Forex opened the doors to high-leverage trading. Brokers began allowing traders to control large positions using a fraction of their own capital. See, this shift introduced a vital metric into the trading conversation: free margin. You follow more than just balance or equity. Free margin acts as your available capital, ready for new trades, adjustments, or managing volatility. It reflects how much flexibility remains in your account at any given moment.

Now, traders across every level rely on it for smarter risk control and better position sizing. As trading volumes grow and markets move faster, the role of free margin continues to expand.

Let’s explore what it means, how it works, and why it’s shaping how serious traders approach every trade.

What is Free Margin in Forex?

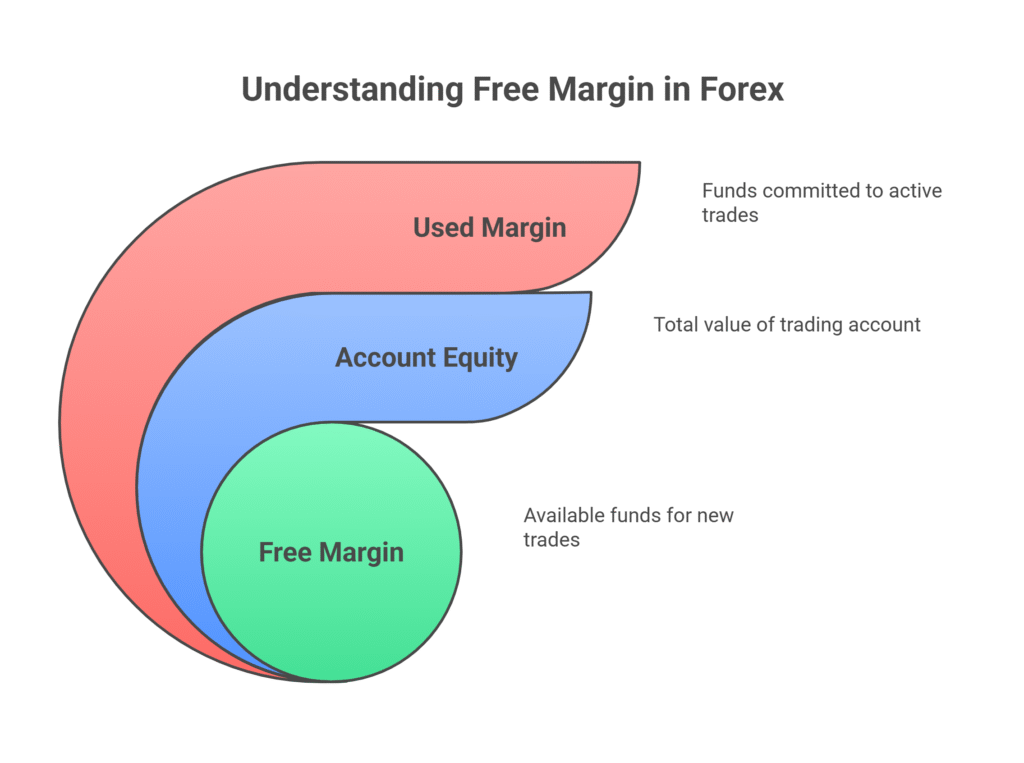

Free margin shows how much money you have left in your trading account to open new positions. It is the difference between your account equity and the margin already used in active trades. You don’t need to calculate it manually every time. Your trading platform shows it in real time. But understanding what it means helps you make better decisions.

Let’s go through it. Say your account balance is $2,000. You open a trade that uses $800 as margin. If the market hasn’t moved much yet, your equity remains close to $2,000. It leaves you with $1,200 in free margin. See, that’s the amount you can still use to open another position—or keep as a buffer.

Now imagine your trade moves in your favor and shows a $300 unrealized profit. Your equity becomes $2,300. Free margin now increases to $1,500. You can see how it responds to price changes. You don’t have to use all of it. In fact, keeping enough free margin protects your open trades from being forced to close. More on that in later sections.

So, for now, think of free margin as your remaining fuel. You need it to keep trading—and to stay safe in volatile markets.

Why Does Free Margin Matter For Traders?

Free margin shows how much power remains in your hands. It tells you what capital is still available after your trades go live. You rely on it to take new positions, adjust your strategy, or hold through volatility. Equity minus used margin gives your free margin. Its figure becomes the line between control and liquidation. CFI explains it clearly—free margin acts as your remaining balance for new trades or withdrawals. A strong free margin gives you flexibility.

In fact, Deriv highlights the margin level. So, that’s your equity divided by used margin, multiplied by 100. Once your free margin drops, the margin level follows. A lower level triggers system action. The platform closes trades based on exposure, starting with the largest loss.

You must protect your free margin before opening new trades. Even a small move in a pair like GBP/JPY can shift your equity fast. See, that shift squeezes your free margin and leaves no room to react. Free margin gives you breathing space. It supports your trading rhythm. It keeps the platform from stepping in. If you manage it well, you protect your strategy, capital, and future moves.

How Do You Calculate Free Margin in a Forex Account?

Free margin equals your equity minus the used margin.

Formula: Free Margin = Equity − Used Margin

Equity is your current account value, including unrealised profits or losses. The used margin is the locked capital holding open trades. Now you can use the Calculator. It shows exactly how to calculate the required margin before opening a position.

Example:

- Lot size: 5

- Leverage: 1:100

- Pair: EUR/USD

- Exchange rate: 1.365

- Account currency: USD

According to Axiory:

(5 × 100,000 ÷ 100) × 1.365 = $6,825

So if your account equity is $10,000, free margin would be:

$10,000 − $6,825 = $3,175

In fact, Axiory provides this tool to help traders prepare before execution. It lets you enter leverage, lot size, and instrument to calculate exact margin needs. Moreover, having a live view of free margin helps plan your next trade or adjust lot sizes for balance. Accurate calculation keeps you in control.

