A bond yield spread measures the difference between two bond yields in basis points. In forex, it reflects rate differentials, signals risk appetite shifts, and guides currency flows and carry trades. For traders, studying spreads helps gauge global sentiment, anticipate central bank moves, and forecast currency direction.

While understanding Bond Yield Spread is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- In Forex, yield spreads drive currency flows by signaling interest rate differentials and global risk appetite.

- Wider spreads = higher risk → safe-haven currencies (JPY, CHF, USD) strengthen; narrower spreads = confidence → risk-on currencies (AUD, NZD) benefit.

- The 10s/2s yield curve spread is a leading recession indicator, often shaping USD demand.

- Carry trade strategies rely on yield differentials, e.g., selling JPY to buy higher-yield currencies like AUD.

- Swap and TED spreads flag financial stress, often triggering risk-off flows into safe havens.

How Are Bond Yield Spreads Calculated?

The yield spread is the direct arithmetic difference between the yields of two debt instruments. This calculation provides a clear measure of the risk premium investors demand for holding one bond over another.

The formula is: Yield Spread = Yield of Bond A – Yield of Bond B

This yield differential is measured in basis points (bps), where 100 bps equals 1%.

- Example 1: Sovereign Spread (Yield Differential)

- U.S. 10-Year Treasury Yield: 4.50%

- Australian 10-Year Government Bond Yield: 4.75%

- Yield Spread: 4.75% – 4.50% = 0.25%, or 25 basis points. For a Forex trader, this 25 bps premium is a key factor influencing the AUD/USD exchange rate. These yield gaps directly tie into interest rate differentials, since bond markets reflect the same central bank dynamics that drive currency valuation.

- Example 2: Credit Spread

- U.S. High-Yield Corporate Bond Index Yield: 8.00%

- U.S. 10-Year Treasury Yield: 4.50%

- Yield Spread: 8.00% – 4.50% = 3.50%, or 350 basis points. A widening of this spread often signals a “risk-off” environment that strengthens safe-haven currencies.

Yield Spread vs. Credit Spread vs. Term Spread

While related, these three types of spreads measure different risks that are critical for Forex traders to understand.

- Yield Spread: This is the general term for the difference in yield between any two bonds.

- Credit Spread: This specifically measures credit risk. It is the yield differential between a corporate bond and a risk-free government bond (like a U.S. Treasury). A wider credit spread indicates higher perceived default risk and a flight to safety.

- Term Spread: This measures maturity risk. It is the difference in yield between two government bonds of the same issuer but with different maturities (e.g., the 10-year vs. the 2-year). This is a key component of the yield curve.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTypes of Spreads in Practice for Forex Traders

