While understanding Compound Finance is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is Compound Finance?

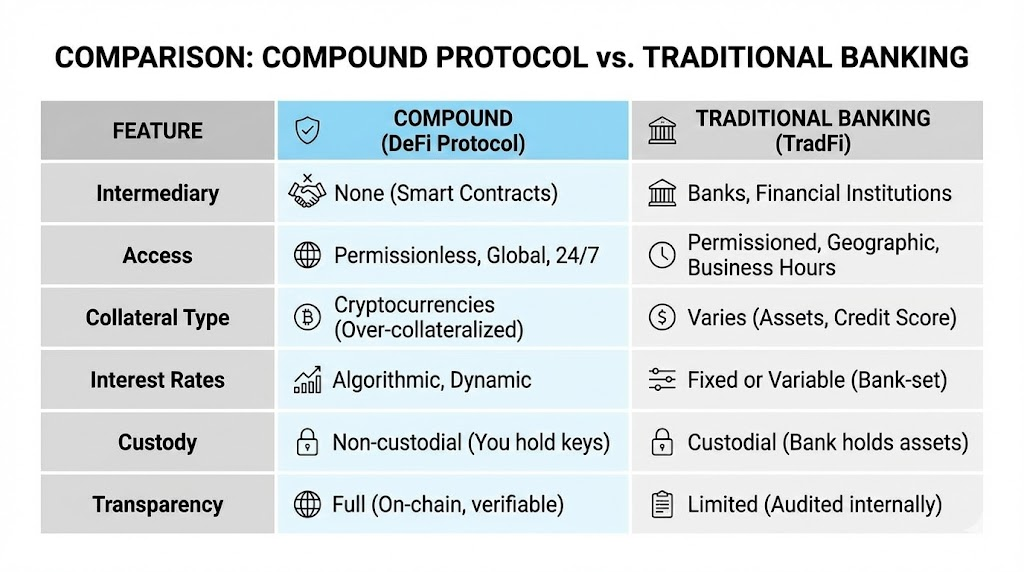

Compound Finance is a decentralized protocol on the Ethereum network. It establishes algorithmic money markets, allowing users to lend and borrow digital assets. The protocol operates without traditional intermediaries, relying instead on smart contracts to manage all transactions and interest rate calculations.

This architecture enables an open, transparent, and globally accessible financial system. Users participate directly in lending pools, earning interest from borrowers who collateralize their loans. The entire process removes the need for banks or centralized exchanges.

The Distinction Between Compound Protocol and Compounding Interest

The Compound Protocol and the concept of compounding interest represent distinct financial mechanisms, despite their similar names. Compounding interest describes the process of earning returns on previously accumulated interest, accelerating wealth growth over time. For example, a 5% annual return on an investment also includes the interest earned on prior years’ interest payments.

Conversely, Compound (with a capital C) refers specifically to the blockchain-based lending and borrowing protocol. While users on the Compound protocol can benefit from the general principle of compounding interest on their earned returns, the protocol itself is an entity. It defines a system for automated interest rate markets. It is not merely a mathematical concept.

How the Ethereum Network Secures Compound Transactions

The Ethereum network secures Compound transactions through its robust blockchain infrastructure and cryptographic verification processes. Every transaction, including asset supplies, borrows, and repayments, is recorded on the immutable Ethereum ledger. This provides an unparalleled level of transparency and auditability.

Smart contracts, self-executing code stored on the Ethereum blockchain, govern all aspects of the Compound protocol. These contracts eliminate the need for trust in a third party. They ensure that rules, such as interest rate calculations and collateral requirements, are enforced automatically and precisely as programmed. The decentralized nature of Ethereum also provides resilience against single points of failure. Learn more about DeFi on Ethereum.

How Does Compound Work? (Algorithmic Lending & Borrowing)

