In financial trading, a limit order allows investors to control the exact price at which a trade occurs. Unlike market orders, which execute immediately at the best available price, limit orders only execute at a specified price or better. This makes them useful for strategic entries, exits, and risk management. However, they carry the risk of non-execution, especially in fast-moving or illiquid markets. Understanding how limit orders work, including their role in the order book and strategic use cases, is key to effective trading.

While understanding Limit Order is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is a Limit Order?

A limit order is a specific instruction given to a brokerage firm to buy or sell a security at a predetermined price or better.

This means that the order will only be executed if the market price reaches the specified limit price or moves beyond it in a favorable direction for the trader.

For instance, a buy limit order will only execute at the set price or lower, while a sell limit order will only execute at the set price or higher. This pre-determined instruction allows investors to exert control over the execution price, rather than simply accepting the current market rate. Limit orders sit within broader forex order types, each designed to balance execution speed, precision, and risk differently.

What is a Buy Limit Orders?

A buy limit order allows investors to purchase a financial asset at a specified maximum price or lower. Traders use this type of order when they believe the current market price is too high and anticipate a pullback. By placing the limit below the current price, they aim to buy at a discount.

For example, if ABC stock is trading at $130, an investor might set a buy limit at $110.50. The order will execute only if the price drops to $110.50 or below. Similarly, if an S&P 500 ETF is priced at €327.10 and the investor expects a drop to €321.61, they can set a buy limit at that level to secure a more favorable entry.

What is a Sell Limit Order?

A sell limit order lets traders sell a security at a specified minimum price or higher. It’s typically placed above the current market price to lock in profits from anticipated price gains.

For example, a trader who bought Nvidia stock at $110.50 may place a sell limit at $138.10—a 25% increase. The order will execute only if the stock hits or exceeds that price. Similarly, an investor holding an S&P 500 ETF might set a sell limit at €400, allowing them to exit the position automatically if the target is met, without constant monitoring.

