A forex trading account is a broker-held account that lets you buy and sell currencies. It serves as your gateway to the $7.5 trillion-a-day forex market, the largest and most liquid in the world. Both retail traders and institutions use these accounts for speculation, hedging, and international payments.

Every forex trade exchanges one currency for another. A forex account gives access to the market, holds funds in a base currency, and enables speculation on pairs like EUR/USD. This guide shows how accounts work, the types available, and how to choose the right one for your needs.

Key Takeaways

- A Forex trading account is required to buy and sell currencies through a broker.

- It acts as your gateway to the $7.5 trillion/day forex market.

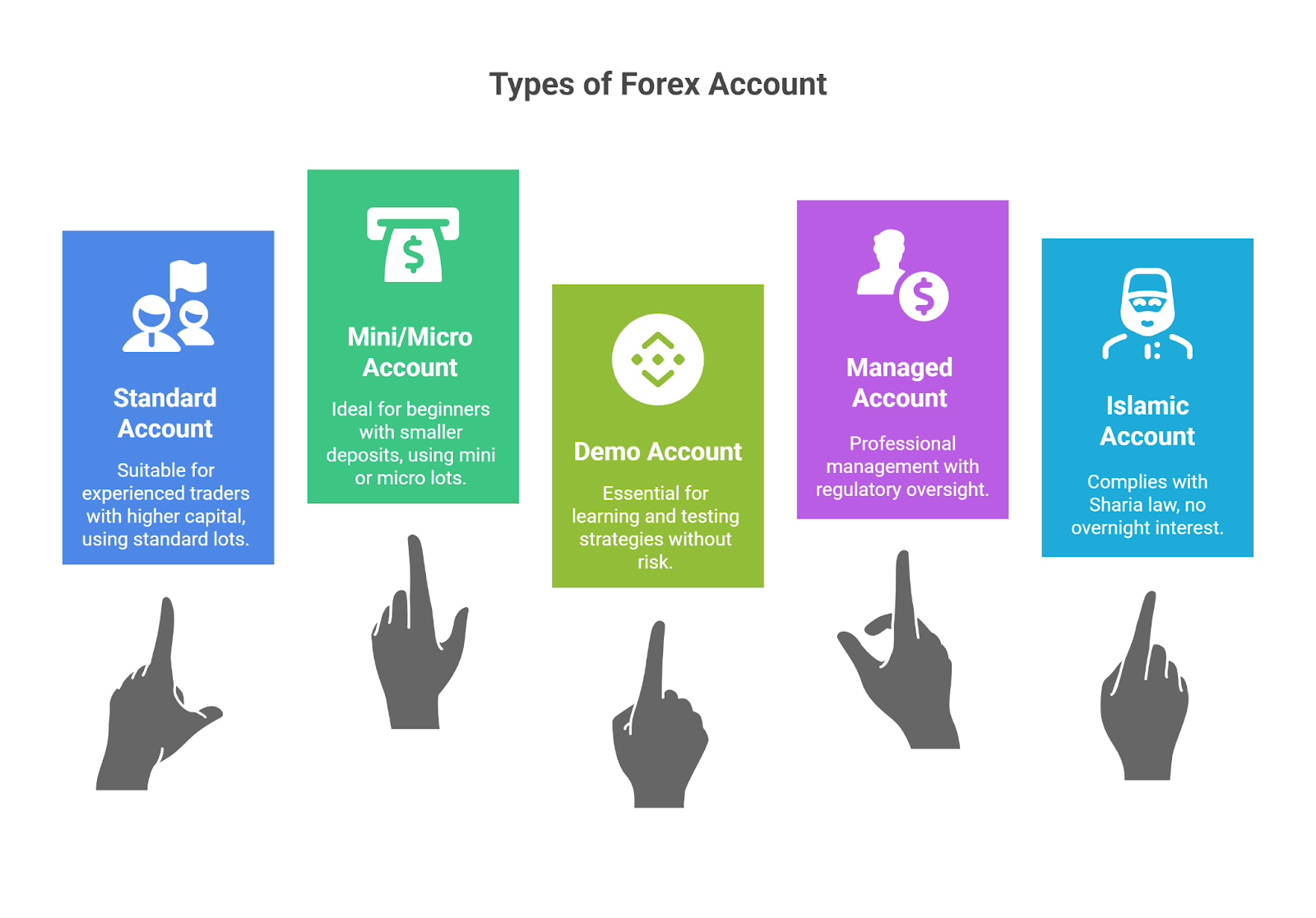

- Accounts vary: Standard, Mini/Micro, Demo, Managed, Islamic, and VIP.

