Managed Forex accounts let investors profit from currency markets without years of training. Professional money managers trade on your behalf. In 2026, choose accounts by reviewing broker regulation, performance transparency, fees, and technology.

Key Takeaways

- Trade without trading – all decisions are handled by a professional fund manager, making it a fully passive investment option.

- Do your homework – success depends on thorough vetting of regulation, performance history, and fees.

- Safety starts with regulation – only work with brokers licensed by top-tier authorities like ASIC, FCA, or CySEC.

- Know every fee – factor in performance, management, and spread costs before committing funds.

- No sure bets – even top managers face losses; past wins don’t guarantee future results.

- You keep the keys – managers can trade, but withdrawals remain under your sole control via LPOA.

What is a Forex Managed Account?

A Forex managed account is an investment account owned by an individual but traded by a professional money manager. The investor supplies capital and grants trading authority through a formal agreement.

Key features include expert oversight, strategy-driven trades, and passive investor involvement, aiming to profit from currency market fluctuations.

How Managed Forex Accounts Differ from DIY Trading?

The main difference between managed forex accounts and DIY trading is control over trading decisions. In DIY trading, the investor handles analysis, risk management, and trade execution. In a managed account, a professional manages these tasks, creating a passive trading approach that reduces emotional bias and learning challenges.

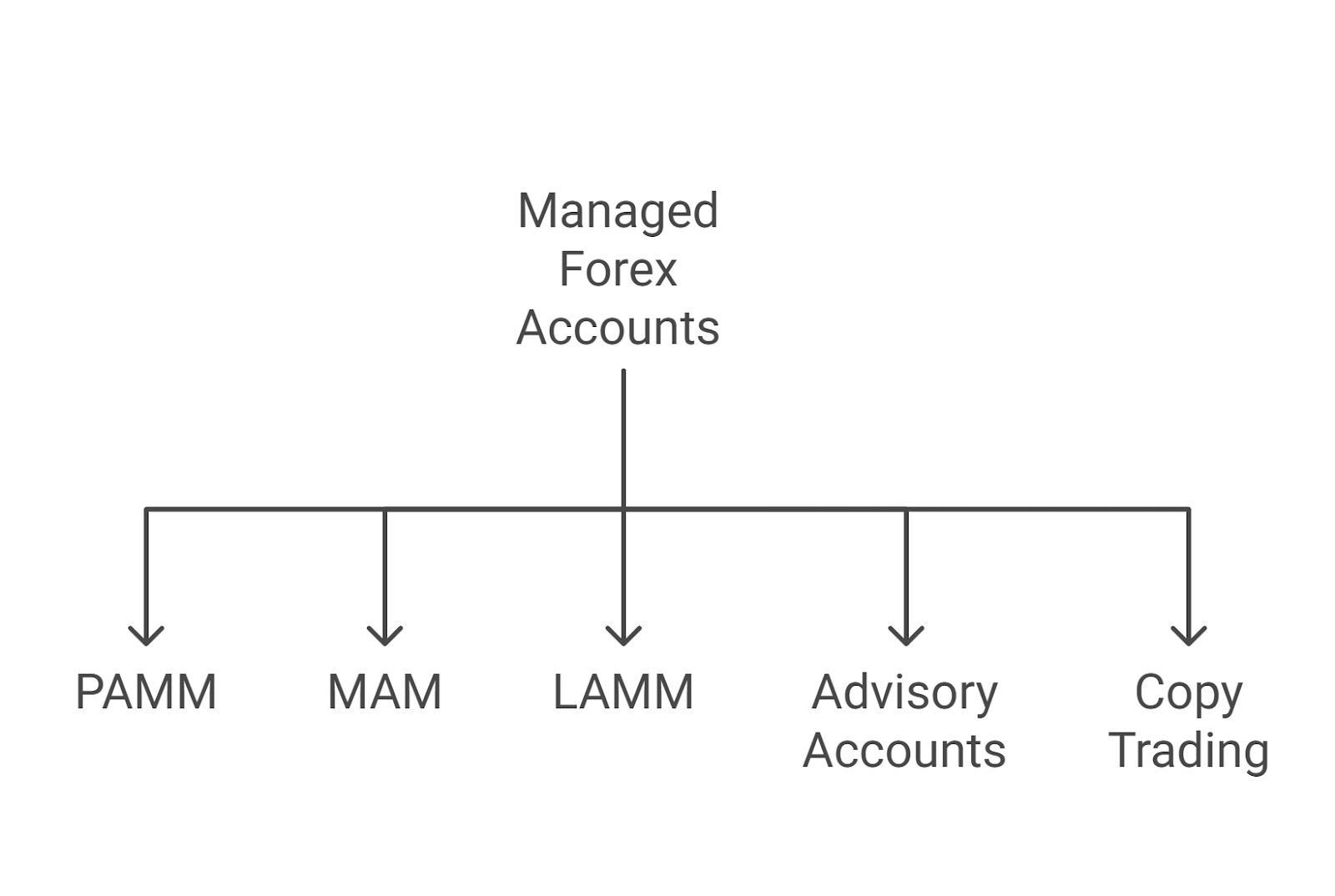

Types of Managed Forex Accounts

Brokers offer several managed account structures to cater to different investor needs and risk appetites.