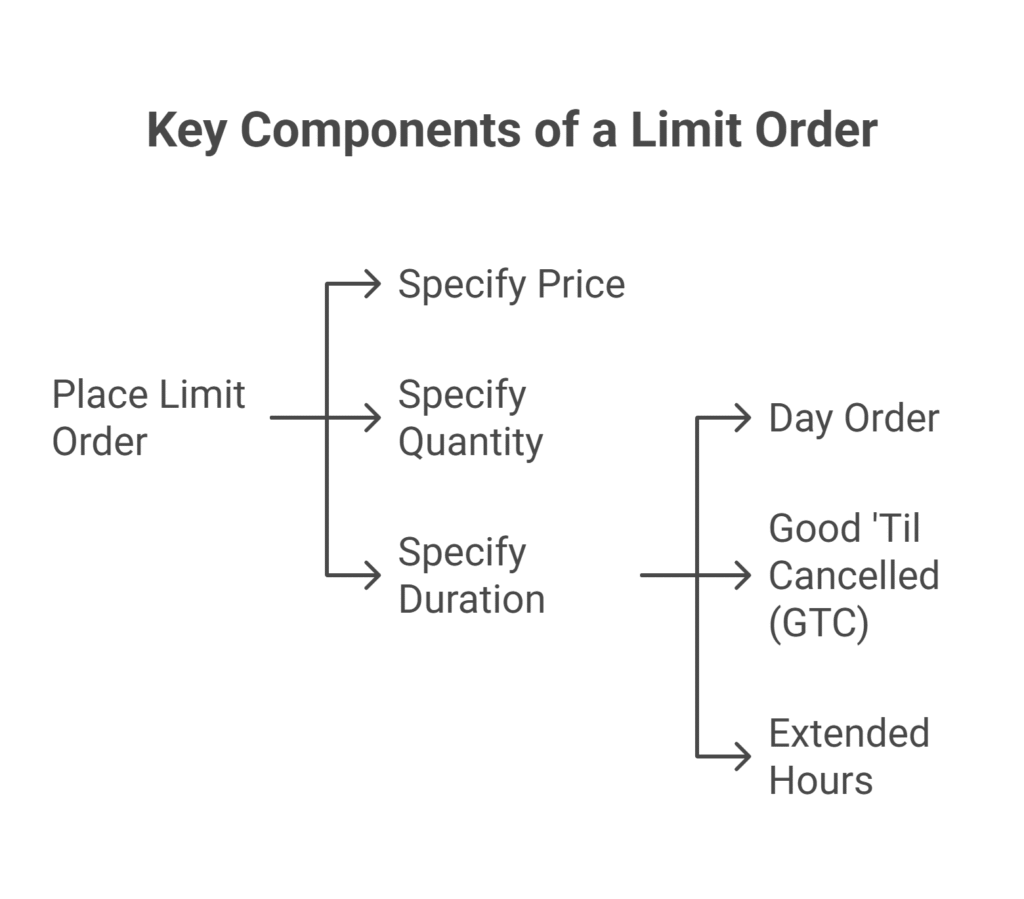

What are the Key Components of a Limit Order?

When an investor places a limit order, they must specify three critical parameters to guide the brokerage in its execution:

The Price is the most fundamental component, representing the exact price at which the order should be executed or at a more favorable rate. This precise instruction serves as the central condition that dictates whether and when the order will be filled. The

Quantity refers to the specific number of shares or units of the security the investor intends to trade. Careful consideration of this quantity is essential to ensure that the resulting trade aligns with the investor’s overall portfolio objectives and avoids unintended outcomes.

The Duration, also known as “Time in Force” (TIF), determines how long the limit order remains active in the market. Several common duration options are available:

- Day Order: This is the most common duration, meaning the order is valid only for the current trading day. If the order is not filled by the market’s close, it is automatically canceled.

- Good ‘Til Cancelled (GTC): A GTC order remains open and active until it is either fully executed, manually canceled by the investor, or reaches a predetermined expiration date set by the brokerage firm (e.g., up to 180 calendar days at Schwab).

- Extended Hours: Limit orders can also be placed for execution during pre-market (typically 7 a.m. to 9:25 a.m. ET) and after-hours (typically 4:05 p.m. to 8 p.m. ET) trading sessions. These can be specified as “Day + extended hours” or “GTC + extended hours.” Orders placed in these extended sessions generally expire at the end of that specific session if they remain unfilled.

The choice of duration is strategic. A Day order suits short-term trades, while a GTC order supports longer-term targets without constant monitoring. Extended hours allow reaction to off-hours news but may come with lower liquidity, affecting execution reliability.

How Limit Orders Interact with the Order Book and Market Depth?

Limit orders form the backbone of the order book—a real-time list of all buy (bid) and sell (ask) orders for a security, sorted by price levels.

The distribution of these orders defines market depth. A deep market—with many orders across various price points—indicates strong liquidity, meaning large trades can be absorbed with minimal price impact. In contrast, shallow depth increases the risk of price slippage from modest trades due to limited available volume. To understand this better, traders often review forex quotes explained since every limit order is ultimately executed against quoted bid and ask prices.

The order book is conceptually divided into two primary sides:

- Bid Side (Buy Orders): This section of the order book displays buy limit orders, representing the prices at which traders are willing to purchase the asset. These orders are typically arranged in descending order, with the highest bid price listed first. A noticeable cluster or “stack” of bids just below the current market price can serve as a strong indicator of potential support, suggesting robust buying interest at that level.

- Ask Side (Sell Orders): This side of the order book showcases sell limit orders, indicating the prices at which traders are willing to sell the asset. These orders are generally arranged in ascending order, with the lowest ask price listed first. A significant concentration or “thick wall” of asks positioned above the current market price can signal a critical resistance level, implying substantial selling pressure at that point.

Beyond execution, the order book is a strategic tool. Traders analyze its structure to gauge sentiment, identify support/resistance, and anticipate price moves. Institutional players watch order depth to assess liquidity, spot hidden activity (like iceberg orders), and detect manipulation tactics such as spoofing.

Monitoring changes in order flow can also reveal accumulation or distribution by large players—helping inform more accurate and timely trade decisions.

When and How Limit Orders are Filled?

