The crypto market operates 24/7, demanding constant liquidity to facilitate seamless trading. Market makers fulfill this critical role, acting as the invisible gears that keep the complex machinery of digital asset exchanges running smoothly. Without them, price volatility increases significantly, and traders face substantial friction.

While understanding Crypto Market Maker is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What Is a Crypto Market Maker? (Definition of Liquidity Provision)

A crypto market maker is a professional entity or individual that enhances an exchange’s liquidity. They achieve this by consistently quoting both a buy (bid) and a sell (ask) price for a particular cryptocurrency. This continuous quoting ensures an active market where traders can always execute orders efficiently.

Market makers use their own capital and sophisticated algorithms to facilitate trading. Their primary function involves creating a stable and deep order book. This stability is critical for new token projects and established cryptocurrencies alike.

The Securities and Exchange Commission (SEC) defines a market maker as a firm that stands ready to buy and sell securities on a regular or continuous basis. In crypto, this definition extends to digital assets, underscoring their role in maintaining orderly markets. Their constant activity reduces the risk of large price swings, which benefits all market participants.

Providing liquidity means market makers act as intermediaries. They stand ready to buy from sellers and sell to buyers, profiting from the small price difference between the bid and ask. This mechanism is central to price discovery and market efficiency.

How Crypto Market Making Works (The Order Book Mechanics)

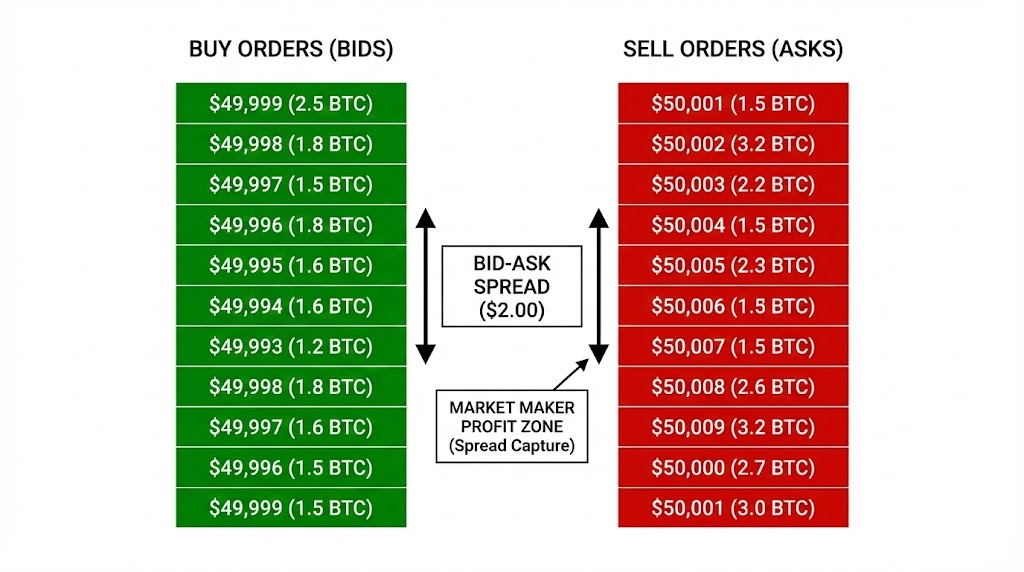

Crypto market making predominantly operates through order books on centralized exchanges (CEXs). These platforms display a list of current buy and sell orders for various assets. Market makers strategically place their limit orders within this order book.

These limit orders are placed at different price points, both above and below the current market price. This strategy ensures the market maker is ready to transact as prices fluctuate. The goal is to always have orders on both sides of the market.

Modern market making is almost entirely algorithmic, driven by high-frequency trading (HFT) bots. Human traders cannot react fast enough to crypto’s rapid price movements. These algorithms execute millions of trades daily, adjusting prices within milliseconds.

The Bid-Ask Spread (Price Discovery)

The bid-ask spread is the core element of market making profit. It represents the difference between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). Market makers capture this spread.

For example, if Bitcoin’s bid price is $50,000 and the ask price is $50,001, the spread is $1. A market maker buys at $50,000 and immediately sells at $50,001. This small, immediate profit accumulates over high trading volumes.

The spread reflects market conditions, including liquidity and volatility. Tighter spreads indicate high liquidity and low volatility. Wider spreads, conversely, suggest lower liquidity and higher price uncertainty. Market makers continuously work to narrow these spreads.

