A Forex Strength Meter is a visual tool that shows which currencies are currently strong and which are weak. It helps traders spot potent trading opportunities by pairing the strongest currency against the weakest. This guide explains what it is, how it functions, and how to integrate it into your trading strategy for a data-driven edge.

While understanding Forex Strength Meter is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- A Forex Strength Meter measures which currencies are strongest and weakest in real time.

- It works by analyzing multiple currency pairs, scoring each, and ranking them for comparison.

- Automated meters are more efficient than manual calculation and better for live trading.

- Strength readings reflect macroeconomic drivers like central bank policy, order flow, and liquidity.

- Different formats exist — MT4/MT5 plugins, TradingView tools, web dashboards, and mobile apps.

- Benefits include faster pair selection, stronger trend confirmation, and reduced false signals.

- To use effectively, combine it with technical analysis, news awareness, and solid risk management.

What Is a Forex Strength Meter?

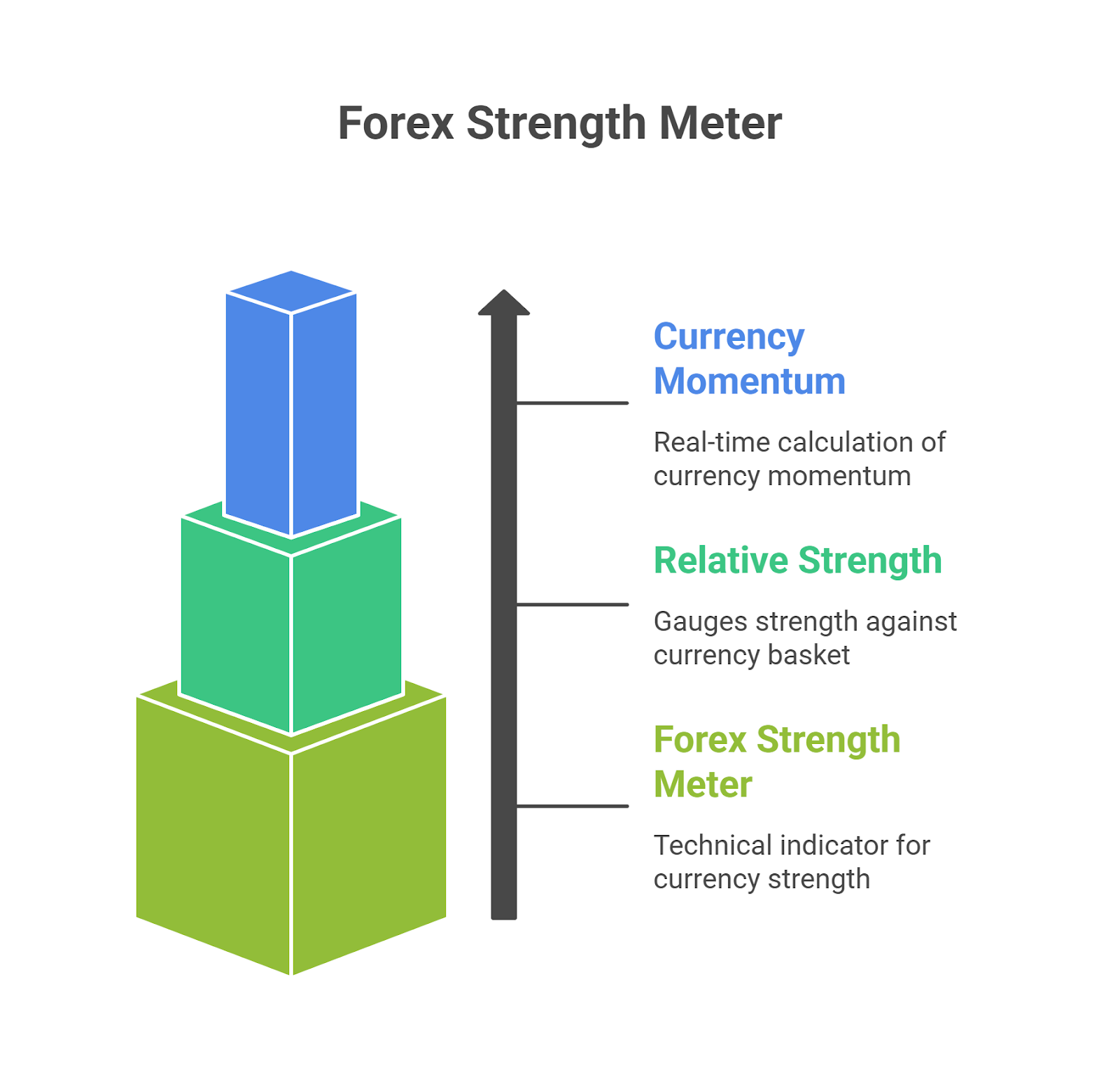

A Forex Strength Meter is a technical indicator that gauges the relative strength or weakness of major currencies. Often called a currency strength index or forex strength indicator, it calculates the momentum of each currency—like USD, EUR, or JPY—in real-time. Unlike indicators that analyze a single currency pair, a strength meter assesses a currency’s performance against a basket of other currencies.

