The main difference between forex and crypto trading in 2026 is liquidity and volatility. Forex handles ~$7.5 trillion in daily trades with strong regulation and stability, making it best for consistent strategies. Crypto averages ~$120 billion daily, operates 24/7, and offers higher volatility, attracting traders seeking faster growth and bigger swings.

While understanding Forex vs Crypto is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- The forex market is the largest in the world with around $7.5 trillion traded daily, compared to crypto’s $120 billion.

- Crypto markets experience extreme volatility with daily swings of 3–15%, while forex pairs usually move less than 1%.

- Profitability in crypto can be explosive in the short term but comes with higher risks, while forex offers steadier, moderate returns.

- Forex operates in a heavily regulated environment with investor protection, while crypto regulation is inconsistent and security risks are higher.

- Beginners often find forex easier to start with thanks to demo accounts, predictable drivers, and structured education.

- Day trading forex favors consistency and tight spreads, while crypto suits traders seeking high-risk, high-reward opportunities in a 24/7 market.

- The future of forex is tied to global finance and CBDC adoption, while crypto’s growth depends on DeFi, tokenization, and institutional adoption.

Quick Comparison: Forex vs Crypto (2026)

This table provides a high-level snapshot for a direct comparison of Forex vs Crypto.

| Feature | Forex Market | Crypto Market |

| Liquidity | Extremely High | Moderate to Low (varies by coin) |

| Volatility | Low | Extremely High |

| Trading Hours | 24 hours, 5 days a week | 24 hours, 7 days a week |

| Regulation | Heavily Regulated | Evolving & Inconsistent |

| Leverage | High (up to 30:1 – 50:1 regulated) | Lower (typically 5:1 – 20:1) |

| Suitability | Traders seeking stability, lower risk | Traders seeking high returns, high risk |

What is Forex Trading?

Forex trading is the exchange of one currency for another in the global foreign exchange market. With over $7.5 trillion traded daily, it is the largest financial market in the world. Traders buy and sell currency pairs like EUR/USD to profit from price movements driven by supply, demand, and economic events.

What is Crypto Trading?

Crypto trading is the buying and selling of digital currencies like Bitcoin, Ethereum, and other altcoins on cryptocurrency exchanges. Traders seek profit from price fluctuations driven by supply, demand, market sentiment, and news. Unlike forex, crypto trading operates 24/7 without central regulation, offering high volatility and growth potential.

