The hammer candlestick signals potential trend reversals. Forex traders use this pattern in technical analysis to identify bullish shifts. It originates from Japanese charting methods developed by Munehisa Homma. The hammer is a single-candle formation suggesting a change from bearish to bullish sentiment. Understanding this pattern is key for traders who also use other formations like the engulfing pattern, doji, and shooting star. This guide explains how to identify, confirm, and trade the hammer pattern.

While understanding Hammer Candlestick Pattern is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- The hammer candlestick is a bullish reversal pattern that appears at the bottom of a downtrend.

- It has a small body near the top, a long lower wick at least twice the body, and little to no upper wick.

- A green hammer is stronger than a red hammer, but both signal potential bullish reversal.

- Confirmation is essential — look for a bullish candle close above the hammer, higher trading volume, or support from RSI/MACD.

- The pattern’s standalone reliability is around 55%, but with confirmation it increases to above 60%.

- Stop-loss is best placed just below the hammer’s wick low, and take-profit should target resistance or a 1:2 risk–reward ratio.

- The hammer works best on higher timeframes like 4-hour, daily, or weekly charts.

- It is more effective in forex and stocks at support zones, but less reliable in crypto without strong confirmation.

- Traders often combine the hammer with moving averages, RSI, or Fibonacci retracements for stronger signals.

- The hammer is useful, but it should always be seen as a probability tool, not a certainty.

What Is a Hammer Candlestick Pattern?

A hammer candlestick is a bullish reversal pattern that forms at the bottom of a downtrend. The candle has a small body near the top with a long lower shadow, showing sellers pushed prices lower but buyers regained control. This signals potential market bottoms and bullish sentiment.

Steve Nison, in his book Japanese Candlestick Charting Techniques, introduced this concept to Western traders. The pattern is named for its shape, which appears to be “hammering out” a market bottom.

What Are the Key Characteristics of the Hammer?

Traders must identify several specific visual features to validate a hammer pattern. These characteristics are essential for its function as a reversal signal.

Here are the 4 key identifiers of a hammer candlestick:

- Preceding Trend: The pattern must follow a clear downtrend.

- Long Lower Shadow: The lower wick must be at least two times the length of the real body. This long shadow shows significant price rejection from the lows.

- Small Real Body: The candle’s body is small and located at the top of the trading range. This shows the closing price was near the opening price.

- Minimal Upper Shadow: The hammer should have little to no upper wick.

The body’s color is a secondary factor. A green (bullish) body indicates the close was above the open and is slightly stronger. However, a red (bearish) hammer is still a valid bullish signal because the core characteristic is the strong rejection of lower prices.

What Are the Types of Hammer Candlestick Variations?

