Ever wondered how you can use your Bitcoin to earn yield on an Ethereum-based DeFi platform? Or why some NFTs on OpenSea are listed in “WETH” instead of regular ETH? If you’ve dabbled in decentralized finance (DeFi), you’ve likely encountered the concept of “wrapped tokens,” and perhaps felt a little confused. You’re not alone! Blockchains, by design, don’t naturally communicate, creating a major barrier to moving assets freely.

While understanding Wrapped Tokens is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What Is a Wrapped Token?

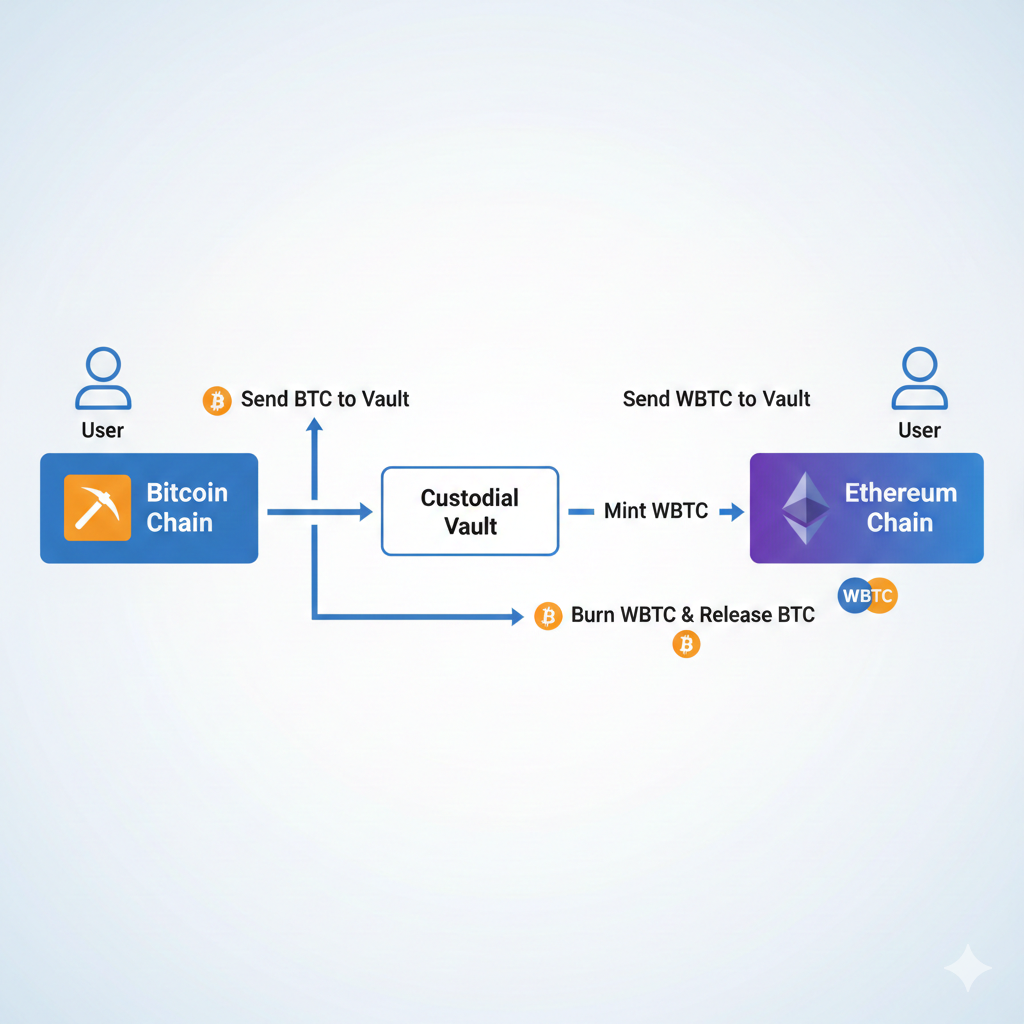

A wrapped token is a cryptocurrency that is “wrapped” to represent another cryptocurrency from a different blockchain. Think of it like taking a Bitcoin, locking it up in a secure digital vault on its native blockchain, and then minting an equivalent token (like Wrapped Bitcoin, or WBTC) on another blockchain, such as Ethereum. This new token is pegged 1:1 to the value of the original asset, meaning if you hold 1 WBTC, it’s worth the same as 1 BTC. The primary purpose is to enable assets that originate on one blockchain to be used on another. Since different blockchains often use different technical standards, wrapping essentially “translates” an asset into a format compatible with a foreign network.

