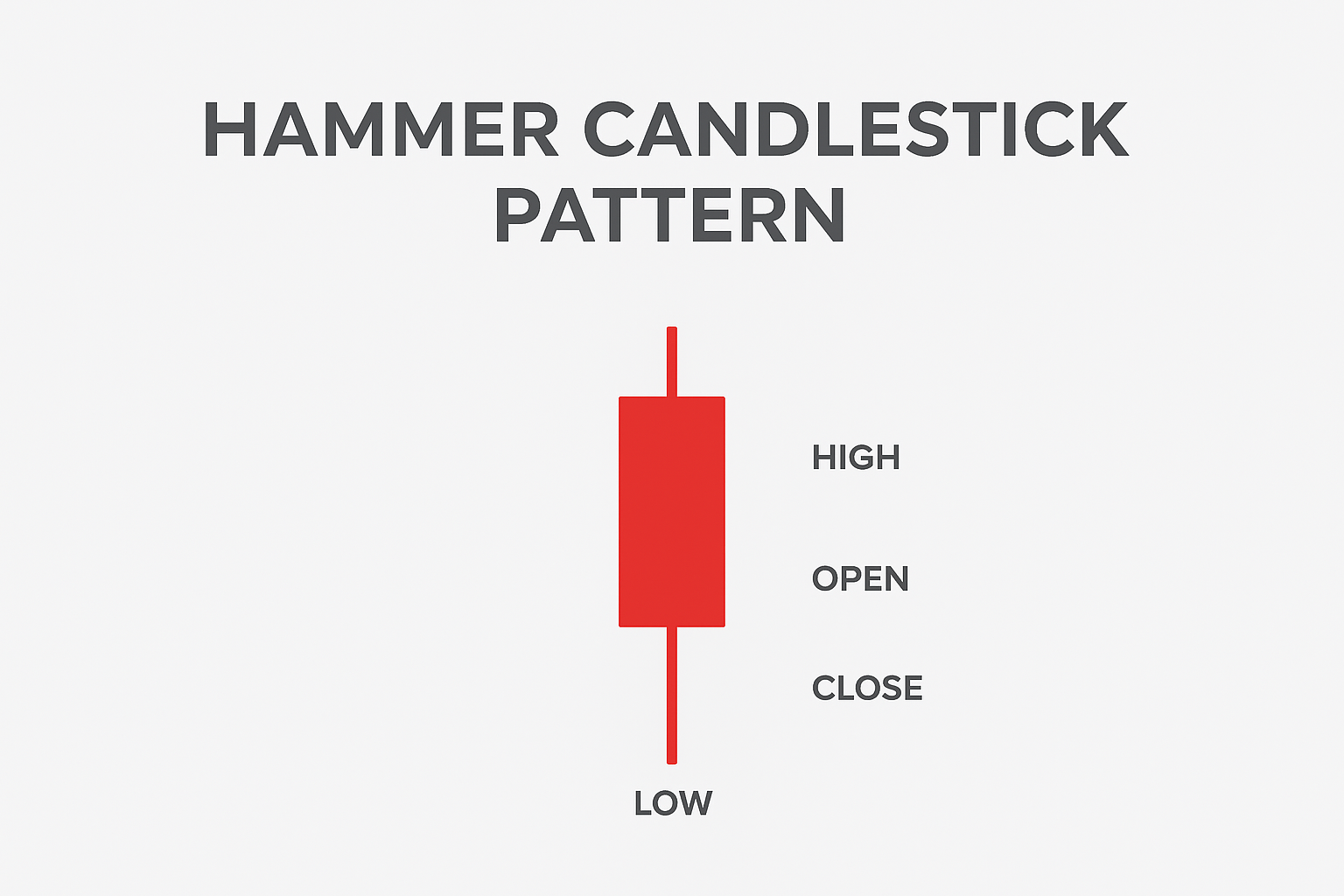

Hammer & Hanging Man

The Hammer is a bullish reversal pattern that forms after a downtrend. It has a long lower wick, showing that buyers rejected lower prices. The Hanging Man looks identical but appears after an uptrend, signaling a potential bearish reversal.

Engulfing Pattern

This two-candle pattern signals a strong potential reversal. A Bullish Engulfing occurs when a large green candle completely “engulfs” the previous small red candle. According to candlestick research, like that compiled by Thomas Bulkowski, engulfing patterns are historically more reliable on daily charts than on intraday charts.