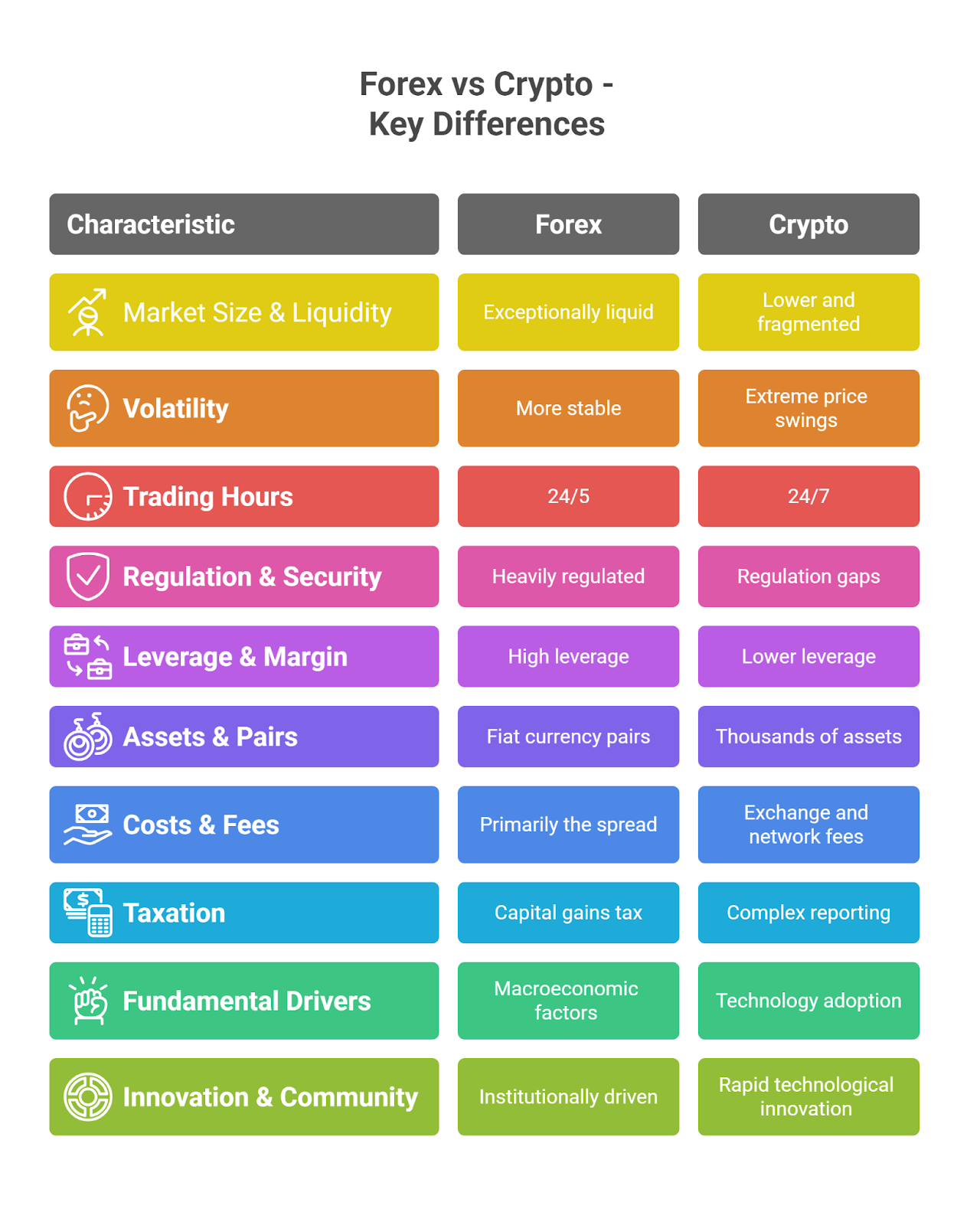

Key Differences Between Forex and Crypto

While both involve speculating on prices, the two markets are fundamentally different.

1. Market Size & Liquidity

The Forex market’s ~$7.5 trillion daily volume dwarfs crypto’s ~$120 billion. This makes Forex exceptionally liquid, meaning you can execute large trades with minimal price impact. Crypto liquidity is much lower and fragmented across many exchanges and coins, whereas Forex liquidity is concentrated in major currency pairs like EUR/USD, GBP/USD, and USD/JPY.

2. Volatility

Crypto is famous for its extreme price swings, with assets like BTC often moving 3-15% in a single day. Major Forex pairs are far more stable, typically moving less than 1% daily.

3. Trading Hours

The Forex market operates 24/5, closing on weekends. The crypto market never closes, offering 24/7 trading access.

4. Regulation & Security

Forex is a mature, heavily regulated market under frameworks like MiFID II in Europe. Brokers like OANDA must follow strict rules, including segregating client funds. The crypto market has significant regulation gaps, exposing traders to higher risks of exchange failure and hacks.

5. Leverage & Margin

Forex brokers traditionally offer high leverage (e.g., 30:1 or 50:1), allowing traders to control large positions with small capital. Crypto exchanges like Binance typically offer lower leverage, especially for altcoins, due to the inherent volatility.

Those interested in standardized derivatives often review the market structure vs futures to see how centralized contracts differ from spot, over-the-counter Forex.

6. Assets & Pairs

Forex trading focuses on a handful of major and minor fiat currency pairs. Crypto offers thousands of assets, from major coins like BTC and ETH to countless altcoins, each with its own unique fundamentals.

7. Costs & Fees

Forex costs are primarily the spread (the difference between the buy and sell price). Crypto trading involves exchange fees (maker/taker fees) and sometimes network fees (gas fees for DeFi).

8. Taxation

Both are subject to capital gains tax in most jurisdictions, but crypto’s decentralized nature can create more complex reporting requirements.

9. Fundamental Drivers

Forex prices are driven by macroeconomic factors like interest rates, inflation, and GDP. Crypto prices are driven by technology adoption, network updates, community sentiment, and regulatory news.

10. Innovation & Community

The crypto market is driven by rapid technological innovation and a highly engaged global community. The Forex market is more traditional and institutionally driven.

Is It Better to Trade Forex or Crypto?

Neither market is universally “better”; the best choice depends on your personal risk tolerance, trading style, and goals.

- Choose Forex if you prioritize a stable, highly regulated environment with predictable trading hours and low volatility. It’s built for traders who value consistency and risk management.

