Forex sentiment analysis studies trader psychology to measure bullish or bearish bias and anticipate currency moves. It reveals crowd behavior beyond charts or reports, helping traders detect trend continuations or reversals. Using tools like the COT report, broker ratios, and community outlooks, sentiment forms the third pillar of forex trading.

Key Takeaways

- Forex sentiment analysis measures whether traders are mostly bullish or bearish on a currency pair.

- It provides a third pillar of trading, complementing technical and fundamental analysis.

- Retail vs. institutional sentiment offers contrasting signals—retail is often contrarian, institutions trend-following.

- Top indicators include the COT report, IG Client Sentiment, Myfxbook, VIX, and open interest.

- Sentiment helps with trend confirmation, contrarian setups, and better risk management.

- Extreme sentiment levels often signal potential reversals in currency trends.

- For best results, combine sentiment data with technical analysis before making trades.

What is Forex Sentiment Analysis?

Forex sentiment analysis measures the collective feeling of market participants toward a specific currency pair. It reveals the percentage of traders who are long (bullish) versus those who are short (bearish), providing a snapshot of the market’s overall bias.

For example, if sentiment data for EUR/USD shows that 75% of retail traders hold long positions, the current market sentiment is overwhelmingly bullish. Conversely, if the majority hold short positions, the sentiment is bearish.

So, does sentiment analysis work in forex?

Yes, it works as a powerful confirmation tool and a source for contrarian trade ideas. It helps you understand why the market might be moving in a certain way by revealing the underlying trader psychology.

Why Forex Market Sentiment Matters

Market sentiment matters because the collective actions of forex traders are what ultimately drive price movements. Market psychology can cause trends to extend or reverse, often independently of technical or fundamental factors.

Here’s why sentiment is important for your trading:

- Trend Confirmation: If a strong uptrend is supported by growing bullish sentiment, it adds conviction to your long trades.

- Contrarian Setups: Extreme sentiment readings often signal market tops or bottoms. If 90% of traders are long, it might be a signal that the trend is overextended and ready to reverse.

- Risk Management: Understanding sentiment helps you anticipate potential volatility. When sentiment is at an extreme, the risk of a sharp and sudden reversal increases.

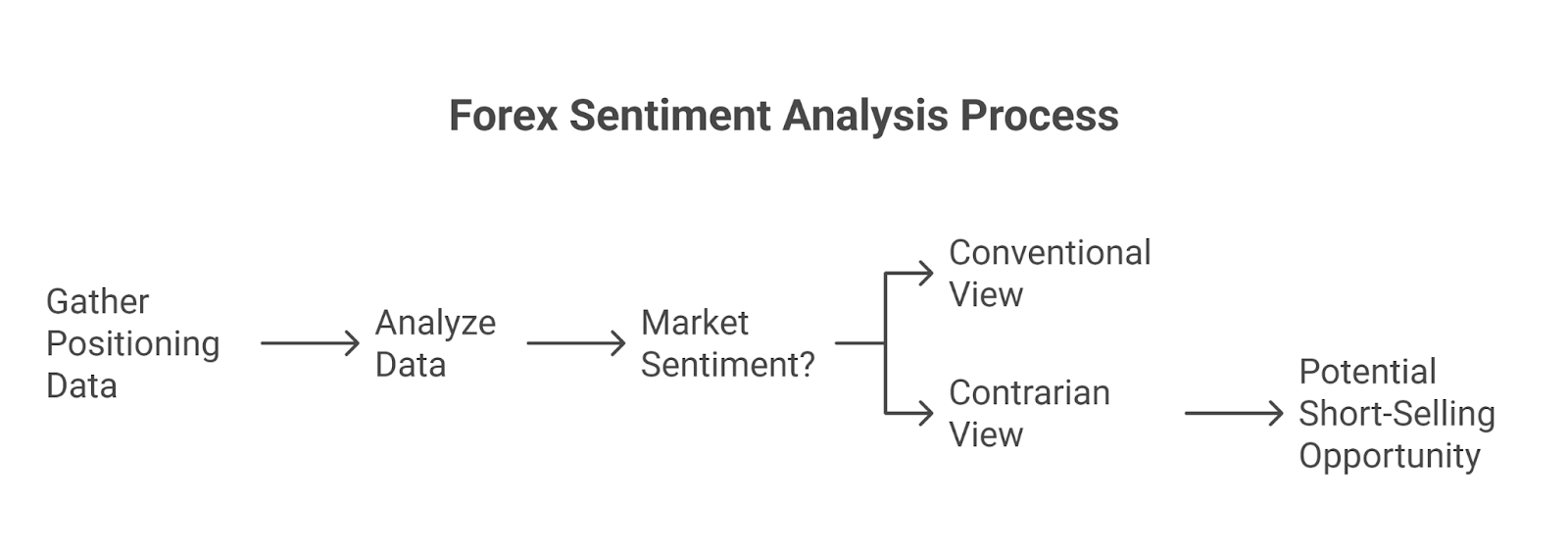

How Forex Sentiment Analysis Works

Sentiment analysis works by aggregating positioning data from various sources to create a measurable indicator of market mood. This data comes from futures markets, retail brokers, and even social media feeds.