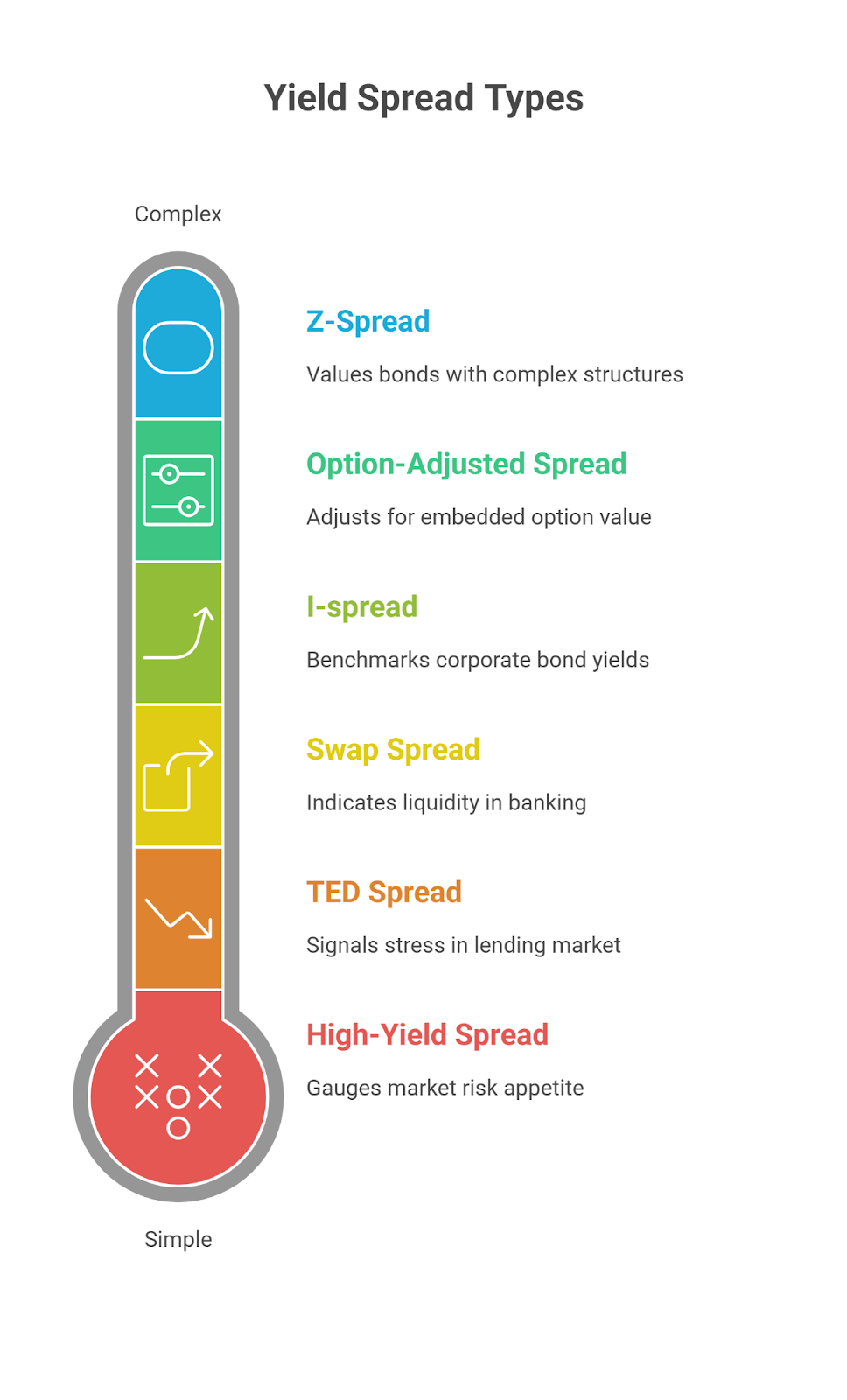

Professionals track several specific spreads to gauge market health and sentiment.

- High-Yield Spread: The difference between the average yield on high-yield bonds (also known as “junk bonds”) and a risk-free government bond. This is a primary barometer of market risk appetite.

- Z-Spread (Zero-Volatility Spread): A more complex spread that measures the constant spread that must be added to the Treasury spot curve to make the discounted cash flows of a bond equal to its market price. It is used for valuing bonds with complex structures.

- Option-Adjusted Spread (OAS): Used for bonds with embedded options, such as callable bonds or mortgage-backed securities (MBS). The OAS adjusts the Z-spread to account for the value of the embedded option.

- Swap Spread: The difference between the fixed rate of an interest rate swap and the yield on a government bond of the same maturity. It is a key indicator of liquidity and credit conditions in the banking system.

- TED Spread: The difference between the interest rates on interbank loans (historically LIBOR, now often compared with SOFR) and short-term U.S. government debt. A widening TED spread signals stress in the interbank lending market.

- I-spread (Interpolated Spread): The spread of a bond’s yield over the swap rate, often used as a benchmark for corporate bonds.

Term Spreads and the Yield Curve (2s/10s, 30s/10s)

The term spread is the primary driver of the yield curve’s shape, which is a powerful indicator of economic expectations.

- Normal Yield Curve (Upward Sloping): Long-term bonds have higher yields than short-term bonds. This is a sign of a healthy, growing economy.

- Flat Yield Curve: Short-term and long-term yields are very similar. This often signals economic uncertainty or a transition period.

- Inverted Yield Curve (Downward Sloping): Short-term bonds have higher yields than long-term bonds. A curve inversion, particularly in the U.S. 10-year vs. 2-year Treasury spread (10s/2s), has been one of the most reliable predictors of a coming recession

What Is the Role of 2s & 10s Yield Spread?

The 2s & 10s yield spread measures the gap between U.S. 10-year and 2-year Treasury yields, signaling market views on growth and interest rates. A steep spread reflects optimism and supports the U.S. dollar, while a flat or inverted spread signals caution and has preceded every U.S. recession since the 1980s. Shifts in these spreads often show up directly in the US Dollar Index, making it a practical confirmation tool for forex traders tracking macro sentiment.

