How Not to Blow Up Your Account in the First Month: 3 Survival Rules for New Traders

Most beginners step into trading with grand expectations. They dream of overnight profits, financial independence, and finally breaking free from the 9-to-5 grind.

But reality hits hard: almost 9 out of 10 new traders wipe out their first account within a month.

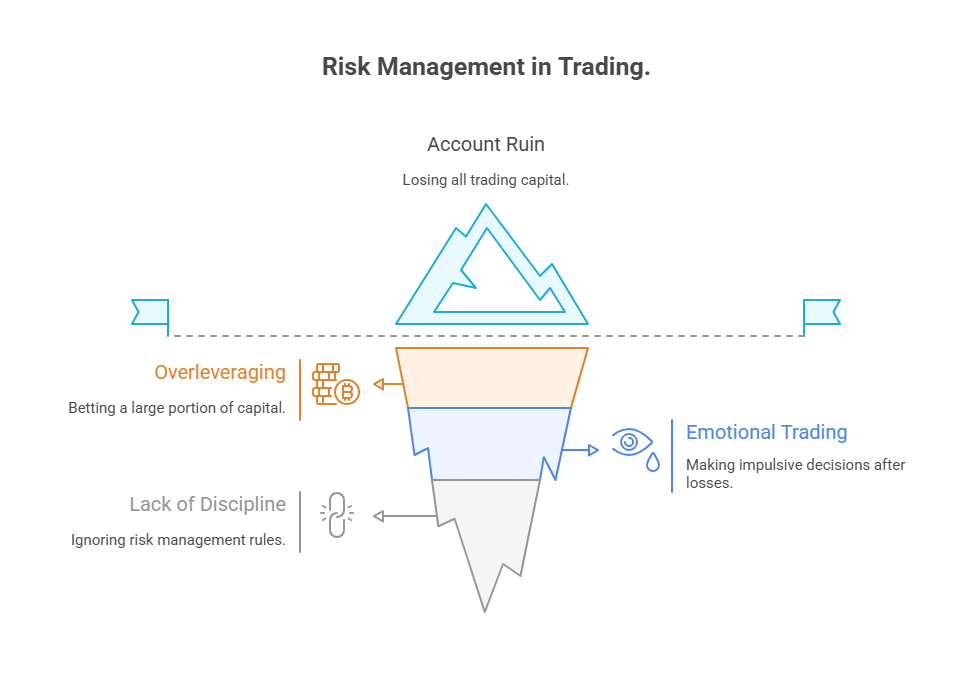

It’s not because trading is unwinnable. It’s because rookies keep stumbling into the same traps-betting too much on a single idea, skipping the plan, and letting emotions call the shots.

The good news? You don’t have to be another cautionary tale. With a bit of discipline, you can protect your money, learn with less stress, and actually give yourself a fighting chance to succeed long-term.

This guide lays out three simple survival rules plus a pre-trade checklist to keep you steady.

The Nightmare of the First Month

Ask almost any trader with scars and stories, and you’ll hear something like this:

“I started with $1,000. Within weeks, it was down to fifty bucks. I felt duped by the market-and by myself.”

Why does this play out so often?

- Overconfidence: “This setup can’t lose.”

- Greed: “If I go all in, I’ll double my account tonight.”

- Fear: “It’s going against me… but maybe it’ll bounce.”

- No structure: “Eh, looks good enough, let’s buy.”

Markets are ruthless toward those mistakes. The first month becomes a cemetery of deposits.

But dodge these traps early, and you don’t just save money-you spare yourself years of bitterness.

Rule #1: Don’t Risk the Farm on a Single Trade

This is the top account killer. The rookie logic goes: “If I bet it all on the right setup, I’ll score big.”

But even the cleanest setups fail. If you’ve staked 50%, 70%, or your whole account, one bad move = instant ruin.

Professional traders never wager more than 1-2% on a single trade.

Imagine this:

- Account size: $1,000

- Max risk per trade: $20

Five losses in a row? You’re down only $100, still in the game.

Now flip it. Risk $500 on one trade, and a single loss guts half your capital. Emotions flare, you chase, and the downward spiral begins.

