Every Forex trader’s biggest tool for spotting turning points is the candlestick chart. Price leaves clues in every candle. The body shows where the market moved. The wick exposes rejection or pressure. Well, there are types of patterns that appear based on price behaviour—and one of them is bearish.

Bearish candlestick patterns show weakness near the top, hesitation after rallies, or pressure from sellers. If you grasp bearish patterns, you can effectively learn to exit before reversals or enter trades when the momentum shifts. They form part of the wider family of candlestick patterns, which traders use to read market sentiment.

While understanding Bearish Candlestick Pattern is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What are Bearish Candlestick Patterns?

Let’s say you’re watching a chart that’s been rising for hours. Every candle pushes higher. Buyers stay in control. Then, out of nowhere, a red candle appears. It closes lower than it opens. Price tries to push up, but fails. That moment right there—that’s bearish. It indicates buyers are losing strength and sellers are stepping in.

Now let’s consider another chart. A strong green candle finishes the session. The next day starts with a gap up. Price opens higher, but doesn’t hold. Sellers jump in. The candle closes deep into the body of the previous green bar, and flips sentiment. That’s bearish because it reflects a shift in control from bulls to bears.

Bearish candlestick patterns show up at the top of uptrends. You often find them when price tests resistance and stalls. A single candle might send the message—like a Hanging Man. Other times, the market speaks in sequences. Two or three candles reveal pressure, failure, and reversal. Patterns like Bearish Engulfing, Evening Star, or Three Black Crows tell that story in layers.

See, every candlestick pattern carries meaning:

- A small body with a long upper wick points to rejection.

- A large red candle that swallows the previous green one signals dominance.

- Three back-to-back bearish candles suggest continuation of selling momentum.

That’s why chart readers trust patterns—as they reflect what indicators often show too late.

But remember that bearish patterns don’t work in isolation. Volume and trend context matters. Bearish signals gain power near resistance, Fibonacci zones, or after strong rallies. A lower close confirms the shift. A failed retest or a volume spike seals the intent.

Bearish VS Bullish Candlestick Patterns

It is important to grasp the difference between bearish and bullish candlestick patterns so you can effectively anticipate market continuation or reversals. Each pattern forms under different trend conditions and tells a unique story about market sentiment, structure, and momentum.

| Characteristic | Bullish Patterns | Bearish Patterns | Confirmation Signal |

| Trend Context | Forms in uptrends | Forms in downtrends | Breakout with volume |

| Price Structure | Higher lows, flat tops | Lower highs, flat bottoms | Clear breakout above/below structure |

| Breakout Direction | Upward | Downward | With momentum spike |

| Volume Behavior | Lower during consolidation, higher on breakout | Lower during consolidation, higher on breakout | Spike at breakout |

| Entry Signal | Break above resistance | Break below support | Follow-through candle close |

| Stop Loss Placement | Below the pattern’s low | Above the pattern’s high | Outside structure |

| Profit Target | Pattern height projected upwards | Pattern height projected downwards | Use measured move |

When Do Bearish Patterns Appear on Charts?

Bearish candlestick patterns usually appear after a strong bullish move when price reaches a significant resistance zone, such as a previous swing high, a psychological level like 1.3000, or a Fibonacci retracement zone like 61.8%. The upward momentum slows down as buyers lose strength near these key levels, and sellers begin to step in quietly. The real body of the candles becomes smaller, upper wicks grow longer, and bullish closes start to lose ground—all signs that the buying pressure is fading and reversal pressure is building.

In many cases, technical indicators like RSI or Stochastic also show overbought conditions, which adds weight to the reversal signal. Volume begins to shift—bearish candles show heavier activity, while bullish candles print lighter. That change doesn’t scream at first, but it marks the start of something critical. Rejection starts forming in the structure. A strong green candle might be followed by a doji, or a red candle might open higher and close below the midpoint of the previous one. That sequence begins to form patterns like Bearish Engulfing, Dark Cloud Cover, or Evening Star.