- Choose Crypto if you are seeking explosive growth potential and are comfortable with extreme volatility, an unregulated 24/7 market, and higher inherent risks.Ultimately, the choice often comes down to personality fit — different crypto vs Forex traders thrive under different conditions, whether it’s the steady pace of forex or the rapid swings of crypto.

For a complete picture, many traders also compare Forex vs Stocks, since equity markets differ sharply from currencies in volatility, liquidity, and accessibility.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTrading Strategies: Forex vs Crypto

While core strategies like scalping, day trading, and swing trading can be applied to both markets, their execution differs significantly.

| Strategy | Forex Trading Approach | Crypto Trading Approach |

| Scalping | Focuses on capturing small profits from tight spreads on liquid pairs like EUR/USD. Requires a stable, low-cost environment. | Targets larger price swings over very short periods on volatile pairs like BTC/USD. Higher transaction fees can be a challenge. |

| Day Trading | Relies on predictable intraday patterns and reactions to scheduled economic news like Nonfarm Payrolls. | Often driven by momentum, social media hype, and technical breakouts. Requires managing extreme intraday volatility. |

| Swing Trading | Aims to capture multi-day trends based on macroeconomic shifts or technical analysis. Moves are generally slower and more measured. | Aims to capture explosive multi-day or multi-week trends driven by adoption news, blockchain forks, or shifts in market sentiment. |

Forex vs Crypto Market Cap: Which Market Is Bigger?

The Forex market is exponentially larger than the crypto market.

- Forex Market Size: The Forex market is defined by its massive ~$7.5 trillion average daily turnover. Its size is rooted in its necessity for global trade, making it the most liquid market in the world.

- Crypto Market Size: The entire crypto market cap is approximately ~$1.2 trillion in 2026, with a daily trading volume of around $120 billion. While much smaller, its growth potential is significantly higher.

Is Crypto More Volatile Than Forex?

Yes, crypto is significantly more volatile than Forex. This is the single most important difference for a trader to understand, as it directly impacts risk and profit potential.

- Forex Volatility: A major currency pair like EUR/USD has an average daily range of ~0.5% to 1%.

- Crypto Volatility: It is common for Bitcoin (BTC) and other major cryptocurrencies to experience daily price swings of 3% to 15% or more.

