Forex liquidity is the ease with which a currency can be bought or sold without causing a major change in its exchange rate. The Forex market is the most liquid financial market in the world, with the Bank for International Settlements (BIS) reporting an average daily turnover of trillions of dollars. For traders, this massive global trading volume is critical for efficient execution, stable pricing, and lower transaction costs.

This guide provides a deep dive into liquidity: what it is, the different types, how to spot it, and how to build trading strategies around it.

Key Takeaways

- Stick to major pairs like EUR/USD or USD/JPY for tight spreads and reliable execution.

- Trade during London–New York overlap for peak liquidity and smoother price action.

- Avoid exotic pairs and off-hour sessions where spreads widen and slippage increases.

- Use limit orders in low-liquidity markets to control entry and exit prices.

- Track bid-ask spreads, trading volume, and market depth before placing trades.

- Watch liquidity zones (support/resistance clusters) to anticipate institutional moves.

- Always adjust position size and use stop-losses in thin markets to manage risk.

What Does Liquidity Mean in Forex?

Liquidity in forex means the market has a high volume of buy and sell orders, allowing traders to execute large trades quickly without causing major price changes. A liquid market ensures tighter spreads, faster order execution, and stability when entering or exiting positions.

A perfect example is comparing a major pair to an exotic one:

- High Liquidity (EUR/USD): Millions of traders are constantly buying and selling. You can execute a large order almost instantly with a very small bid-ask spread.

- Low Liquidity (USD/TRY): Fewer market participants mean a shallower order book. A large order can take longer to fill and will likely cause the price to move, resulting in a wider spread.

Why is Liquidity Crucial for Forex Traders?

High liquidity directly translates into a better trading environment. It is the foundation of an efficient and fair market.

Here are the primary benefits for traders:

- Smooth and Fast Execution: Trades are filled almost instantly at expected prices.

- Low Transaction Costs: High competition among liquidity providers leads to tighter spreads, reducing the cost of entering and exiting trades.

- Reduced Slippage: Slippage—the difference between the expected price and the execution price—is minimal in liquid markets because large orders are easily absorbed.

- Price Stability: Major currency pairs are less prone to extreme, sudden price swings because a massive volume of orders is required to move the price significantly.

