Fakeout is the root cause behind many failed trades and shaken confidence. It tricks you into believing a breakout has happened, only to reverse sharply and hit your stop. You act on a setup that looks perfect—but it never follows through. So you must know how to spot and trade it cleverly. Or else it can cost you time, capital, and discipline.

This guide walks you through exactly what a fakeout is, how to detect it before entry, and how to respond when it happens.

While understanding Fakeouts in Forex? is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a Fakeout in Forex?

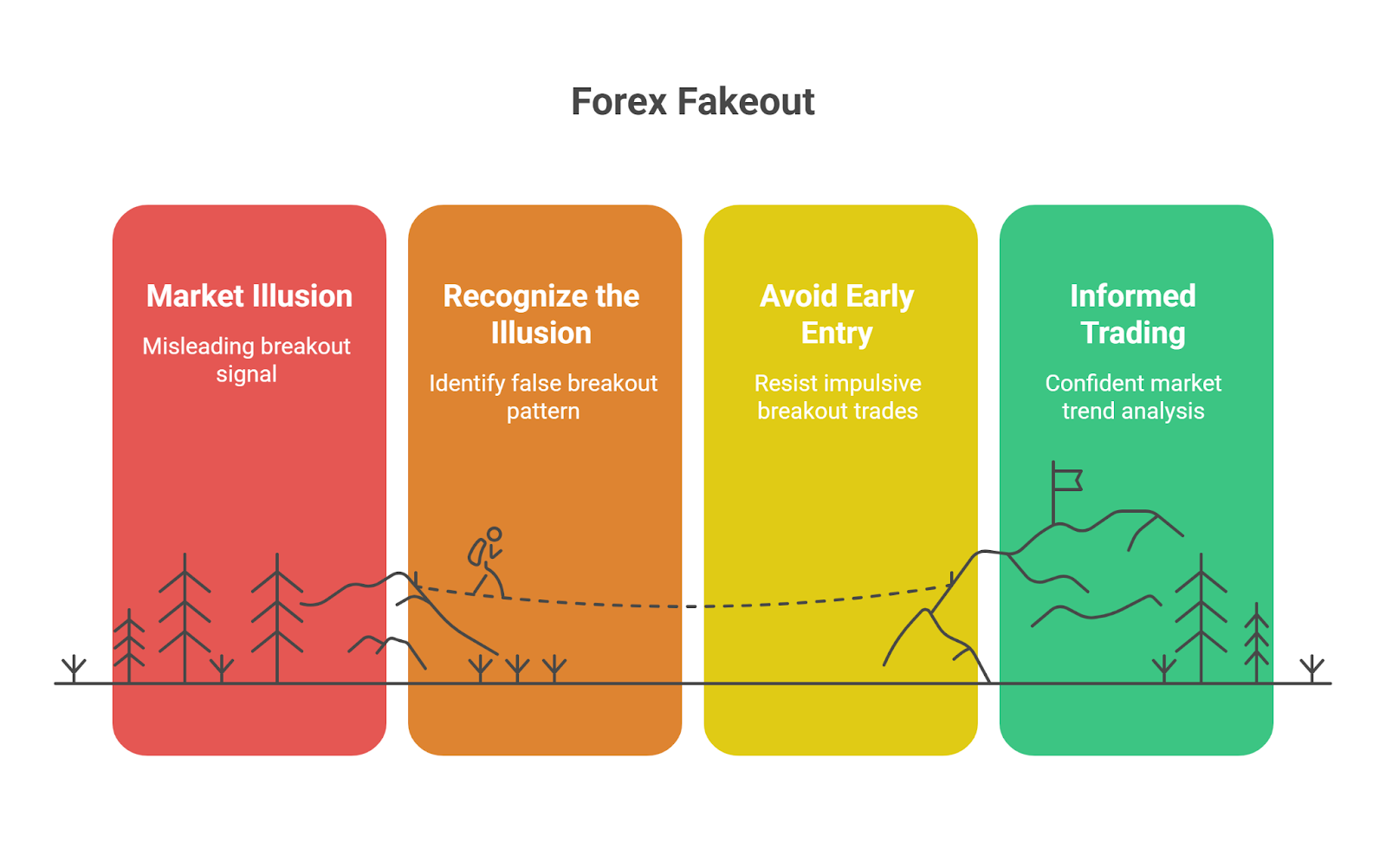

A fakeout or a false breakout is basically an illusion. It makes the market look like it’s breaking into a new trend. It pulls focus toward continuation and encourages early entries near breakout points.