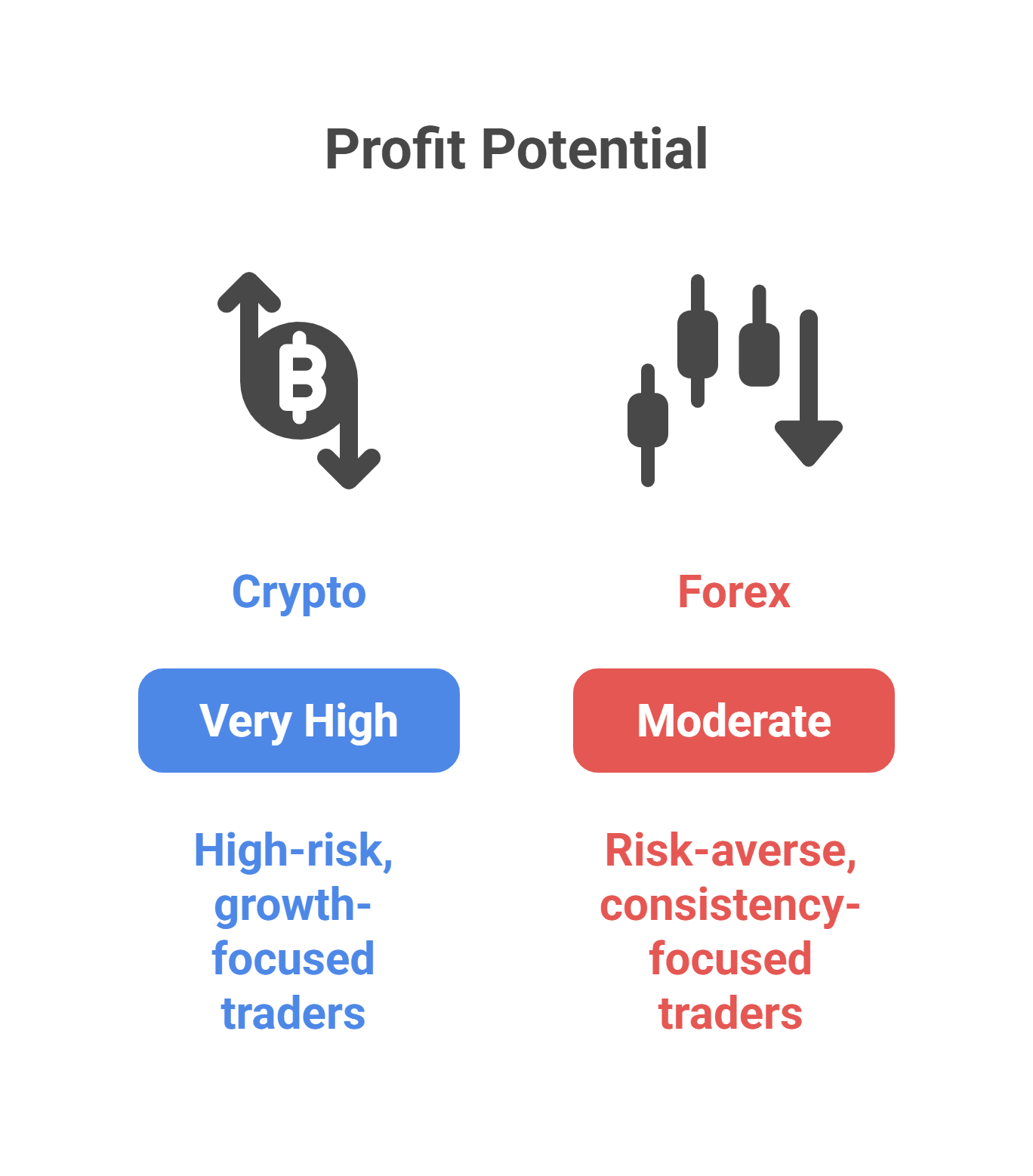

Forex vs Crypto: Which Is More Profitable?

Crypto offers a higher potential for short-term profits but also carries a much higher risk of substantial losses. The extreme volatility means triple-digit percentage gains are possible, but so are 50%+ drawdowns.

Forex is generally less profitable in terms of percentage returns but offers more consistent, risk-adjusted profits. Success in Forex is built on steady gains over time with controlled risk.

| Market | Profit Potential | Risk Level | Best For |

| Crypto | Very High | Very High | High-risk, growth-focused traders |

| Forex | Moderate | Moderate | Risk-averse, consistency-focused traders |

Is Forex Better Than Crypto for Beginners?

Forex is generally better and safer than crypto for beginners due to its strong regulation, structured learning curve, and the availability of superior practice tools.

Capital Requirements

You can start in both markets with small amounts.

- Forex: Most regulated brokers require a minimum deposit of around $100, with leverage up to 30:1 in most regions.

- Crypto: Fractional trading allows you to start with $10 or less. Leverage is typically lower and varies by exchange, often between 5x to 20x.

Practice Tools

This is a key advantage for Forex.

- Forex Demo Accounts: These use live, real-time market data, allowing you to practice in a realistic environment without risking capital. Such demo accounts are often cited among the key benefits of forex trading, giving learners a structured path before entering live markets.

- Crypto Paper Trading: This is often a simulation that may not accurately reflect the true speed, fees, and liquidity of the live market.

Predictability and Learning Curve

- Forex: Price movements are primarily driven by scheduled economic events (interest rates, GDP reports). This creates a structured learning environment.

- Crypto: Prices are heavily sentiment-driven and can be influenced by unpredictable social media trends, hype, and regulatory news, making it harder for beginners to analyze.

The Future of Forex vs Crypto

- The Future of Forex: The Forex market’s future is tied to the stability of global trade and finance. The rise of Central Bank Digital Currencies (CBDCs) could streamline international settlements but is unlikely to replace the existing Forex structure. It will remain the bedrock of the global economy.

- The Future of Crypto: The crypto market’s future is focused on growth and innovation. Key drivers include the expansion of DeFi, the tokenization of real-world assets, and increasing institutional adoption. While its path is less certain, its potential for disruption is immense.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The “Forex vs Crypto” debate has no single right answer; the best market depends entirely on your personal goals, risk tolerance, and trading style.

- Choose Forex if you value stability, deep liquidity, and a highly regulated environment.

- Choose Crypto if you are seeking high growth potential and are comfortable with extreme volatility and higher risk.

Ultimately, success in either market comes down to education, a solid trading plan, and disciplined risk management.