This tool fits within a broader suite of forex analytics, acting as a trend confirmation and pair selection aid. While a volatility index like the VIX measures market fear and a Commitment of Traders (COT) report shows institutional positioning, a strength meter provides a direct, at-a-glance view of relative performance. According to a 2022 Forex.com trader survey, 62% of intraday traders use strength meters alongside sentiment indicators to validate their trading decisions.

How Does a Forex Strength Meter Work?

A forex strength meter works by analyzing the price action of multiple currency pairs simultaneously to generate a normalized strength score for each individual currency. For example, to calculate the strength of the British Pound (GBP), the meter measures its performance against other major currencies in pairs like GBP/USD, GBP/JPY, EUR/GBP, and GBP/AUD.

The core process involves:

- Data Input: The indicator pulls real-time price action data across multiple timeframes for all relevant pairs (e.g., all 28 pairs derived from the 8 major currencies).

- Scoring Algorithm: It applies a proprietary algorithm, often incorporating elements of moving averages and momentum indicators, to each pair.

- Aggregation: The scores are aggregated to produce a single strength value for each currency. A score of 8.0 might signify extreme strength, while a score of 1.0 indicates extreme weakness.

This method creates a correlation matrix that reveals which currencies are driving market movements. Most advanced meters pull data directly from high-liquidity providers like LMAX or EBS to ensure accuracy.

How to Calculate Currency Strength (Manual Method)

While automated tools are far more efficient, calculating currency strength manually helps you understand the underlying logic. The process is similar to how indices like the DXY are calculated using weighted averages, a methodology detailed in the CFA Institute curriculum on currency indices.

Here’s a simplified manual workflow:

- Select a Currency Basket: Choose a set of pairs to analyze.

- Choose a Timeframe: Decide on the lookback period (e.g., the last 24 hours).

- Measure Price Change: For each pair, calculate the price change in pips or percentage.

- Rank and Score: Average the price changes for each currency to create a weighted score.

This manual process is impractical for real-time trading, highlighting the value of automated tools.

Types of Forex Strength Meters

Forex strength meters come in various formats, each suited to different trading styles and platforms.

- MT4/MT5 Plug-ins: These are custom indicators you can install directly onto your MetaTrader platform.

- TradingView Indicators: TradingView offers numerous currency strength indicators that can be added to your analysis workspace.

- Web-Based Dashboards: These are standalone websites that provide a live feed of currency strengths.

- Mobile Apps: Many forex analysis apps now include a currency strength meter.

These tools are part of a broader forex analytics stack that includes volatility dashboards, heat maps, and order book analyzers.

Benefits of Using a Forex Strength Meter

Integrating a strength meter into your analysis offers several measurable advantages. Rather than just “boosting confidence,” it provides objective, data-driven outputs.

- Improves Pair Selection Efficiency: The meter automates the analysis of up to 28 currency pairs, reducing the time spent searching for trending markets.

- Filters for High-Momentum Setups: It identifies pairs with strong directional bias, allowing traders to focus on high-probability trend continuation trades.

- Reduces False Positives: By confirming signals from other indicators (like RSI or MACD), it helps filter out trades in pairs with low momentum or conflicting multi-timeframe correlation. For example, it helps avoid entering a trade based on an H1 signal if the H4 trend shows a weak divergence.

- Quantifies Market Dynamics: It provides a numerical score for momentum, which can be used to set objective criteria for trade entries (e.g., only taking trades with a strength divergence >4 points).