This is why scalpers, who rely on quick moves, face the highest rate of scalping strategy fakeouts compared to longer-term traders.

But in fact, it is a trap.

The move lacks true momentum and the breakout fails, so the price snaps back into the previous range.

It means that what appeared to be strength turns out to be exhaustion. The structure breaks only to reverse and that reversal forms the core of the fakeout.

You must understand that a false breakout does not mark a trend beginning. It marks order collection. Once the reaction completes, the real direction often becomes clearer.

Fakeout vs Breakout: How to Tell the Difference Before Trading

Fakeout is basically one of the major types of Forex Breakouts. So, you must understand the difference between a real breakout and a false breakout.

| Aspect | Breakout | Fakeout |

| Price behavior | Holds and closes beyond the key level | Pierces level briefly, then reverses |

| Candle confirmation | Strong body closes past level | Wicks or reversal candles form quickly |

| Volume pattern | Volume builds and continues | Volume spikes, then fades |

| Retest behavior | Retest holds as support or resistance | Retest fails or never occurs |

| Market structure | Continues in trend direction | Returns to previous range |

| Trader response | Supports continuation setups | Triggers stops and traps entries |

It’s Important to Detect Fakeouts Before Entering

According to professional trading educators like BabyPips and Tradeciety, a real breakout needs three things:

- A strong and decisive close beyond the key level

- Noticeable increase in trading volume during the breakout

- A successful retest that confirms the level has flipped

So, if even one of these is missing, you should already begin to doubt the breakout’s strength. And if all three are absent, what you’re seeing is likely a fakeout. This risk is especially high in range-bound trading, where price often oscillates without follow-through, which is why many traders focus on predicting fakeouts to avoid costly traps.

Still unsure how that looks in real time? Let’s walk through a scenario.

You watch the price approach a clear resistance zone around 1.0930. It’s bounced off this level multiple times in the past. Now, it edges closer again. One candle finally pushes above. You see the breakout start.

But stop here. Look closer.

That breakout candle? It closes with a long wick on top. The body is small. Not a clean finish above the level. Next, volume? Still flat. No surge. Nothing abnormal. This means the move has no real backing.

The candle after that opens and quickly reverses. It drops below the level again. That’s a key clue: the breakout did not hold.

Still, you wait.

Soon, the price rises once more and touches the level again. But now, instead of powering through, it taps and drops. The market fails to hold above resistance, even after the second attempt.

Then you switch to the 1-hour chart.

Now it all makes sense.

That “breakout” is just a wick on the higher timeframe. Nobody is closed above. The higher timeframe shows you the full story — a rejection dressed as a breakout. This structure tells you everything:

- Weak close on the breakout

- Flat or fading volume

- Sharp rejection and return below the level

- Failed retest attempt

- Wick visible on the higher timeframe

That’s a textbook fakeout.

You must be able to spot it all together or else you won’t be able to protect yourself from getting trapped.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow to Trade Fakeouts in Forex?

Trade Setup 1: Wait for the Trap, Then Trade the Snap Back

Markets often push beyond a key level to grab liquidity. That push draws breakout traders in. But once liquidity fills, price snaps back. That’s your chance.

- Mark the key level — horizontal support or resistance where price reacted several times before.

- Watch the breakout candle — if it closes with a long wick, weak volume, or outside a pattern but fails to hold, stay alert.

- Look for confirmation — a fast rejection candle or bearish/bullish engulfing right after the breakout.

- Enter the opposite direction — only once price closes back inside the range.

- Set your stop loss — above or below the fakeout wick.

