Every trader seeks a strategy that offers passive gains with calculated risk. That’s exactly what gave rise to the carry trade in forex markets. If global interest rates diverged—like Japan’s near-zero rates versus Australia’s higher yields, traders saw an opportunity—borrow cheap, invest high, and profit from the spread.

But can a strategy built on rate gaps still thrive in today’s shifting economic landscape? So, is the strategy still viable—or are the risks catching up?

While understanding Carry Trade is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a Carry Trade?

A carry trade is a strategy used in forex markets. It involves borrowing in a currency with a low interest rate. The borrowed amount is converted into a currency with a higher yield. Investopedia (2024) explains that the goal is to earn from the interest rate difference. Common funding currencies include the Japanese Yen (JPY) and Swiss Franc (CHF). So, these have very low or even negative interest rates.

Popular target currencies are the Australian Dollar (AUD), U.S. Dollar (USD), and the Brazilian Real (BRL). See, these usually offer higher returns. TastyFX (2025) notes that stable exchange rates make the strategy more profitable.

John Hancock Investments (2024) adds that large institutions use carry trades when markets are calm. The trade is simple in theory. But risks like currency swings and central bank moves can impact results.

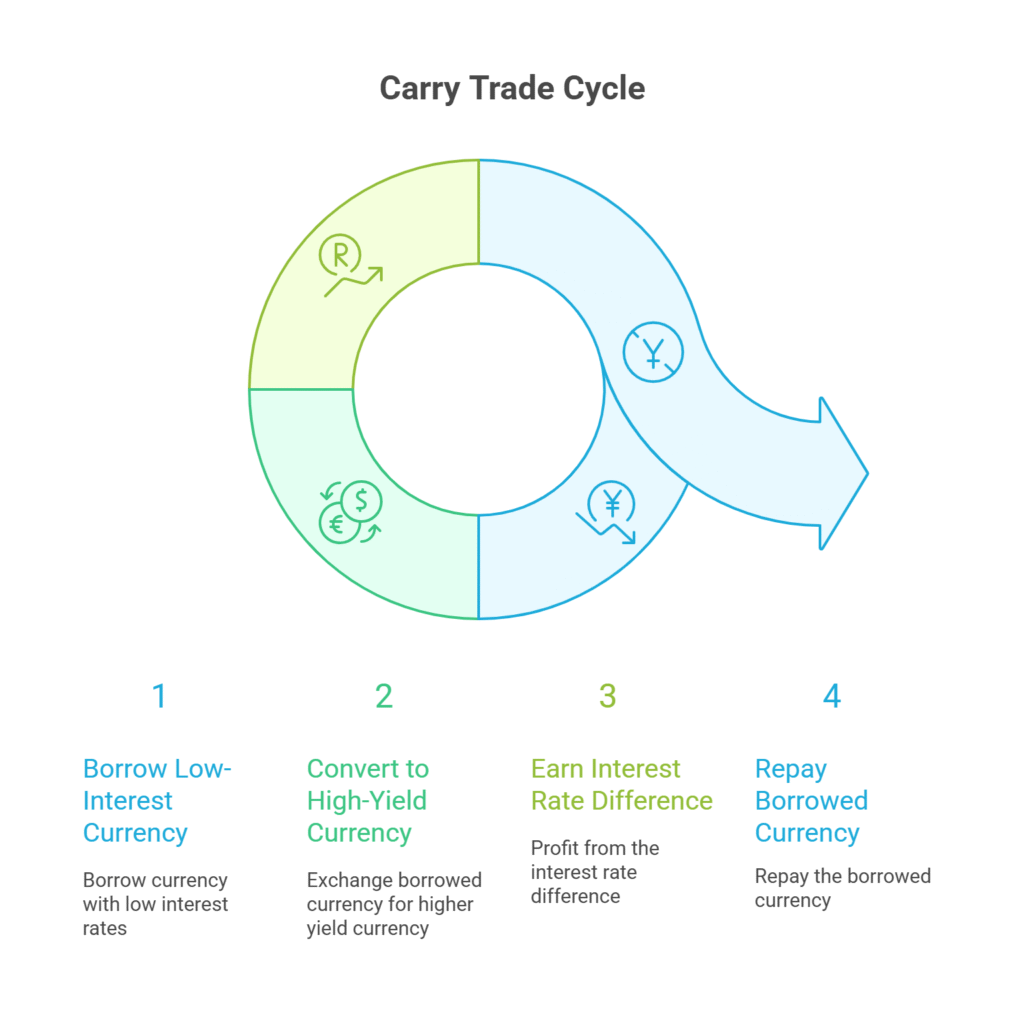

How a Carry Trade Works?

A carry trade begins by borrowing in a currency with a low interest rate. The borrowed funds are then converted into another currency with a higher interest rate. The trader earns money from the gap between the two rates based on Investopedia, 2024.

Now, take the example of borrowing Japanese yen at 0.1% and changing it into U.S. dollars that earn 4%. The profit from the 3.9% difference is called the “carry” (CFI, 2024). In fact, brokers often handle this process automatically for forex traders who hold positions overnight. This setup directly reflects the principles of interest rate trading, since rate gaps form the foundation of the carry trade strategy.

Moreover, traders use leverage to increase their profits. A 10:1 leverage multiplies the gains ten times—but also raises the risk based on Investopedia, 2024. If the exchange rate between the two currencies stays steady, the trader earns a steady return. Carry trades are more common in calm markets. Central bank actions play a big role.

