We don’t rely on luck to trade cryptocurrency; instead, we actively speculate on digital asset price movements via secure exchanges. By analyzing market data, we identify opportunities arising from high volatility.

However, we must manage risks carefully using the 1% rule to protect our capital from rapid swings. It’s vital we maintain emotional control to avoid costly errors, and our complete breakdown below reveals the essential strategies needed to navigate this financial landscape efficiently.

While understanding How to Trade Cryptocurrency is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is cryptocurrency trading?

We define cryptocurrency trading as the active process of speculating on digital asset price movements via an exchange, with the primary goal of securing a financial return.

You might wonder why trade crypto, and the answer often lies in the market’s high volatility, which creates opportunities for rapid gains that traditional stocks rarely offer. As of late 2026, with Bitcoin hovering around $88,000, the market continues to provide significant entry points for those who understand cycle patterns.

However, we must realistically assess if crypto trading is really profitable for your specific situation, as the potential for high rewards always comes with significant risk.

Why Trade Crypto?

While the inherent risks of digital finance are undeniable, the explosive growth of the cryptocurrency market continues to attract investors seeking alternatives to traditional stocks. Unlike equity exchanges with closing bells, digital assets trade twenty-four hours a day, so we aren’t restricted by standard operating times.

We embrace this accessibility, but we also must recognize that high volatility drives rapid price movements. Many traders view these sharp, unpredictable fluctuations as distinct chances to capture value where traditional markets generally remain stagnant. Ultimately, the appeal involves a unique combination of financial autonomy, constant market availability, and the technology’s transformative potential.

Is Crypto Trading Really Profitable?

Although stories of overnight millionaires frequent the headlines, the reality dictates that consistent profitability requires significant skill rather than just luck. We must understand that digital asset markets are incredibly volatile. While we can certainly earn money, we can also lose our entire investment quickly if we aren’t careful.

Profitable trading isn’t about gambling; it involves mastering technical analysis and strict risk management. We need to treat this like a business, not a hobby. Most beginners fail because they chase hype. By studying market trends and adhering to a solid strategy, we position ourselves to capture potential gains responsibly.

How Does Cryptocurrency Trading Work?

Fundamentals dictate that trading cryptocurrency works by exchanging one currency for another, typically swapping fiat money like the US Dollar for digital assets or trading one crypto coin for another. Unlike traditional stock markets, these markets don’t close, so we can trade twenty-four hours a day.

We’ll usually speculate on price movements. If we believe a coin’s value will rise, we buy long; if we think it’ll fall, we sell short. Since prices rely heavily on supply and market demand, volatility remains high. Effectively, we’re trying to predict rapid shifts to secure profit before the market turns against us.

Which Cryptocurrency Exchange Should You Choose?

How we select a trading platform often determines the safety of our initial investment. We shouldn’t rush this decision, as the right exchange safeguards our funds and simplifies our transactions. In December 2026, top-rated exchanges include Coinbase for its beginner-friendly interface, Kraken for its industry-leading low fees, and Gemini for its rigorous security audits.

We must scrutinize fee structures, guaranteeing they don’t eat into our profits. Security is paramount, so we look for strong authentication and cold storage history. Liquidity matters too; high volume ensures we can buy or sell without delays. Finally, we consider geographical restrictions to avoid legal issues.

What Digital Assets Should You Trade? (Bitcoin vs. Altcoins)

Before we select which digital assets to buy, we must address whether a separate cryptocurrency wallet is necessary for our trading strategy. While maintaining funds on an exchange allows for quick transactions, we generally recommend transferring significant holdings to a private wallet for enhanced security.

This approach guarantees we maintain control over our private keys, protecting our investments from the potential risks of centralized platform failures.

Do You Need a Wallet to Trade?

Why leave your funds vulnerable on an exchange when a dedicated wallet offers markedly better security? Although we don’t technically require a personal wallet to execute buy orders, keeping digital assets on an exchange exposes us to custodial risks like hacks or insolvency.

- Hot Wallets: Software-based apps perfect for frequent, smaller transactions.

- Cold Wallets: Hardware devices kept offline for maximum protection.

We strongly advise withdrawing substantial long-term holdings to one of these secure options. ‘Not your keys, not your coins’ remains the golden rule in crypto. We maintain total control over our investments by managing our own private keys.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhat Are the Best Crypto Trading Strategies for Beginners?

We’ll first identify which trading strategy fits your specific style and risk tolerance, as this choice dictates your daily routine. Next, we examine technical analysis to help you confidently read crypto charts and interpret critical market data. Finally, we review how to analyze a crypto project’s fundamentals to guarantee you select assets with real utility and long-term potential.

