Choosing the right forex broker is the single most important decision you’ll make as a trader. The wrong choice can lead to high costs, poor execution, or even the loss of your capital, while the right one provides the tools and security you need to trade with confidence. This guide breaks down the essential factors to consider—from regulation and trading costs to platforms and support—to help you select the best forex broker for your needs in 2026.

Selecting a broker is the foundation of Forex Trading, because your platform choice determines how you learn, practice, and eventually scale in the market.

What Is a Forex Broker and Why Do You Need One?

A forex broker is a financial services company that provides traders with access to the global foreign exchange market.

In short, they are the necessary intermediary that connects you, a retail trader, to the network of banks and financial institutions that trade currencies. Without a broker, it’s nearly impossible for an individual to participate in the forex market.

How Does a Forex Brokerage Account Work?

A forex account works by allowing you to deposit funds and use the broker’s platform to execute trades. The process is simple:

- Open an Account: You start by opening a forex demo account to practice risk-free or a live account with real money.

- Deposit Funds: You fund your account using one of the broker’s payment methods.

- Execute Trades: You use the provided leverage (borrowed capital) to open positions larger than your deposit (margin). For example, with $500 in margin and 100:1 leverage, you can control a $50,000 position.

- Withdraw Profits: You can withdraw your profits back to your bank account or e-wallet.

Difference Between Regulated and Unregulated Brokers

The difference is safety and accountability.

- Regulated brokers are licensed and monitored by government financial authorities like the FCA (UK) or ASIC (Australia). They are required to keep your funds in segregated bank accounts and adhere to fair practices.

- Unregulated brokers operate with no oversight. They can misuse client funds, offer unfair trading conditions, and may disappear without a trace. Choosing a regulated broker is the most important step in protecting your investment.

What Factors to Consider When Choosing a Forex Broker?

Choosing the best forex broker involves evaluating several key factors that directly impact your trading safety, costs, and experience. Here are 12 factors to consider when choosing a foreign exchange broker:

- Regulation and Security: Check for a top-tier license (FCA, ASIC) to ensure fund safety.

- Trading Costs: Analyze spreads, commissions, and swap fees to protect your profits.

- Leverage and Margin: Understand the broker’s leverage limits and risk controls.

- Execution Speed & Slippage: Ensure fast order execution to avoid getting a poor price (slippage).

- Trading Hours: Confirm the broker’s hours align with your personal trading schedule.

- Trading Platforms: Test the platform’s reliability and tools with a demo account.

- Account Types: Choose an account (e.g., Standard, ECN) that fits your trading style.

- Asset Variety: Look for a wide range of forex pairs and other markets for diversification.

- Payment & Withdrawals: Verify fast, secure, and low-cost funding methods.

- Customer Support: Test for responsive and readily available support (24/5 or 24/7).

- Broker Reputation: Research user reviews and check for a history of complaints or fines.

- Educational Resources: Look for quality webinars and courses as a sign of a good broker.

Below is a breakdown of the most important elements every trader should review before opening an account.

Regulation and Security

The first and most critical factor is regulation. Always check whether the broker is licensed by a top-tier financial authority such as the FCA (UK), ASIC (Australia), or CFTC/NFA (US).

- How to verify: Locate the broker’s license number on their website, usually in the footer.

- Go to the Regulator’s Website: Visit the official website of the regulator (e.g., the FCA’s Financial Services Register).

- Search the Register: Enter the license number to confirm that the broker is officially registered and authorized. For security, look for features like Two-Factor Authentication (2FA) and SSL encryption to protect your account and personal data.

Trading Costs

Trading costs are the primary way brokers make money and they directly reduce your profits. The main costs are:

- Spreads: The difference between the buy and sell price of a currency pair. A 1-pip spread on a standard lot of EUR/USD costs about $10.

- Commissions: A fixed fee charged per trade, common on ECN accounts.

- Swaps: An overnight fee for holding positions open past the market close.

- Other Fees: Watch out for hidden costs like inactivity fees or high withdrawal charges..

Example: If you trade 50 standard lots per month, a broker with a 1-pip spread will cost ~$500/month in spreads alone, while a 2-pip spread doubles that cost.

Leverage and Margin

Leverage lets you control larger positions with less capital, but it magnifies both profits and losses.

- Example: With $1,000 and 100:1 leverage, you can open a $100,000 position. A 1% adverse move could wipe out your account.

- Regulatory limits: ESMA and ASIC cap retail leverage at 30:1, while some offshore brokers offer up to 500:1 — which carries far greater risk.

- Risk controls: Understand margin call and stop-out levels before trading.

Execution Speed and Slippage

Execution speed determines how quickly your orders are filled.

- For scalpers: Even a 100–200ms delay can cause slippage, changing your entry/exit price and reducing profitability.

