The Simple Moving Average (SMA) smooths price data into a single line to highlight market trends. It averages prices over set periods, reducing short-term volatility and revealing trend direction. SMA is a core tool in technical analysis across stocks, forex, crypto, and commodities.

While understanding Simple Moving Average (SMA) is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- SMA (Simple Moving Average) is the arithmetic average of an asset’s closing prices over a set period, used to smooth volatility and reveal trends.

- SMA is a lagging indicator that follows price trends rather than predicting them.

- 10–20 SMA for day trading, 50 SMA for swing trading, 200 SMA for long-term investing.

- Widely used in stocks, forex, crypto, and commodities to confirm trends.

- SMA is smoother and better for long-term analysis; EMA reacts faster and is preferred for short-term trades.

- Reacts slowly, can produce false signals in sideways markets, gives equal weight to old and new data.

- Combine SMA with indicators like RSI or MACD, or overlay multiple SMAs across timeframes for stronger confirmation.

What Is Simple Moving Average (SMA)?

The Simple Moving Average (SMA) is a tehnical indicator that calculates an asset’s average price over a set number of periods. It gives equal weight to each data point, making it a true average. Traders use SMA to smooth price data, reduce noise, and identify trend direction.

Unlike the SMA, other moving averages like the Exponential Moving Average (EMA) and Weighted Moving Average (WMA) assign more weight to recent prices, making them more responsive to new information. The SMA’s equal weighting results in a smoother line but a slower reaction to price changes. For traders needing a deeper breakdown, the SMA vs EMA guide clarifies how their differences affect signal speed and reliability.

How to Calculate SMA (With Formula & Example)

You can calculate the SMA with a straightforward formula that sums up a set of closing prices and divides them by the number of periods.

Simple Moving Average for Dummies

Think of the SMA as finding the “average” price over a few days. Here’s how it works in three simple steps:

- Add: Pick a timeframe (like 5 days) and add up the closing price for each of those days.

- Divide: Divide that total sum by the number of days you chose (in this case, 5).

- Plot: The result is the SMA for that day. Plot it on a chart to create a single line.

The formula for the Simple Moving Average is:

SMA=nA1+A2+…+An

Where:

- An is the price of the asset at period n

- n is the total number of periods

Step-by-Step Calculation Example

To calculate a 5-day SMA for a stock, you add the closing prices for the last five days and divide the total by five.

| Day | Closing Price ($) | 5-Day Sum ($) | 5-Day SMA ($) |

| 1 | 150 | – | – |

| 2 | 152 | – | – |

| 3 | 151 | – | – |

| 4 | 154 | – | – |

| 5 | 155 | 762 | 152.40 |

| 6 | 153 | 765 | 153.00 |

| 7 | 156 | 769 | 153.80 |

For day 5, the calculation is (150+152+151+154+155)/5=152.40. For day 6, the oldest price (150) is dropped, and the new price (153) is added: (152+151+154+155+153)/5=153.00.

Key Characteristics of SMA

The Simple Moving Average has three key characteristics that define its behavior as a trading indicator.

- Equal Weighting: The SMA assigns an equal weight to every data point in its calculation period. This means the price on day 1 has the same impact as the price on day 20 in a 20-day SMA. This contrasts with an EMA, which gives more significance to recent prices.

- Lagging Nature: The SMA is a lagging indicator, which means it follows the price trend rather than predicts it. Because it is based on past prices, its signals are delayed. This lag is more pronounced in longer-term SMAs (like the 200-day) than in shorter-term ones (like the 10-day).

- Timeframe Flexibility: Traders can apply the SMA to any timeframe, from short-term intraday charts to long-term weekly or monthly charts. Shorter SMAs react more quickly to price changes and are suited for short-term analysis, while longer SMAs provide a broader view of the market’s long-term trend.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow Simple Moving Averages Work