For instance, when Japan raised interest rates in 2024, many yen-based carry trades had to close, leading to losses worldwide.

Popular Currency Pairs For Carry Trading

| Currency Pair | Funding Currency | Target Currency | Why It’s Popular | Source |

| USD/JPY | Japanese Yen (JPY) | U.S. Dollar (USD) | Yen has near-zero rates; USD offers higher returns post-COVID | TastyFX, 2025; Investopedia |

| AUD/JPY | Japanese Yen (JPY) | Australian Dollar (AUD) | AUD has strong rates; popular in calm markets | CFI, 2024; TastyFX, 2025 |

| NZD/JPY | Japanese Yen (JPY) | New Zealand Dollar (NZD) | NZD offers higher yields with moderate risk | CFI, 2024 |

| USD/CHF | Swiss Franc (CHF) | U.S. Dollar (USD) | CHF is stable; USD usually has higher rates | TastyFX, 2025 |

| EUR/TRY | Euro (EUR) | Turkish Lira (TRY) | TRY has high rates; used in high-risk, high-reward strategies | John Hancock, 2024 |

| USD/ZAR | U.S. Dollar (USD) | South African Rand (ZAR) | ZAR provides large interest rate gaps, risk from volatility | WEF, 2024; TastyFX, 2025 |

| CHF/BRL | Swiss Franc (CHF) | Brazilian Real (BRL) | BRL had up to 15% rates in the early 2000s; used with CHF for spread | TastyFX, 2025 |

Carry Trades in Foreign Exchange Markets

Carry trades in foreign exchange markets involve borrowing in a low-interest currency. The funds are then invested in a higher-yielding currency. But the goal is to profit from the rate gap. So, this works best when the exchange rate remains stable. The Japanese yen (JPY) and Swiss franc (CHF) are common funding currencies. They have low borrowing costs. Traders use them to buy higher-rate currencies like the U.S. dollar (USD), Australian dollar (AUD), or New Zealand dollar (NZD).

According to the European Central Bank (2007), the yen carry trade grew quickly in the mid-2000s. Japan’s low rates and wide global spreads drove this growth. Traders also used leverage to increase returns. Popular pairs like AUD/JPY and NZD/JPY became heavily traded. In fact, this made them more sensitive to market shifts. If the funding currency gains strength or interest gaps narrow, the trade can collapse.

Carry trades work well in calm markets with steady trends. However, they may trigger volatility during global rate changes or financial shocks.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhy Carry Trades Are So Widely Used?