How Wrapping Works: The Mint and Burn Process

The process of creating a wrapped token typically involves a “merchant” and a “custodian” (though decentralized methods exist). Here’s a simplified breakdown of the minting and burning process:

- Locking the Original Asset: A user or merchant sends the original cryptocurrency (e.g., Bitcoin) to a custodian. This custodian could be a centralized entity like BitGo or a decentralized smart contract. The original asset is then “locked” in a secure digital vault on its native blockchain, taking it out of circulation.

- Minting the Wrapped Token: Once the original asset is locked, an equivalent amount of the wrapped token (e.g., WBTC) is minted on the target blockchain (e.g., Ethereum). This newly minted token represents a claim on the locked original asset and is usually an ERC-20 token, making it compatible with Ethereum’s vast DeFi ecosystem.

- Using the Wrapped Token: The user can now use the wrapped token on the target blockchain for various DeFi activities like lending, borrowing, or yield farming.

- Burning and Unwrapping: When the user wants to convert their wrapped token back to the original asset, they send the wrapped token back to the custodian. The custodian then “burns” the wrapped token, removing it from circulation, and releases the equivalent original asset from the vault back to the user.

This 1:1 peg is crucial, as it ensures the wrapped token always holds the same value as its underlying asset.

An Analogy: Stablecoins and Casino Chips

To better understand wrapped tokens, think of them in two simple analogies:

1. Stablecoins: Just as a stablecoin like USDC is pegged 1:1 to the US dollar and held in a bank account, a wrapped token like WBTC is pegged 1:1 to Bitcoin, with the actual BTC held in a verifiable reserve. You trust the issuer of USDC to hold your dollars; you trust the custodian of WBTC to hold your Bitcoin.

2. Casino Chips: Imagine you walk into a casino. You can’t play poker with your cash directly. Instead, you exchange your cash for casino chips. These chips represent your cash, are accepted at all the casino’s games, and can be exchanged back for cash whenever you leave. Your cash is “locked” with the cashier, and the chips are your “wrapped tokens” that allow you to interact with the casino’s ecosystem (the new blockchain). When you’re done, you “un-wrap” your chips back into cash.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhy Do We Need Wrapped Tokens?

The necessity of wrapped tokens stems from fundamental limitations in how different blockchain networks operate.

The Interoperability Problem (Blockchains Don’t Talk)

Blockchains like Bitcoin and Ethereum are designed as independent, secure, and isolated blockchain layers. They each have their own rules, consensus mechanisms, and technical standards. This means you can’t natively send Bitcoin to an Ethereum address, nor can you directly use a Bitcoin as collateral in an an Ethereum-based smart contract. It’s like trying to run an Android app on an iPhone—they speak different “languages” and are incompatible. This lack of direct communication, known as the interoperability problem, isolates liquidity and functionality. Wrapped tokens act as a blockchain bridge, allowing assets from one chain to ‘exist’ and be utilized on another.

Unlocking DeFi Liquidity

One of the most significant reasons for the existence of wrapped tokens is to unlock the vast liquidity trapped on otherwise isolated blockchains, particularly for decentralized finance (DeFi). Bitcoin, for instance, holds the largest market capitalization in crypto, representing immense value. Without wrapped tokens, this value would be entirely inaccessible to DeFi protocols built on Ethereum or other smart contract platforms.

By wrapping Bitcoin into WBTC, users can:

- Lend and Borrow: Use their BTC as collateral to borrow stablecoins or other assets on platforms like Aave or Compound.

- Yield Farm: Provide liquidity to decentralized exchanges (DEXs) like Uniswap in WBTC/ETH or WBTC/USDC pairs, earning trading fees and liquidity mining rewards.

- Trade: Exchange WBTC for other ERC-20 tokens directly on Ethereum’s DEXs without needing to go through a centralized exchange.

This integration of assets from disparate blockchains significantly expands the total value locked (TVL) in DeFi, creating a more interconnected and capital-efficient ecosystem.

Popular Examples of Wrapped Crypto

While Bitcoin and Ethereum are the most prominent, many other cryptocurrencies have wrapped versions to enhance their utility across different chains.

Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) is by far the most successful and widely adopted wrapped token. Launched in 2019, it’s an ERC-20 token on the Ethereum blockchain that is backed 1:1 by Bitcoin. This means that for every 1 WBTC in circulation, there is 1 BTC held in reserve by a custodian. This allows Bitcoin holders to participate in Ethereum’s rich DeFi ecosystem without selling their BTC.

Key characteristics of WBTC:

- ERC-20 Standard: Fully compatible with Ethereum’s smart contracts, wallets, and decentralized applications.

- Custodial Model: The underlying Bitcoin is held by a consortium of custodians, including BitGo, acting as a central entity.

- Proof of Reserve: The collateral (BTC) is auditable on-chain, and custodians often provide transparent “proof of reserve” reports.

WBTC has become a cornerstone of Ethereum DeFi, enabling Bitcoin to be used as collateral for loans, participate in liquidity pools, and engage in yield farming strategies.