- PAMM (Percentage Allocation Management Module): In a PAMM account, investor funds are pooled into a single master account. The manager trades this pooled capital, and profits or losses are distributed automatically among investors based on their percentage contribution.

- MAM (Multi-Account Manager): A MAM account also uses a master account but gives the manager more flexibility to allocate trades and adjust leverage for individual sub-accounts, allowing for customized risk management.

- LAMM (Lot Allocation Management Module): In a LAMM account, an investor decides on a fixed lot size to replicate for every trade the manager makes. The profit or loss is determined by the performance of that specific lot size.

- Advisory Accounts: With an advisory account, a manager provides trade recommendations, but the investor retains final approval and must execute the trades themselves.

- Copy Trading: While distinct, copy trading platforms allow investors to automatically replicate the trades of other successful traders. This serves a similar purpose to a managed account by enabling a hands-off approach.

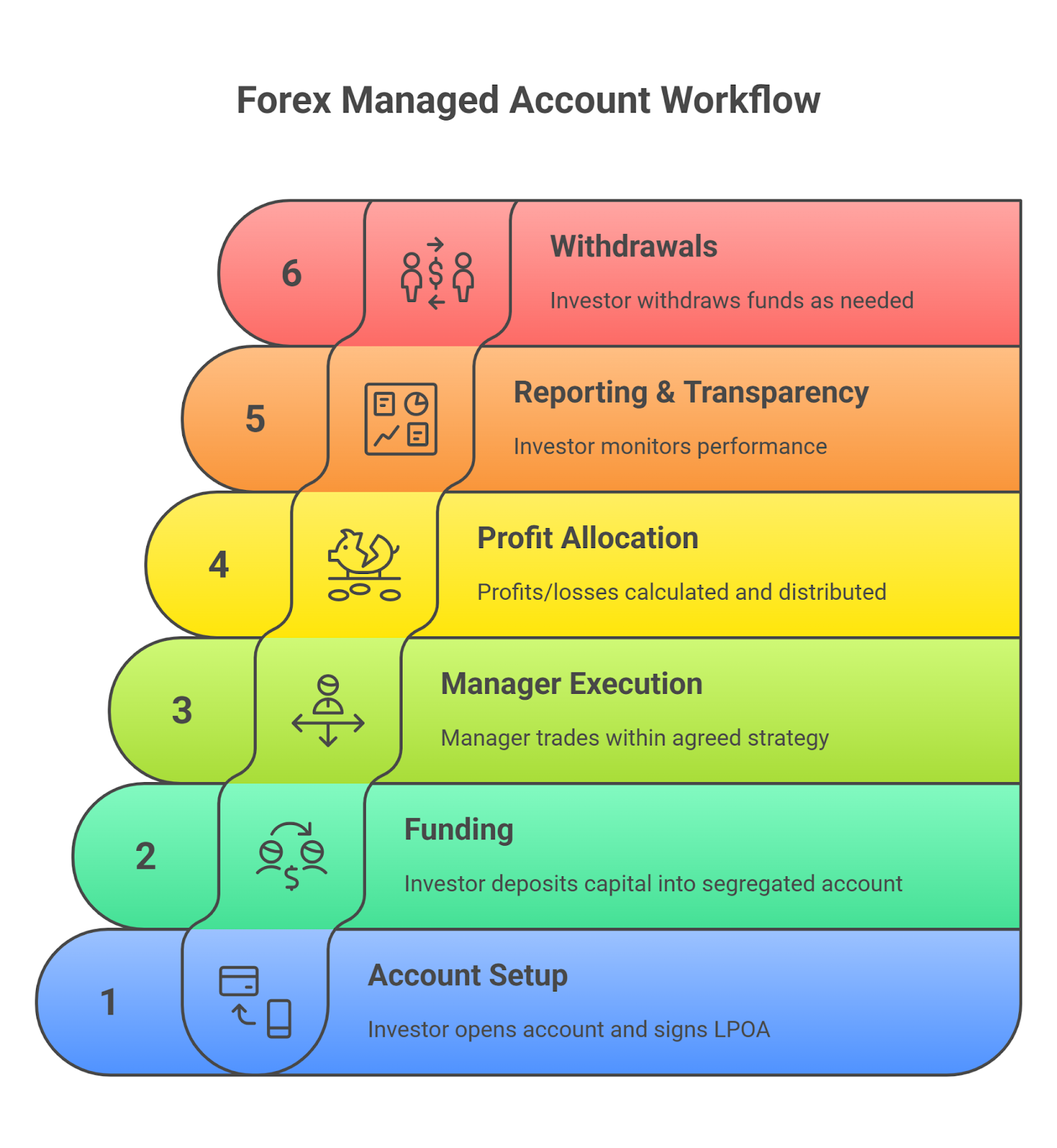

How Do Forex Managed Accounts Work?

Forex managed accounts work through an agreement where the investor grants trading authority to a professional fund manager while keeping full ownership of capital. The manager follows an agreed strategy, executing trades, with profits or losses distributed according to the account structure and contract terms.

Step-by-Step Workflow

- Account Setup: The investor opens an account with a brokerage that offers managed services and signs a Limited Power of Attorney (LPOA). This document grants trading authority to the manager but blocks them from making withdrawals.

- Funding: The investor deposits the investment capital into their personal, segregated account.

- Manager Execution: The fund manager monitors market conditions and places trades via platforms like MT4, MT5, or cTrader. They adhere to agreed risk management rules, such as maximum drawdown and leverage limits.

- Profit Allocation: Gains and losses are calculated in real-time. In structures like PAMM or MAM, performance fees are deducted automatically before profits are distributed to the investor.

- Reporting & Transparency: The investor tracks all trades, account balances, and performance through a broker’s dashboard or a third-party verification tool like Myfxbook.

- Withdrawals: The investor retains the exclusive ability to withdraw profits or capital according to the broker’s terms, without interference from the manager.

Key Roles

- Fund Manager: Designs and executes the trading strategy.

- Broker: Hosts the account, processes trades, and ensures regulatory compliance.

- Investor: Supplies capital, monitors performance, and retains withdrawal rights.

Security & Transparency Features

- LPOA Protection: Prevents unauthorized fund withdrawals by the manager.

