Calculating margin in forex is essential for controlling risk, optimizing leverage, and maintaining a healthy account balance. Whether you’re trading EUR/USD or GBP/JPY, understanding how margin works ensures that you don’t overextend your positions or trigger unnecessary margin calls. This step-by-step guide demystifies how forex margin is calculated—covering everything from required margin formulas to leverage ratios and lot sizing. Designed for both new and intermediate traders, this 2025 guide aligns with modern trading conditions, so you can plan your trades with confidence and avoid costly mistakes.

Key Takeaways

- Forex margin is the required deposit you must make to open a larger leveraged trading position.

- The basic formula to manually calculate margin is Margin = Trade Size / Leverage.

- Higher leverage reduces the amount of margin you need but also significantly increases your potential risk.

- A margin call is a warning from your broker to add more funds or your trades will be closed automatically to prevent further losses.

- Avoid margin calls by using conservative leverage, setting stop-loss orders, and keeping your account well-funded.

- Use a forex margin calculator for quick and accurate calculations, but always understand the manual formula behind it.

What is Forex Margin?

Forex margin is the amount of capital a trader must deposit to open and maintain a leveraged position in the foreign exchange market. Rather than paying the full value of a trade, you only need to commit a percentage of the position size, which is held as collateral by your broker. This percentage is known as the required margin.

For example, if you trade 1 standard lot (100,000 units) of EUR/USD with a margin requirement of 1%, you only need $1,000 to control the full position. The broker provides the rest through leverage, allowing for greater exposure with limited capital.

Margin is closely related to free margin (available capital for new trades), used margin (capital tied up in open trades), and margin level (a risk metric that signals when you’re close to a margin call).

In short, forex margin empowers you to trade larger positions—but it also amplifies risk. Understanding how margin works is the first step toward effective risk management and sustainable trading.

Why is Margin Important in Forex Trading?

Margin is important in forex trading because it determines how much control you have over your capital, your exposure to risk, and your ability to manage multiple trades. Without margin, retail traders would need to fund the entire value of a position—making forex inaccessible to most individuals.

Margin acts as a financial buffer between you and the broker. It allows you to use leverage to amplify your trading power, while also ensuring there’s enough capital in your account to cover potential losses. This makes margin a critical tool for optimizing returns—but also a key risk factor.

Brokers use margin to calculate your margin level, which helps prevent overexposure and triggers margin calls if your equity falls too low. That’s why margin isn’t just about opportunity—it’s about discipline. This discipline links directly to risk management, where margin decisions define how much of your capital stays safe.

For active traders, margin management determines how many positions you can hold, when to close trades, and how much room you have to absorb market swings. In essence, margin is the gatekeeper of your trading flexibility and financial safety.

