Gold futures contracts are standardized agreements allowing traders to buy or sell gold at a predetermined price on a future date, offering exposure to the precious metal without physical ownership. These instruments are crucial for both hedging against price fluctuations and speculating on market movements, amplified by inherent leverage. This guide will teach you the mechanics of gold futures, essential risk management techniques, and advanced trading strategies, enabling you to navigate this dynamic market effectively.

While understanding Futures Contract Gold is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a gold futures contract?

A gold futures contract is a legally binding agreement to buy or sell a specified amount of gold at a pre-determined price on a future date. This agreement is standardized regarding quantity, quality, and delivery location, primarily facilitated by exchanges like the CME Group. Gold futures contracts are standardized agreements traded on exchanges like the CME Group, obligating the buyer to purchase or the seller to deliver a specific quantity of gold at a predetermined price on a future date. These agreements ensure uniformity across all transactions, making the market highly transparent and liquid.

The standardization covers aspects such as the contract size, which for the standard COMEX Gold Futures contract (GC) is 100 troy ounces, and the grade of gold to be delivered. The CME Group acts as the central counterparty, guaranteeing the performance of each contract and mitigating counterparty risk. This structure allows participants to trade with confidence, knowing the terms are clear and enforced.

How do gold futures work?

Gold futures trading involves participants taking positions based on their expectations of future gold prices. A buyer (long position) profits if the price rises by the expiration date, while a seller (short position) profits if the price falls. Most futures contracts are settled in cash, meaning traders exchange the monetary difference between the contract price and the market price at expiration, rather than physically delivering gold. This cash settlement mechanism makes futures highly efficient for speculation and hedging.

The market also plays a vital role in price discovery, as the collective buying and selling activity of futures traders helps to establish the current and anticipated future value of gold. This continuous process reflects real-time supply and demand dynamics, often influencing the spot price of physical gold.

Key Factors Influencing Gold Futures Prices

Several critical factors influence gold futures prices, making their analysis a multifaceted endeavor. Supply and demand dynamics are fundamental, with global gold production, recycling rates, and consumer jewelry demand playing significant roles. Economic data, such as inflation reports, GDP growth, and employment figures, can significantly shift investor sentiment towards gold as a safe-haven asset.

Geopolitical events, including political instability, wars, and trade disputes, often lead to increased demand for gold, driving up its price. Furthermore, interest rates and the strength of the US Dollar have an inverse relationship with gold. Higher interest rates typically make non-yielding assets like gold less attractive, while a stronger dollar makes gold more expensive for holders of other currencies. Traders use both fundamental analysis, examining these macroeconomic factors, and technical analysis, studying price charts and indicators, to predict future price movements.

Margin, Leverage, and Contract Specifications

Trading gold futures requires a clear understanding of margin and leverage, which are fundamental to how these markets operate. Margin is a good-faith deposit, not a down payment, that ensures traders can cover potential losses. Leverage, inherent in futures trading, allows control of a large contract value with a relatively small amount of capital, amplifying both potential gains and losses. Additionally, grasping the specific contract specifications for different gold futures products, such as standard versus Micro Gold Futures, is essential for managing risk and capital effectively.

What are the margin requirements for gold futures?

Margin is the capital deposited with a broker to cover potential losses on a futures position. It is not the full cost of the asset, but rather a percentage of the contract’s total value, acting as a performance bond. Margin requirements for gold futures can be as low as 5-10% of the contract’s total value, significantly amplifying both potential gains and losses. There are two primary types: initial margin, required to open a position, and maintenance margin, the minimum equity needed to keep a position open. If a trader’s account equity falls below the maintenance margin, a margin call is issued, requiring additional funds to be deposited or the position to be closed.

| Initial | Deposit to open a new position | Guarantees contract performance |

| Maintenance | Minimum equity to hold position | Prevents excessive losses |

Amplifying Gains and Risks

Leverage is a powerful characteristic of futures trading, allowing traders to control a large value of gold with a relatively small capital outlay. For example, with a 10% margin, a trader can control a $200,000 gold contract with just $20,000. While this can significantly amplify profits when the market moves favorably, it equally magnifies losses when the market moves against the position. A small percentage move in the price of gold can result in a substantial percentage gain or loss on the initial margin deposited. This inherent magnification necessitates robust risk management strategies to protect capital. Without proper controls, leverage can quickly deplete trading accounts, making it a double-edged sword for futures participants.