How to Use a Forex Strength Meter in Your Trading Strategy

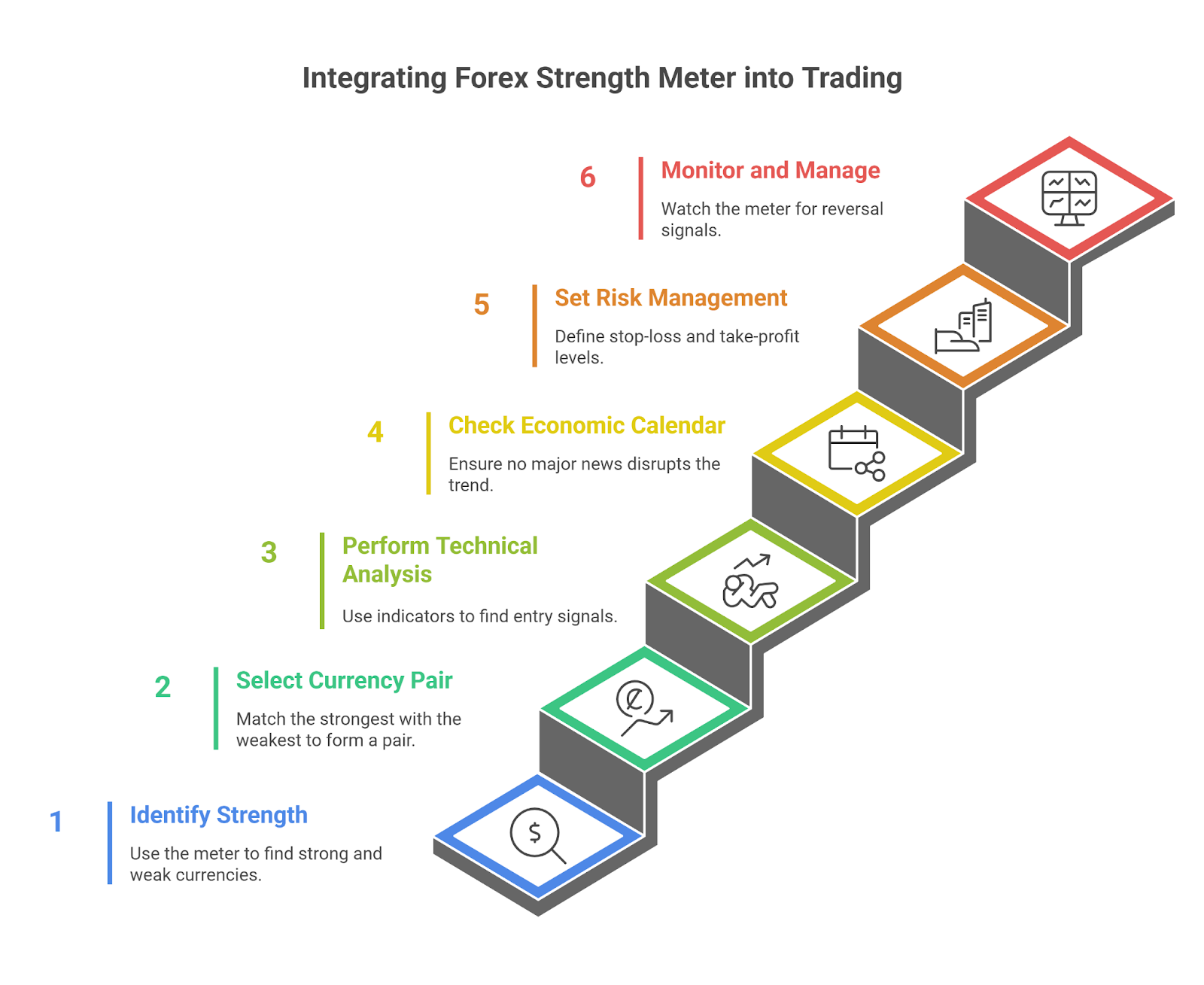

A strength meter should be integrated into a comprehensive trading strategy as a confirmation and filtering tool.

Here is a step-by-step workflow:

- Identify Strength and Weakness: Check the meter to find currencies with the highest and lowest scores.

- Select a Currency Pair: Form a pair by matching the strongest currency with the weakest (e.g., NZD strong, JPY weak → focus on NZD/JPY).

- Perform Technical Analysis: Open the chart for your selected pair. Use other indicators like RSI or moving averages to find a valid entry signal.

- Check the Economic Calendar: Ensure no major news is scheduled that could disrupt the trend.

- Set Risk Management: Define your stop-loss and take-profit levels based on your technical analysis.

- Monitor and Manage: Continue to watch the strength meter. If the currencies begin to reverse, it may be an early signal to exit.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMacroeconomic Drivers and Forex Strength Meters

A strength meter does not operate in a vacuum. Its readings are a direct reflection of underlying macroeconomic forces, order flow, and market microstructure. Understanding these connections is crucial for advanced analysis.

