The US Dollar Index (DXY) measures the value of the US dollar against six major world currencies, with the euro making up 57.6% of the basket. A rising DXY means a stronger dollar; a falling DXY means a weaker one.

This guide provides a deep dive into the DXY’s formula, its impact on global markets like commodities and equities, and its outlook for 2026.

While understanding US Dollar Index (DXY) is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is the US Dollar Index (DXY)?

The US Dollar Index (DXY), also known as USDX or “Dixie,” is a geometrically-averaged calculation that serves as the primary benchmark for the US dollar’s international value. Its purpose is to provide an unbiased measure of the dollar’s strength or weakness against a basket of currencies from its most significant trading partners.

The index was created by the US Federal Reserve in 1973 after the collapse of the Bretton Woods system. Since 1985, it has been maintained by ICE Futures U.S. (Source: ICE).

How is the DXY Calculated? (Formula and Components)

The DXY is calculated using a geometric average of the six component currencies, with weights fixed since 1973. The euro has a dominant weighting, reflecting its economic significance.

DXY Component Currencies and Their Weightings:

| Currency | Weighting |

| Euro (EUR) | 57.6% |

| Japanese Yen (JPY) | 13.6% |

| British Pound (GBP) | 11.9% |

| Canadian Dollar (CAD) | 9.1% |

| Swedish Krona (SEK) | 4.2% |

| Swiss Franc (CHF) | 3.6% |

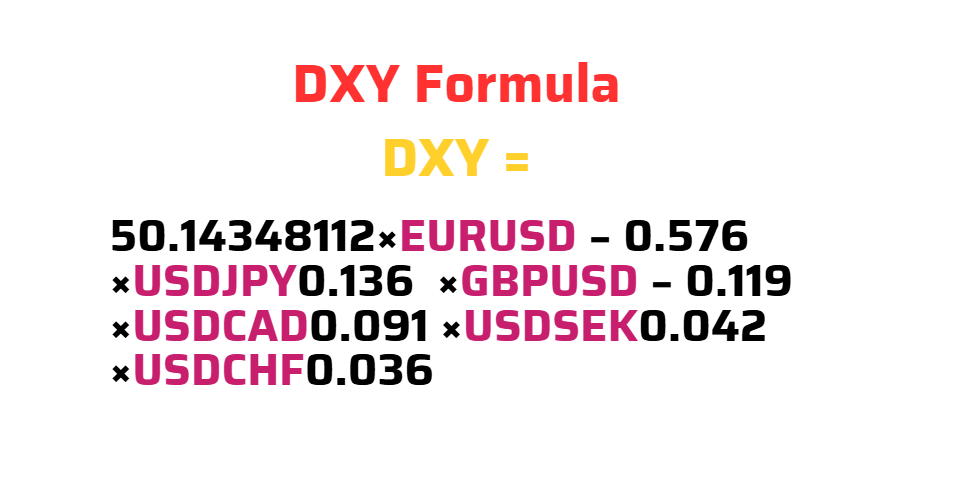

The Official DXY Formula: The index updates every 15 seconds using the following formula:

DXY=50.14348112×EURUSD−0.576×USDJPY0.136×GBPUSD−0.119×USDCAD0.091×USDSEK0.042×USDCHF0.036

DXY vs. Other Dollar Indexes: A Comparison

It is crucial to distinguish the DXY from other dollar indexes that use different methodologies.

- Bloomberg Dollar Spot Index (BBDXY): This index is more dynamic, tracking the USD against a basket of 10 global currencies that are updated annually based on their share of international trade and liquidity.

- Trade-Weighted Dollar Index (Broad Index): Maintained by the Federal Reserve, this index is the most comprehensive measure. It includes a broad basket of 26 currencies and adjusts weights annually based on US trade data, providing a more accurate reflection of the dollar’s value against its actual trading partners, including emerging markets like China and Mexico.

| Feature | US Dollar Index (DXY) | Trade-Weighted Dollar Index (Broad) |

| Components | 6 Currencies (Fixed) | 26+ Currencies (Dynamic) |

| Weighting | Fixed (Euro is 57.6%) | Adjusted annually based on US trade |

| Primary Use | Historical benchmark, tradable instrument | Accurate measure of trade competitiveness |

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesKey Factors That Drive DXY Movements

The DXY is highly sensitive to a range of macroeconomic forces, policy decisions, and global events.