Wrapped Ethereum (WETH) — Why wrap ETH?

This is often the most confusing wrapped token for beginners: “Why wrap Ethereum when it’s already on Ethereum?” The answer lies in technical standards, specifically the ERC-20 standard.

Ethereum (ETH) is the native cryptocurrency of the Ethereum blockchain. However, ETH was created before the ERC-20 token standard was finalized. This means that ETH itself does not strictly comply with the ERC-20 rules, which are essential for tokens to interact seamlessly with decentralized applications, especially those built for trading tokens (like Uniswap) or managing tokenized assets (like OpenSea for NFTs).

WETH is simply ETH “dressed in an ERC-20 suit.” When you “wrap” ETH into WETH, you’re essentially converting your native ETH into an ERC-20 compatible version. This allows it to:

- Be traded in ERC-20 liquidity pools on DEXs.

- Be used consistently as payment for NFTs on platforms that require ERC-20 tokens.

- Function smoothly within any smart contract that expects an ERC-20 input.

The conversion is typically 1:1 and can be done easily through various DeFi platforms or even directly within wallets. When you’re done, you can “unwrap” WETH back to ETH at any time.

The Benefits of Using Wrapped Assets

Wrapped assets offer several compelling advantages that drive their adoption in the crypto space.

Transaction Speed and Cost

One of the primary benefits is leveraging the transaction capabilities of faster and cheaper blockchains. Bitcoin, while secure, has a relatively slow block time and can incur higher transaction fees, especially during periods of network congestion. By wrapping Bitcoin into WBTC, users can take advantage of Ethereum’s (or other destination chain’s) faster transaction finality and potentially lower gas fees for interactions within its ecosystem. This is particularly beneficial for active DeFi traders and yield farmers who need to make multiple transactions quickly and cost-effectively.

Yield Farming and Lending

Wrapped tokens are crucial enablers for popular DeFi activities like yield farming and lending.

- Yield Farming: Users can deposit wrapped assets (e.g., WBTC, WETH, wMATIC) into liquidity pools on decentralized exchanges or lending protocols. By doing so, they provide liquidity to these platforms and, in return, earn a share of trading fees or receive governance tokens as rewards, effectively “farming” yield on their assets.

- Lending: Wrapped tokens can be used as collateral on decentralized lending platforms. For example, a user can deposit WBTC to borrow stablecoins, which can then be used for further investments or personal expenses, all without selling their original Bitcoin. This unlocks capital efficiency for holders of assets that might otherwise sit idle.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountWhat Are the Risks of Wrapped Tokens?

While offering significant benefits, wrapped tokens are not without their risks. Understanding these is crucial for safe participation.

Custodial Risk (Centralization)

Many wrapped tokens, including WBTC, rely on a custodial model. This means a centralized entity (or a consortium of entities) holds the original asset in reserve. This introduces a point of centralization and trust:

- Counterparty Risk: You must trust the custodian to securely hold the underlying assets and not misuse them. If the custodian is compromised, becomes insolvent (like the Alameda/FTX situation which impacted wrapped tokens like soBTC), or acts maliciously, your wrapped tokens could lose their peg or become worthless, as the underlying asset might not be available for unwrapping.

- Auditing and Transparency: While custodians often provide proof-of-reserve audits, the integrity of these audits and the custodian’s operations are still a central point of failure.

Decentralized wrapping solutions, which use smart contracts to custody assets, aim to mitigate this risk but introduce their own set of potential vulnerabilities.

Smart Contract Vulnerabilities

Whether custodial or non-custodial, the minting and burning of wrapped tokens are governed by smart contracts. Like any complex code, these smart contracts can contain bugs or vulnerabilities. If a smart contract is exploited, the underlying assets could be stolen or locked indefinitely, leading to a de-pegging event or even the complete loss of funds. High-profile bridge hacks, such as those involving a wormhole transfer or the Ronin bridge exploits, have demonstrated the severe consequences of smart contract vulnerabilities in cross-chain mechanisms. It’s critical that the smart contracts used for wrapping are rigorously audited.

Peg Stability

The value of a wrapped token is entirely dependent on its 1:1 peg to the underlying asset. Several factors can threaten this peg:

- Custodial Failure: As discussed, if the custodian fails, the trust in the peg diminishes, and the wrapped token’s value can plummet.

- Liquidity Issues: If there isn’t enough liquidity in the market to easily convert wrapped tokens back to their original assets, the peg can temporarily break, leading to price discrepancies.

- Smart Contract Exploits: A breach in the smart contract governing the wrapping process could lead to unauthorized minting or locking of assets, breaking the 1:1 backing.

Users should always be aware that wrapped tokens introduce an additional layer of complexity and potential failure points compared to holding the native asset directly.