📌 Takeaway: Your primary job isn’t winning big. It’s staying alive long enough to learn.

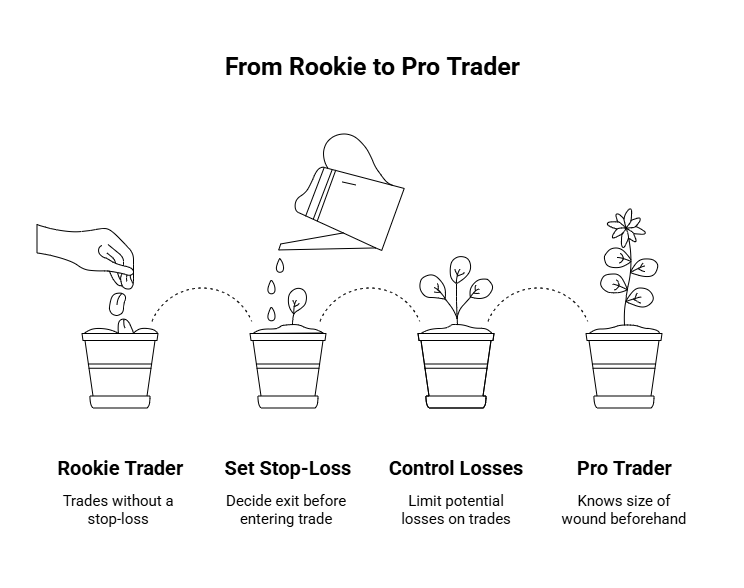

Rule #2: Always Use a Stop-Loss

The second big rookie error: trading without a stop.

The thought goes, “I’ll just hold-it’ll come back.” Sometimes it does. Usually, it doesn’t.

Without a stop, what should’ve been a small, controlled hit mutates into a disaster.

Pros decide their exit before they even enter.

Example:

- You buy gold at $1900.

- Stop-loss at $1880.

- If wrong, you lose $20 (2% of your $1,000).

No big deal.

Without the stop? Gold slides to $1870. Suddenly, you’re down $30.

📌 Takeaway: Every pro takes losses. The difference is, they know the size of the wound before it happens.