Once placed, a limit order enters the exchange’s order book and waits for the market price to reach the specified limit. A buy limit executes when the price falls to or below the limit; a sell limit executes when the price rises to or above it.

Orders are filled on a first-come, first-served basis at each price level. If other orders are ahead in the queue or if there’s not enough volume, the order may be partially filled or remain unfilled.

Importantly, execution is not guaranteed. If the market never hits the limit price or lacks sufficient counter-liquidity, the order stays open until it’s filled, canceled, or expires. This is common with large trades or in illiquid markets, where limited volume can prevent full execution—even if the price is touched.

Thus, effective use of limit orders requires more than just price targeting. Traders must also consider market depth and liquidity conditions to avoid missed opportunities.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesComparison of Limit Order with Other Order Types

Limit Order vs. Market Order

The decision between utilizing a limit order and a market order is a foundational choice for investors, representing a critical trade-off between achieving precise price control and ensuring immediate execution speed.

Market Orders prioritize speed. They instruct a broker to buy or sell immediately at the best available price, making them ideal for liquid markets where quick execution matters more than exact pricing. However, this comes with slippage risk, especially in volatile or after-hours sessions, where the final execution price may differ from the quote.

Limit Orders prioritize price control. They execute only at a specified price or better, ensuring a minimum sale or maximum purchase price. While they reduce slippage, they also carry the risk of non-execution if the market doesn’t reach the target price—particularly in fast or illiquid markets.

The trade-off between these order types centers on the “cost of certainty”:

- Market orders offer execution certainty but at the potential cost of unfavorable pricing.

- Limit orders offer price certainty but may miss trading opportunities altogether.

Choosing between them requires assessing market conditions, trade urgency, and tolerance for price risk. For new traders, mastering limit orders forms part of beginner forex orders, since execution style is often the first practical step in building discipline.

| Aspect | Limit Orders | Market Orders |

| Focus | Price precision | Speed and immediacy |

| Execution Condition | Only at the specified price or better | At the current market price |

| Risk of Non-Execution | High if target price not reached | Low, usually executed immediately |

| Best For | Volatile or thinly traded assets | Large-cap stocks and quick trades |

| Control Over Price | High | Low |

| Speed | Slower (conditional execution) | Immediate |

| Slippage | No slippage to detriment | Prone to slippage |

| Suitability | Active traders, strategic entry/exit | Long-term investors, quick position entry/exit |

| After-Hours Trading | Allowed (often queued for processing) | Risky due to lower volume/higher volatility (avoided by experienced investors) |

Limit Orders vs. Stop Orders

While both limit orders and stop orders serve as instructions to trade securities, they are fundamentally designed to achieve distinct objectives in a trader’s strategy.

Limit Orders are designed to execute trades only at a specified price or better, giving traders control over entry or exit levels. They prevent negative slippage but do not guarantee execution if the market doesn’t reach the target price.

Stop Orders, or stop-loss orders, are triggered when a security hits a predefined stop price—after which they convert into market orders. This ensures execution but not the exact price, exposing the trade to potential slippage, especially in volatile markets.

In essence:

- Limit Order = Guarantees price, not execution.

- Stop Order = Guarantees execution, not price.

Traders use limit orders when they prioritize price precision and are willing to wait. Stop orders are used to manage risk—automatically exiting positions to cap losses or protect gains. However, stop orders can be triggered prematurely by brief price spikes or targeted by algorithms, leading to unintended exits.

Choosing between these order types reflects a trader’s risk tolerance, strategy, and emotional discipline in managing market fluctuations.

The Hybrid: Understanding Stop-Limit Orders

A stop-limit order combines elements of a stop order and a limit order. It requires two prices:

- Stop Price: The trigger point that activates the order.

- Limit Price: The lowest (for sell) or highest (for buy) price at which the trade can be executed.

When the market hits the stop price, the order turns into a limit order. It will only execute at the limit price or better—offering price protection and reducing slippage risk compared to a standard stop order.

However, execution is not guaranteed. If the market quickly moves beyond the limit price after the stop is triggered, the order may remain unfilled.

