By wrapping ETH, users can participate in DeFi activities like trading on DEXs, lending, and bidding on NFTs, which otherwise require the standardized ERC-20 format.

Understanding WETH provides clarity on how Ethereum’s native cryptocurrency participates in the full spectrum of its decentralized finance landscape.

While understanding Wrapped Ethereum (WETH) is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is Wrapped Ethereum (WETH)?

Wrapped Ethereum (WETH) represents a tokenized version of native Ether (ETH) that adheres to the ERC-20 token standard. This 1:1 peg ensures WETH always holds the exact same value as ETH, making it functionally identical in price action. The primary purpose of WETH involves enabling Ether’s full participation within decentralized applications and smart contracts requiring ERC-20 compliance.

WETH operates as a critical interoperability solution on the Ethereum blockchain. It allows native ETH, which predates the ERC-20 standard, to integrate seamlessly into a wide range of DeFi protocols. This integration unlocks new functionalities for Ether across various platforms.

Why is WETH Necessary for the Ethereum Network? (The “Native vs. Token” Problem)

WETH becomes necessary for the Ethereum network due to fundamental technical differences between native Ether and the ERC-20 token standard. Native ETH cannot directly interact with smart contracts designed exclusively for ERC-20 tokens. This incompatibility limits ETH’s utility within the broader DeFi ecosystem.

The Historical Context of ETH and the ERC-20 Standard

Ethereum’s native cryptocurrency, Ether (ETH), launched in July 2015, prior to the finalization of the ERC-20 token standard. The ERC-20 standard, introduced in 2015 and finalized in 2017, defines a common set of rules for fungible tokens on the Ethereum blockchain. This standard specifies how tokens are transferred, how balances are accessed, and how tokens interact with smart contracts.

Native ETH does not inherently conform to these ERC-20 specifications. While ETH serves as the blockchain’s gas fee currency, it lacks specific functions like approve() or transferFrom() that are critical for ERC-20 token interactions within smart contracts. You can learn more about the ERC-20 Token Standard on Ethereum.org.

Interoperability Issues with Native Ether

Native Ether faces significant interoperability issues when attempting to interact with decentralized applications (dApps) built to handle ERC-20 tokens. Many DeFi protocols, including decentralized exchanges (DEXs) and lending platforms, explicitly require tokens to be ERC-20 compliant. Without WETH, native ETH cannot directly be traded, lent, or staked alongside other ERC-20 tokens like DAI, USDC, or UNI.

WETH solves this problem by wrapping native ETH into an ERC-20 compliant token. This conversion enables Ether to access the full functionality of the Ethereum DeFi ecosystem. This allows ETH holders to use their assets in liquidity pools, yield farming, and NFT marketplaces.

How Does the WETH Wrapping Process Work? (Mechanism & Custody)

The WETH wrapping process works by sending native Ether to a specific smart contract, which locks the asset and then mints an equivalent amount of WETH. This mechanism ensures a strict 1:1 peg between ETH and WETH. The smart contract acts as a custodian for the native Ether.

Converting ETH to WETH (Minting via Smart Contract)

Converting native ETH to WETH involves a transaction with a WETH smart contract. Users send their desired amount of ETH to this contract address. Upon receiving the ETH, the contract locks it away and then “mints” an equal amount of WETH tokens.

For example, sending 1 ETH to the WETH smart contract results in the creation of 1 WETH. This process typically incurs a small gas fee in Gwei, as it involves a blockchain transaction. The canonical WETH contract address is verifiable on platforms like Etherscan, and its official source is WETH.io.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesConverting WETH to ETH (Unwrapping and Burning)

Converting WETH back to native ETH, often called “unwrapping,” reverses the initial process. Users send their WETH tokens back to the same WETH smart contract. The contract then “burns” (destroys) the received WETH tokens and “releases” the equivalent amount of native ETH from its locked reserves.

This unwrapping also incurs a gas fee, similar to the wrapping process. The mechanism guarantees that for every WETH token in circulation, exactly one native ETH token remains locked within the smart contract. This transparent and verifiable process maintains the 1:1 peg consistently.