A Practical Example: Imagine the USD/JPY has been in a strong uptrend, and you see broker data showing 75% of retail traders are now in long positions.

- Conventional View: The market is bullish.

- Contrarian View: The “crowd” is often wrong at market extremes. With so many traders already long, there are fewer buyers left to push the price higher. This extreme bullishness could be a signal that the uptrend is exhausted and a reversal is imminent, presenting a potential short-selling opportunity.

Retail vs. Institutional Sentiment: A Key Contrast

A critical distinction in sentiment analysis is between retail and institutional traders. Their behavior and positioning often tell two different stories.

- Retail Sentiment: This reflects the positioning of individual, non-professional traders (the “crowd”). Retail traders are often trend-followers and can be prone to emotional decisions. Extreme retail sentiment is typically used as a contrarian indicator.

- Institutional Sentiment: This reflects the positioning of large players like hedge funds, banks, and corporations, often tracked via the COT report. These players are typically better informed and are considered the “smart money.” Their positioning is often used as a trend-following indicator.

Understanding this contrast is key: when retail traders are overwhelmingly positioned on one side of a trade, institutional players are often taking the other.

Forex Sentiment Indicators

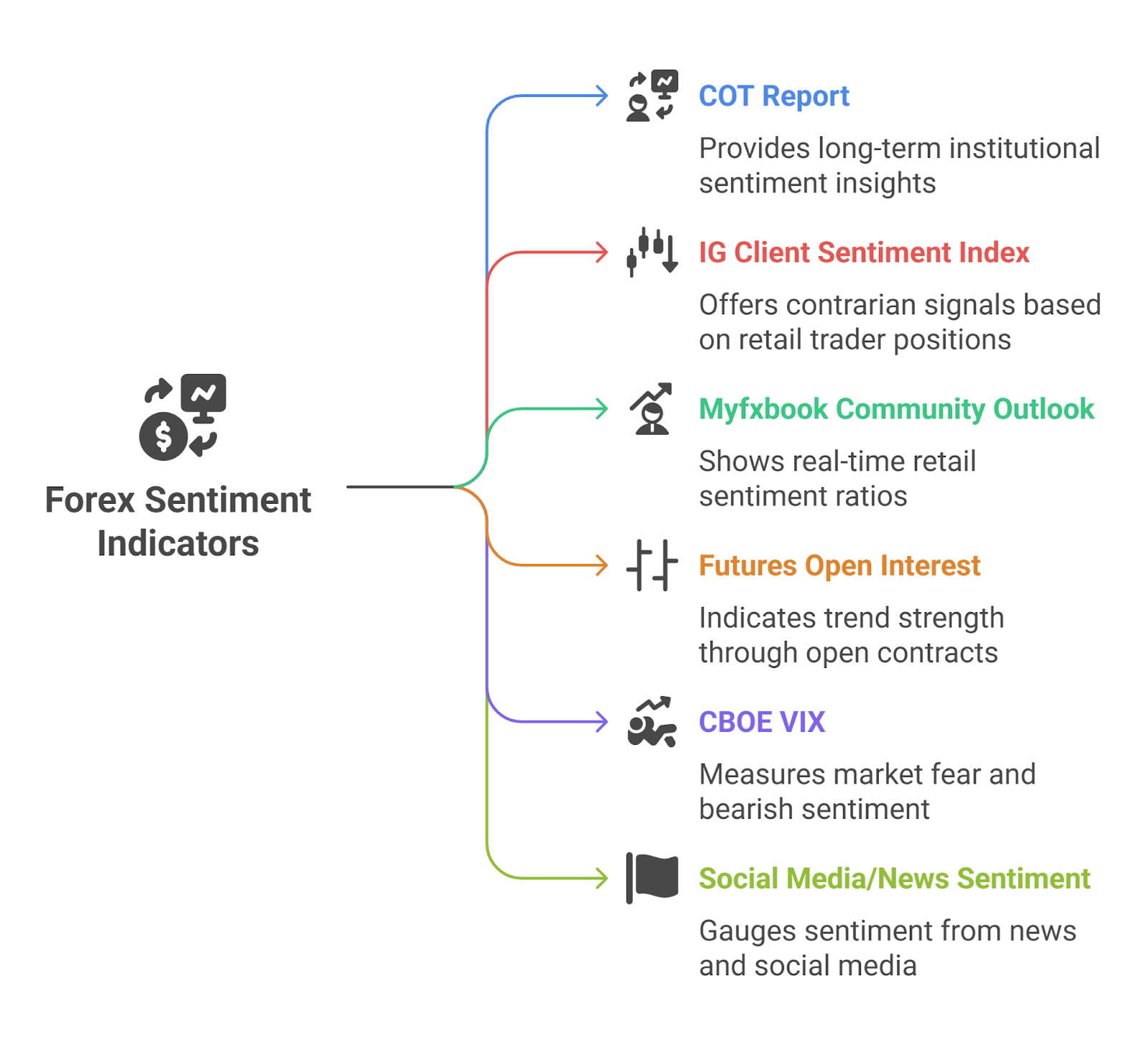

Several key indicators are used to measure market sentiment, each offering a unique perspective.