- Minimum deposits range from $10 (Micro) to $500+ (Standard).

- Leverage and margin let you control large positions with small capital, but increase risk.

- Costs include spreads, commissions, and swaps.

- Regulated brokers provide safety through segregated funds and negative balance protection.

- Beginners should start with a Micro/Mini account or Demo account to manage risk.

How Does a Forex Trading Account Work?

A forex trading account gives traders market access through a broker. Funds are held in a base currency, and the account enables trading pairs like EUR/USD by buying one currency and selling another. It tracks balances, margin, and positions, while the broker connects to liquidity providers to execute orders efficiently.

The core mechanics of trading with a Forex account involve:

- Order Execution: When you place a trade (e.g., buying 1 lot size of EUR/USD), your broker fills the order at the current market price.

- Spreads: The broker profits from the bid-ask spread, which is the small difference between the buying and selling price.

- Leverage: The account allows you to use leverage, which means you can control a large position with a small amount of capital (margin). While this amplifies potential profits, it also increases the risk of a margin call.

Why Do You Need a Forex Account?

You need a forex account to access the $7.5 trillion daily currency market. It is the only practical way for retail traders to buy and sell currency pairs, speculate on price movements, and manage risk. A forex account provides tools, leverage, and liquidity essential for trading.

- Access to Global Currencies: It is your portal to trade dozens of currency pairs from around the world, 24 hours a day, five days a week.

- High Liquidity: The market’s immense size ensures you can almost always enter and exit trades at a stable price with minimal cost.

- Leverage: A Forex account provides capital access far beyond your initial deposit.

- Hedging: Beyond speculation, these accounts can be used for hedging against currency risk.

Types of Forex Accounts

Standard Account

A Standard Account is the most common account type for experienced traders, utilizing a standard lot (100,000 units of the base currency). It typically requires a higher deposit and is best suited for well-capitalized professional traders.

Mini/Micro Account

A Mini Account uses a mini lot (10,000 units), while a Micro Account uses a micro lot (1,000 units). These accounts are ideal for beginners as they allow for trading with a much smaller deposit size and significantly lower risk per trade.

Demo Account

A Demo Account is a free practice account funded with virtual money. It is an essential learning tool that allows new traders to learn the trading platform and test strategies in a zero-risk trading environment.

Managed Account

A Managed Account is an account where an investor deposits capital, but a professional money manager makes all trading decisions. Fund managers offering PAMM/MAM accounts are typically subject to strict regulatory oversight and licensing requirements to protect investor capital.

Islamic (Swap-Free) Account

An Islamic Account complies with Sharia law by not charging or earning overnight interest (swaps). This religious compliance has made forex accessible to the large and growing demographic of Muslim traders worldwide.

VIP/Professional Account

A VIP or Professional Account is designed for high-volume traders. These accounts offer premium features such as a dedicated account manager, tighter spreads, and priority support, but require a very large minimum deposit.

Broker Models and Account Types

Your account’s features often depend on the broker’s business model:

- Market Maker (Dealing Desk): These brokers create the market for their clients, profiting from the spread. They often offer Standard and Micro accounts.

- STP (Straight Through Processing): These brokers pass client orders directly to liquidity providers.

- ECN (Electronic Communication Network): These brokers provide direct access to the interbank market, charging a commission but offering the raw, tightest spreads. ECN accounts are preferred by professional traders.

Each account type comes with different deposit requirements—a micro account may need just $10, while standard accounts often require $500+.