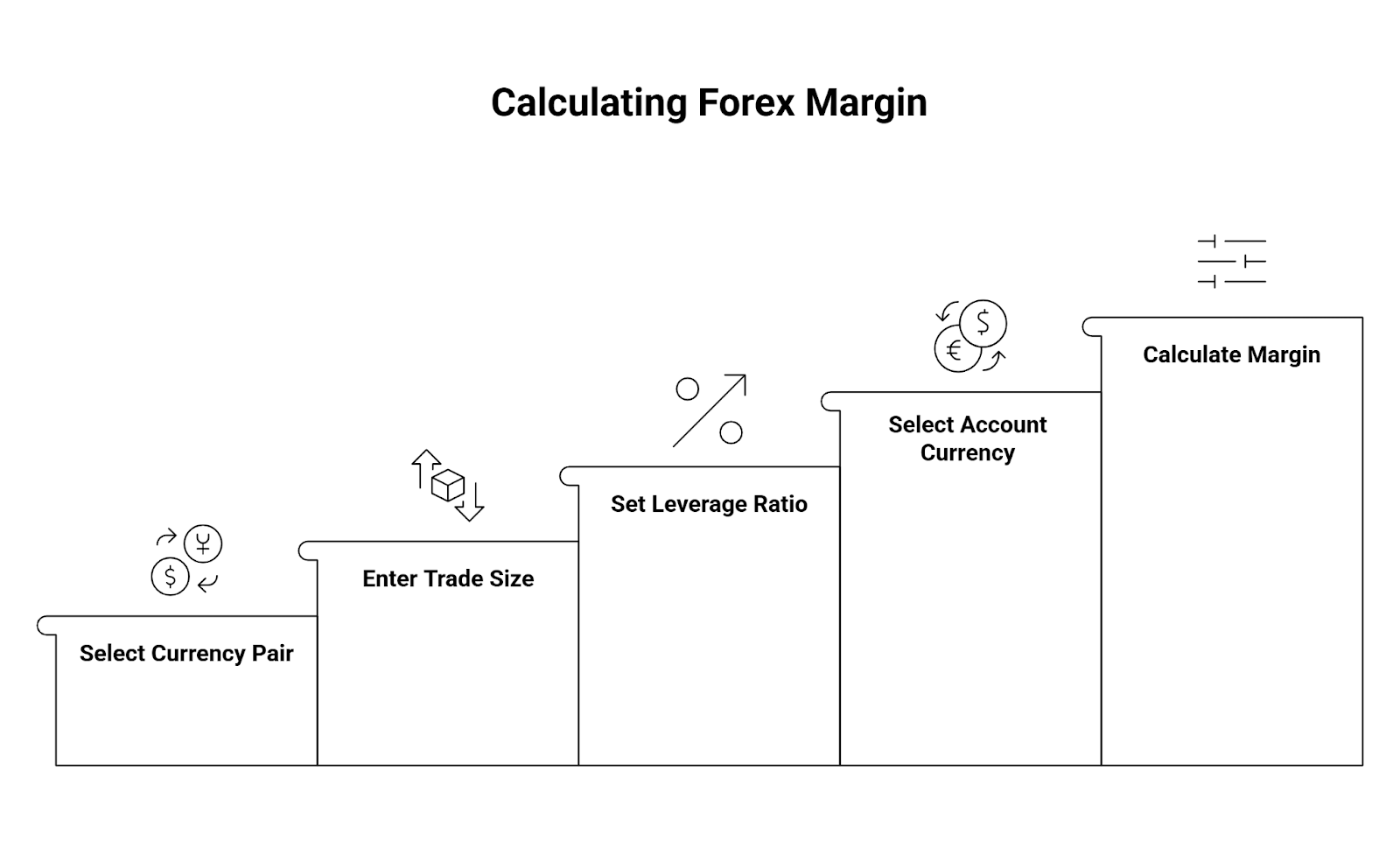

How to Calculate Margin in Forex Using a Tool?

You want to avoid complex manual calculations, which are prone to errors? Okay. Use a forex margin calculator tool to get clarity and accuracy. It’s designed to deliver precise results, just like that.

Step 1: Select the Currency Pair

Choose the currency pair you want to trade. Let’s consider EUR/USD, a popular pair for its high liquidity and tight spreads.

Step 2: Enter the Trade Size

Input the size of the trade you wish to place. For instance, let’s say you decide on 100,000 units, representing a standard lot. This choice allows you to calculate the margin needed for a larger position accurately.

Step 3: Set the Leverage Ratio

Choose the leverage ratio based on your broker’s offering. If your leverage is 1:50, this means you control $50 for every $1 of margin. For a $100,000 position, you only need $2,000 in margin at this leverage level.

Step 4: Select Your Account Currency

If your account is in USD, select USD as the account currency in the calculator. Setting this correctly ensures the margin requirement shows up directly in dollars, avoiding unnecessary conversions.

Step 5: Click “Calculate” to See the Margin

After entering all details, click “Calculate.” The tool will show you need $2,000 in margin to open a EUR/USD trade of 100,000 units. This clear output helps you confirm the exact margin amount needed before opening your position.

How to Calculate Margin Without Tools?

There’s a wide range of margin calculators available to simplify and automate the process. You simply enter your account currency, trade size, leverage, and currency pair, and the tool instantly calculates the margin needed. Is it beneficial? Reduced chance for error and immediate insights. You can use a margin calculator to make precise and strategic trade decisions, right away.

But it’s necessary to know how you can calculate the Margin manually. Yes. The manual method offers clarity on your trade requirements and potential risks.

Here’s the basic formula to calculate margin:

Margin = Trade Size / Leverage

Let’s consider a few examples to illustrate how trade size, leverage, currency pairs, and broker-specific requirements impact margin calculations.

Example 1: Standard Lot with USD Base Currency

You have a USD account and want to trade one standard lot (100,000 units) of EUR/USD. With leverage set at 50:1, calculate the margin requirement by dividing the trade size by leverage:

Margin = $100,000 / 50

Margin = $2,000

In this example, $2,000 is needed in your account to open a $100,000 position on EUR/USD.

Example 2: Mini Lot with Higher Leverage

Suppose you aim to open a smaller position—one mini lot (10,000 units) on GBP/USD—with a leverage of 100:1. Using the same formula, you get:

Margin = $10,000 / 100

Margin = $100

This calculation shows that you only need $100 to open a $10,000 position at 100:1 leverage.

Example 3: Position with Broker-Set Margin Requirement (Percentage)

If your broker sets a margin requirement of 2%, and you wish to trade one standard lot (100,000 units) of USD/JPY, calculate the required margin as follows:

Margin = Trade Size * Margin Requirement

Margin = $100,000 * 0.02

Margin = $2,000

This requirement means you need $2,000 in your account to open this position, regardless of leverage.

