How do you catch a trend without chasing it? What tells you when to stay in a move—and exactly where to stop? What if the chart could guide you through momentum shifts without guesswork? Yes, that’s possible—thanks to Parabolic SAR.

Parabolic SAR is a trend indicator built to track price and flip direction—dot by dot. It follows momentum. It signals exits. It helps you act without delay. Traders who know how it works use it to ride moves with control, not emotion.

So, let’s break down what Parabolic SAR is, how it stops and reverses, and where it fits in your strategy.

While understanding Parabolic SAR is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is Parabolic SAR in Forex?

Parabolic SAR is a chart indicator that helps spot the direction of a trend. It places small dots either above or below each candlestick.

Basically, when a dot appears below the price, it usually means the market is in an uptrend. On the other hand, a dot above the price often signals a downtrend. This makes it easy to see which side is in control—buyers or sellers.

In fact, “SAR” stands for Stop and Reverse. That name shows how it works. Once the price starts moving in the opposite direction, the dots flip to the other side of the chart. This shift can act as an early sign that the trend may be changing.

Traders often use Parabolic SAR to decide when to enter or exit a trade. Because the way the dots move helps keep up with momentum and avoid staying in the wrong direction too long.

The Parabolic SAR Formula

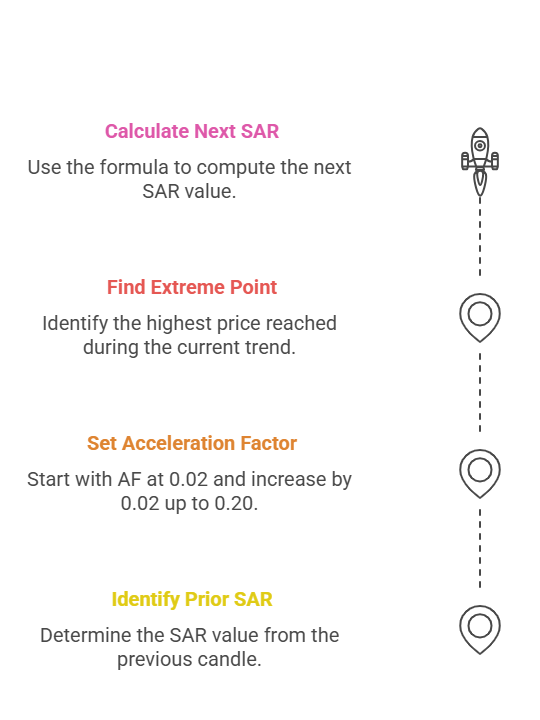

Parabolic SAR uses a simple formula that adjusts as the trend develops. Here’s how the basic calculation works during an uptrend:

SAR = Prior SAR + AF × (EP – Prior SAR)

Each part of the formula plays a role:

- SAR stands for the next value that will appear on the chart.

- Prior SAR is the SAR value from the previous candle.

- AF is the acceleration factor. It usually starts at 0.02 and increases in steps of 0.02, up to a maximum of 0.20.

- EP is the extreme point. This is the highest price reached during the current trend.

In a downtrend, the formula stays the same, but it uses the lowest price as the extreme point.

The acceleration factor increases each time a new high (or low) is reached. See, this is exactly what pushes the SAR value closer to the price. As a result, the dots follow the trend more tightly when momentum picks up.

How Parabolic SAR Works on Price Charts?

Parabolic SAR places dots that follow the price. Each dot shows potential momentum and direction.

In an uptrend, dots stay below the candles. Take EUR/USD as an example. During a strong upward move, each new dot forms just under the price. That signals buying strength. Once a reversal begins, the dot flips above the candle. That shift marks possible weakness.

In a downtrend, dots appear above the price. Consider GBP/USD during a falling trend. Dots form over each candle. That signals continued pressure from sellers. A reversal triggers a dot flip below the price, which shows a potential trend change.

Shorter timeframes, such as 5-minute or 15-minute charts, produce quicker dot changes. That often results in more signals. Longer timeframes, like daily or weekly, give fewer flips but stronger confirmation.

The flip between dots above and below helps traders spot entries and exits. A flip above the price may suggest closing a long position. A flip below often acts as a trigger to end a short position or open a long.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow to Read Parabolic SAR Signals for Entry and Exit?

