Double top and double bottom patterns are two of the most reliable chart formations in forex and stock trading. These reversal signals, shaped like “M” and “W,” help traders spot shifts in market psychology and potential trend changes. Learning how they form, what they indicate, and how to trade them helps investors identify turning points and trade with confidence.

Key Takeaways

- The “M” shape signals a potential price drop, while the “W” shape suggests a potential price rise.

- The main purpose of these patterns is to signal that the previous trend is likely ending and a new one is beginning.

- A pattern is only confirmed and actionable after the price breaks through the “neckline” support or resistance level.

- Always define your entry point (after the neckline break), a stop-loss (above the peaks or below the troughs), and a take-profit target.

- These patterns are moderately reliable, not guaranteed. Always manage risk with a proper stop-loss.

What is a Double Top Pattern?

A double top pattern is a bearish reversal chart pattern that forms after an uptrend. It shows two peaks at nearly the same price level with a trough in between, creating an “M” shape. The pattern signals weakening buying pressure and a potential downward trend reversal.

The formation of a double top reflects a shift in market psychology. The first peak occurs as the uptrend reaches a resistance level. After a pullback (the trough), the price rises again to test the resistance. When the price fails to break above the previous peak for the second time, it indicates that the buying momentum is exhausted.

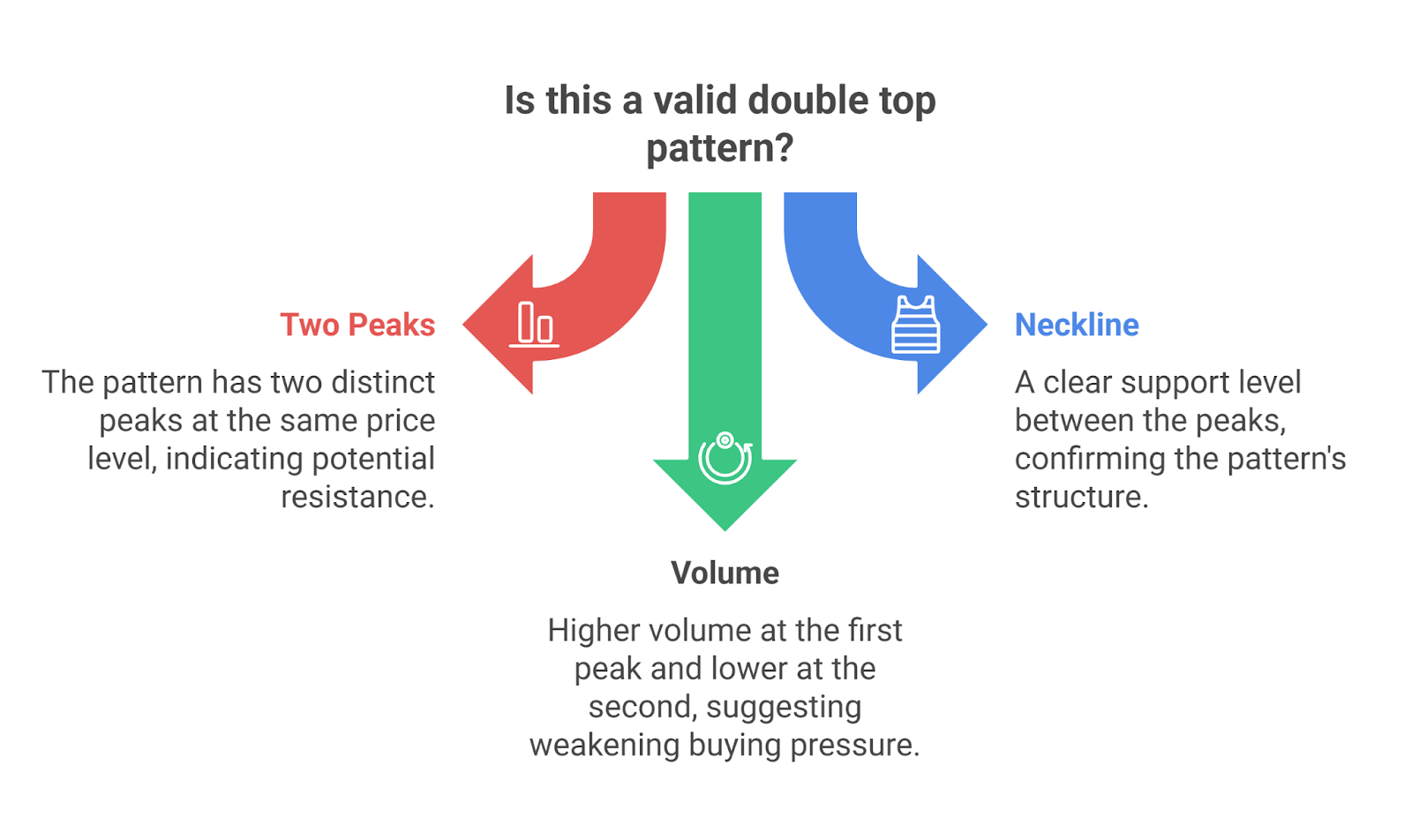

What are the rules for a double top?

The key components of a valid double top pattern include:

- Two Peaks: The pattern must have two distinct and rounded peaks that are at approximately the same price level.

- Neckline: The trough between the two peaks forms a support level known as the neckline.

- Volume: Trading volume is often higher during the first peak and lower during the second, suggesting diminishing buying interest.

