The majority of beginners often wonder if burning crypto is an actual thing or just a concept. Some consider it a process that increases token value, whereas others see it as a marketing strategy.

Well, some traders believe it can increase value, similar to how traders speculate on high-reward opportunities like 100x crypto. But does it really make a difference?

It is important to know what burning crypto is and how it works, you can be mindful at every step of your trading journey.

What is Burning Crypto?

Crypto burning removes coins from circulation forever. Projects send tokens to a burn wallet. Nobody can access this wallet. Once sent, tokens are gone. Supply decreases. Some believe this makes tokens more valuable. Others think it is just a marketing trick.

You may wonder why this happens. Scarcity drives value. Less supply could mean higher prices. Some projects burn tokens to control inflation. Others use it as a marketing stunt. A few even burn tokens to correct mistakes. Each burn sends shockwaves through the market.

Various Crypto platforms do it. Binance Coin (BNB) slashes supply with regular burns. Ethereum (ETH) destroys transaction fees through EIP-1559. Shiba Inu (SHIB) builds hype with massive community burns. Each burn fuels speculation.

But does burning guarantee higher value? Not always. Supply drops, but demand decides the price. A token with no use will stay worthless, no matter how much is burned. Before you invest, look deeper. Crypto moves fast. Stay ahead of the game.

How Does Crypto Burning Work?

Crypto burning removes coins from circulation forever. But how does this actually happen? Who decides which tokens get burned?

First, the project selects the tokens to burn. Some projects schedule regular burns, while others burn tokens based on specific conditions. In some cases, burning happens through transaction fees, where a portion of each fee is permanently destroyed.

Next, the tokens are sent to a burn address—a wallet that nobody can access. This wallet has no private key, meaning the tokens inside can never be recovered or used. Once tokens reach this address, they are considered permanently removed from circulation.

Some projects make burning an automatic process. Ethereum, for example, introduced EIP-1559, where a part of every transaction fee is burned. Other projects, like Binance Coin (BNB), conduct periodic burns based on revenue or token volume. Shiba Inu (SHIB) even allows its community to burn tokens voluntarily.

The final step? The blockchain records the burn. Since blockchains are transparent, anyone can verify the burned tokens. This ensures that the process is legitimate and prevents fraud.

