In cryptocurrency, opportunities for profit often vanish as quickly as they appear. Arbitrage trading offers a unique approach to capitalize on these fleeting moments, but understanding its mechanics, inherent risks, and necessary tools is crucial for success.

While understanding Crypto Arbitrage Trading is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is Crypto Arbitrage Trading?

Crypto arbitrage exploits temporary price discrepancies of the same digital asset across different exchanges or trading pairs, as stated by Coinbase. This strategy involves buying a cryptocurrency on one exchange where it trades at a lower price and simultaneously selling it on another exchange where it trades at a higher price. The goal is to profit from the small, short-lived differences in valuation.

How does crypto arbitrage work?

Crypto arbitrage works by identifying a price difference for a specific asset, such as Bitcoin (BTC) or Ethereum (ETH), across two or more exchanges. For example, if Bitcoin is priced at $84,000 on Exchange A and $84,150 on Exchange B, an arbitrageur could buy 1 BTC on Exchange A and immediately sell it on Exchange B, earning a $150 profit before fees. This process demands speed and efficient execution to capitalize on the brief window before prices normalize.

Is crypto arbitrage profitable?

Crypto arbitrage can be profitable, but it is highly competitive and involves inherent risks. While the profit margin per trade is typically small—often ranging from 0.1% to 2% in 2025—high-frequency trading can accumulate significant gains over time. Profitability relies on swift execution and minimizing transaction fees and other costs that can erode margins.

What are the types of crypto arbitrage?

Crypto arbitrage encompasses several distinct strategies, each leveraging different market conditions to generate profit. Understanding these methods helps traders choose the approach best suited to their risk tolerance and technical capabilities.

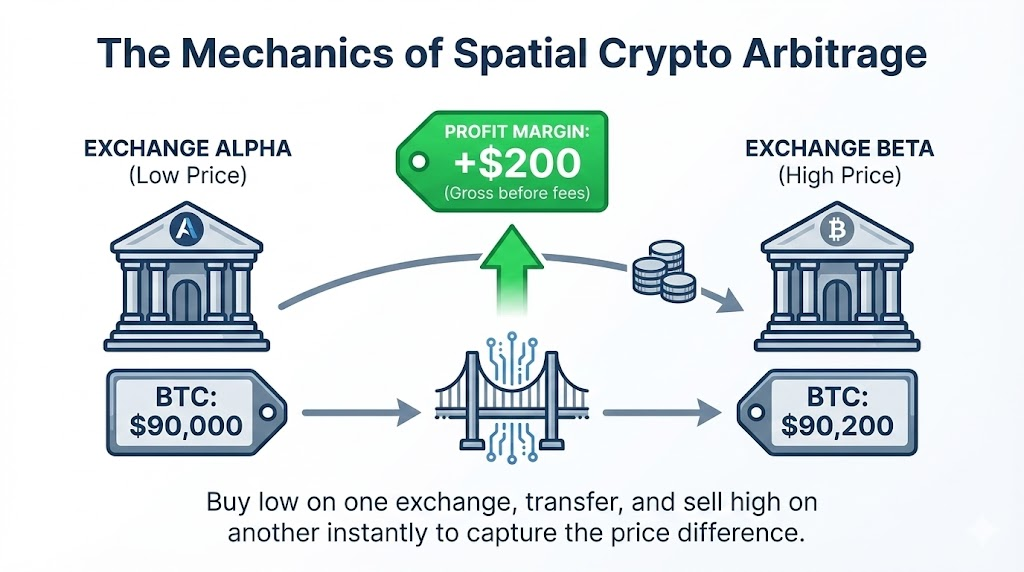

Exchange Arbitrage (Spatial Arbitrage)

Exchange arbitrage, also known as spatial arbitrage, is the most common form of this strategy. It involves buying a cryptocurrency on one exchange and selling it on another to profit from price discrepancies. Factors like liquidity and trading volume between exchanges significantly affect the frequency and size of these opportunities. For example, a less liquid exchange might temporarily list an asset at a lower price than a high-volume exchange like Binance or Coinbase.

Triangular Arbitrage: Exploiting Currency Pair Discrepancies

Triangular arbitrage is a more complex strategy performed on a single exchange, exploiting price discrepancies between three different cryptocurrency pairs. For instance, a trader might convert USD to BTC, then BTC to ETH, and finally ETH back to USD, aiming for a profit if the final USD amount is greater than the initial. This requires rapid calculations and execution, often done through automated trading bots, to take advantage of fleeting imbalances in the order book.

Crypto arbitrage vs traditional arbitrage?

Crypto arbitrage shares similarities with traditional arbitrage in its core principle of exploiting price differences. However, key distinctions exist. Cryptocurrency markets operate 24/7, exhibit significantly higher volatility, and face a less defined regulatory environment compared to traditional financial markets. This necessitates faster execution, often achieved through high-frequency trading and specialized trading bots, to navigate the rapid price movements and avoid slippage.

| Feature | Crypto Arbitrage | Traditional Arbitrage |

| Market Hours | 24/7, 365 days | Weekday business hours |

| Volatility | High | Moderate to Low |

| Assets | Cryptocurrencies | Stocks, Forex, Bonds |

| Execution Speed | Milliseconds (bots) | Seconds to minutes |

| Regulation | Evolving, fragmented | Established, mature |

| Transaction Fees | Variable (gas, network) | Standardized |

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhat are the risks of crypto arbitrage?