Which Strategy Fits Your Style?

Although the prospect of quick gains tempts many newcomers to buy coins impulsively, consistent profitability relies on adopting a trading strategy that strictly aligns with your personality, schedule, and risk tolerance.

We suggest evaluating your availability first. If you work full-time, intense day trading proves overwhelming, so swing trading serves you better. Conversely, if we enjoy fast-paced environments and monitor screens constantly, scalping works. Your psychological resilience is critical; we shouldn’t hold volatile assets overnight if it causes anxiety.

How Do You Read Crypto Charts?

How precisely do we determine the ideal moment to execute a trade once we’ve defined our strategy? We rely on technical analysis, interpreting charts to predict future price movements.

We primarily focus on three specific elements:

- Candlestick Charts: These display the opening, closing, high, and low price points.

- Support/Resistance: We identify levels where prices typically stall or reverse.

- Indicators: Tools like Simple Moving Averages help us spot trends amidst market noise.

How Do You Analyze a Crypto Project?

Technical patterns might track price movements, but they can’t reveal if a digital asset holds actual long-term value.

We call this essential process fundamental analysis. You must research the development team’s history to verify their complete credibility. We always review the project’s whitepaper, which explains the technology and its intended utility. Additionally, we check the tokenomics to carefully understand the max supply structure.

If a coin doesn’t solve a real problem or relies solely on marketing hype, we view it as a dangerous gamble.

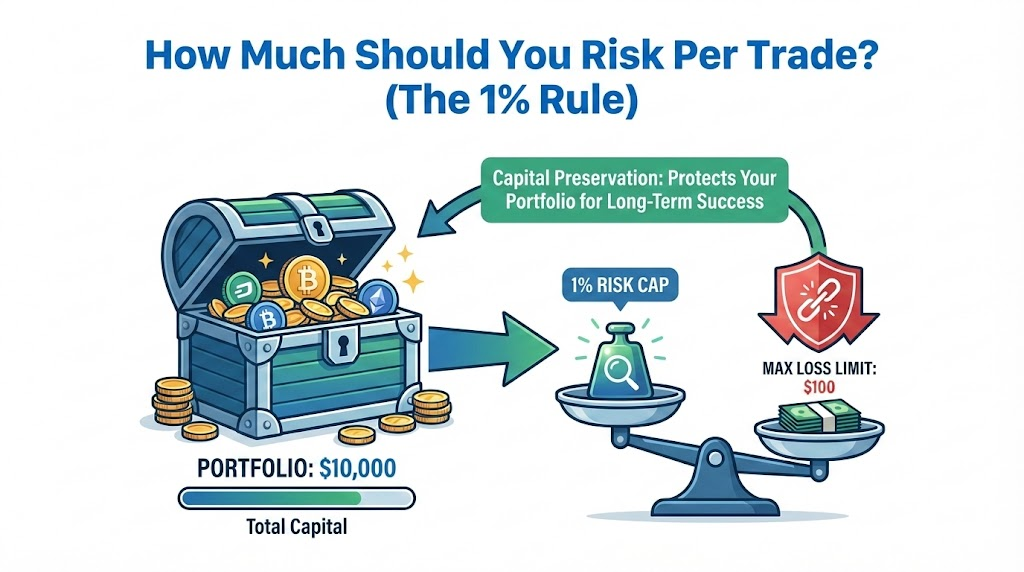

Why is Risk Management the Most Important Skill in Crypto Trading?

We must prioritize risk management because it stands as your primary defense against the inevitable dangers of a volatile market. We’ll explain why sticking to the 1% rule protects your capital from rapid depletion during a losing streak.

What Risks You Can Face in a Volatile Market?

Why do countless beginners watch their portfolios vanish during their first few weeks of trading? We often underestimate how quickly market conditions shift against us.

You simply can’t ignore the four primary threats in this volatile digital landscape:

- Extreme Volatility: Asset prices swing violently, triggering unexpected stop-losses.

- Liquidity Risk: Low trading volume traps us in losing positions.

- Regulatory Uncertainty: Sudden legal changes can crash general market sentiment.

- Operational Failure: Exchange hacks and glitches jeopardize all your funds.

How Much Should You Risk Per Trade? (The 1% Rule)

One fundamental principle often determines whether our portfolio survives a rough patch. We refer to this as the 1% rule. Simply put, we shouldn’t risk more than 1% of our total account balance on any single trade. If our account holds $10,000, we limit our potential loss to just $100. The calculation follows:

$$Risk = \text{Total Balance} \times 0.01$$

Why Is Diversification Necessary?