Carry trades are used across global markets because they are simple, flexible, and rewarding. Traders earn income from the difference between borrowing costs and investment yields. Here’s why they remain widely used:

- Clear profit method: Traders borrow in low-interest currencies like JPY or CHF. They invest in higher-yielding ones like USD, AUD, or NZD. The rate gap becomes steady income.

- Easy to understand and apply: No complex tools are needed. The strategy is based on interest rate policy and currency trends.

- Rollover payments add daily returns: Open positions in forex can earn or pay interest daily. This gives traders a steady income without extra action.

- Leverage increases earning potential: A 2% interest gap with 10:1 leverage can return 20% annually. Many brokers allow high leverage, increasing profits.

- Best in stable, low-volatility markets: If currency prices stay steady, carry trades become reliable. Calm markets help reduce risk.

- Supported by global monetary trends: Long periods of low interest rates, such as post-2008 or post-COVID, made carry trades attractive. Traders took advantage of cheap funding.

- Used by institutions and hedge funds: Big investors use carry trades inside global portfolios. They add yield without taking equity or credit risk.

- Passive income tool: Carry trades generate regular returns. They work well when markets move slowly and interest rates stay predictable.

In short, carry trades are widely used because they are simple to run and deliver strong returns in the right conditions.

Real-World Examples of Carry Trades

See, carry trades gain popularity when interest rate differentials widen across stable currencies. Traders borrow in low-yielding currencies and invest in high-yielding ones to capture the carry. Below are four real-world examples backed by institutional trends and academic research.

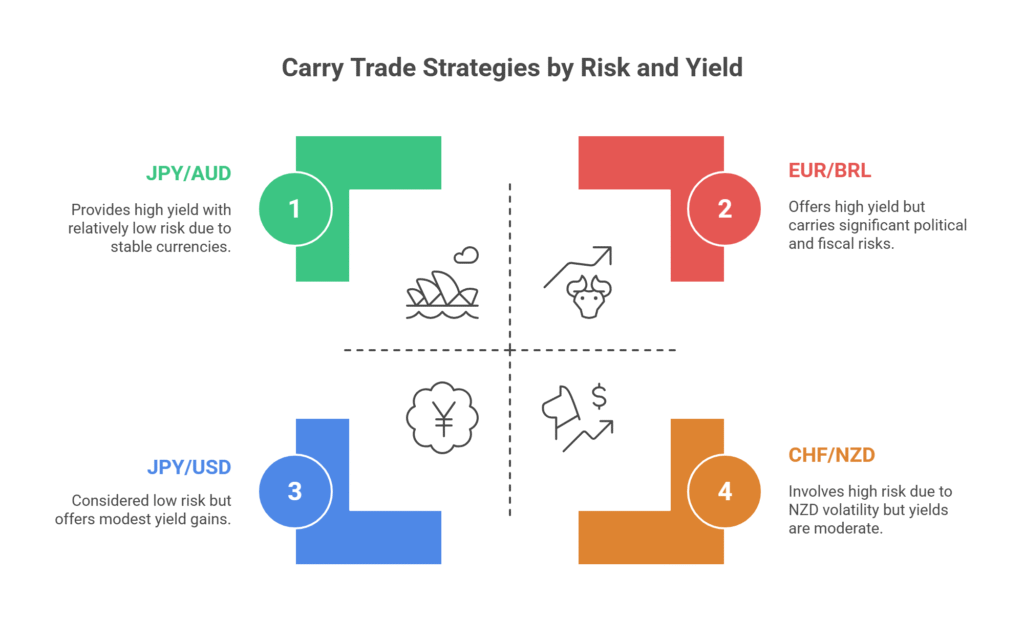

JPY/AUD: Classic Yield Strategy

The Japanese yen has been a top funding currency due to near-zero rates set by the Bank of Japan. According to zForex and Investopedia, investors often convert borrowed JPY into Australian dollars to invest in higher-yield assets.