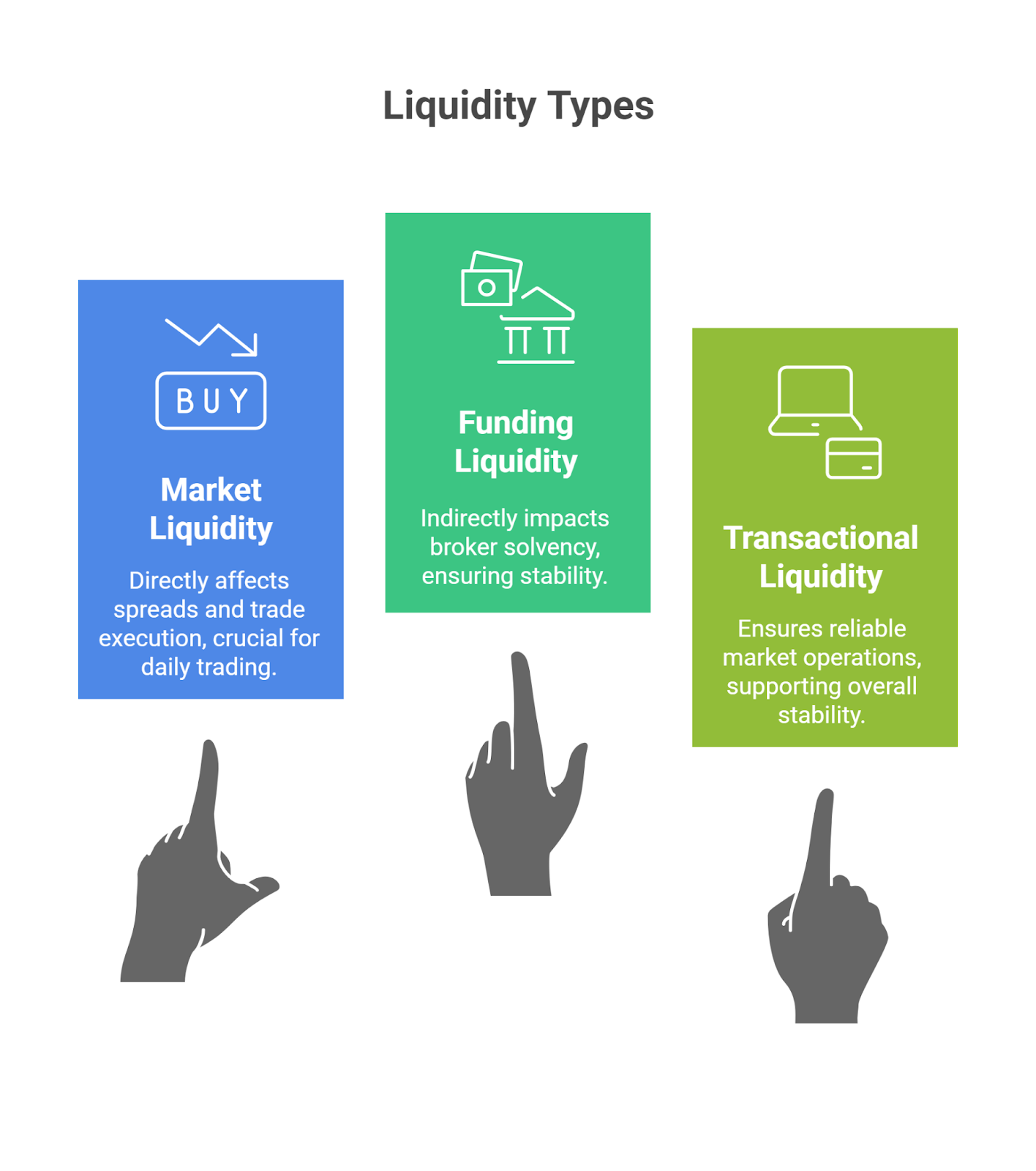

What Are the Main Types of Liquidity in Forex?

While traders primarily interact with “market liquidity,” it’s helpful to understand the different categories that keep the financial system operating smoothly.

| Type of Liquidity | Definition | Impact on a Retail Trader |

| Market Liquidity | The ease of buying and selling assets in the open market. | Direct Impact: Affects your spreads, slippage, and ability to enter/exit trades. |

| Funding Liquidity | The ability of institutions (like your broker) to secure funding to meet their financial obligations. | Indirect Impact: A broker with poor funding liquidity could face solvency issues. |

| Transactional Liquidity | The efficiency and speed of the systems that settle and clear transactions. | Systemic Impact: Ensures the entire market operates reliably. |

For example, imagine a major bank’s settlement system fails for an hour due to a technical glitch. Even if market liquidity is high, trades cannot be cleared, creating a backlog and potential systemic risk. This highlights the critical importance of robust transactional liquidity.

High vs. Low Liquidity: A Direct Comparison

The difference between trading a liquid and an illiquid pair is stark. This comparison between EUR/USD and an exotic pair like NZD/SGD illustrates the impact.

| Feature | High Liquidity (e.g., EUR/USD) | Low Liquidity (e.g., NZD/SGD) |

| Execution | Instantaneous | Can be delayed |

| Spreads | Very tight (low cost) | Wide (high cost) |

| Slippage Risk | Low | High, especially on large orders |

| Price Gaps | Rare | More frequent |

| Volatility | Generally stable | Often erratic and unpredictable |

A Practical Scenario: Example of Liquidity in Forex

Imagine you want to place a standard 10-lot trade ($1,000,000 notional value).

- On EUR/USD (High Liquidity): Your order is filled instantly at or very close to the quoted price. The spread cost is minimal, perhaps $10-$20. Slippage is negligible.

- On USD/TRY (Low Liquidity): Your large order consumes a significant portion of the available orders in the book. The execution might be delayed, you could experience severe slippage (a worse-than-expected price), and the spread cost could be hundreds of dollars.

Who Are the Liquidity Providers in Forex?

The immense liquidity in Forex is created by a network of major financial institutions. These are the players that facilitate the market’s massive daily volume.

- Tier 1 Banks: At the top are the world’s largest global banks that form the interbank market. They handle huge volumes for themselves and their clients. Key players include Citi, Deutsche Bank, and JPMorgan.