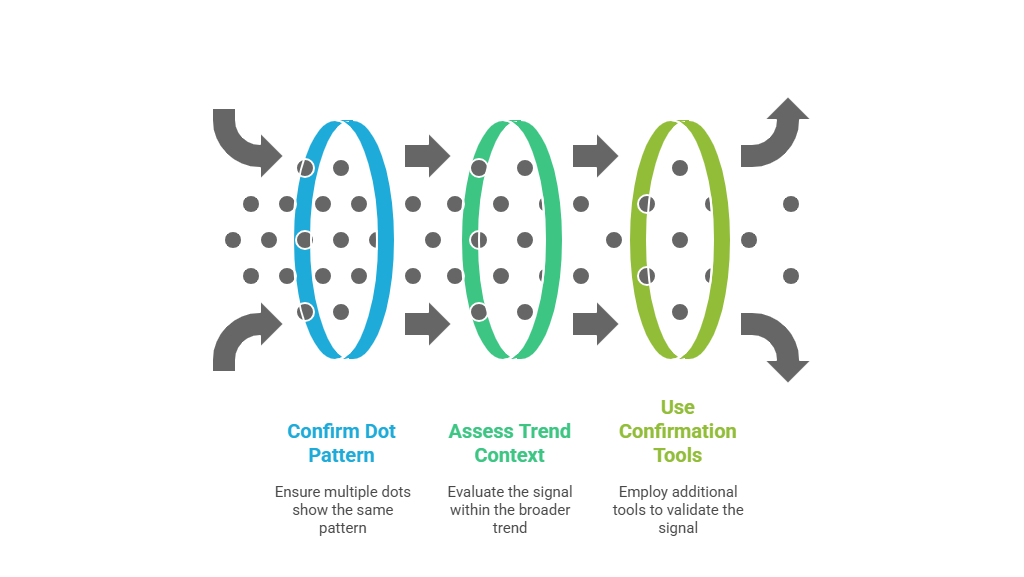

You need to understand that Parabolic SAR signals are not standalone decisions. Reading them correctly means looking at more than just the dot’s position. So, you need to focus on how those dots interact with price momentum, recent candles, and key levels on the chart.

It’s best to start with the basics. A dot below price hints at upward momentum. A dot above suggests the trend may be turning downward. But one signal alone isn’t strong enough. You need confirmation.

Here’s how you guide your eye:

- Check if multiple dots follow the same pattern. Two or more dots flipping positions near a resistance or support level mean more than one.

- Zoom out and see the bigger trend. A Parabolic SAR dot that flips during an uptrend pullback may be a false signal. A flip at a swing high after a long climb adds more weight.

- Use tools that confirm price pressure. Think RSI crossing 50, a long-wick reversal candle, or price breaking a moving average. That’s where SAR becomes valuable.

Now just suppose that you’re inside a trade. You follow the SAR dots with your trailing stop. They climb beneath the price in a long trade. Once they flip, you exit. Simple visual logic—used with precision.

The key is to grasp how parabolic SAR behave as the market shifts. Learn that pattern, and entry/exit signals stop feeling random. Only then it will become part of your trading rhythm.

Best Parabolic SAR Settings for Different Trading Styles

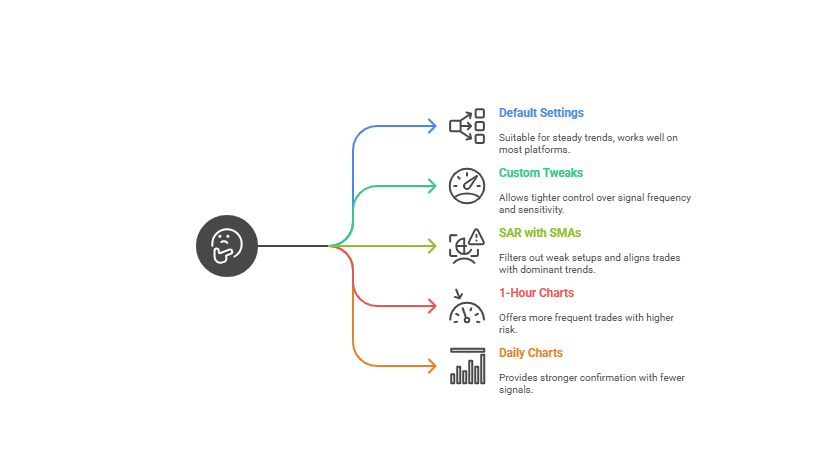

Default Settings vs Custom Tweaks

Most charting platforms use the default SAR settings of AF = 0.02 and Max AF = 0.20. That works well in steady trends. However, different strategies demand different tweaks.

Scalpers and intraday traders may prefer AF = 0.01 to slow the dots and reduce false flips. Swing traders often raise the max AF toward 0.30 to lock in gains faster in high-momentum moves.