Example:

A trader holding a stock at $18.50 sets a sell stop-limit order with a stop at $15.20 and a limit at $14.10. If the price falls to $15.20, the order activates, but it will only sell at $14.10 or higher. If the price drops too fast, the order might never execute—leaving the position exposed.

Stop-limit orders offer more control than stop orders, but also carry the risk of non-execution in fast-moving markets.

Advantages and Disadvantages of Limit Orders

Advantages

- Precision and Price Control: Limit orders let traders define exact entry or exit prices, ensuring transactions only execute at the set level or better. This prevents overpaying (buys) or underselling (sells) and supports disciplined, strategy-aligned trading—especially in volatile markets.

- Risk Management and Emotional Discipline: By predefining trade parameters, limit orders help manage downside risk and reduce impulsive decisions driven by fear or greed. They are especially useful when traders need to manage leverage with limit order precision, ensuring leveraged positions do not spiral into oversized losses. Traders can lock in profits or limit losses with minimal emotional interference.

- Automation and After-Hours Flexibility: Limit orders work automatically once placed, removing the need for constant market monitoring. They can also be set for pre-market or after-hours sessions, offering more flexibility and allowing responses to news outside regular trading hours.

Disadvantages

- Risk of Non-Execution and Missed Opportunities: Limit orders may remain unfilled if the market never reaches the specified price. This can lead to missed opportunities, especially if the price nearly touches the limit but reverses. Traders may get caught in a cycle of adjusting orders and chasing the market, undermining discipline.

- Issues in Volatile or Illiquid Markets: In fast-moving markets, price may briefly touch the limit without enough time or liquidity for full execution, resulting in partial fills or no fills at all. Illiquid assets—with wide spreads and limited volume—amplify this risk, making limit orders harder to execute even if the price technically qualifies.

- Broker Fees and Expiration Concerns: Some brokers charge more for limit orders, which can add up for active traders. Additionally, limit orders expire—either at the end of the day (Day orders) or after a set period (e.g., 180 days for GTC orders). Traders must monitor and refresh these orders to avoid unintentional lapses or missed opportunities.

Strategic Applications and Best Practices

Using Limit Orders in Volatile and Illiquid Markets

Limit orders are essential in volatile or thinly traded markets where price swings and wide bid-ask spreads can lead to unfavorable fills. By setting exact execution prices:

- Traders avoid slippage and retain control.

- In illiquid assets, limit orders prevent large portions of trades from executing at worse prices.

- A common tactic is to set buy limits just above the bid or sell limits just below the ask to balance fill probability and price protection.

Targeting Support and Resistance Levels

Placing limit orders at support (buy) or resistance (sell) levels helps you enter long positions near likely rebounds and exit at anticipated reversals. Proper sizing also ties directly into margin usage, since each unfilled or partially filled order still interacts with available margin.:

- Enter long positions near likely price rebounds.

- Exit positions at anticipated reversal points.

These levels are often visible through order book analysis, where bid clusters indicate support and large sell walls signal resistance.

Integration with Advanced Trading Strategies

Limit orders are critical in various strategies:

- Scalping & HFT: Enable precise, rapid trades exploiting small price moves.

- Swing Trading: Pre-set entry/exit points to automate trades over days/weeks.

- Bracket Orders (OCO): Combine a limit and stop order to manage risk and lock in profits. One cancels the other once filled.

- Fade Strategies: Use opposing limit orders around the current price to catch reversals.

- Breakout/Fade Combos: Combine limit and stop orders to profit from both trends and reversals.

Effective use involves:

- Planning entries, exits, and stops.

- Estimating trade duration.

- Aligning chart patterns across timeframes.

These practices help automate execution, manage risk, and reduce the need for constant screen monitoring.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Limit orders give traders precise control over execution price, making them essential for strategic entries and exits—especially when price certainty outweighs speed. While this control helps avoid unfavorable fills, it carries the risk of non-execution if market conditions don’t meet the specified price.

A deep understanding of market depth, order book dynamics, and liquidity improves placement accuracy and increases execution probability. Limit orders also reinforce disciplined trading by minimizing impulsive decisions and supporting pre-planned strategies.