Let’s go through it using a clear example, based on how CFI and Deriv explain it in their trading guides.

Suppose your account balance is $1,000. You decide to open a standard lot (100,000 units) of EUR/USD. The broker offers a leverage of 1:100, and the market price for EUR/USD is 1.0450. If you want to calculate the required margin:

Required Margin = (100,000 × 1.0450) ÷ 100 = $1,045

Now, you only have $1,000 in your account. It means you can’t even open this position, since the margin required exceeds your balance. So, let’s scale it down to 0.5 lots:

Required Margin = (50,000 × 1.0450) ÷ 100 = $522.50. You open the trade. Your equity remains $1,000 because you haven’t gained or lost anything yet. The used margin is now $522.50.

According to CFI’s formula:

Free Margin = Equity – Used Margin = $1,000 – $522.50 = $477.50

Now consider the trade moves in your favor and you gain $100. Your equity becomes $1,100:

New Free Margin = $1,100 – $522.50 = $577.50

As long as your equity grows or your trade size stays modest, your free margin stays positive. Deriv emphasizes that this buffer allows you to open new trades or absorb losses without triggering a margin call. The moment your equity shrinks too close to your used margin, your free margin disappears—and the risk increases.

So, this example shows how real-time price action, leverage, and trade volume shape your available trading power.

What is a Healthy Margin Level in Forex?

Now focus on the margin level—the percentage that shows how much usable equity exists compared to the capital locked in open trades. This metric plays a key role in risk management. You calculate it using this formula:

Margin Level = (Equity ÷ Used Margin) × 100

According to CFI, a margin level above 100% reflects stability. It shows your equity still covers the margin tied to existing trades. A level around 150%–300% gives you more breathing room. So, this range signals you can manage fluctuations and open new positions if needed.

Deriv sets the stop-out level at 50%. Below this point, the broker starts auto-closing positions to protect the account from total depletion. The system begins with the most unprofitable trades. Traders often treat the 100% level as a warning—where additional funds or trade closures become necessary to avoid a forced exit. In fact, professionals target margin levels above 200% to ensure room for volatility. Higher levels build a cushion against market reversals and strengthen long-term strategy.

Now look at your platform. Most brokers like Axiory or Deriv display margin levels in the trade panel. Monitoring this number keeps you ahead of risk—before the market takes control.

Can You Withdraw Free Margin From Your Account?

Now think of free margin as your account’s flexible portion. It shows how much capital stays available after covering all open trades. Its buffer becomes relevant when you’re planning a withdrawal.

- You can withdraw from your free margin if the request doesn’t interfere with existing margin requirements. Brokers calculate available equity in real time.

- If enough remains after securing current trades, the system allows the withdrawal.

- In fact, Axiory and Deriv both explain that equity minus used margin creates free margin. See, from that figure, withdrawal options depend on broker rules and leverage settings.

- For instance, if your account has $2,000 equity and $500 used margin, then $1,500 stays as free margin. You may withdraw from that $1,500 without triggering a margin call—unless it dips your margin level too low.

- Moreover, platforms often show withdrawal limits dynamically. You see a “withdrawable balance” that factors in your floating profits or losses. That helps you decide whether the amount left is enough to support open trades.

- Always review your broker’s stop-out and margin call thresholds. Some brokers like CFI apply auto-closures near 50%–70% levels. Withdrawals that cut into your buffer may reduce this percentage fast.

So before making a move, run a quick margin check. Your strategy works best when withdrawals happen without shaking your active positions.

What’s The Difference Between Free Margin and Used Margin?

| Aspect | Free Margin | Used Margin |

| Definition | Funds available for opening new positions or absorbing market losses | Funds locked as collateral for currently open trades |

| Formula | Equity – Used Margin | Margin required for all open positions |

| Updates When | Account equity changes due to profit/loss | New positions are opened, or existing ones are closed |

| Usage | Enables new trades, cushions against drawdowns | Maintains margin requirements for active trades |

| Example | Equity: $2,000, Used Margin: $1,200 → Free Margin: $800 | Trade of 1 lot EUR/USD at 1.10 with 1:100 leverage → ~$1,100 used margin |

| Relevance | Shows remaining flexibility in the trading account | Shows current exposure or capital commitment |

How Do Brokers Handle Margin Calls and Stop-Out Levels?

Now, brokers define two thresholds to control risk: margin call level and stop-out level.

A margin call occurs when your margin level reaches a broker-defined limit. At 100%, brokers like Deriv and CFI lock your ability to open new trades. Equity equals used margin at this point (Deriv, 2023; CFI, 2025).

If losses continue, stop-out activates. At 50% for Deriv and 10% for CFI, the platform starts liquidating positions—beginning with the largest losing trade. This automation helps restore the margin level and prevent negative balance. According to Axiory, stop-out levels vary. Their calculator shows that each instrument and account type may trigger liquidation at different percentages, depending on leverage and contract size (Axiory Calculator, 2025).

Brokers apply these rules to enforce stability. You can reduce risk by watching your equity, monitoring exposure, and adjusting position sizes proactively.

Final Words

Free margin signals your readiness to trade. It shows the exact space available to open new positions or manage existing ones. Every change in your balance or equity adjusts this number in real time. Top brokers like Axiory, Deriv, and CFI use free margin as part of their live trading dashboards, guiding decision-making alongside margin level and equity data.

Platforms like Volity.io also emphasize margin control tools to help traders monitor their exposure in fast-moving markets.

So, now is the time to review how much free margin you hold before every trade.