- Place take profit — around the opposite side of the range or use trailing logic.

For example, price breaks above a range at 1.1000, wicks to 1.1025, then closes back below 1.1000 on a bearish engulfing candle. You sell after the close below 1.1000. Stop loss above the wick. Take profit near 1.0950.

Trade Setup 2: Use Fakeouts as Entry Filters

Instead of entering, you simply watch for fakeouts to confirm the true trend direction. Yes, you only trade in the direction of the rejection.

- Let the fakeout play out — don’t enter during the breakout.

- Wait for price to re-enter the range — ideally with a full-bodied candle.

- Watch how it behaves near the original level — does it test and fail again?

- Enter in the direction of the rejection — after confirmation.

- Use volume and momentum indicators — MACD, RSI divergence, or volume spikes help add confidence.

Pro Tip: It is suggested to combine this with a trend bias. If the fakeout goes against the larger trend, your reversal trade has higher odds.

Trade Setup 3: Fade the Second Attempt

Sometimes, price fakes out once, comes back in, then tries to break again. If the second attempt fails too, that’s a strong reversal signal.

- Spot the first fakeout — mark the wick and the close back inside.

- Wait for the second breakout — watch for hesitation or exhaustion candles.

- Enter after the second failure — especially if the volume dries up or RSI diverges.

- Stop above/below the second wick — safe zone.

- Take profit at the middle of the range or swing low/high.

Market Insight: Some traders use the term “double top fakeout” or “stop hunt reversal” for this behavior. It shows market makers shaking out weak hands before the real move.

But How to Avoid Getting Trapped in Fakeouts?

According to institutional trading frameworks, a valid breakout usually presents three core elements:

- Clear build-up below resistance or above support

- Strong breakout candle with body closing past the level

- Follow-through with momentum or volume support

When any of those elements disappear, suspicion should rise.

Let’s walk through it step by step.

You need to start with the structure. Before price even touches the breakout zone, observe the candles. Are higher lows forming near resistance? Are lower highs squeezing toward support? That compression suggests energy building up. Breakouts that happen without such a build-up often lack conviction and fade quickly.

Next comes the breakout itself. A valid breakout candle should close well beyond the key level. If the body barely touches or wicks through the line without strength, it often signals hesitation — a trap in progress. Candles with small bodies, indecision shapes, or long upper/lower wicks often point toward a pending fakeout.

After the break, momentum must follow. Volume rising? Candles stretching in the same direction? Then continuation becomes likely. But if the next candle retraces inside the range, or if volume drops sharply, then the breakout often fails.

Still unsure? Picture this: price moves above resistance in the London session with a sharp spike. The candle closes strong. The next one opens but stalls. Then it prints a doji. A third one reverses fully inside the range. Volume falls. RSI diverges. That sequence points toward a fakeout. Those who entered early got trapped. Those who waited watched the failure unfold — then prepared to go the other way.

Just to be clear: you can avoid fakeouts, if build a habit to:

- Wait for confirmation after breakout. A pullback and successful retest validates strength.

- Use the higher timeframe bias. Breakouts against the trend fail more often.

- Watch volume behavior. Breakouts without strong volume rarely sustain.

- Set alerts instead of market orders. React with clarity instead of guessing.

Reddit traders often report fakeouts that triggered stops by a few pips before the price reversed fully. Many now wait for prices to close inside the range again before entering. In fact, it is recommended to how the next 1–2 candles behave after the breakout instead of rushing in on the first spike.

In short, every real breakout leaves a trail of clues. Every fakeout misses something. So, learn to wait, observe, and act only when the structure proves it. That’s how you stay on the right side of the trap.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountFinal Thoughts

See, trading a fakeout means responding to what happens after that false move. It does not mean you are trying to catch it while it is still forming. You wait for confirmation, let the trap trigger, and focus on how the market reacts once the false breakout fails. Only then, with clear structure and context, can you plan a valid entry.

Yes, you focus on the rejection, assess the volume, and observe the retest. That is what trading fakeouts really means. You do not chase them but simply listen to them.