While minimizing loss on individual trades preserves capital, placing all our funds into a single digital asset creates a dangerous vulnerability. We must protect our entire portfolio by systematically spreading exposure across unrelated projects, ensuring one sudden failure doesn’t wipe us out.

To achieve true diversification, we must prioritize these key strategies:

- Balancing established market leaders with smaller speculative assets.

- Choosing unique projects across sectors like decentralized finance.

- Holding stablecoins to maintain critical liquidity.

- Avoiding assets that strictly follow Bitcoin’s exact price movements.

How Do You Place a Trade on an Exchange?

Once we’ve funded an account, we successfully navigate to the exchange’s trading interface to initiate a transaction. You shouldn’t simply execute a trade immediately, because selecting the correct order type is essential for controlling the entry price and avoiding slippage.

What is the Difference Between Market, Limit, and Stop Orders?

How you instruct the exchange to buy or sell digital assets is just as critical as selecting the right coin to trade.

- Market Orders: We execute trades immediately at current rates, prioritizing speed.

- Limit Orders: We set a fixed price to buy or sell, ensuring we won’t overpay.

- Stop Orders: These automatically trigger a market sell if prices drop, preventing losses.

How to Execute Your First Trade?

Three specific decisions define the success of your initial entry: the asset pair you select, the order type you choose, and the precise amount of capital you deploy. We suggest maneuvering to the exchange’s terminal and searching for your target pair. Enter the quantity you wish to purchase, strictly adhering to your budget.

It’s essential you review the order preview for accuracy before finalizing. After confirming, click ‘Buy’ to submit your request directly to the order book. The system then matches your bid, effectively adding the new digital asset to your secure wallet immediately.

Why Do Most Beginners Fail in Crypto Trading?

We observe that most beginners don’t fail due to poor technical analysis, but rather because they can’t handle the intense psychological pressure of the market. As of December 2026, the Fear & Greed Index is at a low of 16, indicating “Extreme Fear” which often leads beginners to panic sell at the worst possible time.

What Are the Common Psychological Pitfalls?

Every solid trading strategy eventually faces the test of market volatility, and sadly, many beginners fail this exam because they ignore the mental side of investing.

Be fully aware of these four specific mental traps:

- FOMO forces us to buy assets at irrational highs.

- Panic Selling causes exiting positions prematurely during corrections.

- Confirmation Bias blinds us to critical negative signals.

- Greed prevents taking profits before a market trend reverses.

How Can You Control Emotions When Trading?

Recognizing these mental traps is only the first step, so now you must implement concrete strategies to keep your feelings in check. We advise creating a rigid trading plan first. You shouldn’t trade without defining exact entry and exit targets, ensuring data rules over impulse.

Additionally, we strongly recommend automated stop-loss orders. These tools execute sales automatically if prices drop, effectively preventing emotional holding during downturns. Finally, simply stepping away from charts helps greatly.

Ready for More? Advanced Concepts to Explore

Once you’ve mastered the foundational steps, the cryptocurrency market offers considerably more complex avenues for potential profit.

- Margin Trading: Borrowing funds to leverage positions.

- Derivatives: Speculating using contracts like futures.

- DeFi Staking: Locking up coins to earn passive yield.

- Arbitrage: Exploiting price differences across exchanges.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

In the 2026 digital economy, successful cryptocurrency trading is defined by a mastery of risk rather than an appetite for speculation. By utilizing secure exchanges like Coinbase or Kraken and adhering to strict capital preservation rules like the 1% principle, you transform crypto from a volatile gamble into a disciplined financial business. The true secret to longevity in this market isn’t finding the next moonshot, but in developing the psychological resilience to stick to your plan when the Fear & Greed Index screams “Extreme Fear.”

Key Takeaways

- Choose Wisely: Select a secure exchange like Coinbase, Kraken, or Gemini that offers high liquidity and robust security features for your specific region.

- Secure Your Assets: Always withdraw significant long-term holdings to a private cold wallet to protect against exchange-specific risks and maintain control of your private keys.

- Strategy First: Adopt a trading style—HODLing, Swing Trading, or DCA—that aligns with your schedule and emotional risk tolerance to avoid impulsive errors.

- The 1% Rule: Never risk more than 1% of your total account balance on a single trade to ensure your portfolio survives the market’s inherent volatility.

- Manage Emotions: Use stop-loss orders and a trading journal to counteract psychological traps like FOMO and panic selling during “Extreme Fear” cycles.