- For swing traders: Speed is less critical but still important during volatile market events.

- What to check: Ask the broker for average execution times and order fill rates, or test them using a demo account.

Trading Hours

While the forex market operates 24 hours a day, five days a week, a broker’s trading hours can vary depending on their liquidity providers, platform settings, and the instruments they offer.

Why it matters:

- Session Access: Forex liquidity and volatility shift between the Asian, London, and New York sessions. If you trade specific pairs like GBP/JPY or EUR/USD, you’ll want your broker to provide strong pricing during the sessions when those currencies are most active.

- Instrument Availability: Some CFDs — such as commodities, indices, or cryptocurrencies — have fixed trading schedules and may close outside certain hours.

- Server Time Zone: The broker’s platform time zone affects how your daily charts are plotted. For example, a GMT+2 server creates a “New York close” daily candle, which many traders prefer for technical analysis.

- Customer Support: Even if the market is open, support might not be available 24/7. This can be critical if you trade during off-peak hours.

Trading Platforms

Your platform is your trading workspace, so it must be reliable and equipped with the tools you need.

- Popular options: MetaTrader 4 (MT4), MetaTrader 5 (MT5), Volity and cTrader, Volity and cTrader.

- Key features: Advanced charting tools, technical indicators, algorithmic trading support, mobile app access, and an integrated economic calendar.

- Best practice: Test the platform with a demo account before depositing real funds.

Account Types

Brokers offer different account types to suit various traders. A Forex trading account is the gateway to all these options, defining how you access spreads, leverage, and fees.

- Standard Account: A good all-around option for most traders.

- Micro or Cent Account: Allows you to trade with very small position sizes, ideal for beginners.

- ECN Account: Offers ultra-tight spreads with a fixed commission, preferred by scalpers and high-volume traders.

- Islamic Account: A swap-free account that adheres to Sharia law.

- Managed Forex Account: Some brokers also offer managed Forex accounts, where professionals trade on your behalf for a share of profits.

Check each type’s minimum deposit, leverage limits, and trading conditions.

Asset Variety

Diversification can improve risk management. Many brokers offer more than just forex:

- Forex pairs: Major, minor, and exotic forex pairs.

- CFDs: Commodities (gold, oil), stock indices, cryptocurrencies.

- Benefit: More instruments mean more trading opportunities and reduced dependency on one market.

Payment and Withdrawal Options

Funding and withdrawing from your account should be fast, secure, and low-cost.

| Method | Deposit Time | Withdrawal Time |

| Credit/Debit Card | Instant | 1–3 days |

| Skrill/Neteller | Instant | <24 hours |

| Bank Transfer | 1–5 days | 2–7 days |

| Bitcoin | 1–2 hours | 1–2 hours |

Choose brokers with clear withdrawal policies and no hidden processing fees.

Customer Support

Good support can save you money and stress when issues arise.

- Availability: 24/5 or ideally 24/7.

- Channels: Live chat, phone, email.

Broker Reputation

A broker’s reputation reflects its track record with clients and regulators.

- Where to check: Trustpilot and ForexPeaceArmy, and financial forums.

- What to look for: Consistent complaints, unresolved issues, or regulatory fines.

- Bonus step: Search the broker’s name + “scam” or “complaint” to see if serious red flags appear.

Educational Resources

Quality education from a broker is a sign they invest in client success.

- Examples: Webinars, video tutorials, market analysis, forex trading books and detailed trading courses.

- Value: Especially useful for beginners looking to improve skills while trading.

