Understanding gas fees is crucial for any crypto user. This article dissects the mechanics behind these costs and provides actionable strategies to minimize them immediately.

While understanding Gas Fees is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is Gas Fees in Crypto?

Gas fees function as the operational cost for interacting with a blockchain network, primarily Ethereum. Every operation, from sending cryptocurrency to deploying a smart contract, consumes a specific amount of “gas” – a unit representing computational effort. These fees compensate network validators or miners for their work in securing the network and processing transactions.

The concept of “blockchain fuel” is an apt analogy. Just as a car requires fuel to run, a blockchain transaction requires gas to execute. This fuel ensures the network remains secure by deterring spam and allocating resources efficiently. Transactions with higher gas fee bids typically receive priority processing, especially during periods of high network congestion.

Gas Unit vs. Gas Price: Understanding the Difference

It is critical to distinguish between “gas units” and “gas price.” A gas unit represents the fixed amount of computational work a specific transaction type requires. For example, a standard ETH transfer always requires 21,000 gas units. An ERC-20 token transfer typically consumes around 65,000 gas units due to its increased complexity. This amount of work remains constant for that specific transaction.

The gas price, however, fluctuates based on network demand and congestion. This price is expressed in Gwei, which is a small denomination of ETH. When network activity is high, users bid higher gas prices to ensure their transactions are processed quickly. Conversely, during off-peak hours, gas prices typically reduce as demand for block space decreases.

How Gas Fees Work: The Blockchain’s Engine Room

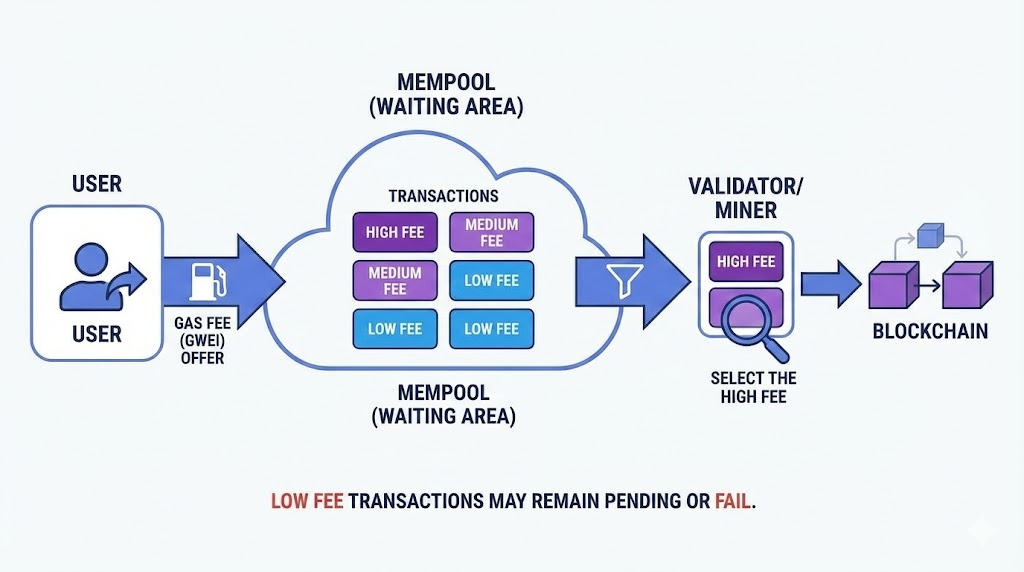

Blockchain networks like Ethereum operate on a decentralized system where individual nodes (validators or miners) process transactions. When a user initiates a transaction, they propose a gas fee they are willing to pay for its inclusion in a block. Validators then select transactions from a “mempool” (a waiting area for unconfirmed transactions) based on the highest gas fees offered.

This system creates a dynamic auction market for block space. Validators receive the proposed gas fees as compensation for their computational resources and risk. This incentive mechanism is vital for maintaining network security and transaction throughput. Without these fees, validators would lack motivation to process transactions, potentially leading to network stagnation.

Network Congestion and Supply-Demand Dynamics

The primary driver of gas fee volatility is network congestion. Blockchain networks have a limited amount of block space available per block. When demand for this space exceeds supply, gas prices increase significantly. This is a classic supply-and-demand dynamic at play.