Providing Liquidity and Depth (Reducing Slippage)

Market makers significantly reduce slippage, a critical issue for traders. Slippage occurs when an order executes at a different price than intended, often due to insufficient liquidity. This deviation can exceed 0.1% on illiquid assets.

By placing numerous buy and sell orders, market makers create market depth. Market depth refers to the volume of orders available at different price levels. A deep market absorbs large trades without significant price impact.

High market depth provides a robust environment for traders. It ensures that large orders can be filled close to the current market price. This stability instills confidence and encourages greater trading activity on an exchange.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow Market Makers Make Money in Crypto (Revenue Models)

Crypto market makers generate revenue primarily through the bid-ask spread and exchange rebates. These two mechanisms form the foundation of their profitability model. Market makers execute a high volume of trades to capitalize on these small, consistent gains.

Their complex algorithms are designed for precision and speed. They continuously analyze market data across multiple exchanges. This enables them to identify and exploit tiny price discrepancies.

Spread Capture (Arbitrage)

Spread capture is the most direct profit mechanism for market makers. They aim to buy at the bid price and sell at the ask price, pocketing the difference. This process is essentially a form of high-frequency arbitrage.

Consider a scenario where Bitcoin trades at a $0.50 spread. If a market maker executes 100,000 such trades daily, their gross profit from spread capture alone can be substantial. These profits accumulate quickly over time.

Market makers also perform arbitrage across different exchanges. If Bitcoin is $50,000 on Exchange A and $50,005 on Exchange B, they buy on A and sell on B. This activity helps synchronize prices globally.

Exchange Rebates (Maker-Taker Fees)

Many exchanges incentivize market makers through “maker-taker” fee structures. Market makers are “makers” because their limit orders create liquidity. Exchanges often provide rebates for these “maker” orders.

Typical maker rebates range from 0.02% to 0.05% of the trade value. Takers, who remove liquidity with market orders, pay a higher fee. This rebate structure provides a powerful incentive for market makers to maintain deep order books.

These rebates can form a significant portion of a market maker’s overall revenue. They allow market makers to profit even from extremely tight spreads. This system ensures consistent liquidity provision.

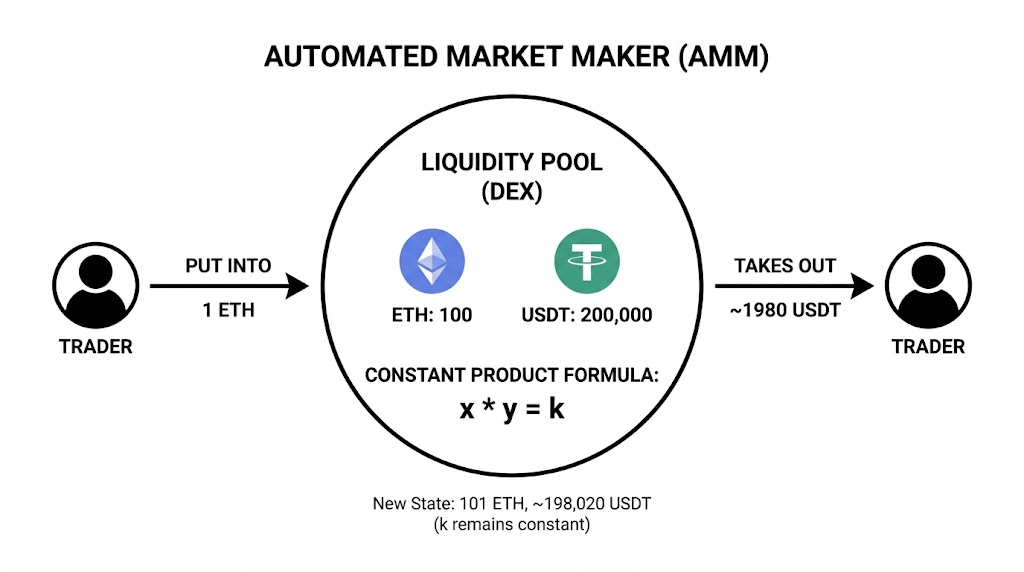

Automated Market Makers (AMM) vs. Order Book Market Makers

The crypto landscape features two primary market making models. Traditional order book market makers operate on centralized exchanges. Automated Market Makers (AMMs) function on decentralized exchanges (DEXs) using smart contracts.