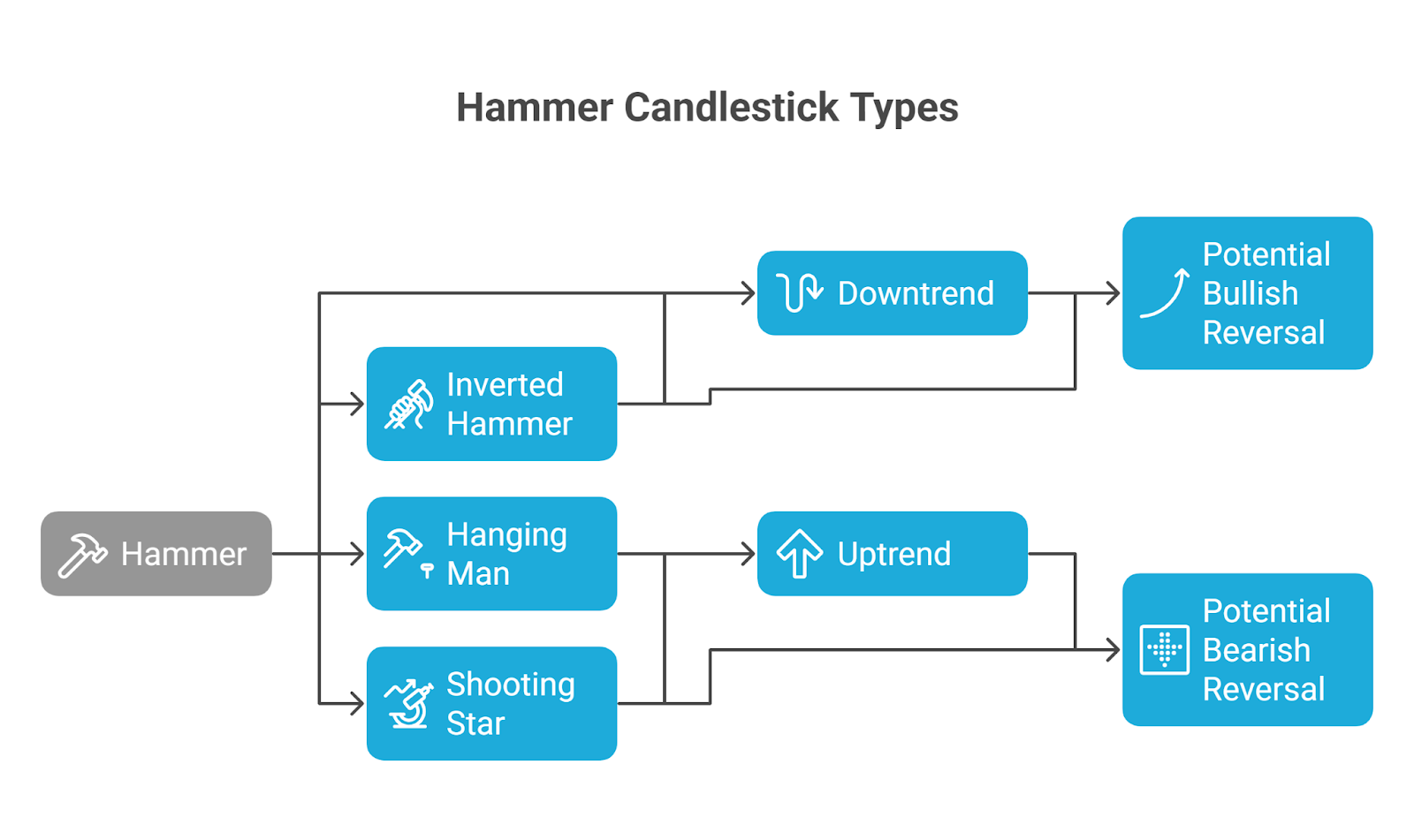

The hammer is part of a family of single-candle patterns. Its variations can signal different market sentiments based on their shape and position within a trend. The main variations are the inverted hammer, hanging man, and shooting star.

Here is a comparison of the hammer and its key variations:

| Pattern | Appearance | Trend Context | Signal |

| Hammer | Small body at the top, long lower wick | Downtrend | Potential Bullish Reversal |

| Inverted Hammer | Small body at the bottom, long upper wick | Downtrend | Potential Bullish Reversal |

| Hanging Man | Identical to a hammer but appears in an uptrend | Uptrend | Potential Bearish Reversal |

| Shooting Star | Identical to an inverted hammer but appears in an uptrend | Uptrend | Potential Bearish Reversal |

How Do You Identify a Hammer on Charts?

Identifying a hammer requires a systematic process. This method applies across forex, stock, and crypto markets.

Here are 3 steps to recognize a hammer pattern:

- Establish the Context: First, confirm a prevailing downtrend. A hammer is not a valid reversal signal without a prior price decline.

- Locate the Shape: Scan the chart for a candle with a small body at the top and a long lower shadow.

- Verify Proportions: Ensure the lower shadow is at least twice the size of the body and there is almost no upper wick.

How Do You Confirm a Hammer Signal?

Confirmation is crucial because a hammer pattern alone is not a definitive trade trigger. False signals can occur, making verification necessary to improve accuracy. Data shows that a standalone hammer has a success rate of about 52–55%. With confirmation, this rate can increase to over 60%.

Here are 3 common confirmation methods:

- A Bullish Confirmation Candle: Wait for the next candle to close above the high of the hammer. This action shows continued buying momentum.

- Increased Trading Volume: A volume spike on the hammer candle validates the signal. It indicates strong buying conviction.

- Technical Indicators: Use oscillators for support. A hammer is more reliable if the

Relative Strength Index (RSI) is below 30 (oversold) or there is bullish divergence on the MACD.

What Are Effective Hammer Pattern Trading Strategies?

An effective hammer strategy requires defined rules for entry, stop-loss, and take-profit. This structure ensures proper risk management.

1. Basic Hammer Strategy

Here is a basic hammer trading strategy:

- Identify: Locate a valid hammer at the bottom of a downtrend, ideally at a key support level.

- Confirm: Wait for the next candle to close above the hammer’s high. This is the

entry trigger. - Entry: Place a buy order at the confirmation candle’s close.

- Stop-Loss: Set the stop-loss just below the low of the hammer’s shadow.

- Take-Profit: Target a resistance level or use a risk-reward ratio of at least 1:2. For example, if the stop-loss risk is 50 pips, the take-profit target should be 100 pips.

Example: If stop-loss = 50 pips → take-profit = 100 pips.

Effective hammer candlestick trading strategies combine strict entry rules, stop-loss placement, and confirmation tools to reduce false signals. The most reliable approaches are:

2. Hammer + Support Strategy

The hammer is more reliable when it forms at a key support level.

- Entry → After confirmation close above the hammer.

- Stop-Loss → Below support zone.

- Take-Profit → Next resistance or measured move.

3. Hammer + Moving Average Strategy

Combining hammers with moving averages filters weak setups.

- Setup → Hammer forms near the 50 EMA(Exponential Moving Average) or 200 SMA acting as dynamic support.

- Entry → Buy when candle closes above hammer high + above the MA.

- Stop-Loss → Below wick low.

- Take-Profit → Resistance zone or MA-based extension.

4. Hammer + RSI Oversold Strategy

Oversold conditions strengthen the hammer’s reversal signal.

- Setup → RSI < 30 when hammer forms.

- Entry → Buy after bullish confirmation candle.

- Stop-Loss → Below hammer wick.

- Take-Profit → At least 1:2 risk–reward.