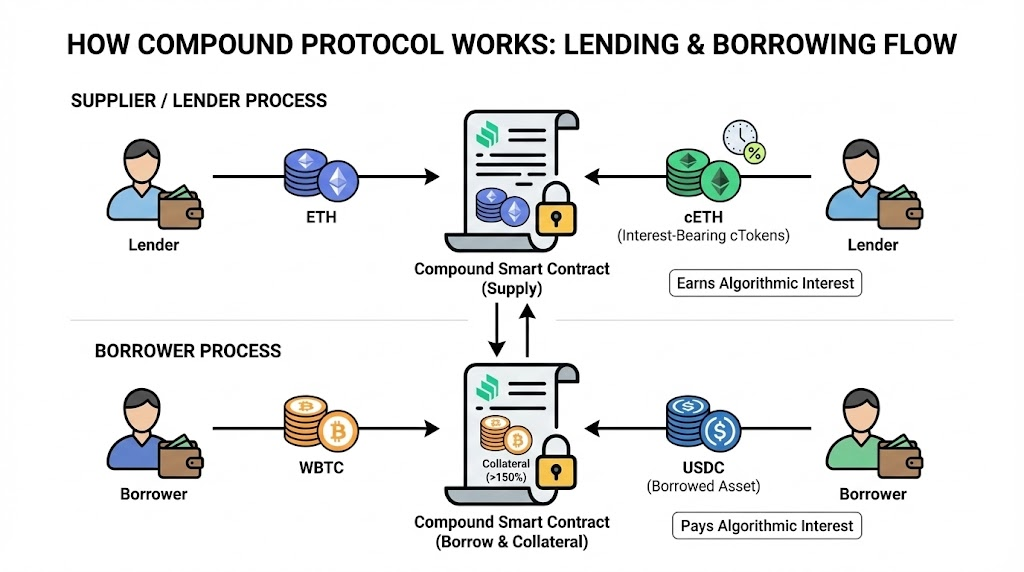

Compound operates through a system of smart contract-controlled liquidity pools, facilitating autonomous lending and borrowing activities. Users interact with these pools to either supply their crypto assets and earn interest or borrow assets by providing collateral. The protocol dynamically adjusts interest rates for both lenders and borrowers based on the supply and demand within each market.

This algorithmic approach ensures that rates respond in real-time to market conditions. High demand for a specific asset leads to increased borrowing rates and increased lending rates. Conversely, abundant supply lowers rates, encouraging borrowing. This mechanism maintains market equilibrium.

Supplying Assets: The Role of Liquidity Pools

Users supply cryptocurrencies to Compound’s liquidity pools, becoming lenders and earning interest on their deposits. These pools are collections of various digital assets, such as ETH, DAI, USDC, and WBTC. When a user supplies an asset, it becomes available for other users to borrow.

The supplier instantly begins accruing interest, paid by borrowers. This interest rate varies between 0.01% to 15% annually, depending on the asset’s utilization rate within the pool. Suppliers retain full control over their assets and can withdraw them at any time, provided sufficient liquidity exists.

Understanding cTokens: The Proof of Deposit Mechanism

cTokens are Compound’s native interest-bearing tokens. They represent a user’s proportional share of a specific asset within a lending pool. For example, when a user supplies Ethereum to Compound, they receive cETH in return. These cTokens automatically accrue interest directly in the user’s wallet.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesThe exchange rate between a cToken and its underlying asset continuously increases over time. This reflects the interest earned. When a user redeems their cTokens, they receive a larger amount of the underlying asset than initially supplied. This mechanism provides a transparent and verifiable proof of deposit and earned interest.

Borrowing Mechanics: Over-Collateralization and Utilization Rates

Borrowing on Compound requires users to supply collateral, typically in an over-collateralized manner, to secure their loans. This means the value of the collateral provided must exceed the value of the borrowed assets. For instance, a user might need to supply 150% collateral to borrow 100% of an asset’s value.

This over-collateralization protects lenders from borrower defaults. Each asset has a specific collateral factor, determining how much a user can borrow against it. If the value of the collateral falls below a certain threshold relative to the loan, the position becomes eligible for liquidation. This mechanism ensures protocol solvency. Review Compound’s algorithmic interest model.

What is the COMP Token? (Governance & Tokenomics)

The COMP token functions as Compound protocol’s native governance token, empowering holders to participate in critical decision-making processes. It is an ERC-20 token on the Ethereum blockchain. Unlike many cryptocurrencies primarily used for speculation, COMP’s core utility is to enable decentralized control over the protocol’s evolution.

Holders of COMP can propose changes, debate modifications, and vote on various parameters. This includes adjusting interest rate models, adding new assets, or upgrading the protocol’s smart contracts. This governance model ensures Compound remains adaptable and community-driven.

How Governance Proposals and Voting Work?

COMP token holders can propose and vote on changes to the Compound protocol. This influences its future development and operational parameters. A user must hold or delegate at least 100,000 COMP tokens to submit a governance proposal. This threshold ensures only serious and well-supported proposals are presented.