The right setting depends on volatility, asset type, and timeframe. So, if you customize it right, it gives you tighter control over signal frequency and sensitivity.

SAR 0.01 0.01 Strategy with 100 and 200 SMA

Pairing SAR (0.01, 0.01) with 100 and 200 SMAs adds structure. Traders use this setup to avoid choppy whipsaws in sideways markets.

The idea is simple:

- Only take SAR buy signals when price stays above both SMAs.

- Only take SAR sell signals when price stays below both SMAs.

The SAR gives your entry. The SMAs confirm direction. Rest assured that this combo filters out weak setups and keeps trades aligned with dominant trends. On major forex pairs, this strategy shines on 1-hour or 4-hour charts.

SAR on 1-Hour vs Daily Charts

Short-term charts like 1-hour show more frequent dot changes. That creates opportunities for multiple entries but increases noise. Best used by experienced intraday traders with clear stop-loss rules.

Daily charts, on the other hand, offer cleaner SAR flips. Each dot holds more weight. Traders use them to trail swing trades or spot early trend reversals in pairs like EUR/USD or GBP/JPY.

Here’s how to think about it:

- Fast charts = more trades, more risk.

- Slow charts = fewer signals, stronger confirmation.

Remember that each timeframe demands a different mindset. SAR adapts to both, but your discipline must match the chart speed.

When to Trust Parabolic SAR in Trending vs Sideways Markets?

Traders often rely on indicators for clarity. The Parabolic SAR offers that—but only under the right conditions. Your timing, your trade direction, and even your exit plan depend on understanding market structure first.

So, how do you know the difference?

How Parabolic SAR Works Best (In Trending Markets)

In a trending market, price flows clearly in one direction—up or down. Imagine EUR/USD climbing from 1.0800 to 1.1000 over two days with higher highs and higher lows. The SAR dots trail neatly below the candles, confirming bullish control.

In this case, every dot shift gives meaningful signals:

- A flip from above to below? Entry point for a long trade.

- Dots climbing in sync with price? Signal to trail your stop-loss.

The dots won’t reverse often, and you can let profits run. The cleaner the trend, the more reliable the SAR becomes.

How Parabolic SAR Misleads (In Sideways Markets)

Now suppose that USD/JPY stuck between 147.00 and 147.80 for an entire day. No clear higher highs or breakdowns. The price moves back and forth like a ping-pong match.

In this flat structure, SAR flips often and prematurely:

- A bullish flip may trigger at 147.40, only for price to fall back.

- A bearish flip at 147.20 reverses the next candle.

Every flip costs time, spreads, and often losses. See, this happens because SAR has no filter for trend strength—it simply reacts to price action.

Key Difference to Spot Before Trading

You need to look at the distance between price and SAR dots:

- In trending markets, that gap widens steadily, showing momentum.

- In sideways markets, dots hug price bars or shift rapidly, creating noise.

Also, apply a 50-period moving average. If the price dances above and below it, expect sideways conditions. If price respects the MA slope, SAR becomes more trustworthy.

Pro Tip: Confirm before you commit. You should use a confirming tool:

- The ADX (Average Directional Index) above 25 signals trend strength.

- Volume spikes during a move suggest conviction behind the trend.

Just make sure that these align with the SAR. Only then entry will be backed by context, not just dots.

How to Use Parabolic SAR in Real Trades?

In order to apply Parabolic SAR in real trades, you first need a clear structure.

The indicator works best after price breaks out of a defined range. Imagine GBP/USD moving sideways around 1.2700. After several candles of indecision, a strong bullish candle closes above resistance. That breakout marks a shift. On the next candle, the first SAR dot appears below the price. That dot confirms upward bias.

Instead of reacting instantly, smart traders confirm this setup. The 50-period moving average should slope upward. RSI should cross above 50. Volume should expand on the breakout. When those conditions align, the SAR dot becomes a trigger—not just a signal.

The entry point often sits just above the breakout candle. A stop-loss fits below the last swing low or below the range base. This setup offers a defined risk and a trend-backed entry. Now the trade begins.

From here, Parabolic SAR becomes a trailing tool. Each new dot forms slightly higher than the last, creating a staircase that follows the price. That staircase acts like an automatic stop-loss. As long as the price climbs and the dots remain underneath, the position stays open. The moment a dot appears above price, the trade closes. It’s visual, mechanical, and simple to manage. This trailing method suits volatile pairs like EUR/JPY or gold, where sharp reversals happen fast.

