The forex market is the world’s largest financial market, with daily turnover above $7.5 trillion, according to the Bank for International Settlements. Over 70% of this volume comes from a small group of major currency pairs, making them the most traded instruments in global forex trading.

Understanding which pairs are the most traded is crucial for traders. It directly impacts liquidity, spreads (trading costs), and risk management. This guide provides a definitive overview of the most traded pairs in 2025, explaining why they dominate, how they correlate with global macro-events, and how to align them with your trading strategy.

While understanding Most Traded Currency Pairs is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Top 7 Most Traded Currency Pairs by Volume

| Pair | Nickname | % of Daily Volume (BIS 2022) |

| EUR/USD | Fiber | 22.7% |

| USD/JPY | Gopher | 13.5% |

| GBP/USD | Cable | 9.5% |

| AUD/USD | Aussie | 5.1% |

| USD/CAD | Loonie | 4.4% |

| USD/CNY | – | 4.1% |

| USD/CHF | Swissy | 3.6% |

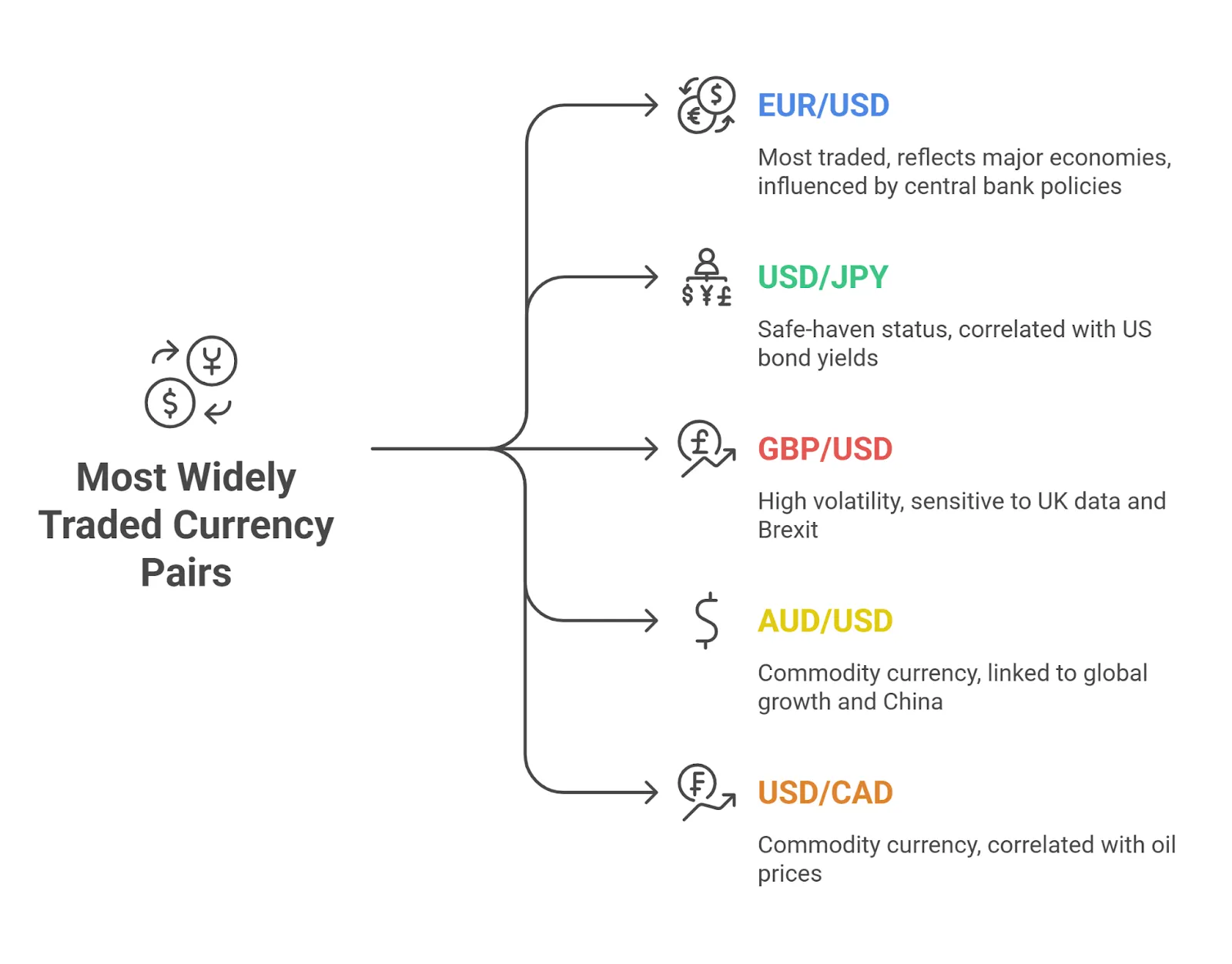

What are the Most Widely Traded Currency Pairs?

The seven major currency pairs are the foundation of the Forex market. Their behavior is a direct reflection of global economic health and policy.

EUR/USD (Euro/US Dollar)

- Definition: The most traded and liquid pair, representing the two largest economies.

- Primary Drivers: Driven by the monetary policy divergence between the European Central Bank (ECB) and the US Federal Reserve (Fed).

- Historical Context: While dominant, its market share has slightly declined from a peak above 28% in 2010 as the Chinese Yuan has risen in prominence.

- Implications for Traders: Institutions often use EUR/USD as a primary hedge against US Dollar exposure.