The COT Report (Commitment of Traders)

Published weekly by the CFTC (Source: cftc.gov), the COT report shows the net long and short positions of large speculators and commercial players in the futures market. It is the primary tool for tracking long-term institutional sentiment.

IG Client Sentiment Index (SSI)

The IG Client Sentiment Index (Source: IG Group) shows the percentage of IG’s retail clients who are long or short on a currency pair. Because retail traders often trade against the prevailing trend, the SSI is primarily used as a strong contrarian indicator.

Myfxbook Community Outlook

Myfxbook (Source: myfxbook.com) aggregates live data from thousands of trading accounts to show community sentiment ratios. Like broker ratios, this is a powerful real-time gauge of retail sentiment.

Other Key Indicators

- Futures Open Interest: Measures the total number of open futures contracts, indicating the strength of conviction behind a trend.

- CBOE VIX (Volatility Index): Often called the “fear index,” a rising VIX (Source: CBOE) indicates increasing market fear and a bearish sentiment.

- Social Media/News Sentiment: Advanced tools use Natural Language Processing (NLP) to gauge sentiment from news articles and social media.

Sentiment Indicator Comparison

| Indicator | Data Source | Update Frequency | What It Measures | When to Use |

| COT Report | CFTC (Futures Market) | Weekly (with a lag) | Institutional & Commercial Positions | For long-term trend analysis |

| IG Client Sentiment | Retail Broker (IG) | Real-Time | Retail Trader Positioning | For short-term contrarian setups |

| Myfxbook Outlook | Myfxbook Community | Real-Time | Retail Trader Positioning | For short-term contrarian setups |

| VIX Index | CBOE (Options Market) | Real-Time | Market Fear / Volatility | For gauging overall risk sentiment |

Tools & Data Sources for Forex Sentiment

Traders can access sentiment data through various platforms and APIs.

- Free Tools:

- IG Client Sentiment, Myfxbook Community Outlook, and DailyFX Sentiment Index (SSI) are popular free resources.

- Premium Tools & APIs:

- APIs from OANDA, TradingEconomics, and the CME Group provide access to order books, positioning ratios, and futures data for developers and quantitative traders.

- TradingView offers many free and paid community-built sentiment indicators.

How to Use Forex Sentiment in Trading Strategies

Integrating sentiment into a trading strategy involves a clear workflow, not just acting on a single number.

Sentiment Trading Workflow

- Collect Data: Gather sentiment information from multiple sources (e.g., COT report for long-term bias, broker ratios for short-term).

- Choose an Approach:

- Alignment: If a trend is strong and institutional sentiment is supportive, trade with the trend.

- Contrarian: If retail sentiment is at an extreme (>80% long or short), look for signs of a reversal against the crowd.

- Confirm with Technicals: Use technical analysis to confirm the trade. Look for candlestick patterns or support/resistance levels that align with your sentiment bias.

- Manage Risk: Always use a stop-loss. Extreme sentiment can persist longer than expected.

Benefits of Forex Sentiment Analysis

Incorporating sentiment analysis into your trading offers several practical advantages.

- Anticipate Trend Reversals: Extreme sentiment readings are powerful leading indicators of potential market tops and bottoms.

- Identify High-Probability Contrarian Trades: Trading against a lopsided retail crowd is a classic strategy used by many professional traders. In fact, many successful Forex traders apply sentiment as a core filter—either aligning with institutional flows or fading crowded retail positions.

- Improve Risk Management: Knowing when sentiment is at an extreme can help you tighten stops or reduce position size to protect against sharp reversals.

- Validate Other Analyses: Sentiment can confirm or contradict signals from your technical and fundamental analysis, providing a more holistic view. For instance, traders often look at RSI sentiment divergence to see whether crowd bias aligns with momentum, helping confirm or challenge their conviction.

Limitations & Risks of Sentiment Analysis

While useful, sentiment analysis has pitfalls and should not be used in isolation.

- COT Report Lag: The weekly COT report is released with a 3-day lag, making it unsuitable for short-term trading decisions.

- Retail Skew: Broker data only represents their own clients and can be heavily skewed towards short-term retail behavior.

- Extremes Can Persist: A market can remain “overbought” or “oversold” with extreme sentiment for a long time. Sentiment alone is not a timing tool.

- It’s Not a Standalone Signal: Sentiment must be confirmed with technical or fundamental analysis. A trade based solely on sentiment is a low-probability bet.

Final Thoughts

Sentiment analysis is the third pillar of forex analysis, complementing Technical Analysis Basics and Fundamental Analysis in Forex by focusing on trader psychology. It provides a unique insight into the market that charts and economic data alone cannot.

For the most effective strategy, triangulate your signals by using multiple sentiment sources (like combining the long-term COT report with real-time Myfxbook data). By integrating sentiment into your overall trading plan, you can make more informed and robust trading decisions.