5. Advanced: Hammer + Fibonacci Retracement

Hammers at Fibonacci levels are high-probability setups.

- Setup → Hammer forms at 50% or 61.8% retracement in a trending market.

- Entry → Confirmation close above hammer.

- Stop-Loss → Wick low.

- Take-Profit → Next Fibonacci extension (127.2% or 161.8%).

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHammer Candlestick Strategies Comparison

| Strategy Type | Confirmation Needed | Strength | Best Market Use |

| Basic Reversal | Candle close | Moderate | All markets |

| Hammer + Support | Support zone | Strong | Forex, stocks |

| Hammer + Moving Average | MA confluence | Strong | Forex, trending assets |

| Hammer + RSI Oversold | RSI < 30 | Strong | Stocks, crypto |

| Hammer + Fibonacci | Fib retracement | Strongest | Swing trading setups |

How Reliable Is the Hammer Pattern?

The hammer pattern is a moderately reliable bullish reversal indicator. According to Thomas Bulkowski’s Encyclopedia of Candlestick Patterns, its performance requires careful consideration and confirmation. Its reliability is often compared to other candlestick patterns.

| Pattern | Reversal Type | Approximate Success Rate (Standalone) |

| Hammer | Bullish | ~55% |

| Bullish Engulfing | Bullish | ~63% |

| Dragonfly Doji | Bullish | ~58% |

Strengths:

- Provides a clear visual signal of a potential turning point.

- Defines a logical level for a stop-loss order.

Weaknesses:

- Can generate false signals in choppy, non-trending markets.

- Requires confirmation, which can delay trade entry.

How Does the Hammer Perform in Different Markets?

The hammer’s effectiveness varies across markets due to differences in liquidity and volatility.

- Forex Markets: The hammer is highly effective in forex because of its high liquidity. It performs well on higher timeframes for major pairs like EUR/USD.

- Stock Trading: The pattern is a popular tool for identifying stock bottoms after a correction. Its reliability increases at established support zones.

- Crypto Markets: High volatility in crypto can cause more false signals. Traders should use stricter confirmation rules to filter out market noise.

What Is the Difference Between a Hammer and Related Patterns?

Traders must distinguish the hammer from visually similar patterns. Confusing them can lead to incorrect trades, as their signals can be opposite.

Here is a comparison of the hammer and its common look-alikes:

| Pattern | Trend | Appearance | Implication |

| Hammer | Downtrend | Small body at top, long lower wick | Bullish Reversal |

| Hanging Man | Uptrend | Small body at top, long lower wick | Bearish Reversal |

| Inverted Hammer | Downtrend | Small body at bottom, long upper wick | Bullish Reversal |

| Dragonfly Doji | Downtrend | No real body, long lower wick | Bullish Reversal |

How Do You Combine the Hammer with Other Indicators?

Combining the hammer with other indicators creates a confluence of signals. This approach increases the probability of a successful trade.

Here are three powerful combinations:

- Hammer with Moving Averages: A hammer rejecting a key moving average (like the 50 EMA) acting as dynamic support is a strong bullish signal.

- Hammer with RSI: A hammer appearing when the RSI is oversold (below 30) confirms that bearish momentum is exhausted.

- Hammer with Fibonacci Retracement: A hammer forming at a key Fibonacci level (e.g., 61.8%) during a larger uptrend’s pullback indicates a high-probability entry zone.

What Are Advanced Considerations for the Hammer Pattern?

Modern traders should consider the impact of algorithmic trading and trading psychology when using the hammer pattern.

- Algorithmic Trading: Trading algorithms are programmed to detect hammer patterns. These systems use strict confirmation rules to avoid false signals and can cause rapid price moves around these levels.

- Trading Psychology: A hammer can trigger FOMO (Fear Of Missing Out) in traders wanting to catch a bottom. Disciplined traders wait for confirmation instead of entering prematurely.

Hammer Trade Example

This example provides a step-by-step walkthrough of a hammer trade setup on the

EUR/USD 4-hour chart.

- Context: The EUR/USD pair is in a clear downtrend and approaches a known support zone.

- Identification: A hammer candle forms at the support level. It has a small body and a long lower wick.

- Confirmation: The RSI is below 30, indicating an oversold condition. The next candle is a large bullish bar that closes above the hammer’s high.

- Execution:

- Entry: A buy order is placed at the close of the confirmation candle.

- Stop-Loss: The stop-loss is set a few pips below the hammer’s low.

- Take-Profit: The take-profit is set at the next resistance level, providing a 1:2.5 risk-reward ratio.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountConclusion

The hammer candlestick is a valuable bullish reversal signal. Its strength comes from its clear visual display of a shift in market control from sellers to buyers. The key to trading it successfully is to remember it signals a probability, not a certainty. For optimal results, traders must always use the hammer in the context of a downtrend and wait for confirmation. By integrating this pattern into a trading strategy with disciplined risk management, it can effectively identify high-probability market turning points.

References

- Nison, S. Japanese Candlestick Charting Techniques.

- Bulkowski, T. Encyclopedia of Candlestick Patterns.

- Forex.com educational library.