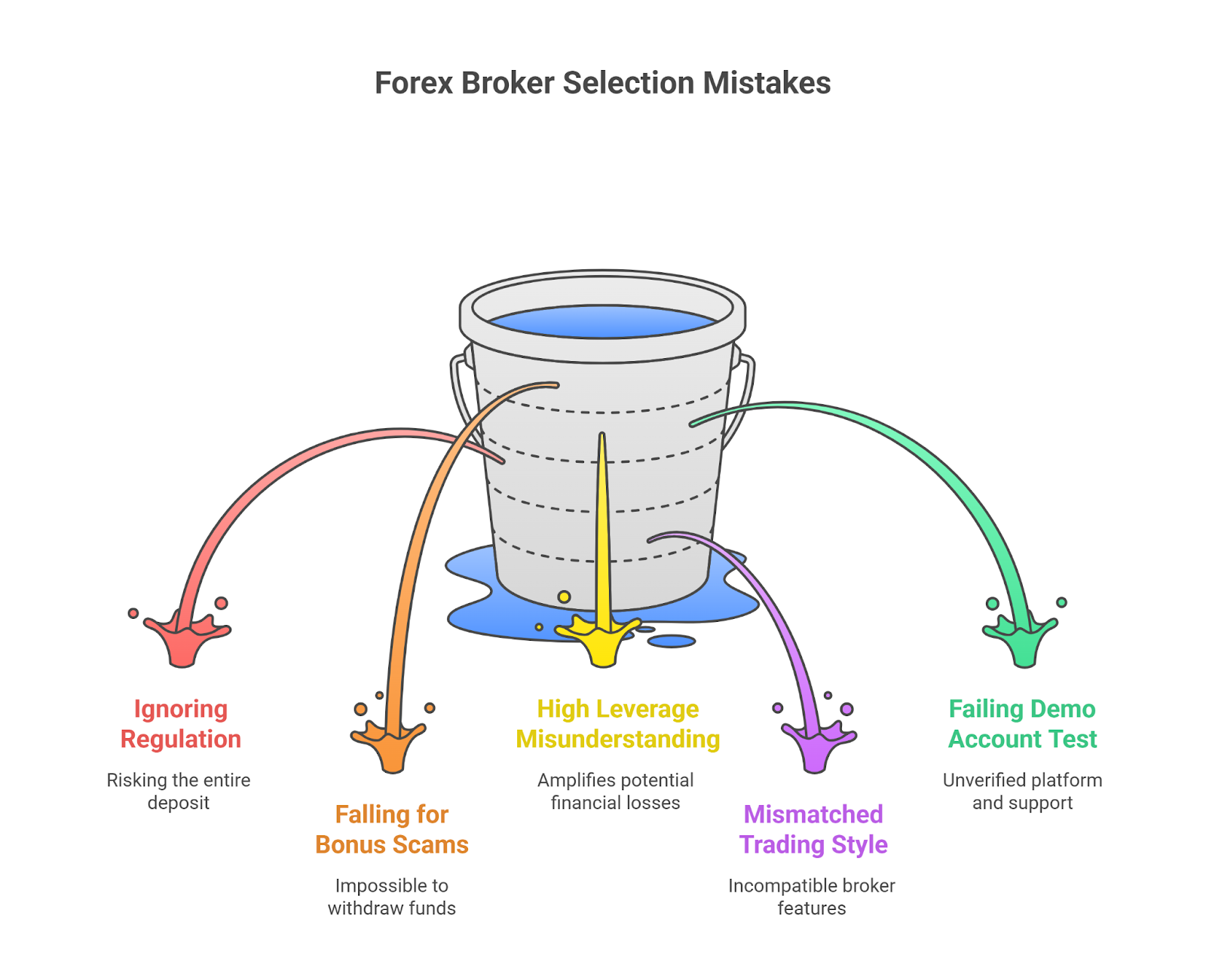

Most Common Mistakes When Choosing a Forex Broker

Even experienced traders can fall into traps when selecting a broker, often because they focus on attractive offers rather than the fundamentals.

Recognizing these mistakes before you commit can save you from unnecessary losses, wasted time, and serious frustration.

- Ignoring Regulation: The single biggest mistake is choosing an unregulated broker and risking your entire deposit.

- Falling for Bonus Scams: Being lured in by a large deposit bonus without reading the terms and conditions, which often make it impossible to withdraw.

- Choosing High Leverage Without Understanding the Risks: New traders often see high leverage as a way to get rich quick, not realizing it also amplifies losses.

- Not Matching the Broker to Your Trading Style: A scalper choosing a Market Maker with wide spreads, or a swing trader choosing a broker with high overnight swap fees. Some traders even bypass traditional brokers by joining Forex prop firms, gaining access to funded accounts but facing strict rules.

- Failing to Test with a Demo Account: Going straight to a live account without first testing the broker’s platform, execution speed, and support.

Tips to Pick the Right Forex Broker

Selecting a forex broker isn’t just about ticking boxes — it’s about matching a broker’s offering to your trading style, risk tolerance, and financial goals. The tips below will help you apply those factors in a practical, decision-making process.

- Verify Regulation First: Before you look at anything else, confirm the broker is licensed by a top-tier regulator.

- Match Costs to Your Style: If you’re a scalper, focus on low spreads and commissions. If you’re a swing trader, check the swap fees.

- Test Drive with a Demo Account: Spend at least a week on a demo account to test the platform and execution.

- Check Withdrawal Policies: Look for brokers with fast withdrawal times and low fees.

- Read Recent User Reviews: Check what other traders have said about the broker in the last 6-12 months.

Bottom Line

Choosing the right forex broker comes down to four key pillars: regulation, trading costs, platform quality, and customer support. By carefully evaluating each of these factors, you can find a reliable partner for your trading journey and avoid the common pitfalls that new traders face. Always prioritize security and transparency over flashy bonuses or unrealistic promises.