- Scenario: If the Fed hikes interest rates faster than the ECB, the USD typically strengthens, putting downward pressure on EUR/USD.

Traders closely watch pip movement in majors like EUR/USD, since even small shifts in value can translate into meaningful profit or loss — which is why knowing how to read forex pairs is a fundamental skill for turning price changes into actionable trades.

USD/JPY (US Dollar/Japanese Yen)

- Definition: The second most traded pair, known for its safe-haven status.

- Key Correlation: It has a strong negative correlation with US 10-year Treasury bond yields. When yields rise (bond prices fall), USD/JPY tends to rise as capital flows into higher-yielding US assets.

- Historical Context: The Bank of Japan’s historically ultra-low interest rate policy has made the JPY a popular funding currency for carry trades.

- Implications for Traders: It is highly sensitive to global risk sentiment. In a “risk-off” environment, traders often buy the JPY, causing the pair’s value to fall.

GBP/USD (British Pound/US Dollar)

- Definition: Known as “Cable,” this pair is famous for its higher volatility.

- Primary Drivers: Highly sensitive to UK economic data (inflation, GDP) and monetary policy from the Bank of England (BoE).

- Historical Context: The 2016 Brexit referendum caused a historic flash crash in GBP/USD, permanently elevating its perceived geopolitical risk.

- Implications for Traders: Its wide daily range offers more significant profit opportunities for day traders and swing traders but also carries higher risk. The impact of these wide ranges depends on your standard lot size, which determines how much each pip fluctuation affects your account balance.

AUD/USD (Australian Dollar/US Dollar)

- Definition: A “commodity currency” whose value is strongly influenced by global growth cycles.

- Key Correlation: It is positively correlated with the price of iron ore and economic data from China, Australia’s largest trading partner.

- Implications for Traders: Used to trade shifts in the global commodity cycle and sentiment towards the Chinese economy.

- Scenario: If China’s PMI data weakens, demand for Australian commodities is expected to fall, typically putting downward pressure on AUD/USD.

USD/CAD (US Dollar/Canadian Dollar)

- Definition: Another major commodity currency, known as the “Loonie.”

- Key Correlation: It has a strong negative correlation with the price of WTI crude oil. A rise in oil prices typically strengthens the CAD, causing USD/CAD to fall.

- Implications for Traders: Popular for traders who also analyze energy markets and want to hedge or speculate on oil price movements.

Minor and Exotic Currency Pairs

Beyond the majors, other categories offer different risk-reward profiles.

- Minor Pairs (Crosses): These are pairs that do not include the US Dollar (e.g., EUR/GBP, EUR/JPY, GBP/JPY). They often have wider spreads and higher volatility. GBP/JPY is famously one of the most volatile of all currency pairs.

- Exotic Pairs: These consist of a major currency paired with one from an emerging economy (e.g., USD/TRY, USD/ZAR). They are characterized by low liquidity, wide spreads, and high sensitivity to political risk.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesThe Evolution of Global Forex Dominance: 2001-2025

The composition of the most traded pairs has evolved, reflecting shifts in the global economy. The most notable changes have been the consistent dominance of the USD and the rise of the Chinese Yuan.

| Currency | Share of Daily Trades (2001, BIS) | Share of Daily Trades (2022, BIS) | Long-Term Trend |

| US Dollar (USD) | 89.9% | 88.3% | Stable Dominance |

| Euro (EUR) | 37.6% | 32.3% | Mature, slight decline |

| Chinese Yuan (CNY) | 0.0% | 7.0% | Rapid Ascension |

Liquidity vs. Volatility: A Trader’s Matrix

Choosing a pair requires balancing liquidity (low cost) and volatility (profit potential).

| Pair | Category | Average Daily Range (Pips) | Volatility |

| EUR/USD | Stable Major | 50 – 80 | Low |

| USD/CHF | Stable Major | 40 – 70 | Low |

| GBP/USD | Volatile Major | 90 – 130 | High |

| GBP/JPY | Volatile Minor | 120 – 180 | Very High |

This contrast becomes clearer when looking at liquidity vs stocks, where equity markets lack the same depth and tight spreads as Forex majors.

How Trading Sessions Impact the Most Traded Pairs

Forex is a 24-hour market, but liquidity and volatility for specific pairs are highest when their home markets are open.

- Asian (Tokyo) Session: Dominated by USD/JPY and commodity crosses like AUD/JPY. Generally lower volatility than other sessions.

- London Session: The session with the highest volume. EUR/USD, GBP/USD, and EUR/GBP are most active as major European economic data is released. Traders who want to align with peak liquidity often study the best session for pairs to capture tighter spreads and stronger directional moves.

- New York Session: High volume, especially during the London-New York overlap (8 AM to 12 PM EST). This is the period of peak liquidity for all USD majors.

Many also compare FX vs crypto volatility to set expectations, since digital assets move with greater extremes despite offering 24/7 trading access.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountThe Role of AI and Algorithmic Trading

The dominance of major pairs is amplified by AI and algorithmic trading. High-frequency trading (HFT) systems account for a huge portion of daily volume and thrive in highly liquid markets with low transaction costs. These systems prefer EUR/USD and USD/JPY because their deep order books allow for the execution of large trades with minimal slippage, reinforcing their status as the most traded pairs.

Bottom Line

The forex market offers thousands of trading combinations, but most activity centers on EUR/USD, USD/JPY, and GBP/USD. These pairs dominate due to stable economies, deep liquidity, and macroeconomic drivers. Traders should match pair selection with strategy, risk tolerance, and knowledge of global correlations to make informed decisions.