Now consider the opposite—a short trade. USD/CAD rallies into 1.3700, prints a bearish engulfing candle, and begins to fade. The next candle opens, and a SAR dot forms above the price. That dot suggests a possible shift in control. But alone, it’s not enough. The setup improves if MACD lines cross down, ADX rises above 25, and the price breaks a swing low. Now there’s alignment. You enter below the bearish candle and place a stop above the high. SAR dots above the price guide your stop downward, adjusting each time a new dot prints lower.

In both long and short trades, SAR doesn’t work as a prediction tool—it works as a structure tool. It builds discipline. Once the trade activates, you follow the dots. You don’t chase. You don’t guess. You manage.

That’s the real value of Parabolic SAR. Not just signals—but structure, consistency, and clarity in the heat of the market.

Parabolic SAR VS the Parabolic Arc Pattern

Parabolic SAR plots live signals. The arc pattern reflects price psychology. Both appear in strong trends, but each tells a different story. SAR shows where price may flip. The arc shows how markets behave in bubbles. You deal with timing in SAR. You deal with emotion in arcs. Knowing both can stop wrong trades. The difference matters more when price runs high or crashes fast.

| Parabolic SAR | Parabolic Arc Pattern |

| Technical indicator; places dots above/below price | Chart pattern; shows a curved rise and sharp fall |

| Calculates entries, exits, and trailing stops | Reflects market psychology and momentum extremes |

| Best used on short to mid-term charts | Typically appears on longer trend formations |

| Gives constant signals regardless of context | Forms during speculative bubbles or euphoric rallies |

| Helps automate strategy with consistent logic | Used to anticipate full trend exhaustion |

| Works well with moving averages and trend filters | Often confirmed through volume spikes and sentiment |

| Suitable for trend-following strategies | Used to spot reversal zones and reduce late entries |

Best Indicators to Combine with Parabolic SAR

You can’t trust Parabolic SAR alone in every market. The dots follow price but ignore strength, direction, or traps. That’s why smart traders combine SAR with other tools.

Start with Moving Averages. Use a 50 or 200-period SMA. The moving average acts like a filter. If price stays above the SMA, focus on long setups only. Below it? Look for short trades. This clears the noise. It also stops you from trading every SAR flip blindly. Price and SAR may flip together, but SMA shows if the move agrees with the broader trend.

Now bring in RSI (Relative Strength Index). RSI reads between 0 and 100. A reading between 40 and 60 shows a stable market. Above 70, the market is overheated. Below 30, it’s undervalued. Don’t use RSI for reversal calls. Use it to measure power. If RSI rises while SAR dots shift below price, you have trend strength. If SAR flips but RSI stays flat, step back. The market lacks conviction.

Add ADX (Average Directional Index) to measure trend force. ADX above 25 shows a real trend. Below 20 means sideways. ADX works well with SAR because it doesn’t care about direction. It shows how strong the trend is. A SAR signal with rising ADX tells you the move is worth following. A SAR flip with weak ADX warns you to skip the trade. Some traders also compare SAR vs Ichimoku since the cloud adds context for trend direction and support/resistance, enhancing entry and exit precision.

Next, use candlestick confirmation. Look at the candle where SAR flips. A strong bullish candle with a long body and no upper wick supports a long setup. A doji or inside bar weakens the case. Candles add the final layer. You see the sentiment behind the signal. You also get better stop-loss placement from the candle body or wick.

For example, combine SAR, 50 SMA, RSI, and ADX like this:

- Price above 50 SMA

- SAR dots flip below price

- RSI near 55 and rising

- ADX above 25

- Bullish engulfing candle or break above range

That’s a strong entry. Everything aligns. Each tool confirms a different element—trend direction, strength, and momentum.

Keep in mind that the goal is not to complicate your screen. The goal is to reduce false signals. SAR gives you timing. The rest tell you whether to trust the move.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountFinal Thoughts

Parabolic SAR offers speed, structure, and clarity. It performs best in strong trends, where price moves cleanly in one direction. Traders use it to trail stops, confirm momentum, and reduce guesswork. The visual dot system makes decision-making faster, especially in fast-moving markets. It also works well with tools like RSI, ADX, and moving averages, giving traders a complete view.

But it comes with limits. In sideways markets, SAR flips too often. It reacts late to sharp reversals. Without confirmation, it leads to poor entries or exits. The tool focuses only on price movement—not strength or context. That’s why it works best as a part of a system, not on its own.

In short, SAR rewards discipline and trend-following. Add the right filters, and it becomes a sharp asset in your strategy.