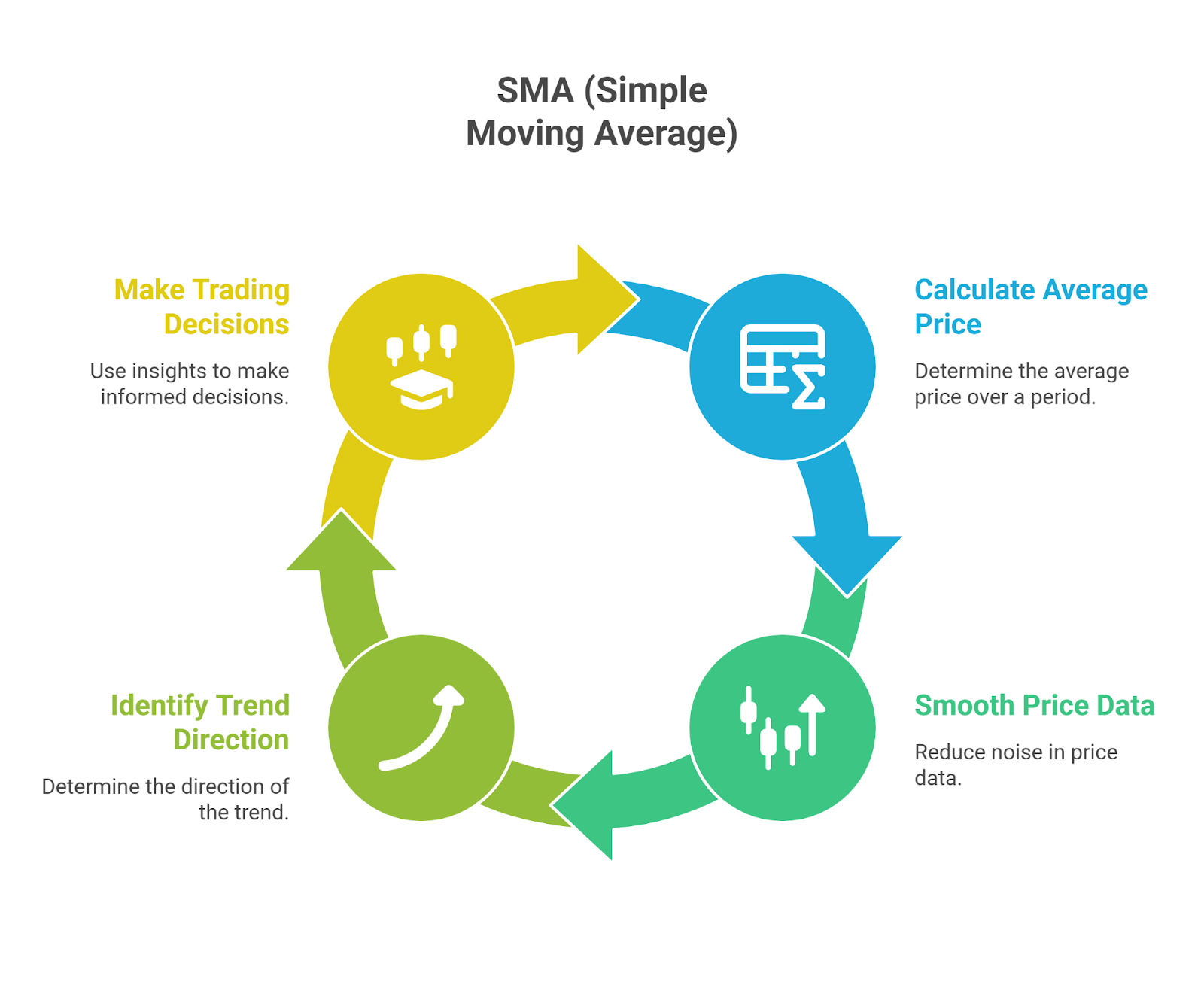

Traders use the SMA in three primary ways to analyze market trends and generate trading signals.

- Trend Identification: The direction of the SMA line indicates the market trend. An upward-sloping SMA suggests an uptrend, while a downward-sloping SMA indicates a downtrend. A flat or sideways SMA points to a ranging market.

- Dynamic Support and Resistance: The SMA line often acts as a dynamic level of support or resistance. In an uptrend, the price may pull back and “bounce” off the SMA, treating it as a support level. In a downtrend, the price may rally to the SMA and find resistance.

- Entry and Exit Signals (Crossovers): A crossover occurs when the asset’s price moves from one side of the SMA line to the other, signaling a potential change in trend. A bullish crossover happens when the price moves above the SMA, suggesting an entry signal. A bearish crossover occurs when the price falls below the SMA, suggesting an exit or short-sell signal.

Popular SMA Periods and Their Uses

The choice of SMA period depends on the trader’s strategy and time horizon. The best SMAs are the 10-day and 20-day for day trading, the 50-day for swing trading, and the 200-day for long-term investing. Certain periods have become standard in technical analysis for their effectiveness in different market conditions.

| SMA Period | Market Use | Trading Style Suitability |

| 10-day / 20-day | Short-term trend | Day Trading, Swing Trading |

| 50-day | Mid-term trend | Swing Trading, Position Trading |

| 100-day | Long-term trend | Position Trading, Long-term Investing |

| 200-day | Major long-term trend | Long-term Investing, Macro Analysis |

SMA Trading Strategies (With Examples)

Four common and effective trading strategies use the Simple Moving Average.

Golden Cross (Bullish Signal)

A Golden Cross occurs when a shorter-term SMA (typically the 50-day) crosses above a longer-term SMA (typically the 200-day). This is a powerful bullish signal that indicates the start of a major long-term uptrend. While traditionally calculated with SMAs, traders also use EMAs to generate this signal for faster confirmation.

