A trading platform is the essential software that connects you to the financial markets. Your choice of platform directly impacts trade execution, costs, and security. A poor platform can lead to slippage and hidden fees, while the right one provides the necessary tools for success.

This guide offers a transparent review of the best options in 2026 to help you make an informed decision.

While understanding Trading Platforms is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

The Evolution of Trading Platforms

Trading platforms have evolved from desktop applications to sophisticated, AI-driven mobile ecosystems.

- 2000–2010: The Desktop Era This period was defined by desktop software like

MetaTrader 4 (MT4), which launched in 2005 and became the dominant platform for forex trading. - 2010–2020: The Rise of Web and Mobile Brokers began introducing web-based platforms and mobile trading apps, allowing traders to manage positions on the go. eToro pioneered social and copy trading during this time.

- 2020–2026: The Mobile-First and AI Era Platforms are now designed as

mobile-first ecosystems with a focus on seamless multi-device experiences. The integration of AI-driven assistants and fractionalization of assets are the defining trends of today.

Our Ranking Criteria: What Makes a Platform “The Best”?

Our trading platform reviews are based on a transparent scoring model that prioritizes security and performance.

The evaluation criteria are weighted as follows:

- Regulation and Safety (25%): Verifies licensing and investor protection measures.

- Costs and Fees (20%): Analyzes spreads, commissions, and other fees.

- Platform and Tools (20%): Assesses charting software and automation capabilities.

- Execution and Speed (15%): Measures latency and order fill quality.

- Asset Availability (10%): Covers the range of tradable instruments.

- Mobile App and Support (10%): Evaluates the mobile experience and customer support.

Top 10 Trading Platforms for 2026

Here is a breakdown of the leading platforms, each excelling in different areas.

- Volity.io (Best Overall Hybrid Platform) Volity.io offers a modern hybrid model, combining a proprietary platform with full MT4/MT5 integration. It provides access to CFDs, forex, crypto, and fractional shares. Its regulatory structure operates through a partnership with the CySEC-regulated UBK Markets Ltd.

- MetaTrader 5 (Best for Advanced Traders) MT5 is a powerful multi-asset platform for traders who need advanced charting and access to centralized markets like stocks and futures.

- cTrader (Best for Scalpers) Known for fast execution and transparent Level II pricing, cTrader is a favorite among scalpers and day traders.

- TradingView (Best for Charting and Analysis) TradingView offers advanced charting tools and a massive social community.

- eToro (Best for Copy and Social Trading) eToro is the leader in social trading, allowing beginners to copy the trades of experienced investors.

- IG (Best for Market Access) IG provides access to over 17,000 markets and offers advanced risk tools like Guaranteed Stop-Loss Orders (GSLOs).

- SaxoTraderGO (Best Premium Platform) Aimed at professional traders, SaxoTraderGO provides access to over 40,000 instruments.

- AvaTrade (Best for Risk Management Options) AvaTrade offers a unique risk tool called AvaProtect™, which allows traders to insure a trade against losses.

- Interactive Brokers (Best for Professionals) IBKR is the top choice for institutional traders, offering ultra-low commissions and direct access to over 150 global markets.

- Binance (Best for Crypto) As the world’s largest cryptocurrency exchange, Binance offers an unparalleled selection of digital assets and deep liquidity.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTop 10 Trading Platforms at a Glance

| Platform | Best For | Regulation Status | Mobile UX | Key Risk Protections |

| Volity.io | All-Round Traders | Partnered with CySEC entity | ⭐⭐⭐⭐⭐ | Negative Balance Protection |

| MetaTrader 5 | Advanced Traders | Broker-Dependent | ⭐⭐⭐⭐ | Broker-Dependent |

| cTrader | Scalpers | Broker-Dependent | ⭐⭐⭐⭐ | Broker-Dependent |

| TradingView | Technical Analysts | Broker-Integrated | ⭐⭐⭐⭐⭐ | Broker-Dependent |

| eToro | Beginners | CySEC, FCA, ASIC | ⭐⭐⭐⭐ | Investor protection funds |

| IG | Market Access | FCA, ASIC | ⭐⭐⭐⭐ | GSLOs, Segregated Funds |

| SaxoTraderGO | Professionals | EU regulators | ⭐⭐⭐⭐ | Segregated Funds |

| AvaTrade | Risk-Averse | Multi-Region | ⭐⭐⭐⭐ | AvaProtect™, Segregated Funds |

| Interactive Brokers | Professionals | SEC, FCA, FINRA | ⭐⭐⭐ | SIPC protection |

| Binance | Crypto Traders | Varies globally | ⭐⭐⭐⭐ | SAFU Fund (crypto insurance) |

Understanding Regulation & Safety

A platform’s regulatory status is the most critical factor for ensuring trading safety. Top-tier financial authorities enforce strict rules to protect investors.