- Segregated Accounts: Keeps investor capital separate from the broker’s operational funds.

- Real-Time Monitoring: Ensures the investor can view open positions, past trades, and profit/loss statements at any time.

Benefits of Managed Forex Accounts

Investors choose managed forex accounts for several compelling advantages that align with goals of passive income generation, portfolio diversification, and disciplined risk management.

- Access Professional Expertise: These accounts provide access to the skills of seasoned traders with proven track records. Managers use their in-depth market knowledge and disciplined strategies to execute trades without emotional interference.

- Enable Passive Investment: Managed accounts offer a completely passive structure that requires minimal involvement from the investor.

- Utilize Systematic Risk Management: Professional managers employ sophisticated protocols to protect investor capital. They use tools such as controlled leverage and stop-loss orders to mitigate risks. Forex can also serve as a diversification tool within a broader investment portfolio.

- Maintain Full Transparency: Reputable providers ensure investors can monitor all account activity and performance in real-time. This is achieved through secure online dashboards that provide access to detailed performance reports and complete trade histories.

Risks and Considerations

Managed forex accounts involve significant risks that require careful consideration before investment. These risks span market volatility, manager integrity, associated costs, and regulatory compliance.

- Market Risk: The forex market is subject to unexpected currency fluctuations caused by economic events and political instability. The use of leverage magnifies the financial impact of both winning and losing trades, creating a critical risk factor.

- Manager and Fraud Risk: A primary operational risk is the potential for financial loss due to manager incompetence or deliberate fraud. This can include managers misrepresenting their performance track records or using unregulated brokers. Thorough due diligence is essential to mitigate this risk.

- High Cost Structure: A key consideration is that multiple layers of fees reduce net investment returns. These costs typically include:

- Management Fee: An annual fee based on a percentage of total assets.

- Performance Fee: A percentage of profits generated.

- Brokerage Fees: Spreads and commissions on every trade.

- Regulatory Risk: Investing through an unlicensed manager or broker introduces a significant lack of investor protection. Regulatory bodies like ASIC and the FCA mandate strict rules, such as the segregation of client funds, which are absent when dealing with unregulated entities. For traders who dislike fees and giving up control, some prefer prop firm accounts over managed services, since you trade firm capital directly instead of paying performance fees.