While often perceived as ‘risk-free’, crypto arbitrage involves significant risks such as slippage, transaction fees, withdrawal delays, and market volatility, as highlighted by Gemini. These challenges can quickly erode potential profits and turn seemingly lucrative opportunities into losses if not managed effectively.

Slippage and Execution Risk: The Speed Challenge

Slippage occurs when the price of an asset changes between the time an order is placed and when it is executed. This is a common frustration in crypto arbitrage, especially with rapid price movements, as prices can change before a trade executes. The need for high-frequency trading and near-instantaneous execution is paramount to minimize execution risk and make sure the arbitrage opportunity remains viable.

Transaction Fees and Withdrawal Delays: Eating into Profits

Various transaction fees, including trading fees, network gas fees, and withdrawal fees between exchanges, can significantly impact profitability. These fees can quickly eat into the small margins typical of arbitrage trades. Furthermore, delays in transferring funds between exchanges can cause the price discrepancy to disappear, rendering the trade unprofitable.

Market Volatility and Regulatory Uncertainty

The inherent volatility of cryptocurrency markets poses a substantial risk to arbitrageurs. Rapid price swings can close arbitrage windows instantly. Beyond price movements, the evolving and often uncertain regulatory landscape across different jurisdictions introduces additional risks. Changes in regulations can impact exchange operations, fund transfers, and even the legality of certain arbitrage strategies.

What tools are used for crypto arbitrage?

Automated trading bots are widely used in crypto arbitrage to execute trades quickly and efficiently, capitalizing on fleeting opportunities, as confirmed by Kraken. These technological tools are essential for modern arbitrage trading, enabling traders to overcome the speed and computational demands that manual trading cannot match.

Why Arbitrage Bots are Essential for Modern Trading?

Arbitrage bots offer a significant edge by providing unparalleled speed and 24/7 operation. They can monitor countless exchanges and trading pairs simultaneously, identifying price discrepancies in milliseconds. This automated trading capability removes human emotion, such as FOMO, from the decision-making process.

How Bots Work: APIs and Real-Time Data

Arbitrage bots function by connecting to cryptocurrency exchanges through Application Programming Interfaces (APIs). This API connection allows the bot to access real-time market data, including order book depth and bid-ask spread, and to execute trades directly on the exchange. The bot processes vast amounts of data to identify profitable arbitrage opportunities and then places buy and sell orders automatically.

Is an arbitrage bot worth it?

Choosing an arbitrage bot involves evaluating various features and considering whether the investment is “worth it.” For many, a bot is worth the investment due to the time saved and the ability to capture opportunities that would be impossible manually. While DIY bots offer flexibility, managed bots provide ease of use and support, often requiring a subscription fee.

| Feature | DIY Bots | Managed Bots (e.g., Coinrule) |

| Setup | Complex, coding required | Easy, user-friendly interface |

| Customization | High, full control | Limited to platform options |

| Cost | Time/development effort | Subscription fees |

| Maintenance | High, self-managed | Low, provider handles |

| Security | User’s responsibility | Provider’s responsibility |

Best crypto arbitrage strategies?

Beyond fundamental exchange arbitrage and triangular arbitrage, advanced strategies delve into more complex market dynamics and quantitative models. These methods often require deeper technical understanding and specialized tools to execute effectively.

Statistical Arbitrage: Leveraging Quantitative Models

Statistical arbitrage, a more complex strategy, involves using quantitative models to identify mispricings based on historical data and correlations, as explained by CoinAPI.io. Instead of direct price differences, this approach looks for assets that historically move together (cointegration) but have temporarily diverged. Traders might employ mean reversion strategies, betting that the prices will eventually return to their historical average.

Flash Loan Arbitrage in DeFi

Flash loan arbitrage is a unique and advanced Decentralized Finance (DeFi) strategy that allows traders to borrow large sums of capital without any upfront collateral, provided the loan is repaid within the same blockchain transaction. This enables arbitrageurs to execute complex sequences of trades all within a single atomic transaction. However, it carries high smart contract risk and requires sophisticated technical knowledge.

The Psychology of Arbitrage: Avoiding Common Pitfalls

While arbitrage trading crypto appears purely technical, the psychological aspect of trading can significantly impact a trader’s decision-making and overall profitability. Understanding and managing cognitive biases is as crucial as mastering technical strategies.

Cultivating a disciplined arbitrage mindset involves adhering strictly to predefined rules and objective market data analysis. This means accepting small losses as part of the trading process and avoiding overtrading based on emotion. Leveraging automated trading bots can help remove the emotional element from execution, allowing traders to focus on strategy development and risk management.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBOTTOM LINE

Crypto arbitrage trading remains one of the few strategies where the objective is to exploit market inefficiencies rather than predict direction, making it a cornerstone of high-frequency digital finance. However, the path to profitability is paved with technical hurdles; success requires a robust combination of ultra-low latency bots and the foresight to pre-fund accounts to combat slippage. By 2025, as markets become more liquid and gaps narrow, your edge lies not just in finding a price difference, but in the efficiency with which you execute and the discipline you maintain over fees. Master the mechanics, respect the math, and treat every millisecond as a potential margin.

Key Takeaways

- Offloading is Key: Crypto engines free your main CPU, boosting performance and efficiency.

- Hardware for Security: Dedicated hardware engines provide superior speed and crucial key isolation, making them far more resistant to attacks.

- Ubiquitous Protectors: From your smartphone’s Secure Enclave to cloud servers, crypto engines are silently safeguarding your data.

- Future-Proofing: The evolution towards post-quantum cryptography will rely heavily on advanced crypto engine designs.