In 2026, this market has shifted toward curated “launchpads” and whitelists to mitigate the extreme risks of project failure and exit scams. This guide explores the intricate process, inherent risks, and crucial strategies for navigating the early-stage crypto market effectively.

While understanding Early-Stage Investing is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What does ‘buying crypto before listing’ mean?

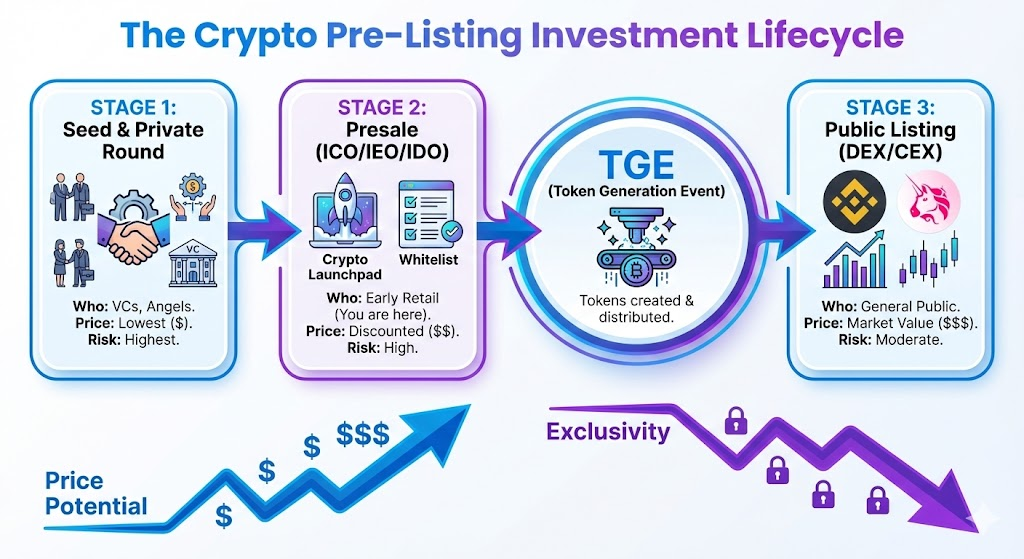

Buying new crypto before listing on major exchanges refers to acquiring tokens from early-stage crypto projects through various private or public sale events, known as crypto presales. These events occur prior to the token becoming available for trading on large, established platforms like Binance or Coinbase. This early access allows investors to potentially purchase tokens at a lower price point compared to their initial public listing, aiming for significant appreciation post-listing.

Why would someone buy crypto before listing?

Investors are motivated to buy crypto before listing due to the potential for substantial returns if the project succeeds and the token’s value increases upon its public crypto listing. Early investment can offer a significant edge, as prices during presales are typically lower, reflecting the higher risk and earlier stage of development. In 2026, the “asymmetric upside”—where small investments can lead to life-changing moves—remains the primary driver for retail and institutional interest alike.

Is it legal to buy crypto before listing?

The legality of buying new crypto before listing is complex and largely depends on the specific jurisdiction and the project’s compliance with local financial regulations. While not inherently illegal, the regulatory landscape surrounding crypto presales is evolving and varies widely across countries. For instance, in the United States, most presales are restricted to accredited investors under SEC guidelines to protect retail users from high-risk ventures.

What are crypto presales?

Crypto presales encompass various fundraising methods used by early-stage crypto projects to sell tokens to investors before public trading. These events secure crucial capital for development, marketing, and operations. Structures and accessibility differ significantly, each with distinct risk profiles and participation requirements.

What is an Initial Coin Offering (ICO)?

An Initial Coin Offering (ICO) is a fundraising method where a project sells a new cryptocurrency directly to investors. While they offer a decentralized way to raise capital, they are the most prone to fraud. In 2026, standalone ICOs have largely been replaced by more secure launchpad models, as historical data shows that nearly 80% of early-era ICOs were either poorly executed or intentional scams.

What is an Initial Exchange Offering (IEO)?

An Initial Exchange Offering (IEO) is a type of crypto presale conducted on a . Unlike ICOs, projects are vetted by the hosting exchange (e.g., Binance Launchpad or OKX Jumpstart), which adds a layer of credibility. The exchange handles the sale mechanics and KYC, providing a safer environment for users to gain early access.

What is a Seed Round or Private Sale?