So, it should be clear that bearish patterns don’t emerge out of nowhere. Price hesitation, bearish volume, structural resistance, and confirmation in price action create the exact conditions where bearish patterns appear and shift the direction of the chart.

Why Bearish Patterns Matter in Forex Trading?

- Show when buyers lose control near resistance

- Help catch trend reversals before price collapses

- Confirm entry zones near key levels like Fibonacci or supply

- Filter out false rallies in volatile pairs

- Support tighter stop-loss placement using candle structure

- Strengthen exit timing after profit runs

- Align with fundamentals when sentiment shifts negative

- Build confluence with indicators like RSI and volume divergence

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesSingle Candlestick Bearish Patterns

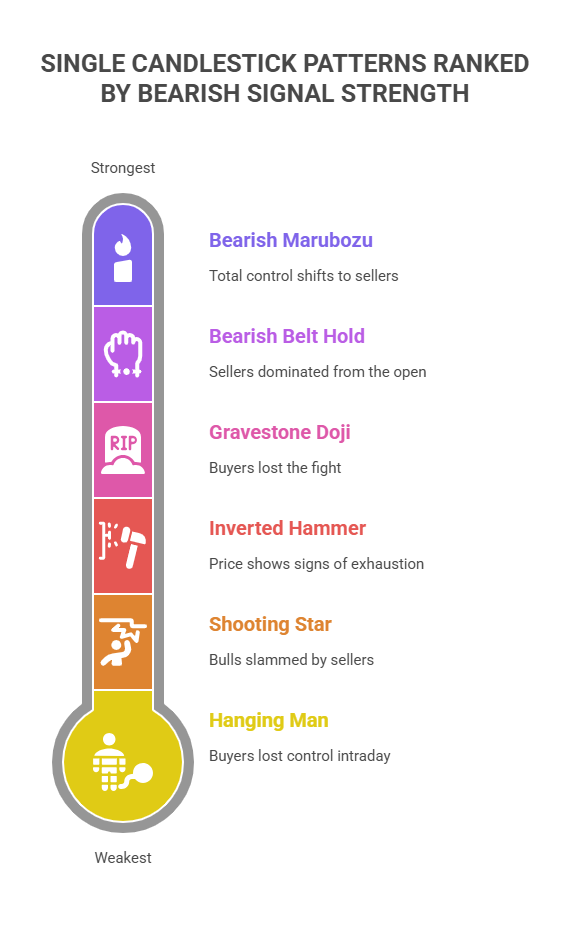

Some bearish patterns speak in one candle. When price stretches too far and sentiment flips fast, single candlestick formations give early warnings. You can spot them near highs, after news spikes, or at psychological zones.

Each one signals something different—but all share one idea: selling pressure is creeping in.

Hanging Man

Let’s say EUR/USD has been rallying for days and then prints a candle with a small body and a long lower shadow near 1.1200. That’s a Hanging Man. It shows buyers lost control intraday. The price dropped hard, then closed near the open.

- You use it after a strong bullish trend.

- Confirmation comes if the next candle breaks the low.

- Combine it with RSI divergence or fading volume for more weight.

- Works well near swing highs, previous supply zones, or pivot resistance.

Shooting Star

What if GBP/JPY pushes to a key round level like 188.00 and suddenly a candle prints with a tiny body and a long upper shadow? That’s a Shooting Star. Bulls tried to push but got slammed by sellers.

- Use it when price tests highs or resistance zones.

- Stronger signal if the body is near the low and volume spikes.

- Best used after impulsive rallies or on overbought conditions.

- Follow-up candle should close lower for clear validation.

Inverted Hammer

Let’s say USD/CHF rallies into 0.9150, then prints a small body with a long upper wick. That’s an Inverted Hammer—but bearish when it comes after a strong push and fails to continue.

- Use it when price shows signs of exhaustion.

- Wait for the next candle to break lower.