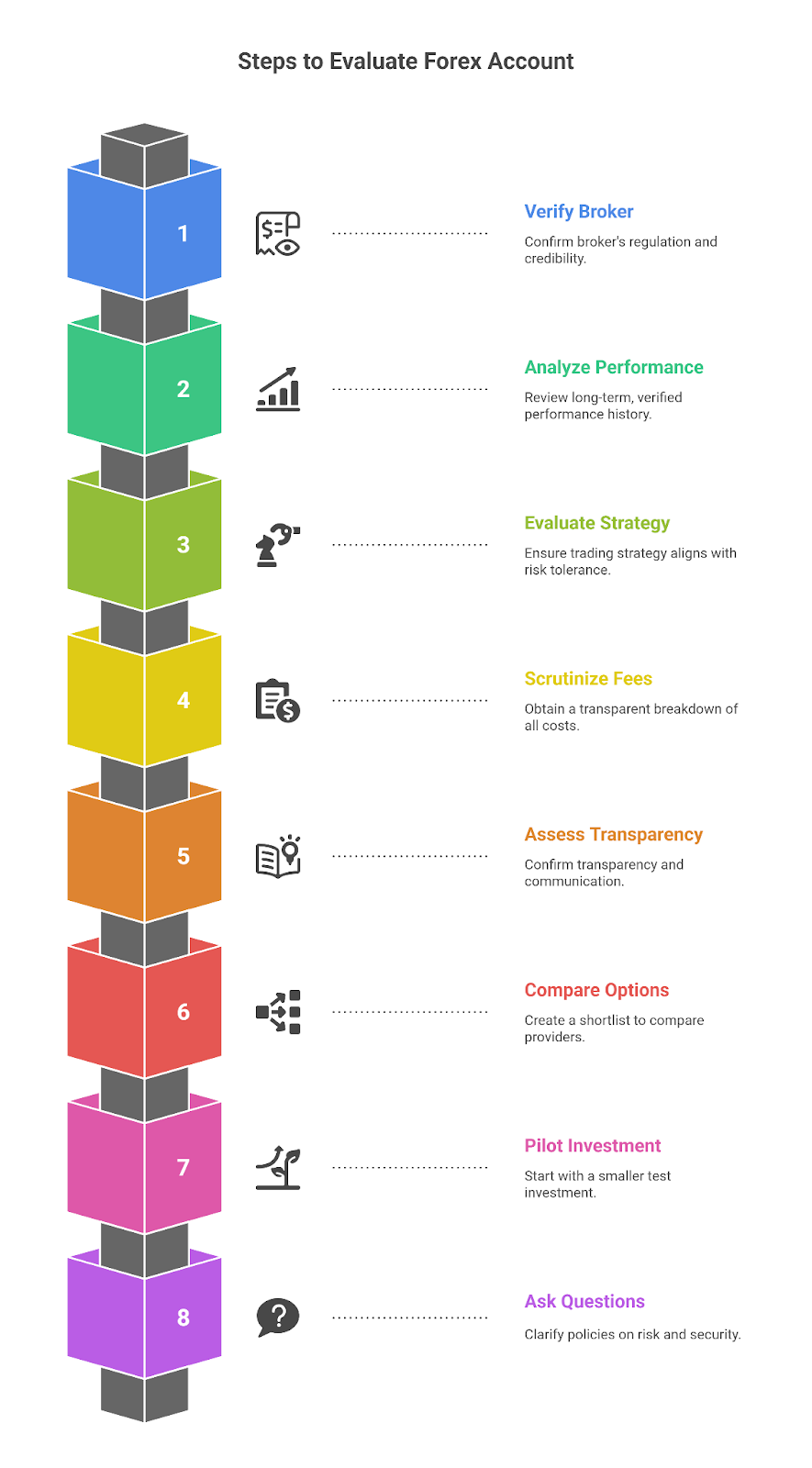

How to Evaluate a Managed Forex Account

Selecting a high-quality managed forex account requires a structured evaluation process. A disciplined approach ensures a partnership with a reputable manager and a secure broker.

- Verify Broker Regulation and Credibility: The initial step is to confirm the broker’s regulatory status with a top-tier financial authority. Determine the appropriate account structure for your needs, such as PAMM or MAM, and ensure the broker has a history of reliability.

- Analyze the Performance Track Record: Review a long-term, verified performance history, preferably from a third-party platform like Myfxbook. Focus on consistency over several years and analyze the maximum drawdown figure to understand the strategy’s historical risk.

- Evaluate the Trading Strategy: Ensure the manager’s trading methodology aligns with your personal risk tolerance. Understand whether their style is conservative or aggressive and review their specific approach to risk management.