Seed Rounds and Private Sales represent the absolute earliest stages of investment, typically restricted to venture capitalists or high-net-worth individuals. Retail investors usually gain access slightly later through an Initial DEX Offering (IDO), which uses for distribution. IDOs rely on liquidity pools, offering a decentralized approach but often suffering from high price volatility at launch.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhat due diligence is needed for early crypto investments?

Effective due diligence is paramount for early crypto investments. In 2026, the sheer volume of new tokens—exceeding 2.1 billion in theft value mid-year—requires investors to move beyond the hype and verify project fundamentals.

The Whitepaper & Roadmap: Blueprint for Success

The project’s whitepaper serves as its foundational blueprint. A legitimate whitepaper in 2026 should go beyond marketing fluff to include technical architecture, detailed security measures, and a realistic roadmap. If a roadmap lacks specific milestones or relies entirely on “listing on Binance” as its only goal, it is a major red flag.

Analyzing Tokenomics: Supply, Demand, and Value Accrual

Tokenomics refers to the economic model of the asset. Investors must check the token distribution and vesting schedules. If the development team holds 50% of the supply with no lock-up period, they can dump their tokens as soon as the price rises, leading to a “rug pull.”

A strong team with a verifiable history in the industry is a key indicator of success. Furthermore, a smart contract audit by independent firms like CertiK or Hacken is non-negotiable. An audit ensures the code doesn’t contain “backdoors” that allow developers to steal deposited funds.

How do I find new crypto projects before they list?

Finding new crypto projects before they list requires active research across multiple channels. High-signal platforms include crypto launchpad platforms like CoinList, Polkastarter, and DAO Maker. These platforms act as filters, only hosting projects that have passed rigorous internal vetting processes.

What platforms allow buying crypto before listing?

In 2026, the best platforms are categorized by their level of decentralization:

- Centralized Launchpads: Binance Launchpad, OKX Jumpstart, and Bybit Web3 provide high security and liquidity but require strict KYC.

- Decentralized Launchpads: Polkastarter and Seedify allow wallet-based participation and often feature innovative gaming or DeFi projects.

- Aggregators: Apps like “Best Wallet” now integrate presale hubs that allow users to discover and buy unlisted tokens directly within a secure mobile interface.

How to participate in a crypto presale?

Participating typically involves these steps:

- Choose a Launchpad: Select a platform that matches your risk tolerance.

- Identity Verification: Complete Know Your Customer (KYC) if using a centralized platform.

- Wallet Setup: Connect a non-custodial wallet (like MetaMask or Trust Wallet).

- Funding: Load your wallet with the required “base token” (often ETH, BNB, or USDT).

- Registration: Sign up for the specific project’s whitelist or lottery system.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountWhat are the risks of buying crypto before listing?

Buying new crypto before listing carries substantial risks. In late 2026, security firms reported that wallet compromises and phishing scams accounted for over 85% of total value lost in early-stage ventures.

Effective risk management means never investing more than you can afford to lose. Because many early-stage projects fail entirely, diversification is key. Instead of betting your entire portfolio on one ICO, spread your capital across multiple vetted projects.

How do token vesting schedules work?

Token vesting schedules release tokens over time (e.g., 10% per month for 10 months). While this protects the market from sudden sell-offs, it also means your investment remains illiquid for months. Investors must account for these lock-up periods when planning their exit strategy.

BOTTOM LINE

Buying crypto before listing is the highest-risk, highest-reward endeavor in the digital asset space. While the potential for 100x gains exists, the market is rife with rug pulls, logic flaws, and extreme volatility. Success in 2026 requires a shift from chasing hype to performing rigorous due diligence: verifying audits, scrutinizing vesting schedules, and utilizing vetted launchpads. By treating early-stage investing as a disciplined research process rather than a lottery, you can position yourself to capture the growth of the next generation of blockchain technology while safeguarding your primary capital.

Key Takeaways

- Early Access Advantage: Buying before listing allows you to secure tokens at a lower entry price, often before the “mass retail” demand drives the price up on major exchanges.

- Launchpad Vetting: Centralized launchpads (Binance, OKX) offer a safer environment because they perform their own due diligence and security checks before hosting a sale.

- The Audit Must: Never participate in a presale for an unaudited project; smart contract audits are the only way to ensure the code doesn’t contain malicious “drainer” functions.

- Patience is Required: Most early-stage investments come with vesting periods, meaning your capital will be locked up and illiquid for several months or even years.

- FOMO is the Enemy: Emotional decision-making accounts for a massive portion of investor losses. Always stick to a predefined due diligence checklist regardless of the social media hype.