- It works best near resistance levels or where previous moves failed.

- Ideal for fading extended rallies.

Bearish Marubozu

Suppose that AUD/USD is near 0.6700. Suddenly, a long red candle forms—no wicks, just open at high and close at low. That’s a Bearish Marubozu. Total control shifts to sellers.

- Use it when the market breaks structure.

- Strongest when it appears after consolidation or fakeout highs.

- Great for momentum traders aiming for short continuation.

- Works well with volume spikes and MACD crossovers.

Gravestone Doji

Let’s say NZD/USD opens, shoots up during the session, but closes right at the open. Long upper shadow, no body. That’s a Gravestone Doji. The buyers lost the fight.

- Use it near psychological resistance like 0.6200 or a fib zone.

- Stronger if it forms after several green candles.

- Wait for a lower close next session to confirm it.

- Ideal on H4 or Daily timeframes for cleaner signals.

Bearish Belt Hold

For instance, USD/JPY gaps up to 145.00, then drops and closes near session low without bottom wicks. That’s a Bearish Belt Hold. Sellers dominated right from the open.

- Use it after sharp gap-ups or rally extensions.

- Better signal if paired with resistance or Bollinger band touches.

- Works well on news days or post-NFP reactions.

- Follow through matters—the next candle should hold low.

Two-Candle Bearish Reversal Patterns

Reversals often build in stages. Two-candle patterns show hesitation followed by a shift. All these patterns highlight that buyers tried to hold ground—but sellers stepped in and took over. You find them near major resistance, after impulsive pushes, or around false breakouts. When price structure pairs with candle contrast, reversal becomes clear.

Bearish Engulfing

Let’s say EUR/USD climbs for three sessions and prints a small green candle near 1.1040. Next day, a large red candle opens higher, swallows the previous body, and closes lower near 1.0960. That’s bearish Engulfing.

- You use it after uptrends or swing highs.

- Best when the engulfing candle closes below key support.

- Confirmation comes from volume rise or a follow-up break of structure.

- Works best on H4 and Daily, especially near fib levels or round numbers.

Dark Cloud Cover

Suppose that GBP/USD rallies to 1.3000 and a green candle prints. Next session, price opens above, pushes higher, but closes deep into the body of the first candle. That’s a Dark Cloud Cover.

- Use it when the second candle closes below the midpoint of the first.

- Stronger when it forms after a long bullish leg.

- Look for RSI turning from overbought or rejection from trendlines.

- Ideal on D1 or H4 before high-impact news.

Bearish Harami

For instance, USD/CAD climbs sharply and large green candle forms near 1.3750. Next candle opens inside and stays inside that body, closing lower. That inside red candle forms a Bearish Harami.

- Use it when volatility shrinks suddenly after strong momentum.

- Works well when price meets fib resistance or horizontal supply.

- Confirmation needs a break of the low or a bearish MACD cross.

- Best for swing entries on Daily or H4 charts.

Bearish Harami Cross

Similar setup—but instead of a full red candle, the second is a Doji. Let’s say AUD/USD prints a bullish candle followed by a Doji inside the same range near 0.6850. That’s a Bearish Harami Cross.

- Use it when momentum dries up.

- Stronger when price rejects from the top wick area.

- Best near Bollinger band tops or weekly resistance levels.

- Wait for the third candle to close bearish before acting.

Tweezer Top

Price pushes into resistance—say 145.80 on USD/JPY. One green candle and one red candle print side by side, both with matching highs. That’s a Tweezer Top.

- Strong reversal signal if wicks reject the same high twice.

- Works better with RSI divergence or when stochastic curves down.

- Use it near supply zones or failed breakouts.

- Confirmation comes if price closes below both candle lows.

Bearish Counterattack Line

Let’s say NZD/USD prints a big green candle on the H4. The next opens lower but closes at the same level as the previous close. That matching close forms a Bearish Counterattack.

- Use it when the price seems overextended.

