Navigating the cryptocurrency market often feels overwhelming for new investors. The best crypto exchanges for beginners simplify this complexity, offering intuitive platforms, robust security, and transparent fee structures. These platforms enable first-time users to acquire, hold, and trade digital assets with confidence.

The burgeoning digital asset economy creates significant opportunities for financial growth and diversification. However, selecting the right entry point remains critical for long-term success. This guide evaluates leading beginner-friendly exchanges to help you make an informed decision today.

While understanding Crypto Exchanges is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What Makes a Crypto Exchange Truly Beginner-Friendly?

A beginner-friendly crypto exchange prioritizes accessibility, safety, and straightforward functionality. These platforms remove technical barriers, allowing new users to focus on investment goals rather than complex trading interfaces. They offer simplified buying processes, clear dashboards, and extensive educational resources.

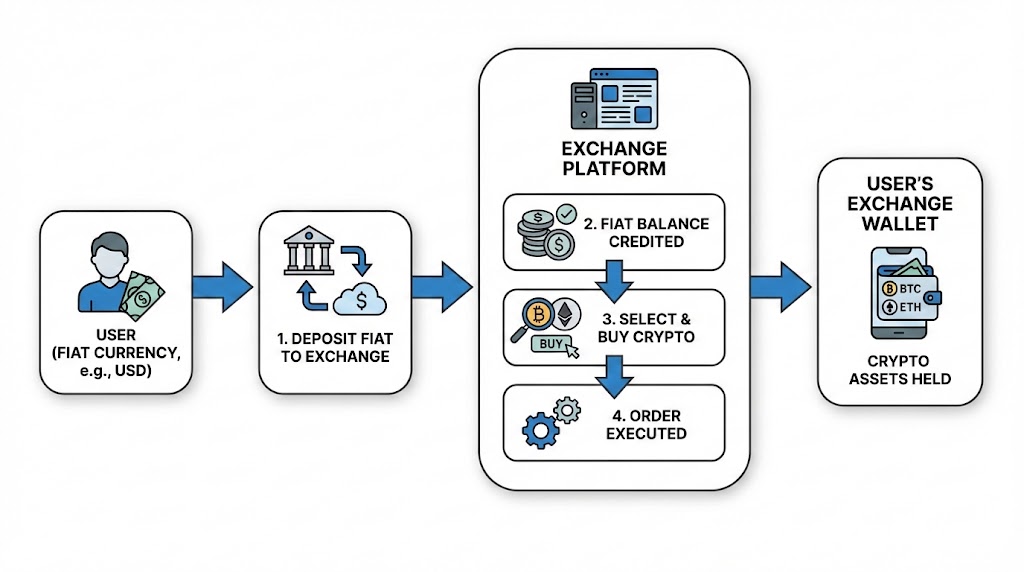

For instance, a platform becomes beginner-friendly by offering direct fiat-to-crypto purchases. It also provides guidance on secure asset storage. This approach reduces friction for individuals taking their initial steps into the crypto market.

CEX vs. Brokers: Knowing the Difference Protects Your Money

Understanding the distinction between a Centralized Exchange (CEX) and a brokerage is fundamental for new crypto investors. Centralized exchanges provide direct access to a market where users trade cryptocurrencies with each other. They hold user funds and facilitate order matching through their internal systems.

Conversely, a cryptocurrency broker acts as an intermediary. Brokers buy and sell crypto on behalf of their clients, often using their own inventory. This typically means simpler user interfaces but potentially higher spread fees. Robinhood operates as a brokerage, offering limited direct control over assets. In contrast, Coinbase functions primarily as a CEX, providing more direct market access.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesEssential Attributes: How Safe Crypto Platforms Protect Your Investments

Selecting a secure and reliable crypto exchange is paramount for new investors. Key attributes include stringent security measures, clear regulatory compliance, and a user-friendly interface. These elements collectively minimize risk and enhance the overall trading experience. A robust platform safeguards user assets against potential threats.

It also ensures operations adhere to established legal and financial standards. Focus on platforms with a proven track record of security and transparency.

Beyond Passwords: The Security Measures That Safeguard Your Crypto

Crypto security refers to the protocols like Cold Storage and 2FA used to protect user funds and data from unauthorized access. Reputable exchanges implement a multi-layered security strategy. This includes storing a significant portion of assets in offline cold storage wallets. This method shields funds from online hacking attempts.

Two-factor authentication (2FA) adds another critical layer of defense. It requires users to verify their identity through a second device or method. Regulatory bodies such as the SEC provide investor alerts regarding the risks of unregulated platforms, emphasizing the importance of choosing compliant services. Top exchanges also employ advanced encryption for data transmission. This protects personal and financial information.