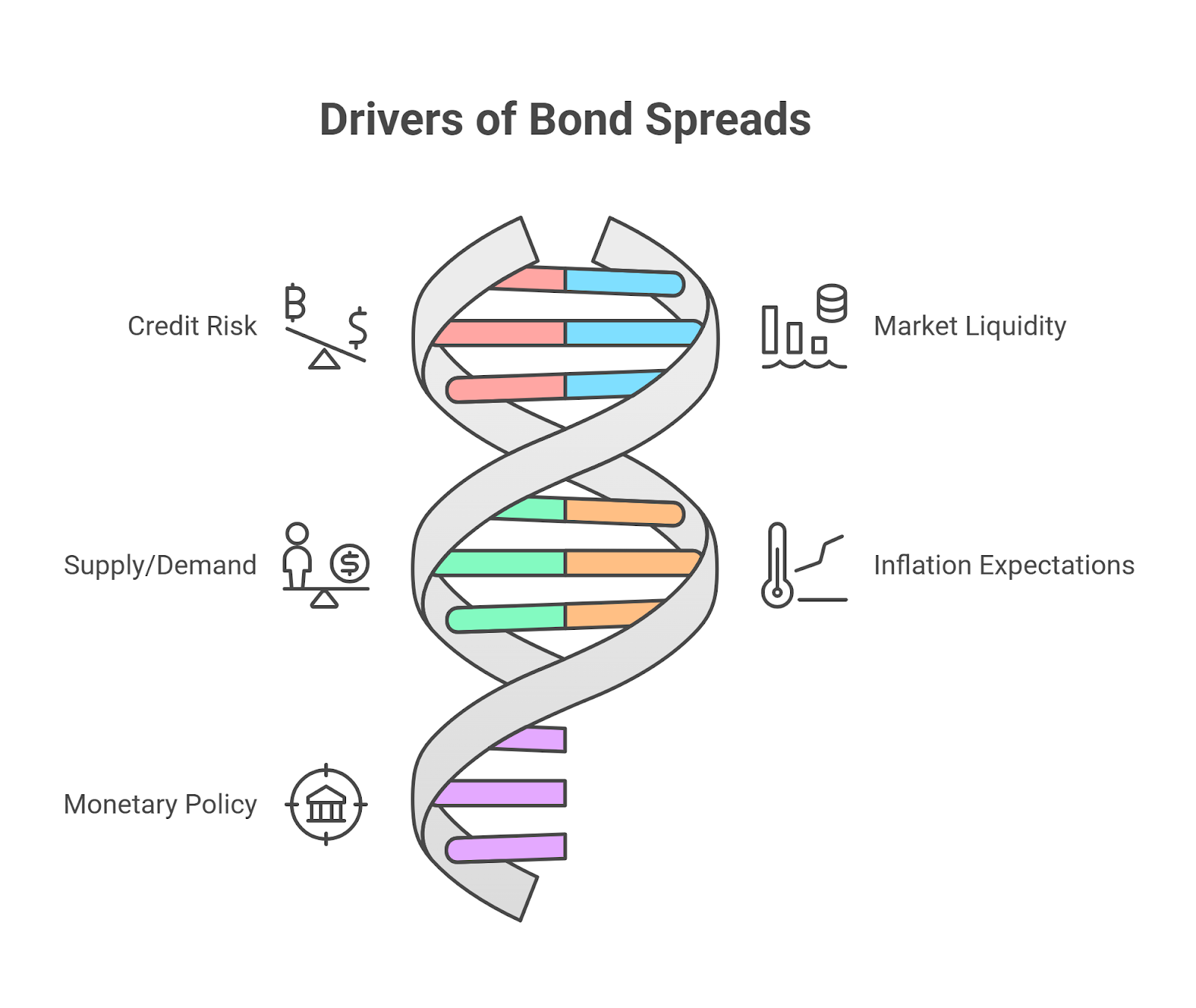

The 5 Major Drivers of Bond Spreads

There are five major factors—credit risk, liquidity, supply/demand, inflation, and monetary policy—that explain over 80% of observed spread movements in global bond markets.

- Higher credit risk widens spreads. An increase in the perceived default risk of a company or country (higher sovereign risk) forces issuers to offer a larger risk premium.

- Lower market liquidity widens spreads. During a crisis, investors demand a higher liquidity premium for holding less liquid assets, causing spreads to increase.

- Excess supply of bonds widens spreads. Heavy issuance of corporate or government debt can lead to an oversupply that requires higher yields to attract buyers.

- Rising inflation expectations widen term spreads. This typically pushes long-term yields higher than short-term yields, steepening the yield curve.

- Tighter monetary policy raises yields and widens spreads. Central bank interest rate hikes and Quantitative Tightening (QT) directly impact government bond yields and credit conditions.

FX Strategy: Using Yield Spreads for Carry & Macro Trades

For Forex traders, yield spreads are not just an analytical tool; they are a direct source of trading strategies.

- The Carry Trade: This classic strategy involves profiting from the yield differential between two countries. A trader sells a currency with a low interest rate (like the Japanese Yen) and buys a currency with a high interest rate (like the Australian Dollar). Pairs like AUD/JPY are prime examples.

- Hedging Emerging Market Sovereign Risk: The spread on a country’s USD-denominated bonds versus U.S. Treasuries is a direct proxy for its sovereign risk. A widening of this spread can be a leading indicator of weakness in that country’s currency (e.g., USD/TRY).

- Trading Spread-Driven Volatility: A rapid widening of credit spreads signals market fear. This often leads to higher implied volatility in FX options, creating opportunities for volatility traders.

Worked Scenarios for Forex Traders

- If credit spreads widen…: this signals a risk-off market. Then safe-haven currencies like the JPY and CHF tend to strengthen against high-beta currencies like the AUD.

- If the 10s/2s term spread inverts…: this signals a high probability of a future recession. Then the US Dollar may initially strengthen due to safe-haven demand, even if the Fed is expected to cut rates later.

- If swap spreads widen significantly…: this signals funding stress in the banking system. Then this can trigger a major flight to quality, causing the US Dollar to rally strongly.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Yield spreads act as an early warning system for markets. They reveal clues about growth, interest rates, and risk appetite before headlines catch up. A steep curve signals optimism and expansion, while a flat or inverted curve warns of caution and slower conditions. Read the curve, ask questions, and track global confidence through its shape.