- More effective when formed after fast news moves.

- Support comes from high volume and correlation with USD strength.

- Best on H1 to H4 in reversal zones.

Bearish Kicker Pattern

Suppose that USD/CHF trends higher, printing clean green candles. Suddenly, a red candle opens way below the previous close and drives lower—no overlap. That’s a Bearish Kicker.

- High-impact signal after news or fundamental shifts.

- Use it when sentiment flips fast (like after Fed or CPI).

- Works best on Daily or H4.

- Volume must spike to confirm momentum shift.

On-Neck Line

After a long bullish run, EUR/GBP prints a long red candle, then a small green candle opens below and closes near the low of the red one. That’s an On-Neck Line.

- Use it when price fails to rally after a drop.

- Weak reversal on its own, but stronger with confluence.

- Combine with moving average rejections or volume fades.

- Ideal for fading false recoveries.

In-Neck Line

Similar to On-Neck, but the green candle closes slightly higher—still under halfway of the red one. Let’s say price drops, pauses, and forms this structure on USD/CAD near 1.3660.

- Weak reversal, signals hesitation more than reversal.

- Use only with strong volume rejection.

- Confirm with indicators like OBV or MACD slowdown.

- Good for short scalps or tight stops.

Thrusting Pattern

Look closely if you find a bearish candle forming after a rally and then the next green candle opening lower but closing into the body of the red candle—without breaking the midpoint. That’s a Thrusting Pattern.

- Use when price tests key zones but fails to reclaim them.

- Acts more like a continuation than a reversal.

- Great for breakout traders looking for retests.

- Stronger when followed by a bearish candle closing lower.

Three-Candle Bearish Patterns

Three-candle patterns unfold the reversal in phases—build, pause, shift. You don’t simply see rejection, but clearly watch the control change candle by candle. Use them where trends stretch too far, and let confirmation guide the trade.

Evening Star

Let’s say GBP/USD trends higher for days and prints a strong green candle near 1.3080. The next candle forms a small-bodied range near the high, then the third prints a red candle closing well into the first. That’s an Evening Star.

- Use it after extended bullish moves.

- Stronger when the middle candle gaps or wicks higher.

- Best near daily resistance, round numbers, or fib clusters.

- Confirmed if the third candle closes below the midline of the first.

Evening Doji Star

Same setup as the Evening Star—but the middle candle is a Doji. Let’s say EUR/USD prints a green candle, then a Doji with upper wicks near a key level like 1.1045, followed by a red candle closing lower. That’s an Evening Doji Star.

- High-probability reversal when Doji shows indecision.

- Use it near overbought zones or after parabolic pushes.

- Stronger when RSI diverges and price holds below the third candle’s low.

- Works best on H4 and Daily around news events or exhaustion candles.

Three Black Crows

For instance, USD/JPY rises sharply, then stalls near 146.00. Over three sessions, price prints three consecutive bearish candles, each with lower highs and lower closes. That’s Three Black Crows.

- Shows full bearish control and trend reversal.

- Use it when uptrend loses momentum or after fakeouts.

- Stronger with high bearish volume or MACD crossover.

- Best on Daily or Weekly to confirm macro shifts.

Deliberation Pattern

Let’s say NZD/USD trends upward. First two candles are bullish, the third is also green but smaller and closes near the previous candle’s high. That final candle shows hesitation. That’s a Deliberation Pattern.

- Early signal of buyer fatigue.

- Use when volume shrinks on the third candle.

- Stronger near resistance or fib projections.

- Wait for a bearish candle next session to confirm.

Advance Block Pattern

What if Price climbs with three green candles? Each candle gets smaller, and upper wicks start to appear. Let’s say AUD/USD prints this near 0.6850 after a rally. That’s an Advance Block.

- Shows buyers losing steam.

- Use near prior supply or overbought RSI zones.

- Stronger if the last candle shows a long upper wick.