Understanding Crypto Fees: Why Every Cent Matters

Crypto exchanges employ various fee structures. Understanding these helps beginners minimize costs and maximize investment returns. Two primary models exist: maker/taker fees and spread fees. Maker/taker fees are common on advanced exchanges. They reward users who add liquidity (makers) and charge those who remove it (takers). These fees often start as low as 0.1% for high-volume traders.

Spread fees are typically found on simpler brokerage platforms. These represent the difference between the bid and ask price of an asset. For example, Coinbase charges spread fees of approximately 0.5% for most transactions. Robinhood also uses a spread-based model, which might seem “commission-free” but includes the cost in the asset price. New investors should carefully compare these structures.

User Experience Matters: Navigating Crypto with Confidence

A well-designed user interface (UI) significantly impacts a beginner’s ability to navigate the crypto market effectively. Intuitive UIs feature clear navigation, simplified purchasing flows, and easy-to-understand dashboards. These elements reduce the learning curve associated with digital asset trading. Exchanges also provide extensive educational resources to help users understand blockchain technology, trading strategies, and market dynamics.

These resources include tutorials, articles, and webinars. They equip new investors with the knowledge needed to make informed decisions. A platform with strong customer support, accessible via live chat, email, or phone, further enhances the beginner experience. It provides timely assistance for any queries or issues.

Your First Picks: Top-Rated Crypto Exchanges for New Investors

Several leading crypto exchanges cater specifically to beginners. They balance ease of use with robust features and security. These platforms offer simplified onboarding processes. They also provide comprehensive educational tools. This section details some of the most recommended options for first-time investors entering the digital asset space.

Each exchange provides distinct advantages. These range from unparalleled user experience to extensive asset variety.

Coinbase: The Gold Standard for Crypto Newcomers

Coinbase consistently ranks as one of the easiest platforms for beginners to enter the crypto market. It provides a highly intuitive user interface. New users can easily purchase Bitcoin (BTC), Ethereum (ETH), and hundreds of other cryptocurrencies. The platform offers a simplified “Buy/Sell” option. This streamlines transactions for those unfamiliar with complex order books.

Coinbase also includes Coinbase Learn, which offers educational content and rewards users with small amounts of crypto for completing lessons. This encourages learning while investing. Spread fees on Coinbase generally hover around 0.5% for most transactions, making costs transparent. The platform also implements robust security measures. This includes storing 98% of customer funds in cold storage.

Kraken: Powerful Security, Pro-Level Tools for Beginners

Kraken strikes a balance between beginner-friendliness and advanced trading features. While its primary interface is straightforward, users gain free access to Kraken Pro. This professional trading platform offers lower fees starting at 0.16% for makers and 0.26% for takers, along with more sophisticated tools. Kraken is particularly known for its exceptional security protocols. It maintains a strong track record against hacks.

The exchange supports a wide range of cryptocurrencies. It also offers staking services, allowing users to earn rewards on their holdings. Kraken operates globally and adheres to strict regulatory compliance, including KYC (Know Your Customer) verification. It provides a secure environment for new investors to grow their portfolios.

Binance: Explore a Universe of Crypto with Extensive Support

Binance is the world’s largest cryptocurrency exchange by trading volume. It offers an unparalleled selection of digital assets and advanced trading features. While seemingly complex, Binance provides a “Lite” mode designed specifically for beginners. This simplifies the interface for basic buying and selling. Binance features extremely competitive fees, often starting as low as 0.1% for spot trading.

The platform also offers extensive educational resources through Binance Academy. This includes articles, guides, and courses covering various crypto topics. Binance implements rigorous security measures, including cold storage, 2FA, and an insurance fund for user assets. This combination of vast selection, low fees, and educational support makes it a strong contender for beginners.

Uphold and Robinhood: Diversified Options for Crypto and Beyond

Uphold and Robinhood serve as diversified platforms that appeal to beginners seeking integrated financial services. Uphold specializes in enabling seamless trading between various asset classes. This includes cryptocurrencies, fiat currencies, and precious metals. It offers staking opportunities on select cryptocurrencies, allowing users to earn passive income.

Robinhood operates as a brokerage platform, simplifying cryptocurrency investing alongside traditional stocks and ETFs. It provides a highly intuitive mobile-first experience. However, Robinhood offers limited functionality compared to dedicated crypto exchanges. Users typically cannot transfer crypto off the platform, nor can they directly stake assets. FINRA.org offers resources on understanding regulated brokerage practices.