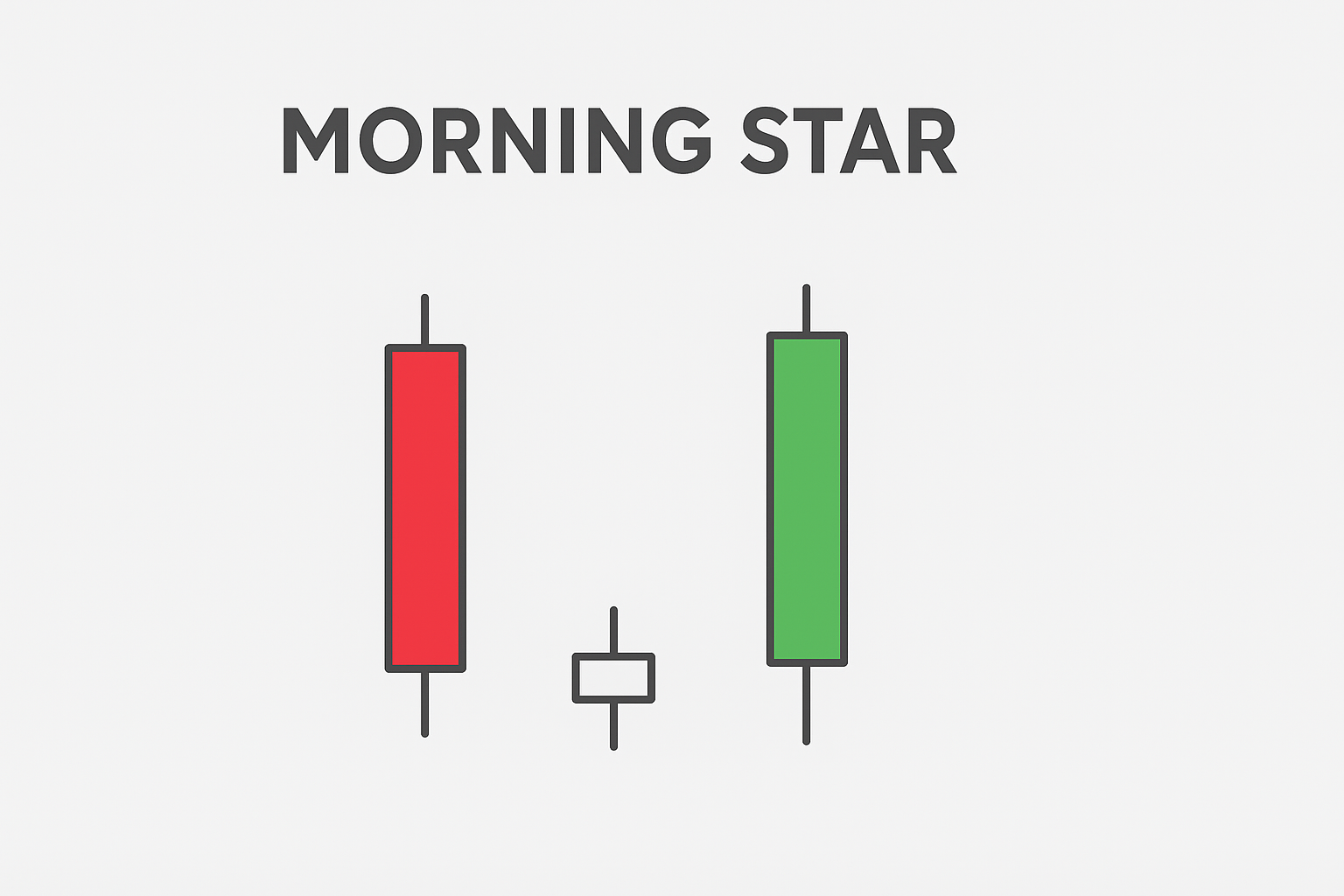

Morning Star & Evening Star

These are three-candle reversal patterns. The Morning Star is a bullish signal at the bottom of a downtrend. The Evening Star is a bearish signal at the top of an uptrend. Both indicate a significant shift in momentum.

Actionable Trade Setups

Professionals use candlestick anatomy as the basis for defined, rule-based trade setups.

Bull Flag

A bull flag is a continuation pattern marking a brief consolidation before the next move up. Notice how the flag’s pullback is a candlestick cluster of small-bodied candles after a long bullish body—a direct application of reading body size as momentum.

Flat-Top Breakout

This pattern forms when the price tests a resistance level multiple times. It relies on reading the long upper wicks at resistance as failed breakout attempts, followed by a strong, long-bodied candle that signals a decisive sentiment shift and breakout.

ABCD Pattern

The ABCD pattern is a classic harmonic setup. It consists of an initial impulse leg (A to B), followed by a retracement to a higher low (B to C), and finally a breakout leg (C to D) that often mirrors the length of the A-B leg.

Confirmation Tools & Risk Management

Never rely on candlestick patterns alone. Always use confirmation tools and practice proper risk management.

- Moving Averages (9 & 20 EMA): Use these to confirm the short-term trend direction.

- Momentum Oscillators (RSI & MACD): Use the RSI to spot overbought/oversold conditions and the MACD to identify momentum shifts that confirm a pattern.

- Volume: A volume spike (≥1.5x the average) on your breakout candle confirms conviction.

- Support/Resistance & Liquidity Zones: The most reliable patterns form at significant price levels. Institutional traders pay close attention to these liquidity zones, as they are areas where large orders can be executed. This ties directly into technical analysis in Forex, where candlestick reading becomes one layer of a wider toolkit that includes indicators, structure, and macro context.

Candlestick Charts Across Markets

Candlesticks are universal, but their interpretation has slight nuances depending on the market.

- Stocks: Trading is confined to session hours, so the daily open and close are significant levels.

- Forex: The market is open 24/5, so a “daily” candle’s open/close depends on your broker’s server time.

- Crypto: The market is open 24/7. Candlesticks are often more volatile, and patterns can form and resolve very quickly.

Limitations of Candlestick Charts

While powerful, candlestick charts have limitations.

- They are short-term focused: They are best for analyzing price action over a few periods, not for long-term investment analysis.

- They can produce false signals: Not every pattern will result in the expected outcome, especially in choppy markets.

- They require context and confirmation: A single candle or pattern is meaningless without considering the overall trend, volume, and other indicators.

- Avoid single-candle setups: Relying on a single candle to make a trading decision is a low-probability strategy. Always look for confirmation.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountConclusion

Candlestick charts are an indispensable tool, offering a simple yet profound look into the market by combining OHLC price data with a clear visual of trading psychology.

The best traders don’t just memorize every candlestick pattern—they master a few key setups, practice daily in real market conditions, and manage risk with unwavering discipline. True proficiency comes from using candlesticks to read the market’s story and making consistent, high-probability decisions.