Institutional market makers like GSR and Keyrock are prominent examples in the order book model. They deploy vast capital and advanced algorithms. AMMs, conversely, democratize market making through liquidity pools.

The Role of Liquidity Pools in DeFi

Automated Market Makers power decentralized finance (DeFi) ecosystems. Instead of an order book, AMMs use liquidity pools. These pools consist of two or more token pairs (e.g., ETH/USDT) locked in a smart contract.

Users, known as liquidity providers (LPs), deposit their crypto into these pools. The smart contract then uses a mathematical formula (like the Constant Product Formula $x * y = k$) to determine asset prices. This formula ensures a balance between tokens.

Traders interact directly with the liquidity pool, not an order book. When a trader swaps ETH for USDT, they add ETH to the pool and remove USDT. The formula automatically adjusts the price based on the ratio change. LPs earn trading fees for providing liquidity.

Risks Faced by Crypto Market Makers (Inventory Management)

Crypto market making is not without significant risks. The primary challenge involves inventory risk. This risk arises from holding a substantial amount of a specific cryptocurrency.

If the price of the held asset drops significantly, the market maker faces losses. This is particularly pronounced in volatile markets. Efficient inventory management is crucial for profitability.

Market makers employ sophisticated hedging strategies to mitigate inventory risk. They may use futures contracts or options to offset potential losses from price declines. These strategies aim to neutralize exposure.

Market Maker vs. Broker (Distinctions & Roles)

Understanding the distinction between a market maker and a broker is essential. While both facilitate trading, their roles, responsibilities, and revenue models differ fundamentally. A broker acts as an agent, while a market maker acts as a principal.

A broker executes trades on behalf of clients. They typically charge a commission for this service. Brokers do not take on inventory risk; they simply facilitate the connection between buyer and seller. They represent the client’s interests.

A market maker, conversely, trades with their own capital. They buy and sell assets from their own inventory. Their goal is to profit from the bid-ask spread, not a commission from a client. They represent their own interests.

Brokers fulfill client orders, seeking the best available price in the market. Market makers are the market, providing the prices themselves. This fundamental difference shapes their operational strategies and risk profiles.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountWhy Market Makers Are Essential for Token Projects (Market Health)

Market makers are indispensable for the health and viability of new token projects. They provide immediate liquidity for newly launched cryptocurrencies. This prevents extreme price volatility shortly after launch.

New tokens often suffer from low trading volume and wide bid-ask spreads. Market makers step in to stabilize prices. They establish a “fair value” for the asset by continuously adjusting their quotes based on demand.

Their presence encourages trading activity by reducing slippage. Traders are more likely to engage with a token that has deep liquidity. This engagement fosters organic growth and price stability.

| Feature | Order Book Market Makers | Automated Market Makers (AMMs) |

| Platform | Centralized Exchanges (CEXs) | Decentralized Exchanges (DEXs) |

| Mechanism | Order book, limit orders | Liquidity pools, smart contracts |

| Participants | Professional entities (e.g., GSR, Keyrock) | Individual liquidity providers (LPs) |

| Pricing Model | Bid–ask spread, market-driven pricing | Mathematical formula (e.g., x·y = k) |

| Revenue Source | Spread capture, exchange rebates | Share of trading fees |

| Key Risk | Inventory risk, intense competition | Impermanent loss |

Bottom Line

Market makers serve as the critical infrastructure that transforms volatile digital assets into tradable, liquid instruments, ensuring the 2025 crypto economy remains functional and accessible. Whether through institutional order books or decentralized liquidity pools, these entities absorb the friction of the marketplace, allowing you to execute trades with confidence. By understanding the profit motives and risks behind market making, you can better navigate exchange order books and make more informed decisions when choosing where to provide or consume liquidity in the digital space.

Key Takeaways

- Liquidity Provision: Market makers act as the constant counterparty, ensuring you can buy or sell crypto at any time.

- Spread Mastery: Their primary profit comes from the ‘Bid-Ask Spread,’ the small difference between buy and sell quotes.

- Volatility Buffering: By maintaining deep order books, they stabilize asset prices and prevent extreme, erratic swings.

- CEX vs. DEX: Institutional firms handle order books on centralized exchanges, while smart contracts manage liquidity in DeFi.

- Risk Management: Market makers constantly hedge their portfolios to survive the high-volatility nature of digital assets.