Australia’s central bank has historically maintained interest rates between 3%–5% during expansion periods. So, this made the JPY/AUD pair a high-carry opportunity. However, the trade loses appeal during risk-off periods or when the yen strengthens, as seen during global downturns.

JPY/USD: Safe-Haven Divergence

As noted by TastyFX and John Hancock Investments, borrowing in JPY and investing in USD has long been a favored strategy. If the Federal Reserve raises rates. The interest rate gap reached over 5% during 2022–2023, which created a powerful carry environment.

In early 2024, the yen began appreciating amid speculation that the Bank of Japan might end its ultra-loose policy. As a result, carry trades were unwound en masse, causing volatility across forex markets.

CHF/NZD: Wide Yield Spread

The Swiss franc consistently holds negative or near-zero yields, driven by the Swiss National Bank’s deflation-fighting stance. New Zealand, on the other hand, often posts some of the highest policy rates among developed nations.

According to CFI and zForex, CHF/NZD remains a high-interest-rate differential pair. Investors borrow CHF to invest in NZD-denominated bonds or deposits. The risk lies in NZD volatility, which can rapidly offset carry gains.

EUR/BRL: High-Yield, High-Risk

Some investors take on higher volatility for larger yields by borrowing in euros and investing in Brazilian real. The ECB’s historically dovish policies make the euro an appealing funding currency, while Brazil’s central bank often offers double-digit rates to control inflation.

As mentioned in Blueberry Markets and City Traders Imperium, the EUR/BRL carry trade has delivered substantial returns during stable periods. But see, yet political and fiscal risks in Brazil can sharply reverse the trade, which makes it suitable only for risk-tolerant portfolios.

What Causes a Carry Trade to Unwind?

A carry trade unwinds when the interest rate gap starts to narrow. If the funding country’s central bank hints at rate hikes, profits shrink. The European Central Bank (2007) noted that even rate expectations can trigger early exits. Currency risk matters. If the borrowed currency rises in value, it becomes more expensive to repay. So, this can wipe out profits or create losses, as TastyFX (2025) explains.

Market volatility speeds up the process. John Hancock Investments (2024) states that economic shocks lower demand for high-yield currencies. Investors rush to exit risky positions and unwind leverage. In 2024, the yen carry trade collapsed quickly. The World Economic Forum (2024) reported that rising Japanese yields led to institutional selling and emerging market outflows.

Moreover, leverage adds pressure. According to Investopedia (2024), even small currency moves can trigger margin calls. Traders are forced to liquidate fast.

Is Carry Trade Still Worth It in 2025?

Carry trades remain a relevant strategy in 2025—but only for traders who adapt to changing conditions. In fact, TastyFX (2025) confirms that favorable interest rate spreads still exist. The Japanese yen continues to function as a reliable funding currency, while central banks like the Federal Reserve and the Reserve Bank of New Zealand maintain higher policy rates. You can see that it creates ongoing opportunities for traders seeking yield differentials.

- Moreover, Investopedia (2024) notes that the strategy has become more complex. Global interest rate cycles are no longer synchronized.

- Traders now face a higher probability of policy surprises, which can instantly erode carry trade profits.

- Now, consider the 2024 yen carry trade reversal. The World Economic Forum (2024) explains that a sudden rise in Japanese bond yields triggered mass position closures.

- So, as a result, the yen appreciated sharply, which caused heavy losses across emerging markets and leveraged trades.

John Hancock Investments (2024) further emphasizes that carry trades are not obsolete—but success depends on precision. Today’s traders need advanced risk controls, better liquidity management, and a keen awareness of macroeconomic signals.

In short, carry trading in 2025 still works—but only for traders who treat it as a strategy, not a shortcut.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountConclusion: Should You Use a Carry Trade Strategy?

Yes—if used with discipline. Carry trades can still generate returns from interest rate differentials, especially in stable markets. But risks like currency swings, policy shifts, and leverage exposure demand caution. So, use this strategy only if you monitor central banks closely, manage risk tightly, and accept that gains may reverse quickly.