- Scrutinize the Fee Structure: Obtain a transparent breakdown of all associated costs. Confirm the performance fee percentage and verify if it is calculated using a “high-water mark,” which ensures fees are only paid on new profits.

- Assess Transparency and Communication: Confirm the provider offers full transparency through real-time account access. A reputable manager provides regular, detailed performance reports and maintains open lines of communication.

- Compare Multiple Options: Create a shortlist of two to three providers to compare them based on critical criteria, including regulation, fees, historical performance, and platform features.

- Commit a Pilot Investment: When possible, start with a smaller test investment. This action allows you to evaluate the manager’s service and performance firsthand with limited financial risk.

- Ask Critical Questions: Before signing any agreement, ask direct questions to clarify policies on risk and security. Inquire about maximum drawdown limits, the protection and segregation of client funds, and the availability of an independently audited track record.

How to Find a Regulated Broker

A regulated broker is licensed and supervised by a government financial authority such as ASIC, FCA, or CySEC.

The process to confirm a broker’s regulatory status includes two mandatory steps:

- Locate the license number and the name of the regulator on the broker’s official website, which is typically found in the footer.

- Verify this information on the regulator’s official public register. Our complete, step-by-step guide on How to Choose the Best Forex Broker provides further detail on this process.

What Fees Should You Consider?

You should consider three types of fees:

- Manager Fees: Performance and/or management fees paid to the fund manager.

- Brokerage Fees: Spreads and commissions on each trade.

- Administrative Fees: Any fees for deposits, withdrawals, or account inactivity.

Choosing the Best Execution Model

The execution model impacts trade speed and cost. An ECN (Electronic Communication Network) model is often preferred because it provides direct access to liquidity providers, resulting in tighter spreads and faster execution with minimal intervention from the broker.

How Much Leverage to Use?

Leverage should be used with extreme caution. For managed accounts, a conservative leverage ratio (e.g., 10:1 to 30:1) is generally safer. The manager should have a clear policy on maximum leverage to control risk.

What are the Best Trading Platforms for Managed Accounts?

The industry-standard platforms for managed accounts are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They fully support PAMM and MAM technology, offer advanced charting tools, and are known for their stability and security.

What to Avoid When Choosing a Managed Account

Avoid any provider that promises unrealistic or guaranteed returns, lacks regulatory oversight, is not transparent about fees, or uses high-pressure sales tactics to rush your decision.

How to Avoid Forex and CFD Scams?

To avoid scams, exclusively deal with brokers regulated in top-tier jurisdictions. Be skeptical of unsolicited offers on social media, never share your account passwords, and independently verify all claims made by a manager or broker.

Alternatives to Managed Forex Accounts

If a traditional managed account is not the right fit, several other options provide exposure to the forex market with varying levels of control and cost.

| Alternative | Core Function | Level of Investor Control | Best Suited For |

| Copy Trading Platforms | Automatically mirrors the trades of selected professional traders into your personal account. | High (Investor chooses traders and can stop copying at any time). | Investors seeking expert strategies with full account control and flexibility. |

| Trading Signals | Provides specific buy/sell trade recommendations via notifications. | Very High (Investor must manually execute every suggested trade). | Traders who want expert guidance but retain final execution control. |

| PAMM and MAM Accounts | A manager trades a pool of investor funds through a single master account with automated profit distribution. | Low (Similar to a traditional managed account). | Investors want a managed solution, often with lower minimum investments. |

| DIY Forex Trading | The investor researches, analyzes, and executes all trades independently. | Absolute (Investor makes all decisions). | Individuals dedicated to learning trading who want to avoid management fees. |

| Robo-Advisors & AI | An algorithm automatically manages the portfolio and executes trades based on predefined rules. | Low (The system operates autonomously after setup). | Investors seeking a data-driven, automated approach without human emotion. |

| Forex Funds | A professionally managed investment fund, similar to a mutual fund, that specializes in currency trading. | Very Low (Investor owns shares in the fund, not a personal trading account). | High-net-worth individuals seeking portfolio diversification. |

How to Choose the Right Alternative?

The best choice depends on your goals:

- For flexibility and control: Choose Copy Trading or Trading Signals.

- For a lower-cost managed solution: Choose a broker’s PAMM/MAM program.

- For a completely automated, hands-off approach: Consider a Robo-Advisor.

Bottom Line

Choosing one of the best managed forex accounts in 2026 can be a powerful strategy for diversifying a portfolio and generating passive income. The key lies in balancing the convenience of professional management with a clear understanding of the risks and costs involved. Regulation, transparency, and verified performance are the cornerstones of a secure investment.