- Confirmed if followed by a bearish engulfing or Marubozu.

Rare and Advanced Bearish Candlestick Patterns

Every advanced pattern forms through a sequence of control shifts between buyers and sellers. Forex traders reading clean price action near structure zones gain clarity when these formations unfold in full. Volume spikes, confirmation closes, and momentum indicators add strength to the signal—each element guides what comes next.

Abandoned Baby

Price rallies strong into a resistance zone. A green candle forms. A Doji then appears with a visible gap on both sides. After that, a red candle follows through with a gap down. No overlap forms between any of the bodies or shadows.

- Expect this setup after news spikes or earnings-related gaps in forex.

- Use on Daily or H4 near key horizontal levels.

- High-volume break below the third candle strengthens conviction.

Tri-Star Top

Three Dojis cluster occurs near a major swing high. The middle one shifts slightly above the others. Volatility compresses while range contracts.

- Often shows up when markets hesitate before trend reversals.

- Use around resistance backed by RSI divergence or Bollinger squeeze.

- Strong reversal setup when followed by long bearish confirmation.

Upside Gap Two Crows

Price prints a green candle. Next candle opens with a gap above and closes bearish. Another red candle forms and closes below the first. Gaps remain open.

- Common during overextended moves where buyers lose momentum.

- Best near fib extensions or psychological round numbers.

- Entry improves when volume surges downward after the second red candle.

Bearish Side-by-Side White Lines

A sharp red candle appears first. Then two green candles follow, forming nearly identical bodies that do not breach prior highs. Both form within the lower third of the initial red candle.

- Signals temporary buying without commitment.

- Useful during pullbacks in established downtrends.

- Works well on H1–H4 charts backed by low-volume recovery candles.

Bearish Ladder Top

Three ascending green candles print in sequence. A small-bodied candle with a long upper wick follows. Then a strong red candle appears, closing below the second candle in the sequence.

- Indicates weakening bullish intent and incoming reversal.

- Best for spotting turning points near supply clusters or key zones.

- Added weight when stochastic or MACD crossover occurs just after.

Downside Tasuki Gap

Price drops sharply and gaps lower on the next session. A small green candle forms inside the gap zone but fails to cover it.

- Confirms continuation rather than reversal.

- Stronger when printed during trend resumption after consolidation.

- Found near breakout zones or after structural rejection from MAs.

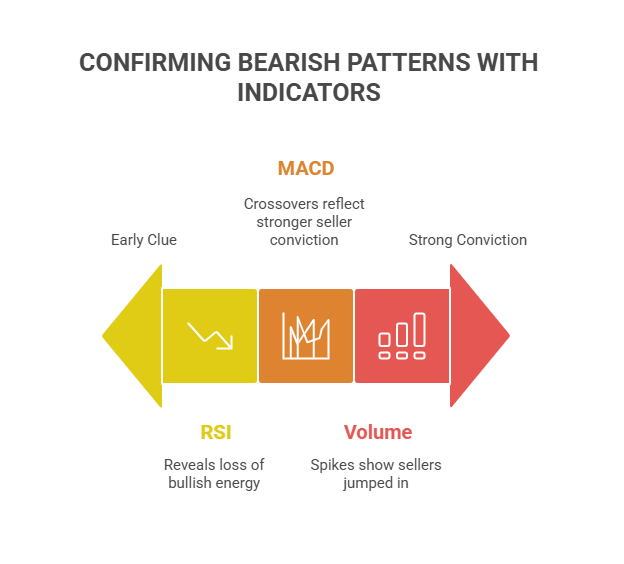

How to Confirm Bearish Patterns Using RSI, MACD, and Volume?

So first of all, reading candlestick patterns gives the first clue. But real confirmation always comes from what happens underneath—momentum shifts, pressure build-up, and trading volume. Once a bearish pattern forms, the next step is to check if RSI, MACD, and volume agree with that story. If there’s no alignment, then the bearish candlestick patterns lose credibility.