- Monetary Policy: The Federal Reserve’s decisions are the primary driver. Interest rate hikes and Quantitative Tightening (QT) typically strengthen the dollar (DXY rises), while rate cuts and Quantitative Easing (QE) weaken it.

- Economic Indicators: Strong US economic data (high GDP, low unemployment) boosts the dollar. A persistent trade deficit tends to weaken it.

- Global Risk Sentiment: During global crises, investors often flock to the US dollar as a safe-haven asset, causing the DXY to rise.

The DXY’s Impact on Global Markets

The DXY’s movements have significant ripple effects across other asset classes.

DXY and Commodities (Gold, Oil)

A strong inverse correlation exists between the DXY and dollar-denominated commodities. A stronger dollar makes commodities like gold and oil more expensive for holders of other currencies, which tends to reduce demand and lower prices. For example, a 10% rise in the DXY from 100 to 110 has historically correlated with a significant fall in the price of gold.

DXY and Equities (S&P 500)

The relationship is complex. While a strong dollar can attract foreign investment into US stocks, it also creates headwinds for US multinational corporations. A rising DXY means that profits earned in foreign currencies translate back into fewer dollars, which can negatively impact the S&P 500.

DXY and Bonds (US Treasuries)

Historically, rising Treasury yields attracted foreign capital, strengthening the dollar. However, a divergence has been observed in 2024-2026, where high yields driven by US fiscal stress (debt and deficits) have coincided with a weaker DXY, challenging its safe-haven status.