High demand often correlates with significant market events, popular decentralized application (dApp) usage, or new token launches. Users often find themselves paying much higher fees to ensure their transactions confirm quickly during these peak times. Conversely, lower network activity leads to lower gas prices, providing opportunities for cheaper transactions.

Calculating Ethereum Gas Fees: Understanding EIP-1559

Ethereum’s London Hard Fork introduced EIP-1559, a significant change to how gas fees are calculated and managed. This upgrade transformed the fee market from a simple auction to a more predictable system involving a “base fee” and a “priority fee” (also known as a “miner tip”). This mechanism improves transparency and predictability for users.

The Base Fee is a protocol-adjusted fee that automatically increases or decreases based on network congestion. This portion of the gas fee is burned (removed from circulation) rather than paid to validators. Burning the base fee helps manage ETH’s supply and makes transaction costs more transparent and predictable.

The Priority Fee, or “miner tip,” is an optional amount users can add to incentivize validators to prioritize their transaction. This fee goes directly to the validator who includes the transaction in a block. Users can adjust their priority fee based on how quickly they need their transaction confirmed. A higher tip increases the likelihood of faster processing.

Understanding Gwei and Wei Denominations

Gas fees are denominated in Gwei, a sub-unit of Ether. Specifically, 1 Gwei equals 0.000000001 ETH. This small denomination allows for precise pricing of computational effort without dealing with extremely long decimal numbers in ETH. For even finer granularity, 1 ETH contains $10^{18}$ Wei, making Wei the smallest unit of Ether.

The total gas fee for a transaction is calculated using the following formula:

Total Fee = Gas Limit × (Base Fee + Priority Fee)

If a transaction consumes less than the specified gas limit, the remaining gas is refunded. However, the initial gas limit sets the maximum computational effort allowed for that transaction. Failed transactions, often caused by insufficient gas limits or smart contract errors, still incur the full gas fee because the network’s computational resources were still used.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhy Are Gas Fees So High? (And Why They Keep Changing)

High gas fees result from fundamental limitations and economic principles within blockchain networks. The core issue revolves around block space scarcity and the computational complexity of various operations. These factors create an environment where demand can easily outstrip supply, driving up costs.

Blockchains have specific block space limitations. Each block can only hold a finite amount of data and transactions. When the network is busy, many users simultaneously compete to get their transactions included in the next available block. This fierce competition drives up the “price” of block space, leading to higher gas fees. Ethereum, in particular, has faced these scalability challenges, impacting its transaction throughput.

Complexity of Smart Contract Interactions

The complexity of smart contract interactions significantly influences gas fees. A simple token transfer requires a fixed 21,000 gas units. However, interacting with decentralized finance (DeFi) protocols, minting non-fungible tokens (NFTs), or executing complex multi-step smart contracts demands far more computational resources. These complex operations require greater gas limits, which directly translates to higher total fees.

Each additional line of code executed by a smart contract consumes more gas. This makes certain DeFi operations, like liquidity pool interactions or intricate swaps, considerably more expensive than basic transfers. The increasing popularity and complexity of dApps often contribute to overall network congestion and elevated gas prices.

Gas Fees Compared: Ethereum vs. Faster, Cheaper Blockchains

While Ethereum historically pioneered smart contract functionality, its high gas fees have driven innovation in alternative blockchain architectures. These alternatives offer different approaches to transaction processing and fee structures. Understanding these comparisons helps users identify more cost-effective options for their crypto activities.

Layer 1 Alternatives like Solana, Binance Smart Chain (BSC), and Avalanche offer different consensus mechanisms and scaling solutions. Solana, for instance, utilizes a Proof-of-History (PoH) consensus combined with Proof-of-Stake (PoS). This architecture processes transactions in parallel, allowing for significantly higher throughput and lower, more deterministic fees, often costing fractions of a cent. Solana’s “rent” model, instead of burning gas, charges for storage of accounts on-chain.

Layer 2 Scaling Solutions (Arbitrum, Optimism, Polygon)

Layer 2 (L2) scaling solutions operate on top of the Ethereum mainnet. They process transactions off-chain, bundling them into a single, highly compressed transaction that is then settled on the Ethereum mainnet. This significantly reduces the load on the mainnet. Popular L2s include Arbitrum, Optimism, and Polygon (a sidechain often referred to as an L2).