A common question is, “Does a double top have to be exact?” The two peaks do not need to be at the exact same price, but they should be relatively close. A variance of a few percentage points is generally acceptable.

How do you confirm a double top?

A double top pattern is confirmed when the price breaks below the neckline support level. This breakout should ideally be accompanied by an increase in trading volume, which signals strong selling pressure and validates the reversal.

For example, if a stock forms two peaks around $100 and the trough between them is at $95 (the neckline), the pattern is confirmed when the price closes below $95 on significant volume.

What invalidates a double top?

A double top pattern is invalidated if the price makes a higher high after the second peak. If the price rallies and breaks above the resistance level established by the first two peaks, it signifies that the uptrend is still intact, and the bearish reversal signal is void.

Is a double top always bearish?

Yes, a double top is considered a bearish pattern. Its formation indicates that the asset’s price is likely to decline. However, like all chart patterns, it is not infallible, and false signals can occur.

What happens if a double top pattern forms?

When a confirmed double top pattern forms, it signals a shift from a bullish trend to a bearish one. This reversal suggests that the price is likely to continue downward, often by a distance equal to the height of the pattern from the peaks to the neckline.

What is a Double Bottom Pattern?

A double bottom pattern is a bullish reversal signal that forms after a downtrend. It features two troughs at nearly the same price level with a peak in between, creating a “W” shape. The pattern shows selling pressure fading and signals a potential upward trend reversal.

This pattern forms due to a change in market psychology from bearish to bullish. The first trough marks a support level where selling pressure is temporarily absorbed. After a brief rally (the peak), sellers push the price back down. The second failure to break the support level indicates that the selling power is exhausted, and buyers are beginning to take control.