- Large Brokers and ECNs: Brokers and Electronic Communication Networks (ECNs) aggregate price feeds from multiple Tier 1 banks to create a deep liquidity pool for their clients.

- Market Makers: These are typically brokerages that guarantee a two-sided (buy and sell) market at all times, adding another layer of liquidity.

What Factors Affect Forex Liquidity?

Liquidity is not static; it ebbs and flows throughout the day and week based on market activity. The most significant factor is the 24-hour trading session cycle.

| Trading Session | Key Characteristics | Liquidity Level |

| Tokyo | Lower volume, often range-bound for major pairs. | Moderate to Low |

| London | Highest trading volume, significant price movements. | Very High |

| New York | High volume, especially during the overlap with London. | High |

Peak liquidity occurs during the London-New York overlap (8 AM to 12 PM EST). Other factors include major economic news releases and shifts in market sentiment.

How to Spot Liquidity on a Forex Chart

While you can’t see liquidity directly, you can easily spot its effects on your chart and trading platform.

- Look at the Spread: This is your primary indicator. A consistently tight bid-ask spread is the clearest sign of high liquidity.

- Analyze the Volume Bars: High volume bars on your chart indicate periods of intense trading activity and deep liquidity. Low, flat volume bars signal illiquid conditions.

- Check for Price Gaps: Frequent gaps between candles, especially on lower timeframes, suggest a lack of liquidity.

- Use Advanced Tools: Many platforms offer tools like liquidity heatmaps or order flow indicators that visualize order book depth, showing you where large clusters of orders are waiting.

Liquidity vs. Volatility

It’s crucial not to confuse liquidity with volatility.

- Liquidity = The volume of orders available. It provides smoothness and efficiency.

- Volatility = The speed and magnitude of price changes.

They have an inverse relationship. For example, during the Non-Farm Payroll (NFP) report, liquidity often vanishes for a few seconds. Many providers pull their orders, but a flood of new orders hits the market. This combination of low liquidity + high volatility can cause massive slippage, potentially triggering a trader’s stop-loss far from its intended price.

What Are Liquidity Zones in Forex? (And How Institutions Use Them)

Liquidity zones are price areas on a chart where a dense cluster of orders (especially stop-losses) is likely to accumulate. These zones are typically found just above recent highs and below recent lows, as well as at key support and resistance levels.

These pools of orders are targets for institutional traders who need massive liquidity to fill their large positions. This can lead to a phenomenon known as “institutional liquidity hunting” or a “stop hunt,” where price is deliberately pushed into a zone to trigger the cluster of stops before reversing in the intended direction.

The Dangers of Low Liquidity: From Slippage to Flash Crashes

Trading in low-liquidity conditions is extremely risky.

- High Transaction Costs: Wide spreads can erode your profits quickly.

- Severe Slippage: Your trades may be executed at prices far from what you expected.

- Price Gaps: The price can “gap” up or down, jumping over your stop-loss completely.

- Liquidity Stress & Flash Crashes: In extreme cases, a sudden lack of liquidity can lead to a “flash crash,” where prices plummet hundreds of pips in minutes as automated systems struggle to find orders.