These solutions provide 10x to 100x reduction in transaction costs compared to directly interacting with the Ethereum mainnet. They achieve this by leveraging various technologies like Optimistic Rollups and ZK-Rollups. While transactions on L2s still require a small gas fee, they are dramatically cheaper and faster, making them an essential strategy for mitigating high mainnet costs. Users typically bridge their assets from Ethereum to an L2 to take advantage of these lower fees.

How to Reduce Gas Fees (And Smart Ways to Save)

Reducing gas fees requires strategic planning and leveraging available tools. While eliminating fees entirely on the Ethereum mainnet is impossible, users can employ several effective strategies to minimize their transaction costs. These methods focus on timing, tool utilization, and transaction aggregation.

One primary strategy involves timing transactions during off-peak hours. Network congestion directly impacts gas prices. Historically, Sunday evenings (UTC) or early weekday mornings often see the lowest traffic, resulting in reduced gas fees. Avoiding peak times like weekday afternoons or major market events can lead to substantial savings. Planning non-urgent transactions for these quieter periods is an efficient way to save.

Using Gas Trackers and Simulation Tools

Utilizing gas trackers and simulation tools is a highly effective method. Platforms like Etherscan’s Gas Tracker provide real-time updates on current gas prices, showing estimates for “fast,” “standard,” and “slow” transactions. These tools help users identify optimal times to transact. Some wallets and dApps also integrate gas estimation features, allowing users to see the potential cost before confirming a transaction.

Transaction simulation tools can also predict potential outcomes and costs. These tools allow users to estimate the gas required for complex smart contract interactions without actually executing them on the mainnet. This prevents costly failed transactions that still incur gas fees.

Aggregating Transactions and Batching

Aggregating transactions and batching involves combining multiple operations into a single transaction where possible. For instance, if you need to transfer tokens to several addresses, some dApps or custom smart contracts allow you to batch these transfers. This reduces the total gas cost by paying for one overall transaction instead of multiple individual ones.

Similarly, if you interact with a DeFi protocol regularly, consider performing multiple actions at once rather than making separate transactions over time. For example, if you plan to deposit funds and then stake them, executing both actions in a single, well-planned transaction can reduce overall gas expenditure. This strategy is more complex but provides significant savings for frequent users.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountThe Future of Gas Fees: Ethereum’s Scaling Road Ahead

The issue of high gas fees is not static; blockchain developers actively pursue solutions. Ethereum, in particular, has a multi-phase roadmap designed to address scalability and reduce transaction costs fundamentally. These upgrades aim to enhance network efficiency and capacity.

A critical future upgrade involves Danksharding, an advanced form of sharding. Sharding involves splitting the blockchain into smaller, more manageable segments called “shards.” Each shard can process transactions in parallel, vastly increasing the network’s overall throughput. Danksharding specifically focuses on improving data availability for Layer 2 rollups, making them even more efficient and cost-effective.

📌 REMEMBER: Ethereum’s transition to Proof-of-Stake (the Merge) was the first step. Subsequent upgrades, like sharding, focus on improving data availability and network capacity to handle more transactions at lower costs.

This future scaling strategy aims to significantly reduce gas fees by providing abundant block space for L2 solutions. As Layer 2s become even cheaper and more performant, the need for direct mainnet interaction for most users diminishes. The goal is to make Ethereum accessible and affordable for a global user base, enabling a new wave of decentralized applications and services.

Key Takeaways

- Understanding Gas Units vs. Gas Price clarifies transaction costs.

- Utilizing Layer 2 scaling solutions dramatically reduces fees.

- Timing transactions during off-peak hours saves significant money.

- EIP-1559 introduces Base Fees (burned) and Priority Fees (tips) for validators.

- Failed transactions still incur full gas fees as network resources are consumed.

Bottom Line

Gas fees represent the inescapable economic reality of securing a decentralized world, serving as both a reward for the network’s protectors and a filter against inefficiency. While the Ethereum mainnet remains the premium corridor for large-scale security, the 2025 landscape offers a mature ecosystem of Layer 2 solutions and alternative chains that have effectively solved the affordability crisis for retail users. By treating gas management as a strategic part of your trading toolkit—using simulation tools, timing the markets, and migrating to L2s—you can ensure that transaction costs remain a manageable overhead rather than a barrier to entry in the digital asset economy.