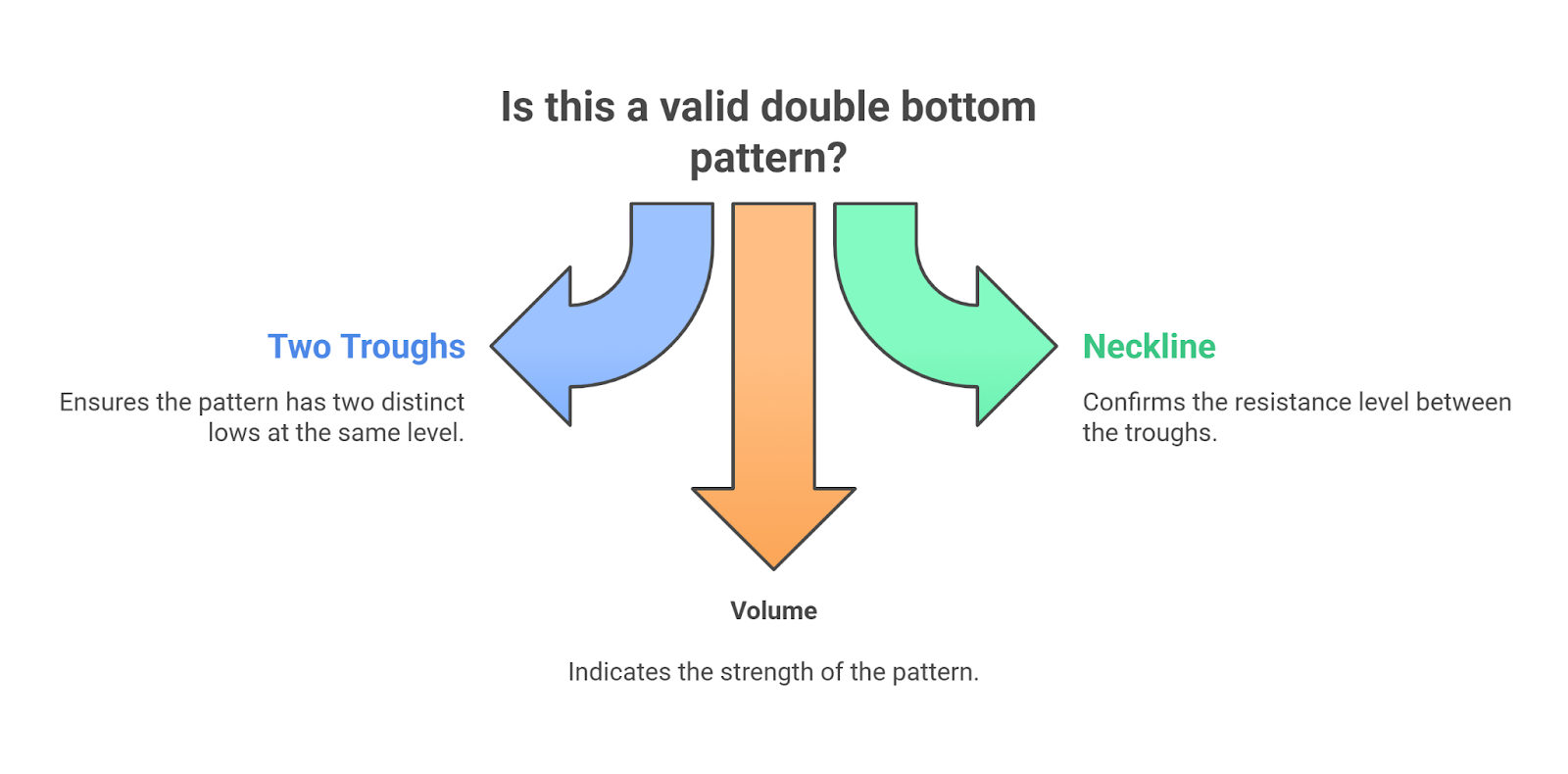

What is the rule for a double bottom?

The rules for identifying a double bottom are:

- Two Troughs: The pattern features two clear troughs at approximately the same support level.

- Neckline: The peak between the two troughs creates a resistance level, which is the neckline.

- Volume: Volume is typically higher during the first trough and may increase as the price approaches the neckline after the second trough.

How do you confirm a double bottom?

Confirmation of a double bottom occurs when the price breaks above the neckline resistance. This breakout should be accompanied by a noticeable increase in volume, confirming the strength of the bullish reversal.

What invalidates a double bottom pattern?

A double bottom pattern is invalidated if the price forms a new lower low after the second trough. If the price breaks below the support level established by the first two troughs, it signals that the downtrend is continuing, and the bullish pattern has failed.

Is a double bottom good for a stock?

Yes, a double bottom is generally considered a good sign for a stock as it indicates a potential bullish reversal. The pattern suggests that the stock has found a strong support level and may be poised for a significant upward move, presenting a possible buying opportunity.

What is the purpose of a double bottom?

The primary purpose of a double bottom is to identify potential trend reversals from bearish to bullish. It helps traders spot the end of a downtrend and the beginning of a new uptrend.