Example 4: Cross-Currency Trade in Non-USD Account

For an account in GBP, you decide to trade EUR/AUD. Suppose the current EUR/GBP exchange rate is 0.85, and you plan a 100,000 EUR position with a 20:1 leverage ratio. Calculate margin as follows:

Margin in EUR = $100,000 / 20

Margin in EUR = €5,000

Convert this to GBP based on the current rate:

Margin in GBP = €5,000 * 0.85

Margin in GBP = £4,250

In this example, £4,250 is required in your GBP account to open a 100,000 EUR position with 20:1 leverage.

Example 5: High-Leverage Trade with Small Position Size

You want to trade one micro lot (1,000 units) of AUD/USD with a high leverage of 200:1. Calculate the margin requirement:

Margin = Trade Size / Leverage

Margin = 1,000 / 200

Margin = $5

In this case, you need just $5 to open a 1,000-unit position at 200:1 leverage.

How to Calculate Margin Across Different Currency Pairs?

Calculating margin for different currency pairs requires understanding how leverage and trade size interact, especially when your account’s base currency differs from the pair you’re trading. Here’s how you’d approach margin calculations across a few different currency pairs.

Do you have a common trade in EUR/USD? Let’s say you want to open a €100,000 position with leverage of 50:1. Use the basic margin formula to divide the trade size by leverage:

Margin = €100,000 / 50

Margin = €2,000

This means you need €2,000 in your account to open a €100,000 position with 50:1 leverage. If your account is in USD, and the EUR/USD exchange rate is 1.10, convert the margin to USD:

Margin in USD = €2,000 * 1.10

Margin in USD = $2,200

In this case, you’d need $2,200 in your USD account to cover the position in EUR/USD with 50:1 leverage.

Now let’s consider trading AUD/JPY with an AUD position of 100,000 and a leverage of 30:1. Start with the margin in AUD:

Margin = 100,000 AUD / 30

Margin = 3,333.33 AUD

If your account is in USD, you’ll need to convert this to your base currency. Assuming the AUD/USD rate is 0.75:

Margin in USD = 3,333.33 AUD * 0.75

Margin in USD = $2,500

You’d need $2,500 in your USD account to open a 100,000 AUD position on AUD/JPY with 30:1 leverage.

What if you’re opting for a position in GBP/USD? Let’s suppose you want to trade £50,000 with a leverage of 20:1. First, calculate the margin requirement in GBP:

Margin = £50,000 / 20

Margin = £2,500

If your account is in USD and the GBP/USD exchange rate is 1.30:

Margin in USD = £2,500 * 1.30

Margin in USD = $3,250

In this case, a $3,250 margin in a USD account allows you to open a £50,000 position on GBP/USD with 20:1 leverage.

Now, let’s consider one final example. Suppose you’re trading NZD/USD with an NZD position of 75,000. So, a leverage of 25:1 would work similarly. Calculate the margin in NZD first:

Margin = 75,000 NZD / 25

Margin = 3,000 NZD

If your account is in USD, convert this using the NZD/USD exchange rate. If NZD/USD is 0.70:

Margin in USD = 3,000 NZD * 0.70

Margin in USD = $2,100

You’d need $2,100 in a USD account to manage a 75,000 NZD position on NZD/USD with 25:1 leverage.

Tips to Use Forex Margin Calculators

- Double-check that the calculator reflects your account currency to avoid unnecessary conversions.

- Match the leverage ratio with your broker’s settings to get an accurate margin requirement.

- Select the correct lot size to reflect your intended position accurately.

- Choose the exact currency pair you plan to trade, as different pairs have different margin requirements.

- Use a calculator that updates exchange rates in real time for precise margin calculations.

- Review the margin output carefully to confirm it aligns with your risk tolerance and available funds before placing the trade.

Understanding Margin Levels and Equity

Alright, you have learned to calculate margin. Now, you need to understand some additional factors that go beyond simple calculations. It’s essential to know margin, but other elements like margin levels, equity, and free margin play equally critical roles in managing your account effectively.

If you avoid these, you’d risk unexpected losses or margin calls that could close your trades automatically, cutting into your capital.

Margin level basically gives you a snapshot of your account’s health. It measures the ratio of your account’s equity to the used margin, which brokers use to assess if you can keep holding positions. A low margin level can trigger a margin call or force the broker to close positions, which prevents further losses. Equity, which includes your account balance and open trade outcomes, fluctuates with each market movement. High equity means you have more flexibility, while low equity increases risk and limits your trading capacity. This is why brokers set an equity requirement to secure margin and keep positions open.

It’s important to know that currency pairs also affect margin requirements, especially when your account’s base currency differs from the currency pair you trade. Each pair carries specific margin requirements based on volatility, trade size, and broker conditions. For example, trading GBP/JPY with a USD-based account requires adjustments based on exchange rates, which makes precise calculations crucial.