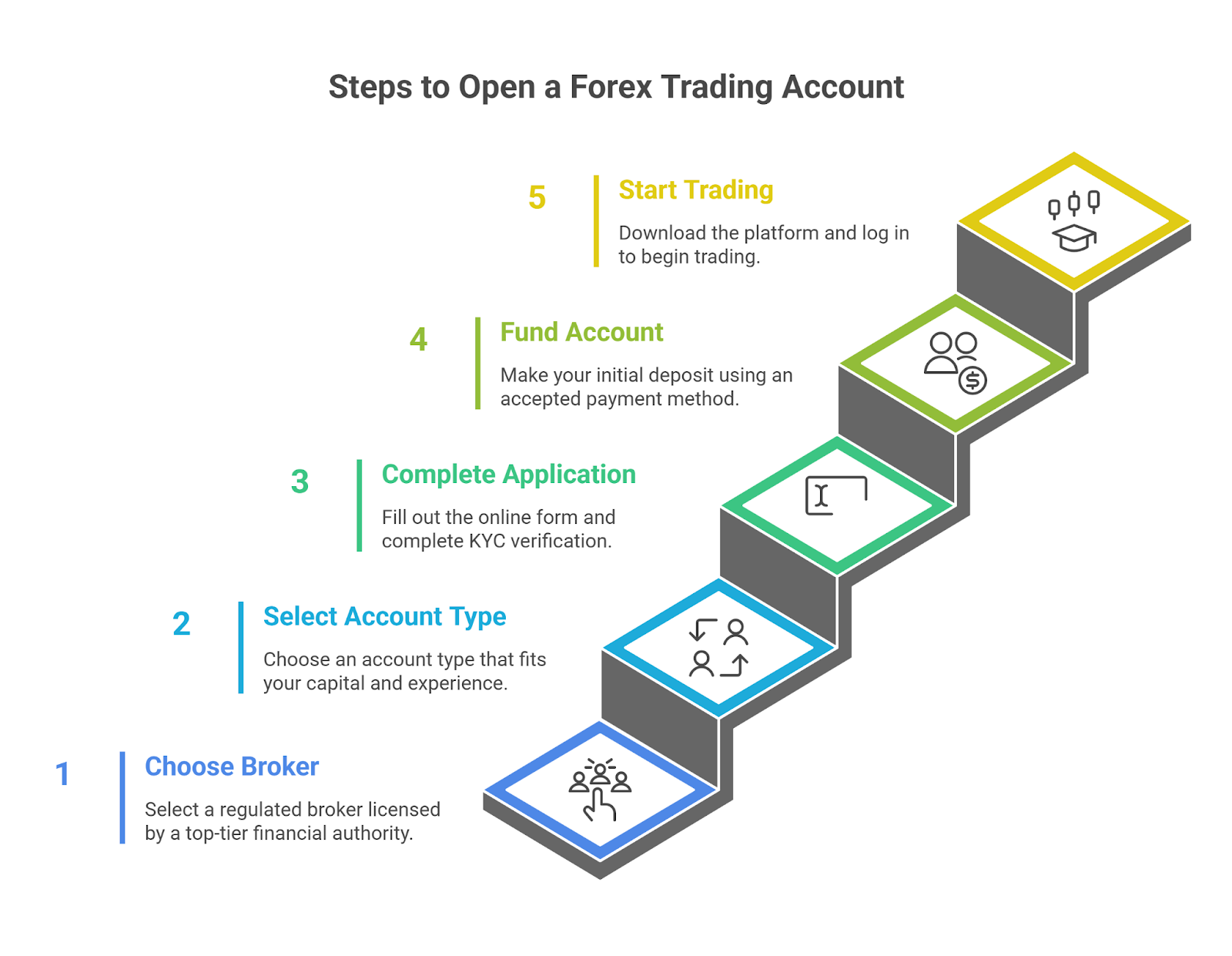

How to Open a Forex Trading Account

To start trading currencies, you first need a forex trading account. Opening one is a simple process that involves a few key steps, from choosing a broker to funding your account. Following these steps ensures you are set up to trade securely and access the global forex market with confidence.

- Choose a Regulated Broker: Select a broker licensed by a top-tier financial authority (e.g., FCA, ASIC, ESMA).

- Select Your Account Type: Choose the account that fits your capital and experience (e.g., Micro for beginners).

- Complete the Application & KYC: Fill out the online form and complete the KYC (Know Your Customer) verification.

- Fund Your Account: Make your initial deposit using an accepted payment method.

- Start Trading: Download the platform, such as MT4 or MT5, and log in.

What is the Minimum Deposit for a Forex Account?