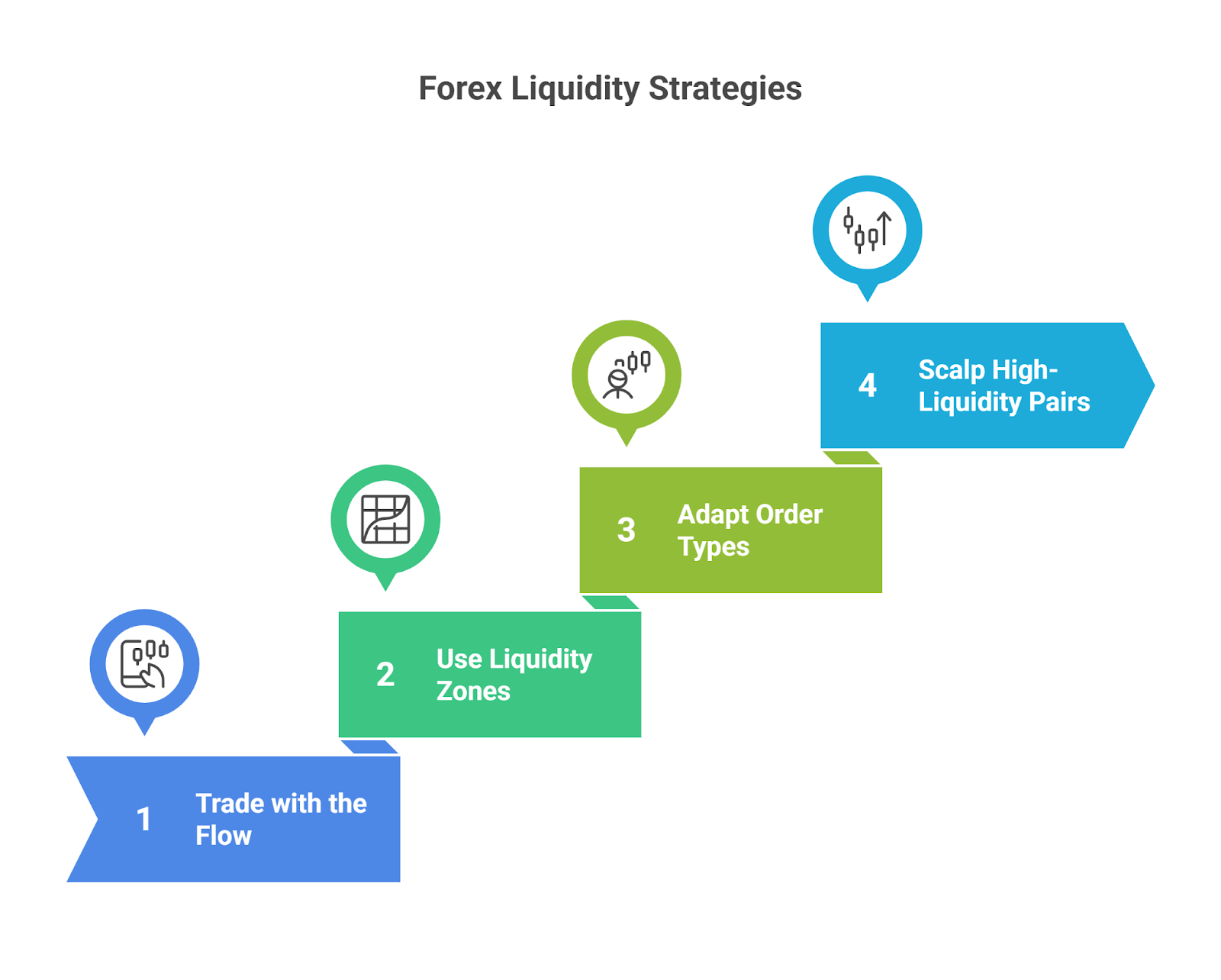

Best Forex Liquidity Strategies

Smart traders build strategies that leverage liquidity conditions to their advantage. A clear liquidity strategy helps minimize risk and maximize opportunities.

- Trade with the Flow: Focus your trading on major pairs during the peak-liquidity London and New York sessions. This is the simplest and most effective strategy for most traders.

- Use Liquidity Zones for Targets: Identify key liquidity zones above and below the current price. These often act as price magnets and make excellent take-profit levels.

- Adapt Your Order Types: In highly liquid markets, market orders work well. In thinner markets (like exotic pairs or off-hours), always use limit orders to protect yourself from slippage.

- Scalp High-Liquidity Pairs: Scalping strategies rely on capturing small profits from tight spreads and fast execution, which is only possible in the most liquid pairs like EUR/USD.

What Are the Most Liquid Forex Pairs?

The most liquid pairs are the “majors,” which consistently have the highest trading volume and tightest spreads. The EUR/USD is the undisputed leader.

| Forex Pair | Relative Liquidity | Typical Spread Range |

| EUR/USD | Very High | 0.1 – 1.0 pips |

| USD/JPY | Very High | 0.2 – 1.2 pips |

| GBP/USD | High | 0.3 – 1.5 pips |

| AUD/USD | High | 0.3 – 1.5 pips |

Conclusion

Understanding liquidity is not just theoretical; it’s a practical tool for improving your trading performance. By aligning your trading with periods of high liquidity—focusing on major pairs during peak sessions—you gain a statistical edge through better prices and more reliable execution. Recognizing and respecting the risks of low liquidity is a fundamental part of risk management that protects your capital from unpredictable market behavior.