Key global regulators include:

- FCA (UK): The Financial Conduct Authority is known for its strict consumer protection rules.

- CySEC (Cyprus): A key regulator for many brokers operating within the European Union.

- ASIC (Australia): Australia’s primary financial markets watchdog.

- SEC & FINRA (USA): Enforce strict rules for U.S.-based markets, with FINRA offering SIPC insurance for investors.

- ESMA (EU): Helps to harmonize financial rules across the EU under frameworks like MiFID II.

Essential Risk Management Tools Explained

Effective platforms provide tools to help you manage risk.

- Negative Balance Protection (NBP): This feature ensures you cannot lose more money than you have in your account. Volity.io offers this protection.

- Guaranteed Stop-Loss Orders (GSLOs): A GSLO guarantees to close your trade at the exact price you set, regardless of market volatility. IG is well-known for offering GSLOs.

- Segregated Client Funds: Regulators require brokers to keep client money in accounts separate from their own operational funds, protecting your money if the broker becomes insolvent.

Best Platforms by Category

Here’s a breakdown of the best platforms for specific use cases.

| Trader Type | Key Needs | Recommended Platforms |

| Beginner Trader | Simple interface, educational resources, low minimum deposit. | eToro, Volity.io Standard Account. |

| Scalper | Ultra-fast execution, low spreads, Level II data. | cTrader, Volity.io VIP Account. |

| Algo Trader | EA support, robust backtesting, API access. | MetaTrader 4 / MT5. |

| Technical Analyst | Advanced charting tools, large indicator library, social features. | TradingView. |

| Multi-Asset Investor | Access to global markets in one account. | Volity.io, Interactive Brokers, SaxoTraderGO. |

Volity.io Case Study: A Modern Hybrid Approach

Volity.io stands out by offering a hybrid platform that blends proprietary innovation with robust security.

- Regulatory Mechanics: Volity.io is registered in St. Lucia and acts as an introducing broker to UBK Markets Ltd, a firm regulated by CySEC. This structure means that while Volity provides the front-end technology, the execution and custody of funds are handled under the CySEC regulatory framework.

- Standout Features:

- Negative Balance Protection: A crucial safety net that ensures traders cannot lose more than their account balance.

- Fractional Shares: Allows traders with smaller capital to invest in high-priced stocks by purchasing a fraction of a share.

- VIP Cashback: The loyalty program rewards high-volume traders with cashback, effectively reducing their trading costs.

- Islamic Accounts: Swap-free accounts are available for traders who require them.

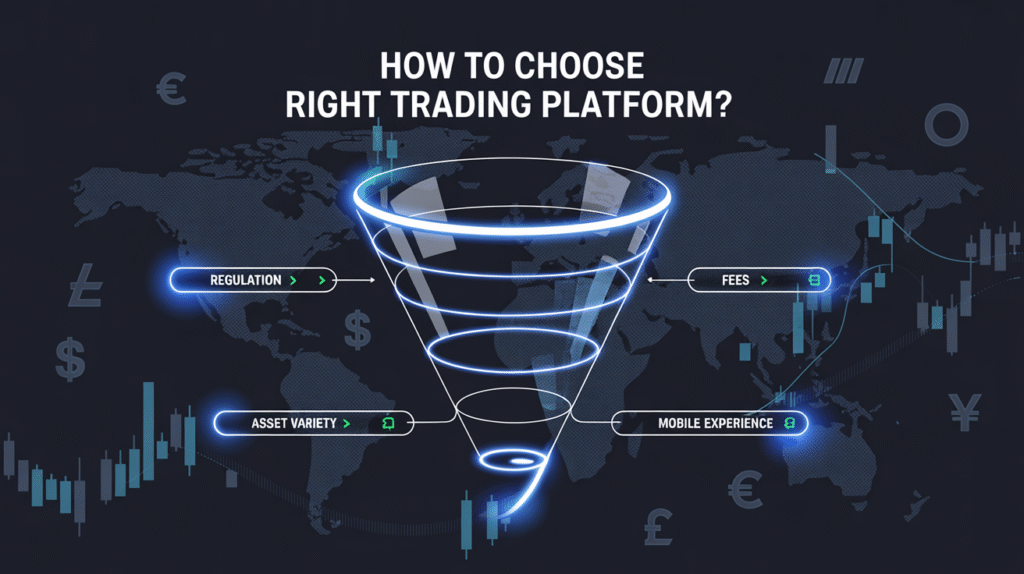

How to Choose the Right Trading Platform?

Use this decision funnel to select the best platform for your needs:

- Start with Regulation: Is the platform regulated by a top-tier authority?

- Match Assets to Your Goals: Does it offer the markets you want to trade?

- Analyze the Costs: Are the fees transparent and competitive?

- Evaluate the Tools: Does it have the charting, automation, and risk management features you need?

- Test the Mobile UX: Is the mobile app stable, fast, and fully functional?

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo Account