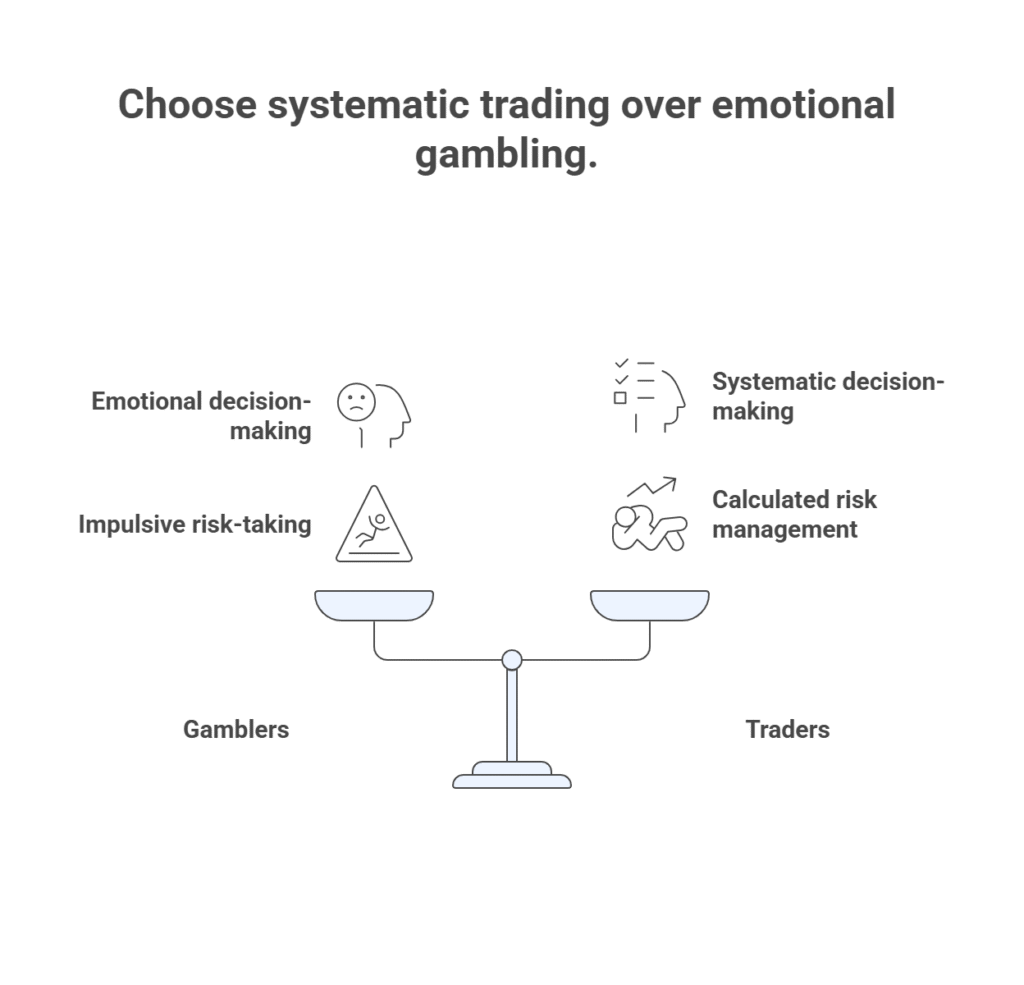

Rule #3: Trade Your System, Not Your Nerves

Markets are designed to mess with your head.

Price rockets upward, your pulse spikes: “I have to jump in!” You buy the top. Minutes later, it reverses.

Or, you’re in small profit but anxious: “Better grab it before it vanishes.” You exit too early-and then watch the trade run in your favor without you.

Pros don’t wing it. They follow systems.

A system doesn’t need to be complex:

- Enter only if price breaks key support/resistance.

- Confirm with an indicator (say RSI > 50 for buys).

- Always use stop-loss with fixed risk.

- No signal = no trade.

📌 Takeaway: Gamblers chase feelings. Traders execute rules.

Pre-Trade Checklist

(Stick This Next to Your Screen)

Before clicking Buy or Sell, ask yourself:

☑ Am I risking 2% or less of my account?

☑ Did I set entry, stop, and take-profit?

☑ Is my risk/reward at least 1:2?

☑ Does this match my system’s rules?

☑ Am I calm-not trading out of fear or FOMO?

☑ Did I check the news calendar?

It may feel tedious. But this list is what separates the survivors from the blown-up accounts.

A Beginner’s Story

Take Alex, a 35-year-old IT guy in Berlin. He opened a CFD account with €2,000-smart, motivated, eager.

Week 1: He tripled his position size on EUR/USD because it “looked obvious.” Lost €400.

Week 2: Determined to win it back, he doubled down. Another loss. Now down 50%.

Week 3: Panicked, he held a gold trade without a stop. Overnight move cleaned out nearly everything.

By week 4, Alex quit-convinced trading was a scam.

But it wasn’t trading that scammed him. It was his approach.

If Alex had stuck to the three rules, his account would’ve survived. He could’ve kept learning instead of walking away bitter.

👉 The market didn’t crush Alex. His lack of discipline did.

The Better Path

Now imagine the flip side.

End of month one: your deposit is intact. Losses are small and managed. Wins feel steady, not like a lottery ticket.

By month six, you’re not “trying strategies” at random-you’re following a clear plan. The account is growing slowly, but safely.

That’s not a fantasy. That’s what happens when survival comes before shortcuts.

Why Beginners Need This

Searches like:

- how not to blow trading account

- beginner trading mistakes

- risk management in trading

- CFD trading tips

…all circle back to one truth. New traders don’t really want a jackpot. They want to avoid catastrophe.

This guide answers that need, in plain language, with relatable examples-and a free checklist to boot. That’s how you win trust, not just clicks.

The Bottom Line

Blowing up your first account isn’t some rite of passage. It’s a mistake-and a preventable one.

Remember the rules:

- Risk ≤ 2% per trade.

- Always use a stop.

- Trade the system, not emotions.

And check yourself before every entry.

👉 Do that, and your first account won’t be a casualty. It’ll be the start of a career.