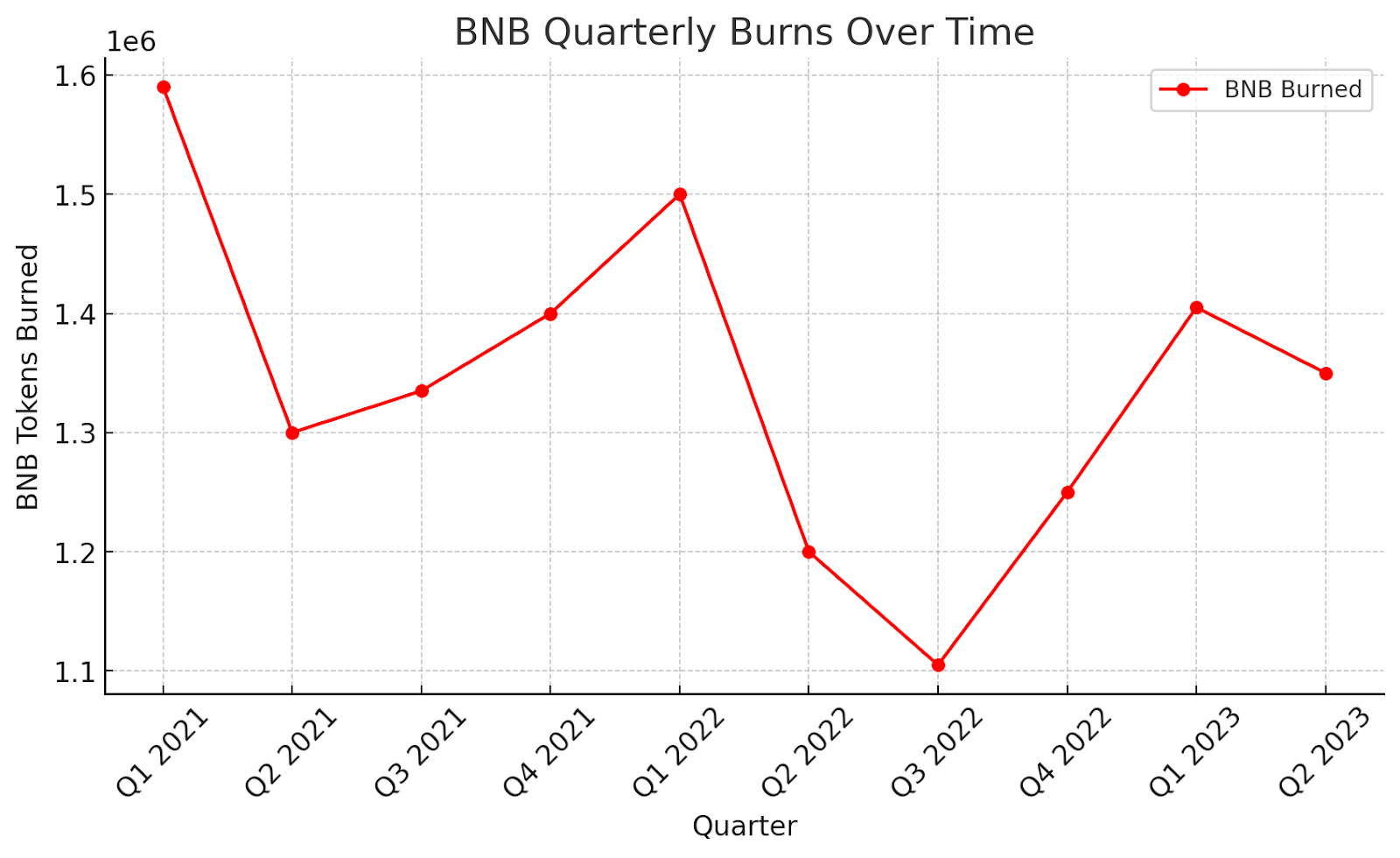

Take a look at Binance (BNB). It has a structured burning process based on trading activity. The graph shows how Binance has burned tokens over time.

Some projects use smart contracts to automate burning, just as blockchain networks use crypto nodes to validate transactions and maintain decentralization. Ethereum (ETH) burns a part of transaction fees, while Binance (BNB) burns coins based on trading volume.

See. Crypto burning follows a clear structure, but its impact depends on market demand. Lower supply can drive up value, but only if demand stays strong.

How Is Crypto Burned Step by Step?

Crypto projects follow a structured process to burn tokens. Each project sets its own rules, but the main steps remain the same. It is important to understand this process to see how tokens are permanently removed from circulation.

Step 1: Decide How Many Tokens to Burn

- Crypto projects determine the number of tokens they want to remove.

- Some projects have pre-planned burns, while others decide based on market conditions.

Step 2: Send Tokens to a Burn Address

- The selected tokens are then sent to a special wallet called a burn address or dead wallet.

- No one has the private key to this wallet so the tokens stay inaccessible forever.

Step 3: Record the Transaction on the Blockchain

- Every burn transaction is recorded on the blockchain.

- This ensures transparency, allowing anyone to verify that the tokens are truly burned.

Step 4: Reduce the Total Supply

- Once tokens are burned, they are removed from the market.

- The remaining supply decreases, which may affect the token’s value over time.

Step 5: Monitor and Repeat the Process

- Some projects burn tokens regularly, while others do it only under special conditions.

- Investors and analysts track burns to understand their impact on supply and price.

Where Do the Burned Coins Go?

Burned coins do not vanish. They are sent to a special blockchain wallet. A burn address. No one owns this wallet, and no one has the private key to access it. As the tokens are sent there, they get lost forever and cannot be redeemed, transferred, or used.

Anyone can verify that a token burn has taken place because every blockchain transaction is recorded on a public ledger. Transaction details become visible on the network. However, burned tokens have no purpose since they are locked in an unreachable address.

Some blockchains have specific burn addresses that are widely recognized. For example:

- Ethereum (ETH) burns a portion of every transaction fee. The burned ETH is sent to a null address which then reduces the total supply over time.

- Binance Coin (BNB) follows a scheduled burning process. Binance selects a number of BNB tokens and sends them to an unreachable wallet.

- Shiba Inu (SHIB) has a collaborative burning system where users voluntarily send tokens to a dead wallet to reduce supply.

Keep in mind that burned coins cannot be recovered. It is an irreversible process which makes it a permanent way to remove tokens from circulation.

Why Is Burning Crypto Even a Thing?

Crypto projects burn coins to control supply, increase value, and maintain stability. The process removes tokens permanently, affecting demand and the confidence of investors.

Burning reduces the number of available tokens. A lower supply can increase demand which makes the remaining coins more valuable. Many projects use burning to create scarcity and support price growth.

- Managing Supply and Demand – Prevents oversupply and controls inflation.

- Increasing Token Value – Creates scarcity, which may raise prices.

- Maintaining Stability – Helps prevent price drops and builds investor trust.

- Supporting Proof-of-Burn (PoB) Systems – Some networks require burning for mining rights.

- Ensuring Fair Distribution – Stops projects from hoarding too many tokens.

It is a method used to control supply and strengthen investor trust. Each project burns tokens for a purpose, but the main goal is to support long-term value.

Does Crypto Burning Affect You?

Crypto burning can affect you if you own that coin. When tokens are burned, fewer remain in circulation. This can make the coin rarer and may increase its value.

However, prices do not always rise. Some burns have little effect. It depends on the project, the market, and investor interest.

Always check why a project is burning tokens. A well-planned burn can help investors, but some burns do nothing at all.

How to Avoid Accidental Crypto Burning?

Sending tokens to the wrong address can result in a permanent loss. Since burned tokens cannot be recovered, it is important to be careful.

Here are simple ways to avoid mistakes:

- Double-check the address – Always verify before sending tokens.

- Avoid unknown burn addresses – There are scams that trick users into burning coins.

- Use trusted platforms – Stick to well-known wallets and exchanges.

- Understand the process – Know how burning works before making transactions.

A small mistake can lead to lost funds. Taking precautions helps to keep your crypto safe.

Final Thoughts

Crypto burning is a common way for projects to manage supply and maintain value. It reduces the number of tokens in the market, which can create scarcity and impact price. Some burns help investors, while others may have little effect.

Before trusting a crypto platform, ask yourself, why does it burn tokens? Some projects use burning as a strategy, while others may have hidden risks, like honeypot scams that trap unsuspecting investors. You must know how it works so you can make better choices and avoid mistakes.

Crypto is always changing. Staying informed keeps you one step ahead.