RSI: Spot the Momentum Shift

Let’s say a Shooting Star appears on GBP/JPY after a clear rally. RSI already sits above 70. The next candle fails to push higher. RSI starts curving downward toward 60. That change reveals loss of bullish energy. Most strong reversals follow the same path—price hesitates, and RSI pulls back. If RSI formed a lower high while price formed a higher one, that divergence exposes weakening demand. Once RSI dips below 50, sellers gain an edge. For traders, that drop acts as a signal. Momentum confirms the setup.

MACD: Follow the Crossover Clue

MACD reveals trend exhaustion more slowly, but its crossovers hold weight. Imagine a Bearish Engulfing candle forms at the top of a long push on USD/CAD. MACD histogram begins shrinking. Signal line crosses underneath. Trend pressure fades. When MACD shifts direction and begins heading toward zero, sellers start dominating. A crossover near the zero line reflects stronger conviction. Patterns like the Evening Star or Bearish Harami become more valid when MACD follows with clear reversal pressure. Once that crossover completes, price often accelerates in the new direction.

Volume: Watch Who’s Committed

Now suppose that a Hanging Man prints on EUR/USD at a key resistance level. Price barely closes red—but volume spikes. That increase shows sellers jumped in. Volume reveals real participation. Green candles forming earlier with low volume, followed by a high-volume red candle, often means the market paused and then turned. Three Black Crows backed by increasing volume signal continuation. A single Bearish Marubozu paired with a volume burst speaks louder than any indicator. Volume works best near psychological price levels or Fibonacci extensions. If volume matches the reversal story, the setup gains serious traction.

Best Timeframes to Trade Bearish Candlestick Setups

| Timeframe | Best Use | Recommended Patterns |

| M15 – M30 | Scalping reversals at minor resistance; fast entries in volatile sessions | Shooting Star, Bearish Belt Hold |

| H1 | Short-term pullback reversals; works well in volatile news-driven sessions | Bearish Engulfing, Tweezer Top |

| H4 | Swing entries after trend exhaustion; ideal for pairs in consolidation zones | Evening Star, Dark Cloud Cover, Three Black Crows |

| Daily | Trend shifts or strong rejection at key zones; perfect for swing traders | Gravestone Doji, Bearish Harami Cross |

| Weekly | Macro-level shifts; confirms multi-day or swing biases | Bearish Marubozu, Tri-Star Top, Advance Block |

Common Mistakes Traders Make with Bearish Patterns

- Chasing patterns without trend alignment often backfires. When the market still trends up, even clean bearish signals tend to fail.

- Jumping in before candle confirmation exposes the trade to traps. A pattern gains validity only after a proper close.

- Skipping volume analysis limits insight. Without rising sell-side volume, the pattern may hold no real pressure.

- Blindly trusting every wick and shadow can create noise. Not all shooting stars or hammers signal reversal.

- Forgetting higher timeframe structure leads to confusion. A bearish signal on the 15-minute chart might go against a weekly uptrend.

- Treating every resistance touch as rejection leaves no room for context. Smart traders wait for failed retests or momentum loss.

- Using patterns alone for entry and exit creates inconsistent outcomes. Confirmation from RSI or MACD adds a real edge.

- Holding onto losing trades hoping for reversal often turns minor mistakes into major drawdowns.

- Reacting emotionally to candle shape instead of setup context results in poor decision-making.

- Overfitting patterns to random charts wastes time. Not all candles form from logical price action.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountFinal Thoughts

Every bearish candlestick pattern tells a story. But reading that story right demands more than shapes and colours. It takes context, timing, and patience. Price hesitates near the top, momentum fades, volume shifts—and that’s where traders who understand structure take the lead.

If you treat patterns as part of a bigger plan, they give clarity in chaos. But if you chase every shadow without confirmation, the chart gives nothing back. So trade what’s clear, confirm what you see, and stay aligned with the rhythm of the market.