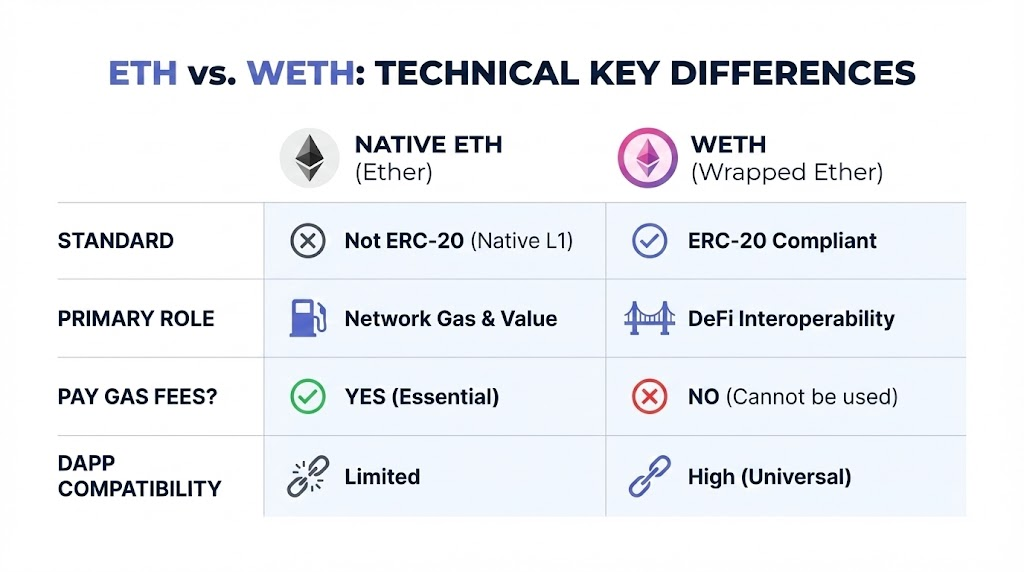

WETH vs. ETH: Key Technical Differences

WETH and ETH are not technically the same, despite their 1:1 value peg. Their primary difference lies in their underlying technical standards and functionalities. ETH functions as the native currency of the Ethereum blockchain, while WETH exists as an ERC-20 token built on that blockchain.

This distinction becomes critical for smart contract interactions. ETH acts as the network’s gas payment, whereas WETH cannot fulfill this role. WETH, however, provides the interoperability ETH lacks within the ERC-20 ecosystem. The table below highlights their key technical differences.

| Feature | Ethereum (ETH) | Wrapped Ethereum (WETH) |

| Asset Type | Native coin (Layer 1 currency) | ERC-20 token |

| Gas Fees | Used to pay gas fees | Cannot be used to pay gas fees |

| Interoperability | Limited in some dApps | High (ERC-20 compatible) |

| Value Source | Market demand | Pegged 1:1 to ETH |

| Creation | Mining / Staking (PoS) | Minting via smart contract |

Primary Use Cases for WETH in Decentralized Finance (DeFi)

WETH serves several primary use cases within decentralized finance, primarily by enabling native Ether to function seamlessly with ERC-20 compliant platforms. Without WETH, ETH holders would face significant limitations in participating in various DeFi activities. WETH provides crucial liquidity and utility across the ecosystem.

Trading on Decentralized Exchanges (Uniswap/Sushiswap)

Decentralized exchanges (DEXs) like Uniswap, Sushiswap, and PancakeSwap primarily operate using ERC-20 tokens. These platforms utilize automated market makers (AMMs) that require token pairs to adhere to the same standard. Since native ETH is not an ERC-20 token, it cannot directly form liquidity pools with other ERC-20 tokens.

WETH solves this by allowing ETH to be converted into an ERC-20 format. This enables users to provide WETH alongside other ERC-20 tokens (e.g., WETH/USDC) to liquidity pools, facilitating seamless trading and liquidity provision. It expands trading opportunities significantly.

NFT Bidding and Marketplaces (OpenSea)

NFT marketplaces also heavily rely on ERC-20 token compatibility for various functions, including bidding. Platforms like OpenSea often require WETH for placing bids on NFTs. This is because the bidding system operates via smart contracts that mandate ERC-20 token interactions.

When a user places a bid on an NFT, their WETH gets locked in a smart contract. If their bid is accepted, the WETH transfers to the seller. This mechanism ensures fair and transparent bidding processes on these platforms.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountKey Takeaways

- ERC-20 Compatibility: WETH provides the necessary standardization for native Ether to interact with modern DeFi protocols and smart contracts.

- 1:1 Peg Maintenance: Through a transparent mint-and-burn mechanism within a custodian smart contract, WETH always maintains the exact value of native ETH.

- Interoperability Anchor: WETH is essential for high-volume activities like DEX trading pools, lending markets (Aave), and NFT bidding (OpenSea).

- Gas Fee Distinction: While ETH is the primary asset for paying network transaction fees, WETH cannot be used for gas and requires a small buffer of ETH to be unwrapped.

Bottom Line

WETH is the unsung hero of the Ethereum ecosystem, providing the essential standardization needed to bridge the gap between native assets and smart contract logic. By wrapping ETH into the ERC-20 format, users gain unrestricted access to the high-yield world of DeFi and the burgeoning NFT market without sacrificing their exposure to ETH’s price. As decentralized finance continues to mature, WETH remains a foundational tool for any investor looking to maximize the utility of their digital assets.