The minimum deposit for a Forex account can range from as little as $10 for a Micro Account to $500 or more for a Standard Account. This low entry barrier is a key advantage, but it’s important to start with enough capital to manage risk effectively.

Leverage and Margin in Forex Accounts

Leverage allows you to control a large position size with a small amount of capital, known as margin. EU regulation from bodies like ESMA was designed for investor protection, capping leverage at 1:30 for retail clients. Traders can apply for professional classification to access higher leverage (e.g., 1:500 from offshore brokers), but this removes some regulatory protections.

Leverage Risk Example:

- At 1:30 leverage, a $1,000 deposit lets you control $30,000. A 3.33% move against you could trigger a margin call.

- At 1:500 leverage, the same deposit controls $500,000. A tiny 0.2% move against you could wipe out your entire capital.

Costs and Fees of Forex Accounts

- Spread: The difference between the buy and sell price. For example, a 1-pip spread on EUR/USD equals $10 on a standard lot. If a day trader executes 5 standard lots, their spread costs for the day would be $50, excluding any swaps or commissions.

- Commission: A per-trade fee charged by ECN brokers in exchange for tighter spreads.

- Swap: An overnight interest fee for holding a position past the market close.

These costs impact leveraged trades even more, as a small spread becomes magnified when controlling larger positions.

Trading Platforms for Forex Accounts

Forex trading accounts operate through specialized platforms that connect traders to the market. These platforms provide the tools for charting, analysis, and order execution, making them essential for managing trades effectively. Here are some of the most famous forex trading platforms.

- MT4: Ideal for beginners and algorithmic traders due to its simplicity and vast library of custom tools.

- MT5: Best for multi-asset traders who want access to stocks and futures in addition to forex.

- cTrader: Suits traders needing advanced depth-of-market views and a modern user interface.

- TradingView: Preferred by chart-focused retail traders for its superior charting tools and social features.

- Volity.io: A streamlined web and mobile platform ideal for traders who want a simple, all-in-one solution for trading multiple asset classes, including forex, crypto, stocks, and gold.

Which Forex Account is Best for Beginners?

A Micro or Mini account is the best forex account for beginners. These account types allow a beginner trader to start with a low deposit and trade with very small position sizes (micro lots). This minimizes the risk of significant financial loss while learning the fundamentals of trading and risk management.

In addition to the account type, the choice of trading platform is crucial. A simple, all-in-one solution like Volity.io is ideal for beginners. Its streamlined web and mobile interface is often less intimidating than more complex platforms, allowing new traders to focus on their strategy without being overwhelmed by complicated tools.

Are Forex Accounts Safe?

Yes, Forex accounts are safe provided you use a well-regulated broker. Top-tier regulators like the FCA (UK), ASIC (Australia), and ESMA (EU) enforce strict rules to ensure investor safety, including:

- Segregated Funds: Client money must be held in accounts separate from the broker’s operational funds.

- Negative Balance Protection: You cannot lose more money than you have in your account.

- Compensation Schemes: Protects your funds up to a certain limit if the broker becomes insolvent.

Demo vs Live Forex Accounts

| Feature | Demo Account | Live Account |

| Capital | Virtual Funds (Risk-Free) | Real Capital (Risk Involved) |

| Psychology | None (No fear or greed) | High (Trading psychology is a major factor) |

| Execution | Perfect, instantaneous | Subject to execution slippage and requotes |

| Purpose | Learning, practice, strategy testing | Earning profit |

Tips for Choosing the Right Forex Account

- Prioritize Regulation: Only choose brokers regulated by a top-tier authority.

- Compare Fees: Look at the typical spreads, commissions, and swap fees.

- Test the Platform: Open a demo account to ensure you are comfortable with the broker’s platform.

- Match the Account Type to Your Goals: Choose a Micro or Mini account if you are a beginner.

- Check Customer Support: Ensure the broker offers reliable and accessible customer service.

Bottom Line

A Forex trading account is an essential tool that provides your portal to the world’s largest financial market. The key to success is choosing the right type of account with a secure, regulated broker that aligns with your capital, experience, and trading style.

By understanding the differences between account types and prioritizing risk management, you can leverage the unique benefits of the Forex market. The best first step for any new trader is to open a demo trading account and practice until you are confident in your strategy and abilities.