Gold Futures Contract Specifications (GC vs. MGC)

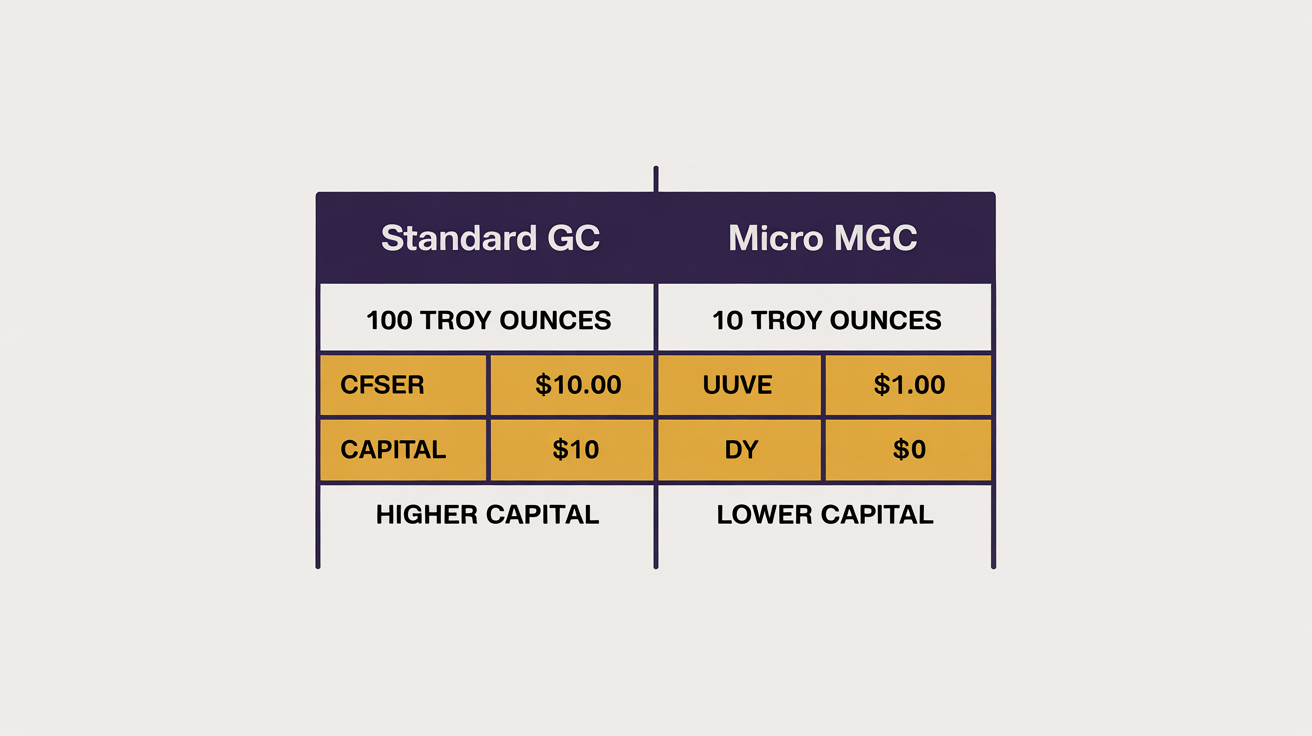

Understanding contract specifications is vital for trading gold futures effectively, as they define the size, value, and trading terms. The standard COMEX Gold Futures contract (GC) represents 100 troy ounces of gold, making it a substantial commitment. Each “tick,” or minimum price fluctuation, typically represents a $10 movement per contract.

For traders seeking greater accessibility and reduced capital commitment, Micro Gold Futures (MGC) contracts are available. These contracts represent 10 troy ounces, offering a more manageable entry point for retail traders. MGC contracts allow participation in the gold market with lower margin requirements, making them ideal for beginners or those testing strategies with smaller capital.

| Contract Size | 100 troy ounces | 10 troy ounces |

| Tick Value | $10.00 | $1.00 |

| Expiration | Monthly | Monthly |

| Exchange | CME Group (COMEX) | CME Group (COMEX) |

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow to Trade Gold Futures: Strategies, Benefits, and Risks

Gold futures offer a versatile tool for market participants, providing distinct benefits such as liquidity and leverage, primarily through hedging and speculation. However, these advantages come with inherent risks that demand careful consideration and proactive risk management. Understanding both the potential rewards and the pitfalls is crucial for anyone engaging in this dynamic market.