How Central Bank Policy Impacts Strength Readings

Central bank policy is the primary driver of a currency’s long-term strength or weakness. When a central bank like the Federal Reserve adopts a hawkish stance (raising interest rates to fight inflation), it makes holding that currency more attractive, causing its strength reading to rise. Conversely, a dovish policy (lowering rates) will decrease its strength. The meter acts as a real-time gauge of how the market is pricing in these policies.

Order Flow vs. Strength Meters

Order flow analysis tracks large institutional buy and sell orders, revealing the “why” behind price movements. A strength meter shows the “what”—the result of that flow. To sharpen this view, some traders contrast meter readings with the Williams %R indicator, since it measures overbought/oversold levels on a single pair, offering a micro-level momentum check against the macro currency strength.

For example, if a meter shows a sudden spike in EUR strength, it is likely due to significant institutional order flow or liquidity imbalances in the market. Using a meter alongside order flow tools provides a more complete picture of market dynamics.

Spreads, Liquidity, and Execution Speed

A strong reading on a meter is only useful if the resulting currency pair is tradable. Pairs with wide spreads or low liquidity can lead to slippage and poor trade execution, negating any potential edge. A key use of a strength meter is to identify strong trends in liquid, major pairs, thereby avoiding these low-liquidity traps. It also helps in arbitrage avoidance, as discrepancies in strength are often quickly corrected in efficient markets.

Case Study: A Data-Backed Example of a Strength Divergence Trade

Quantitative examples demonstrate the meter’s practical value far better than generic claims.

Consider a historical scenario: On August 4, 2022, the Bank of England raised interest rates by 50 basis points, signaling a hawkish policy stance. On the same day, the Bank of Japan reiterated its commitment to an ultra-dovish policy. A forex strength meter would have reflected this fundamental divergence:

- GBP Strength Score: Climbed to 7.8

- JPY Strength Score: Dropped to 2.1

This divergence of 5.7 points signaled a high-probability long trade on GBP/JPY. Following this signal, the pair rose over 250 pips (1.5%) in the subsequent 24 hours.

Furthermore, simulated backtesting provides valuable insights. A backtest of EUR/USD strength divergences greater than 4 points from 2020–2024 showed that setups confirmed with an RSI divergence produced a 62% win rate, compared to a 49% win rate when using RSI alone. This highlights the meter’s role in filtering for higher-probability setups.

Forex Strength Meter vs Currency Strength Index

While often used interchangeably, there is a technical difference between a “meter” and an “index.”

A Forex Strength Meter measures the relative, pairwise strength of one currency against another in real-time. A Currency Strength Index, like the US Dollar Index (DXY), measures a currency’s value against a fixed, weighted basket of other currencies.

| Feature | Forex Strength Meter | Currency Strength Index (e.g., DXY) |

| Purpose | Identify short-term trading opportunities | Provide a long-term economic benchmark |

| Calculation | Relative, against all other currencies | Fixed, weighted basket of currencies |

| Update Speed | Real-time (seconds to minutes) | Slower (often end-of-day) |

| Use Case | Selecting pairs for intraday trading | Analyzing long-term macro trends |

Best Forex Strength Meters (Tools & Software)

The best meter depends on your platform, budget, and customization needs. Popular options include:

- MT4/MT5 Indicators: Available on the MQL5 marketplace.

- TradingView: The platform’s “Currency Strength Meter” is a popular choice.

- Online Dashboards: Websites like LiveCharts offer free, web-based meters.

- Proprietary Broker Tools: Brokers like OANDA and Pepperstone offer their own meters.

Prioritize accuracy, low latency, and positive user reviews from communities like Forex Peace Army.

Common Mistakes to Avoid When Using a Forex Strength Meter

A strength meter is a powerful tool, but it can lead to losses if misused. Avoid these common pitfalls:

- Over-reliance: Never use the meter as a standalone signal. Always confirm with price action.

- Ignoring Macro Events: A currency can reverse its strength instantly due to major economic releases.

- Using the Wrong Timeframe: Ensure the meter’s timeframe aligns with your trading strategy to avoid false signals from conflicting multi-timeframe correlation.

- Chasing Extremes: An extremely high reading could indicate an overbought currency due for a reversal.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

A Forex Strength Meter is a powerful addition to any trader’s toolkit. It cuts through market noise to provide a clear, data-driven view of which currencies are leading. By improving pair selection efficiency and helping to confirm trading signals, it can enhance your strategy and provide objective validation for your trades.

Remember, the meter is not a standalone system but a component of a complete trading plan. For optimal results, integrate its insights with your technical analysis and a solid risk management strategy.