- Example: In 2020, Tesla’s (TSLA) stock experienced a Golden Cross, which preceded a significant and sustained bull run.

Death Cross (Bearish Signal)

A Death Cross is the opposite of a Golden Cross. It happens when a shorter-term SMA (50-day) crosses below a longer-term SMA (200-day). This bearish signal suggests the potential start of a major long-term downtrend. Like the Golden Cross, it can also be calculated using EMAs.

- Example: Many stocks, including Apple (AAPL), showed a Death Cross before major market downturns, signaling a period of decline.

Price/SMA Crossover

This strategy involves watching for the price to cross above or below a single SMA. A move above the SMA is a buy signal, while a drop below is a sell signal. It is most effective in strongly trending markets but can produce false signals in sideways markets.

SMA Bounce

In a strong uptrend, traders can use the SMA as a dynamic support level. The strategy is to buy when the price pulls back to the SMA line and then “bounces” off it, resuming its upward move. The reverse is true in a downtrend, where the SMA acts as resistance.

SMA vs. EMA: Which Is Better?

Neither the SMA nor the EMA is universally “better”; the best choice depends entirely on your trading style and strategy. The primary difference is speed and responsiveness.

The EMA is generally better for short-term and day traders who need signals that react quickly to the latest price action. By placing more weight on recent data, the EMA identifies trend shifts faster than the SMA, which is crucial for capitalizing on short-term moves.

The SMA is better for long-term investors and swing traders who prioritize a smoother, more stable view of the market. The SMA’s equal weighting filters out more market noise, making it more reliable for confirming major, long-term trends and avoiding false signals from minor volatility.

SMA vs. EMA vs. WMA

The Simple (SMA), Exponential (EMA), and Weighted (WMA) moving averages all differ in their calculation method and responsiveness.

| Feature | Simple Moving Average (SMA) | Exponential Moving Average (EMA) | Weighted Moving Average (WMA) |

| Weighting | Equal | Exponential (more on recent data) | Linear (more on recent data) |

| Reactivity | Slow (smoothest) | Fast | Very Fast (most sensitive) |

| Best For | Identifying long-term, stable trends | Identifying short-term trends; day trading | Catching very early trend shifts |

| Weakness | Slow to react to price changes | Prone to more false signals (whipsaws) | Most prone to false signals |

SMA in Different Markets

The SMA is a versatile tool applicable across various asset classes.

- Stocks: The 50-day and 200-day SMAs are critical indicators for stock market analysis, used to identify long-term trends and generate Golden Cross/Death Cross signals.

- Forex: Forex traders often use shorter-term SMAs (like 10, 20, and 50) on intraday charts (e.g., 1-hour or 4-hour) to capture quick trend movements in currency pairs.

- Cryptocurrencies: Due to high volatility, traders might use a combination of a short-term SMA (e.g., 10-day) to ride momentum and a long-term SMA (e.g., 50-day) to define the overall trend.

- Commodities: In commodity futures, the SMA helps identify sustained trends driven by supply and demand factors. Long-term SMAs like the 100-day or 200-day are common.