What are the benefits of trading gold futures?

Trading gold futures offers several compelling benefits for investors and traders. Firstly, futures contracts provide high liquidity, meaning they can be easily bought and sold without significantly impacting prices, allowing for efficient entry and exit from positions. Secondly, the inherent leverage allows traders to control a large contract value with a relatively small amount of capital, potentially amplifying returns. This capital efficiency can be a significant advantage. Thirdly, gold futures contribute to efficient price discovery for the underlying commodity, offering a transparent view of market sentiment. Finally, futures contracts provide flexibility, enabling both hedging against price volatility for producers or consumers and speculation on price movements for traders seeking profit.

What are the risks of trading gold futures?

While offering significant opportunities, trading gold futures also involves substantial risks that traders must acknowledge and manage. The most prominent is market risk, where adverse price movements can lead to significant losses, often magnified by leverage. Futures markets can be highly volatile, and sudden price swings can quickly erode capital. There is also liquidity risk in less active contracts or during extreme market conditions, making it difficult to exit positions at desired prices. Counterparty risk, though largely mitigated by clearinghouses like the CME Group, still exists in certain over-the-counter agreements. Additionally, the fixed expiration date of futures contracts introduces rollover risk if a trader wishes to maintain a position beyond the current contract’s life.

| Market Risk | Adverse price movements |

| Leverage Risk | Amplified losses due to borrowed capital |

| Liquidity Risk | Difficulty in exiting positions |

| Counterparty Risk | Default by other party (mitigated by exchanges) |

| Rollover Risk | Costs associated with extending positions |

Common Strategies for Trading Gold Futures

Common strategies for trading gold futures primarily revolve around hedging and speculation. Hedging is a risk reduction strategy, often employed by gold producers or jewelers to lock in future selling or buying prices, thereby protecting against adverse price movements. For example, a gold mining company might sell futures contracts to secure a price for its future production. Speculation, on the other hand, involves taking calculated risks to profit from anticipated price changes. Speculative strategies can include trend following, where traders buy in uptrends and sell in downtrends, or range trading, profiting from price fluctuations within defined boundaries.

Essential Risk Management for Gold Futures Traders

Effective risk management is not merely a suggestion but a critical pillar for sustained profitability and capital preservation in gold futures trading. Given the inherent leverage and volatility of these markets, a disciplined approach to managing potential losses is paramount. This section delves into the foundational principles and practical tools that traders can implement to mitigate risks and protect their capital, directly addressing the common concern: “I lost money on gold futures, how do I manage risk better?”

The Fundamentals of Risk Management in Futures Trading

Effective risk management in futures trading begins with a clear understanding of fundamental principles aimed at capital preservation. The most crucial principle is to never risk more capital than you can afford to lose. Gold futures, with their inherent leverage, can amplify both gains and losses, making it possible to lose significant capital quickly.

Therefore, defining acceptable risk levels before entering any trade is essential. Traders should establish a maximum percentage of their total trading capital they are willing to risk on a single trade, often recommended to be between 1-2%. This disciplined approach helps in safeguarding the trading account from catastrophic losses and ensures longevity in the market, directly addressing the pain point of previous losses.

Stop Loss, Position Sizing, and Diversification

Implementing practical tools is key to mitigating risk in gold futures. A stop-loss order is an instruction to close a trade automatically if the price moves against your position to a predetermined level, limiting potential losses. Setting a stop loss requires careful consideration of market volatility and support/resistance levels.

Position sizing determines the number of contracts a trader enters based on their capital and risk tolerance. For instance, the 1-2% rule suggests risking no more than 1-2% of trading capital on any single trade, ensuring that a series of losses does not wipe out the account. While diversification is more challenging in a single commodity market, it can involve spreading risk across different contract months or even combining gold futures with other uncorrelated assets in a broader portfolio.

| Stop Loss Order | Automatic exit at predetermined price level | Limits potential trade losses |

| Position Sizing | Calculating optimal contract quantity per trade | Controls capital at risk per trade |

| Diversification | Spreading risk across various assets/contracts | Reduces overall portfolio volatility |

Monitoring Market Data for Risk Assessment

Beyond individual trade management, monitoring broader market data is crucial for holistic risk assessment in gold futures.

Key indicators like Open Interest and Volume provide valuable insights into market sentiment and potential price movements.