Double Top vs Double Bottom Patterns

The main difference between a double top and a double bottom is direction. A double top is a bearish reversal that forms after an uptrend, shaped like “M,” signaling weakening buying pressure. A double bottom is a bullish reversal that forms after a downtrend, shaped like “W,” signaling fading selling pressure

When you need to decide whether a trend is about to reverse, it’s important to understand the difference between Double Top and Double Bottom patterns.

| Aspect | Double Top (Bearish Reversal) | Double Bottom (Bullish Reversal) |

| Shape | Resembles the letter “M” | Resembles the letter “W” |

| Trend Context | Forms after a sustained uptrend | Forms after a prolonged downtrend |

| Market Psychology | Buying momentum weakens; sellers regain control | Selling pressure weakens; buyers regain control |

| Formation | Two peaks at similar resistance level | Two troughs at similar support level |

| Neckline Confirmation | Bearish signal confirmed when price breaks below neckline | Bullish signal confirmed when price breaks above neckline |

| Volume Behavior | Volume often fades on the second peak, then spikes on breakdown | Volume often builds on the second trough, then spikes on breakout |

| Price Targeting | Drop often equals distance between peak & neckline | Rally often equals distance between trough & neckline |

| Trader Sentiment | Seen as a signal to exit longs / open shorts | Seen as a signal to exit shorts / open longs |

| Reliability Factors | More reliable on longer timeframes with strong volume | More reliable when neckline breakout is supported by volume |

| Risk of Failure | Can become a triple top or consolidation if neckline holds | Can become a triple bottom or sideways trend if neckline holds |

How Do You Trade Double Tops and Double Bottoms?

Trading these patterns involves waiting for confirmation and using specific entry, stop-loss, and take-profit levels.

How to Trade a Double Top?

To trade a double top, traders usually wait for the price to form two peaks at a resistance level, then enter a short trade when the neckline breaks with strong volume. A stop-loss is often placed just above the second peak, and the profit target is typically the distance between the peak and neckline projected downward.

- Identify the Pattern – Spot two peaks at resistance with a trough forming the neckline.

- Wait for Confirmation – Pattern is valid only when price closes below the neckline with strong volume.

- Entry Point – Enter short on the neckline break or wait for a retest as support turns resistance.

- Stop-Loss Placement – Place stop above the second peak (safer) or just above the neckline (tighter).

- Take-Profit Target – Measure peak-to-neckline distance and project it downward for target price.

How to Trade a Double Bottom?

To trade a double bottom, traders usually wait for the price to form two troughs at a support level, then enter a long trade when the neckline breaks with strong volume. A stop-loss is often placed just below the second trough, and the profit target is typically the distance between the trough and neckline projected upward.

- Identify the Pattern – Spot two troughs at support with a peak forming the neckline.

- Wait for Confirmation – Pattern is valid only when price closes above the neckline with strong buying volume.

- Entry Point – Enter long on the neckline breakout or wait for a pullback to neckline support.

- Stop-Loss Placement – Place stop below the second trough (safer) or just under the neckline (tighter).

- Take-Profit Target – Measure neckline-to-trough distance and project it upward for target price.

What is the profit for a double bottom?

The take-profit for a double bottom is determined using the measured move method. For instance, if the troughs are at $50 and the neckline is at $55, the pattern’s height is $5. The take-profit target would be set at $60 ($55 breakout + $5 height).

How Reliable Are Double Tops and Double Bottoms?

Double tops and double bottoms are considered moderately reliable, with success rates often cited in the 60% to 70% range, depending on market conditions and confirming factors like volume.

How accurate is a double bottom?

The accuracy of a double bottom pattern increases when:

- There is a significant prior downtrend.

- The breakout above the neckline occurs on high volume.

- The pattern forms over a longer timeframe.

What is the success rate of a double top?

The success rate of a double top is similar to the double bottom and is higher when the pattern is well-defined, the breakout is confirmed with volume, and it appears after a prolonged uptrend.

Bottom Line

The Double Top and Double Bottom are mirror-image chart patterns that signal potential trend reversals. The Double Top, recognized by its “M” shape, is a bearish indicator that warns of a potential price decline after an uptrend. Conversely, the Double Bottom, with its distinct “W” shape, is a bullish indicator suggesting a price rally may follow a downtrend.

For traders, the critical element for both patterns is confirmation, which occurs when the price breaks through the neckline. This breakout validates the reversal signal and provides a clear, actionable point for entering a trade. Mastering these patterns offers a strategic advantage in anticipating shifts in market sentiment.