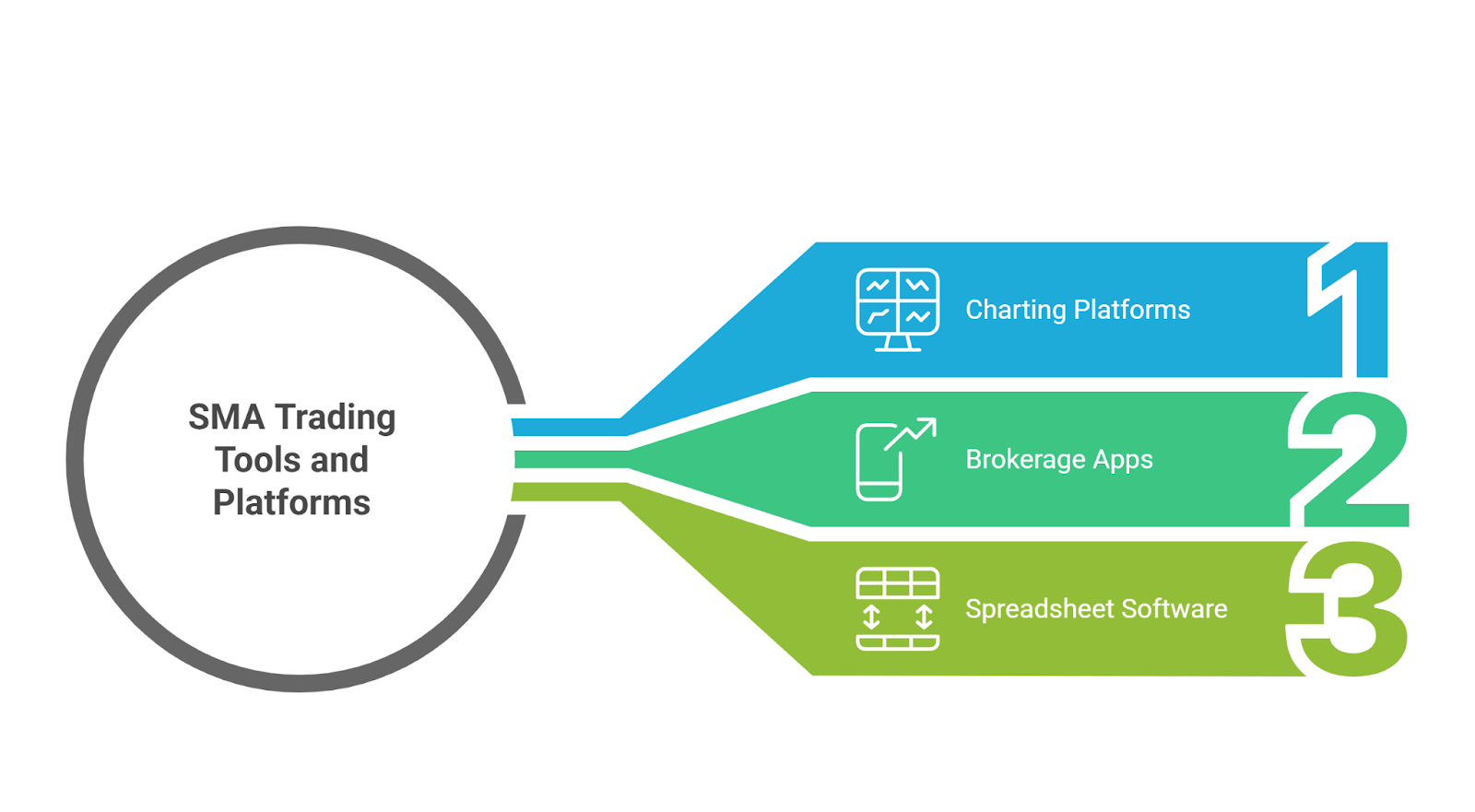

Tools and Platforms for SMA Trading

Numerous trading platforms and charting software offer built-in tools for applying the SMA.

- Charting Platforms: TradingView, MetaTrader (MT4/MT5), and NinjaTrader are industry-standard platforms that allow traders to easily add and customize SMAs and other indicators on their charts.

- Brokerage Apps: Many modern retail brokerage platforms, including Robinhood and ThinkorSwim, provide basic charting tools with SMA indicators.

- Spreadsheet Software: You can calculate the SMA manually using Google Sheets or Microsoft Excel. This is a useful exercise for beginners to understand the mechanics of the formula.

Advantages of SMA

The primary advantages of using the Simple Moving Average include its simplicity, effectiveness in smoothing market noise, and clarity in trend identification.

- Simplicity: The SMA is easy to calculate and understand, making it an excellent starting point for beginner traders.

- Noise Reduction: It filters out random, short-term price fluctuations, providing a clearer view of the underlying trend.

- Trend Confirmation: It is a reliable tool for confirming the direction and strength of long-term market trends.

Limitations of SMA

The main limitations of the SMA are its lagging nature, its potential for false signals in non-trending markets, and its equal weighting system.

- Lagging Indicator: Because it is based on past data, the SMA always reacts after the market has already started moving, which can lead to delayed entry and exit signals.

- False Signals: In sideways or ranging markets, the price can frequently cross back and forth over the SMA, generating numerous false signals (whipsaws).

- Ignore Recent Price Action: The SMA’s equal weighting gives the same importance to old price data as it does to new data. Critics aligned with the Efficient Market Hypothesis (EMH) argue this is inefficient.

Advanced SMA Concepts

Beyond the basics, traders can use the SMA in more sophisticated ways.

- Adaptive SMA: An Adaptive SMA is a type of moving average that automatically adjusts its calculation period based on market volatility. It becomes faster in trending markets and slower in ranging markets. An advanced evolution is the Guppy Multiple Moving Average (GMMA), which builds on the SMA and EMA framework by layering multiple averages to capture both short-term trader activity and long-term investor sentiment.

- Multi-Timeframe Overlays: A trader might overlay a long-term SMA (e.g., 200-day) onto a short-term chart (e.g., 1-hour) to ensure their intraday trades align with the major market trend.

- Combining SMA with Other Indicators: The SMA is most powerful when used in conjunction with other indicators like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD). This combination helps confirm signals and reduce the likelihood of acting on false positives.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The Simple Moving Average (SMA) smooths price action and provides clear signals for trends, support, and resistance. It is easy for beginners to learn and remains a core tool for experienced traders. For best results, use the SMA with other indicators like RSI or MACD, and practice on a demo account before trading live.