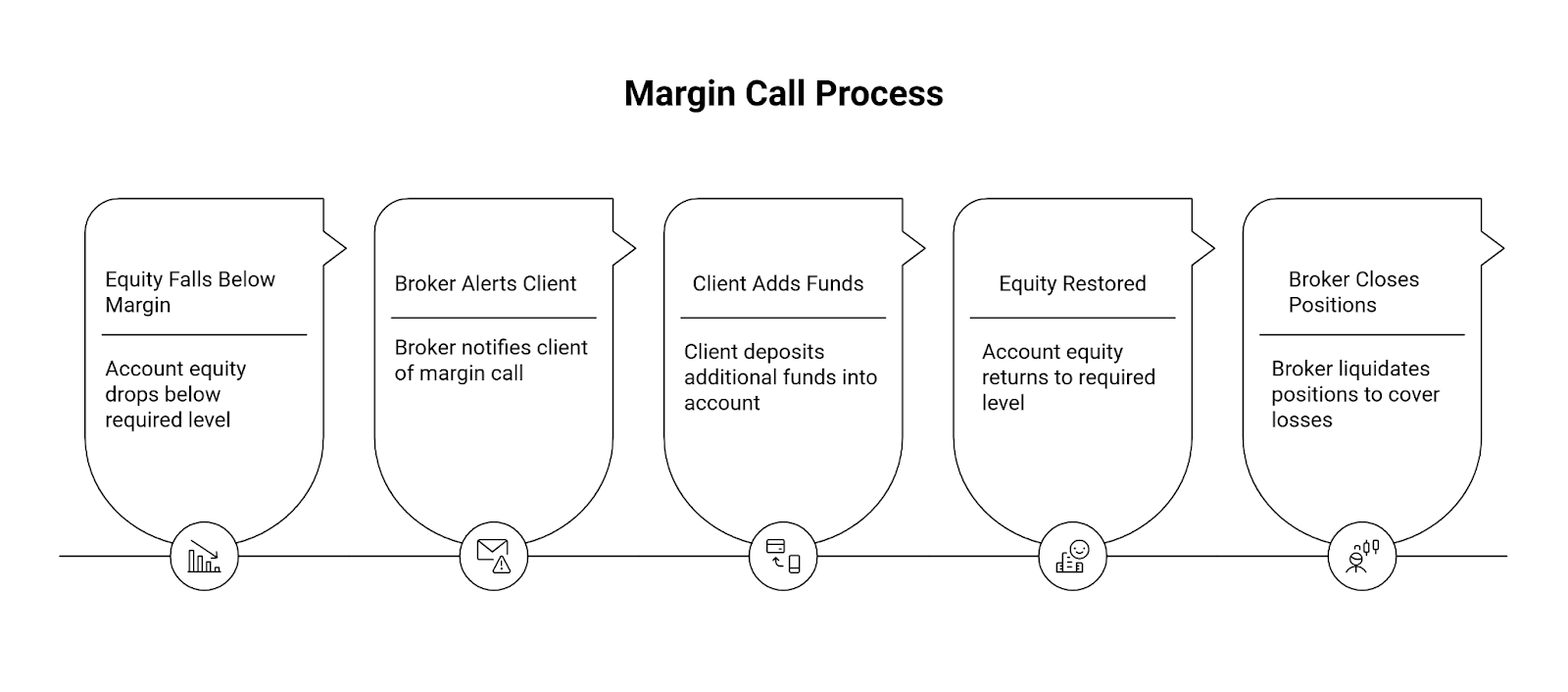

What is a Margin Call and How to Avoid It?

A margin call occurs when your account’s equity falls below the broker’s required margin level. When this happens, the broker may alert you to add more funds to maintain your open positions. If you don’t respond to a margin call quickly, the broker may start closing positions automatically to protect against further losses.

It’s worth noting that such a situation arises because leveraged trading amplifies both profits and losses, which makes margin levels an essential tool for risk management.

Here are a few tips to avoid a margin call:

- Check margin levels regularly to maintain required balance.

- Use conservative leverage ratios for added stability.

- Keep your account well-funded to handle unexpected shifts.

- Set stop-loss orders to limit potential losses.

- Choose less volatile currency pairs to avoid rapid margin level drops.

Bottom Line

Mastering how to calculate margin in forex isn’t just a technical skill—it’s a trading essential. Knowing your margin requirements helps you control risk, avoid margin calls, and size your positions with confidence. Whether you’re trading manually or using a forex margin calculator, accuracy is everything.

As you apply what you’ve learned, remember: leverage is a double-edged sword. Use it with discipline, monitor your account balance regularly, and always define your risk before opening a trade. Margin should support a long-term trading strategy—not fuel reckless decisions.

In the end, smart margin management keeps your capital protected and your trading consistent. It’s not about guessing—it’s about planning every move with precision.