Open interest refers to the total number of outstanding futures contracts that have not been settled, indicating the level of participation and capital flowing into the market.

High open interest combined with rising prices can signal strong bullish conviction, while declining open interest might suggest a waning trend.

Similarly, volume measures the number of contracts traded over a period, reflecting market activity and liquidity. A sudden surge in volume often precedes significant price moves or reversals. Integrating these metrics with technical analysis can help traders anticipate shifts and adjust their risk exposure accordingly.

Gold Futures vs. Physical Gold & Other Alternatives

When considering an investment in gold, market participants often weigh the options between holding physical gold and trading gold futures contracts. Each approach presents a distinct set of characteristics, advantages, and disadvantages regarding liquidity, capital requirements, and direct ownership. Understanding these differences is crucial for making an informed decision that aligns with individual investment goals and risk tolerance.

Gold Futures vs. Physical Gold: Which is Better?

Deciding whether gold futures or physical gold is better depends entirely on an investor’s objectives, timeframe, and risk appetite. Gold futures offer leverage, allowing control of a large gold position with a smaller capital outlay, and are highly liquid, making entry and exit easy. They are ideal for speculation on short-to-medium-term price movements and hedging.

However, futures involve significant market risk due to leverage and have expiration dates, requiring active management. Physical gold, such as bullion or coins, offers direct ownership and is often viewed as a long-term store of value and a hedge against inflation. It carries no counterparty risk and provides a sense of security. However, physical gold requires storage, often incurs insurance costs, lacks leverage, and has lower liquidity than futures, making it less suitable for active trading.

The choice boils down to active trading and capital efficiency (futures) versus long-term security and direct ownership (physical).

| Ownership | Contractual claim | Direct ownership |

| Leverage | High (magnifies gains/losses) | None |

| Liquidity | High (easy to buy/sell) | Moderate (can be slower to sell) |

| Capital Required | Small % of contract value (margin) | Full market value |

| Storage Costs | None | Yes (vaults, insurance) |

| Short Selling | Easy (profit from falling prices) | Difficult/Impractical |

| Expiration Date | Yes (requires rollover or settlement) | None |

| Price Volatility | High (due to leverage) | Lower (reflects actual asset) |

| Primary Use | Speculation, Hedging | Long-term store of value, Inflation hedge |

Other Ways to Invest in Gold

Beyond futures and physical bullion, several other avenues exist for investing in gold, each with its unique profile. Gold Exchange-Traded Funds (ETFs) offer a convenient way to gain exposure to gold prices without the complexities of futures or physical storage. These funds typically hold physical gold or gold-related derivatives and trade like stocks on major exchanges.

Mining stocks represent equity in companies involved in gold exploration and production. Their value is influenced by gold prices but also by company-specific factors like management, operational efficiency, and geopolitical risks.

Lastly, gold certificates provide proof of ownership for a specific quantity of gold held by a third party, eliminating storage concerns but introducing counterparty risk. These alternatives cater to different risk appetites and investment strategies, offering various levels of involvement with the gold market.

Advanced Insights for Gold Futures Trading

Successful gold futures trading extends beyond mechanics to include advanced market analysis and robust psychological resilience, areas often neglected in beginner guides. While understanding contract specifications and basic strategies is foundational, true differentiation comes from mastering the unseen forces that drive market movements and developing the mental fortitude to navigate them. This section explores these critical, often-overlooked aspects, providing a holistic view for aspiring traders.

Psychology of Successful Trading

The psychology of trading is arguably as critical as any technical or fundamental analysis, yet it remains an often-neglected area. Emotional biases often account for a significant portion of individual trader losses, often exceeding 40% in volatile markets. Emotions like fear, greed, hope, and overconfidence can lead to irrational decisions, such as chasing runaway trades, cutting profits too soon, or holding onto losing positions for too long.

To deal with emotional trading when the market swings wildly, developing discipline and emotional control is paramount. Practical steps include adhering strictly to a predefined trading plan, consistently applying risk management rules, and maintaining a trading journal to review decisions objectively. Cultivating patience and detachment from individual trade outcomes fosters a clearer mindset, crucial for long-term success.

Unlocking Market Secrets with the Commitment of Traders (COT) Report

The Commitment of Traders (COT) Report is a powerful, yet often underutilized, tool for analyzing gold futures market data. Published weekly by the Commodity Futures Trading Commission (CFTC), it details the net long and short positions of various market participants in specific futures markets. The report categorizes traders into key groups: commercials (producers/hedgers), non-commercials (large speculators), and non-reportables (small speculators).