Starting Small: Minimum Deposits and Overcoming Entry Barriers

New investors often wonder about the initial capital required to start trading cryptocurrency. Many exchanges feature accessible minimum deposit requirements. These facilitate entry into the market without significant financial commitment. The typical range for minimum deposits is between $10 and $50.

This low barrier enables individuals to test the waters of crypto investing. It also helps them gain experience before committing larger sums.

Can You Really Start Crypto Investing With Just $100?

Yes, you can absolutely start crypto investing with just $100. Many prominent exchanges enable deposits as low as $10 or $50. Coinbase allows purchases with as little as $2. Kraken accepts minimum deposits of $10 for fiat currencies. This accessibility means a $100 initial investment provides sufficient capital to acquire fractional shares of major cryptocurrencies.

This also allows for experimentation with different assets. Beginners should focus on dollar-cost averaging. This involves investing a fixed amount regularly. It mitigates volatility risks associated with market timing.

| Exchange | Minimum Deposit (Approx.) |

| Coinbase | $2 |

| Kraken | $10 |

| Binance | $10 |

| Uphold | $10 |

| Robinhood | $1 |

Navigating Volatility: Smart Risk Management for New Traders

The cryptocurrency market is known for its extreme volatility. Implementing sound risk management strategies is crucial for beginners. This protects capital and fosters sustainable growth. Smart risk management involves diversifying portfolios, setting clear investment limits, and understanding potential losses.

New traders must prioritize capital preservation above rapid gains. This approach builds resilience against market fluctuations. It also helps avoid common pitfalls.

The $1000/Day Dream: Realistic Crypto Trading for Beginners

While it is theoretically possible for high-volume, experienced traders to make $1000 a day in crypto, this outcome is highly unlikely and extremely risky for beginners. Such daily profits often require substantial capital, advanced trading strategies, and significant risk tolerance. The crypto market exhibits rapid price swings, meaning potential gains accompany equally rapid losses.

For new investors, focusing on long-term growth through diversified holdings and consistent investing practices yields more realistic and safer returns. Avoid strategies promising guaranteed high daily profits. They often lead to substantial financial losses.

Essential Crypto Terms for New Traders

Understanding key cryptocurrency terms provides a solid foundation for new investors. This glossary covers fundamental concepts. It empowers beginners to navigate discussions and make informed decisions. Familiarity with these terms reduces confusion. It also helps in understanding market analysis.

This section defines critical vocabulary. It ensures a clear understanding of the crypto landscape.

- Altcoin: Any cryptocurrency other than Bitcoin. Major altcoins include Ethereum, Solana, and Cardano.

- Blockchain: A distributed, immutable ledger technology that underpins cryptocurrencies.

- Cold Storage: Offline storage of cryptocurrency to protect it from online threats. This includes hardware wallets and paper wallets.

- Decentralized Finance (DeFi): Financial applications built on blockchain technology without intermediaries.

- Fiat Currency: Government-issued currency, such as USD or EUR, not backed by a commodity.

- HODL: A common misspelling of “hold,” meaning to keep cryptocurrency rather than selling it.

- KYC (Know Your Customer): Regulatory process for verifying the identity of clients to prevent fraud.

- Liquidity Pool: A collection of funds locked in a smart contract. It facilitates decentralized trading.

- Market Capitalization (Market Cap): Total value of a cryptocurrency’s circulating supply.

- Mining: The process of validating transactions on a blockchain and adding them to the distributed ledger.

- Stablecoin: A cryptocurrency designed to maintain a stable value against a reference asset. Examples include USDT and USDC, pegged to the US Dollar.

- Volatility: The degree of variation of a trading price series over time. Crypto markets show high volatility.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Selecting the best crypto exchange in 2026 is about finding a balance between robust security and effortless usability. For those prioritizing education and simplicity, Coinbase remains the premier entry point. Kraken stands out for its legendary security track record and professional-grade tools, while Binance offers a vast ecosystem for those seeking the lowest fees and maximum asset variety. Regardless of your choice, the key to success lies in starting small, using regulated platforms, and treating your digital portfolio with the same care as traditional investments.

Key Takeaways

- Security First: Prioritize exchanges that offer 1:1 asset backing and store the majority of funds in offline cold storage.

- Fee Transparency: Look for clear maker/taker or spread fee schedules to avoid losing capital to hidden transaction costs.

- Regulatory Alignment: Choose platforms that comply with local financial authorities to ensure your consumer protections remain intact.

- Educational Support: Beginner-friendly platforms often reward you with crypto for learning about blockchain fundamentals.