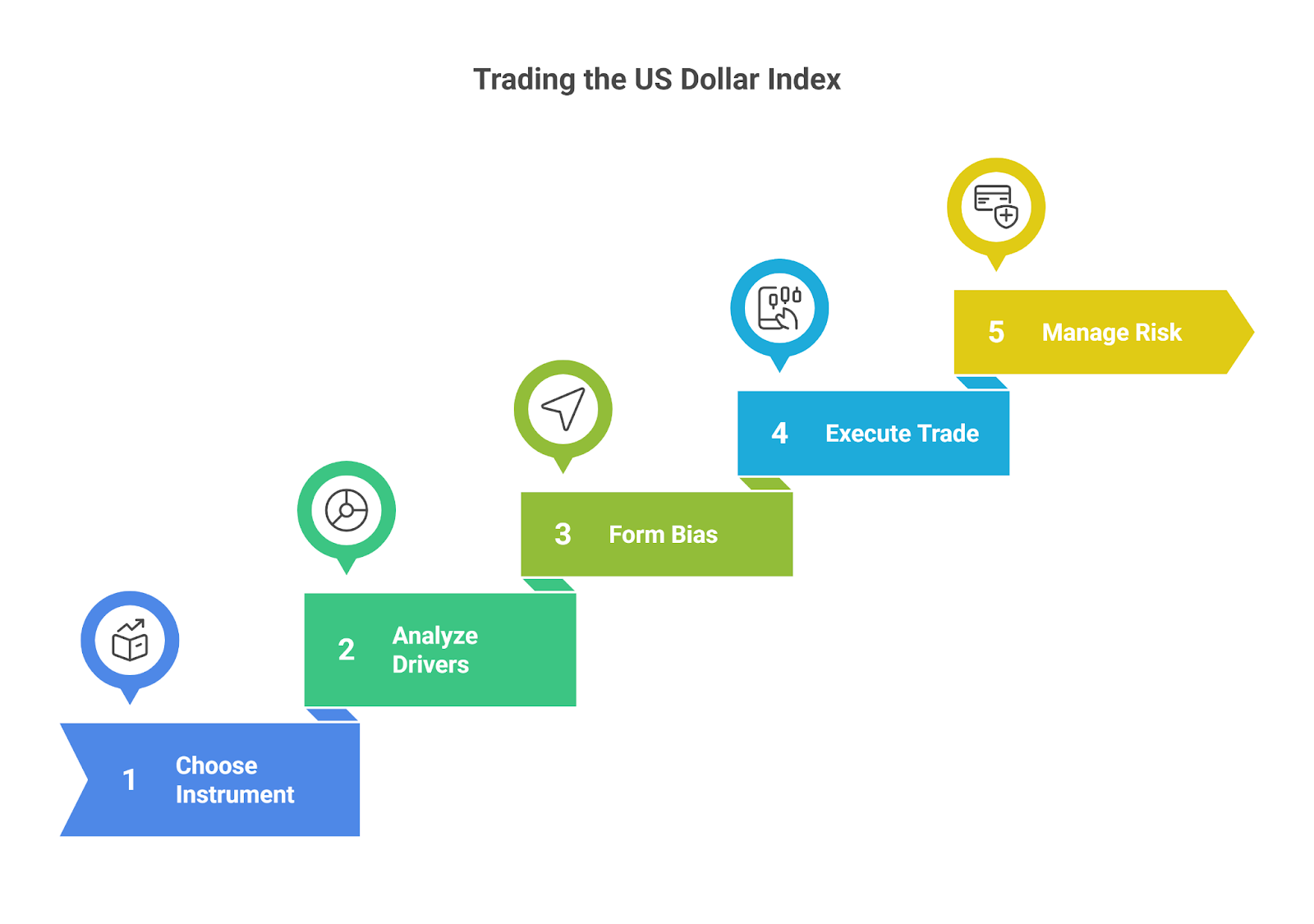

How to Trade the US Dollar Index (DXY): A Step-by-Step Guide

Trading the DXY involves speculating on its price movements using derivative instruments.

- Choose Your Instrument: Select a DXY-linked product. The most common are Futures Contracts (DX) traded on the ICE exchange, ETFs like the Invesco DB US Dollar Index Bullish Fund (UUP), and CFDs offered by forex brokers.

- Analyze the Drivers: Evaluate the key factors moving the dollar, including upcoming Fed announcements, economic data releases, and global risk sentiment.

- Form a Directional Bias: Based on your analysis, decide if you expect the DXY to rise (strengthening dollar) or fall (weakening dollar).

- Execute the Trade: Open a long (buy) position if you are bullish or a short (sell) position if you are bearish.

- Manage Risk: Set a stop-loss order to define your maximum acceptable loss and determine a take-profit level based on your analysis. Many successful Forex traders also integrate the US Dollar Index into their broader strategy, using it as a benchmark to time entries across major pairs like EUR/USD and USD/JPY.

US Dollar Index (DXY) 2026 Outlook

The DXY’s outlook for 2026 is shaped by several competing macroeconomic forces:

- Federal Reserve Policy: The path of interest rates remains the key driver. Any pivot towards rate cuts could put downward pressure on the DXY.

- US Fiscal Stress: Growing concerns over the US national debt and budget deficit could weigh on investor confidence and the dollar’s long-term value.

- The Rise of BRICS Currencies: While the Chinese Yuan and a potential BRICS currency are not immediate threats to the dollar’s reserve status, their increasing use in international trade is a long-term trend that could gradually erode the DXY’s dominance.

- Safe-Haven Flows: Ongoing geopolitical tensions continue to support the dollar’s role as the world’s primary safe-haven currency, providing a floor for the DXY during crises.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The US Dollar Index (DXY) is more than just a number; it is a critical barometer of the dollar’s strength and a reflection of global macroeconomic forces. It is driven by Fed policy, economic data, and geopolitical events, and its movements have a profound impact on commodity prices, corporate earnings, and central bank decisions worldwide.

For traders and investors, understanding the DXY’s components, drivers, and correlations is essential for navigating the complexities of the global financial markets and recognizing the dollar’s enduring role as a reserve and safe-haven currency.