For gold futures, analyzing the positions of commercials (who often take positions opposite to the prevailing trend, as they are hedging) and non-commercials (who tend to follow trends) can offer unique insights into potential market reversals or continuations. This report, when combined with Open Interest and Volume data, provides a comprehensive view of market sentiment and institutional flows, offering a significant edge in forecasting price movements.

Seasonal Trends and Intermarket Relationships in Gold

Understanding seasonal trends in gold and its intermarket relationships can provide advanced traders with a deeper analytical edge. Gold prices often exhibit observable seasonal patterns, such as increased demand during specific periods like the Indian wedding season (August-November) or around Chinese New Year.

These cyclical demands can create predictable price strength. Furthermore, gold’s price action is intricately linked to other major financial markets, a concept known as intermarket analysis. For instance, gold typically has an inverse relationship with the US Dollar; a stronger dollar makes gold more expensive for international buyers, often leading to price declines.

Similarly, gold often moves inversely to interest rates and bond markets; higher real interest rates increase the opportunity cost of holding non-yielding gold. Monitoring these relationships can help traders anticipate gold’s movements based on broader macro trends.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountPlatforms and Brokers

Embarking on the journey of trading gold futures requires a structured approach, starting with education and carefully selecting the right trading environment. For beginners, understanding the step-by-step process of setting up an account and choosing an appropriate broker is crucial.

This foundational knowledge, coupled with a realistic assessment of the suitability of futures trading, helps to set the stage for a more informed and potentially successful trading experience.

How to start trading gold futures?

Starting to trade gold futures involves a systematic approach, especially for new traders. First, education is paramount; thoroughly understand the mechanics of futures contracts, margin, leverage, and risk management.

Second, choose a reputable futures broker that aligns with your needs, considering factors like regulation, fees, and available platforms.

Third, fund your account with sufficient capital, always ensuring it’s discretionary capital you can afford to lose. Fourth, start with a demo account to practice trading strategies without real financial risk, familiarizing yourself with the platform and market dynamics.

Finally, when ready for live trading, consider starting with Micro Gold Futures (MGC) contracts. These smaller contracts require less capital and offer a lower-risk entry point, allowing you to gain experience gradually before potentially scaling up to standard contracts.

Brokers and Platforms for Gold Futures Trading

Choosing the right broker and trading platform is a critical step for gold futures traders. A reputable broker should be well-regulated by authorities like the CFTC in the US, ensuring investor protection. Key criteria for selection include competitive fees (commissions and exchange fees), reliable trading platforms with robust charting and analytical tools, and responsive customer service.

Popular brokers known for futures trading include Charles Schwab, Interactive Brokers, and TD Ameritrade (now part of Schwab). The best trading platforms for gold futures typically offer real-time data, advanced order types (like stop-loss and OCO orders), and customizable interfaces. Examples include Trader Workstation (Interactive Brokers), thinkorswim (Charles Schwab), and NinjaTrader.

Many brokers also offer mobile trading apps for on-the-go access, though desktop platforms are generally preferred for in-depth analysis and execution.

Is Gold Futures Trading Suitable for Beginners?

Gold futures trading can be suitable for beginners, but it comes with a steep learning curve and significant inherent risks. It is not for everyone. Beginners must possess a strong understanding of risk management, as the leverage involved can lead to rapid capital depletion if not managed properly. The psychological demands of futures trading, especially during volatile market swings, require discipline and emotional control.

For those new to the market, starting with a demo account is highly recommended to gain experience without financial risk. Furthermore, beginning with Micro Gold Futures (MGC) contracts allows for participation with a much smaller capital commitment, reducing the potential impact of early mistakes. Ultimately, suitability depends on a beginner’s commitment to education, their capital availability, and their ability to adhere to strict risk management protocols.

Key Takeaways

- Gold futures are standardized contracts for future gold delivery or cash settlement, primarily traded on the CME Group.

- Leverage allows control of large positions with small capital, amplifying both gains and losses, making risk management essential.

- Micro Gold Futures (MGC) offer a smaller, more accessible entry point for retail traders compared to standard contracts.

- Effective trading involves understanding market factors, implementing tools like stop-loss orders and position sizing, and mastering trading psychology.

- Gold futures serve both hedging and speculation purposes, but require diligent monitoring of market data and adherence to a disciplined trading plan.