Once a proposal is submitted, it enters a voting period, typically lasting 3 days. COMP holders can then vote for or against the proposal. Their voting power is proportional to the amount of COMP they hold or have delegated. A proposal passes if it receives a majority of votes and meets a minimum quorum requirement.

COMP Distribution and “Yield Farming” History

COMP tokens were initially distributed to users through a process known as “yield farming.” This incentivized liquidity provision and protocol usage. For over two years, Compound allocated a portion of newly minted COMP tokens daily to lenders and borrowers. This distribution was proportional to their activity within the protocol.

This strategy successfully bootstrapped Compound’s liquidity. It also attracted a large user base by offering two streams of income: earned interest on supplied assets and governance tokens. The total supply of COMP tokens is capped at 10 million. Approximately 4.2 million COMP tokens have entered circulation through distribution and rewards.

Is Compound a Good Crypto Investment?

Assessing Compound (COMP) as a crypto investment requires evaluating its utility, protocol stability, and inherent market risks. As a governance token, COMP’s value is intrinsically linked to the success and adoption of the Compound protocol. Its primary utility is enabling decentralized control over a significant DeFi money market.

Investors typically consider factors like Total Value Locked (TVL) in the protocol, transaction volume, and the overall growth of the DeFi sector. COMP represents a stake in a foundational DeFi infrastructure. It is not just a speculative asset.

Risks: Smart Contract Bugs and Liquidation Events

Investing in Compound carries specific risks, primarily related to smart contract vulnerabilities and the potential for liquidation events. While Compound’s smart contracts undergo rigorous audits, no code is entirely bug-free. A critical vulnerability could lead to significant financial losses for users.

Additionally, borrowers face liquidation risk if their collateral’s value drops below the required threshold. This can trigger forced sales of their collateral to repay loans. Market volatility in cryptocurrencies exacerbates these risks.

Future Outlook: Price Predictions and 2030 Projections

The future outlook for Compound (COMP) depends on broader DeFi adoption, continued protocol development, and its ability to maintain competitive interest rates. Projections for its price in 2030 are speculative. They rely heavily on the long-term growth of the decentralized finance ecosystem.

Factors like increased institutional adoption of DeFi, regulatory clarity, and Compound’s ability to innovate against competitors will influence its trajectory. The capped supply of 10 million COMP tokens introduces a deflationary aspect. This could support its value as demand for governance participation grows.

Compound vs. Traditional Finance vs. Other Protocols

Compound fundamentally differs from traditional finance institutions by offering permissionless, algorithmic lending and borrowing. It also presents unique advantages compared to other DeFi protocols. Traditional banks require intermediaries, credit checks, and often have geographical limitations.

Compared to other DeFi lending protocols like Aave or MakerDAO, Compound pioneered many of the yield farming mechanisms and established a robust governance model. While similar in function, each protocol has distinct features. These include supported assets, collateral factors, and fee structures.

The Impact of Global Figures on DeFi (Donald Trump’s Crypto Ventures)

Global figures, including Donald Trump, are increasingly involved in crypto ventures. This highlights the growing mainstream relevance for protocols like Compound and invites comparisons to traditional finance. Donald Trump’s “World Liberty Financial” project, for example, explores similar concepts to DeFi lending platforms.

This development signals a significant shift. Concepts once confined to niche crypto communities now attract high-profile attention. It validates the underlying model of decentralized money markets. While Trump’s venture is distinct from Compound, its existence underscores the power and potential of the lending infrastructure Compound pioneered.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Compound transformed the concept of a bank into a set of autonomous mathematical equations, providing a blueprint for the future of decentralized liquidity. By enabling peer-to-protocol lending through its ingenious cToken and COMP governance models, it has created a transparent, permissionless gateway for global capital. As we move further into the 2025 DeFi landscape, Compound’s legacy as a foundational money market ensures it remains a critical infrastructure layer for anyone seeking to escape the constraints of traditional financial intermediaries.

Key Takeaways

- Algorithmic Lending: Compound uses smart contracts to automate interest rates based on real-time supply and demand, removing human intermediaries.

- cToken Innovation: When you deposit assets, you receive cTokens that act as a proof-of-deposit and automatically grow in value as interest accrues.

- Decentralized Governance: The COMP token allows holders to vote on protocol changes, ensuring the community, not a central board, dictates the future of the platform.

- Over-Collateralization: To ensure protocol safety, borrowers must provide more value in collateral than they intend to borrow, protecting lenders from default.

- Ethereum Security: Operating as a non-custodial protocol on Ethereum, Compound leverages blockchain transparency and auditability for all lending transactions.