Forex Prop firms give skilled forex traders access to significant capital, advanced tools, and performance-based payouts. The best prop firms combine fair profit splits, clear rules, and reliable funding to help traders scale quickly. This guide ranks top firms so you can choose the right partner for your trading goals.

While understanding Forex Prop Firms is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- Prop firms fund skilled traders in exchange for a profit split.

- Profit splits range from 70% to 95%, depending on the firm.

- Evaluations test consistency through single or multi-phase challenges.

- Scaling plans can grow accounts to $4 million or more.

- Strict risk rules include drawdown and daily loss limits.

- Choosing the right firm depends on your strategy and goals.

8 Top Prop Firms in 2026

Top prop firms offer high payouts, fast funding, and flexible rules. Many traders fail due to strict guidelines and slow withdrawals. The right firm increases your success. Which firms lead in 2026?

- FTMO – Highest Payouts: Traders receive up to 90% profit share. The firm scales accounts to $400,000 (FTMO, 2024). A two-phase challenge tests consistency but refunds fees after passing. Withdrawals process in 14 days.

- The Funded Trader – Large Capital: Funding reaches $600,000, with weekly payouts and 90% profit share (The Funded Trader, 2024). A single-step challenge helps more traders qualify.

- SurgeTrader – Fastest Funding: Evaluation requires only one phase, which allows traders to start within 24 hours (SurgeTrader, 2024). Profit share reaches 90%, and capital goes up to $1 million.

- True Forex Funds – Quick Payouts: Withdrawals process in less than 24 hours, faster than most firms (TrustPilot, 2024). Traders receive 80% profit share, and a one-step evaluation offers flexibility.

- Maverick Currencies – Professional Traders: Unlike demo-based firms, Maverick provides real capital and structured mentorship (Maverick Currencies, 2024). Profit share reaches 70%, with options for scaling accounts.

- E8 Funding – Simple Challenges: A one-step challenge with an 8% profittarget helps traders pass quickly (E8 Funding, 2024). Withdrawals occur every 14 days, and funding reaches $250,000.

- The 5%ers – Instant Funding: Traders skip evaluations and receive funds immediately (The 5%ers, 2024). Capital scales to $4 million, with a 70% profit share.

- AquaFunded – Highest Profit Shares: Profit share goes up to 95%, the highest in the industry (AquaFunded, 2024). Bi-weekly payouts and 8% profit targets offer an easier path to funding.

What is a Forex prop firm?

A forex prop firm is a company that provides traders with capital to trade the forex market in exchange for a share of profits. It enables skilled traders without enough personal funds to trade larger positions without risking their own capital, offering a path to scale and earn. By contrast, choosing a forex broker means you trade with your own deposit, making prop firms a distinctive alternative funding route.

Prop firms require traders to pass an evaluation to prove their strategy is consistent and profitable. Successful traders gain access to a funded account, professional resources, and structured career growth through scaling plans. Some firms offer profit splits of up to 95%.

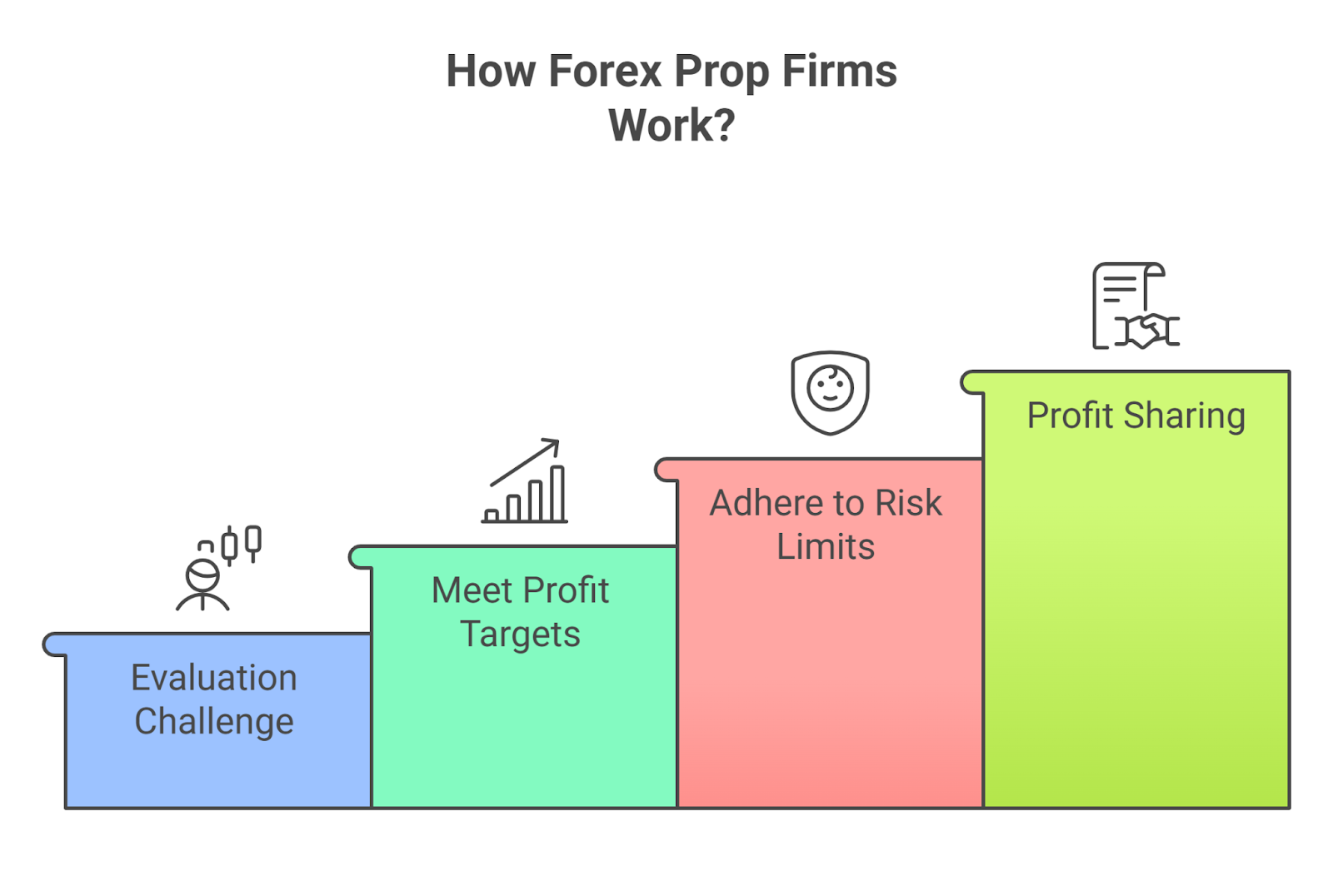

How do Forex prop firms work?

Forex prop firms work by testing traders through an evaluation challenge, funding those who meet profit targets within strict risk limits, and sharing profits based on agreed splits. Risk rules often include maximum daily loss and total drawdown limits to ensure consistent and controlled trading performance.

Successful completion grants access to a funded account, where the trader keeps a majority of the profits. These firms enforce strict rules on all funded accounts; breaking these rules results in disqualification. Consistent performance can lead to higher capital allocations through scaling plans, with some firms allowing traders to manage accounts worth over $1 million.

What are the key factors when choosing a prop firm?

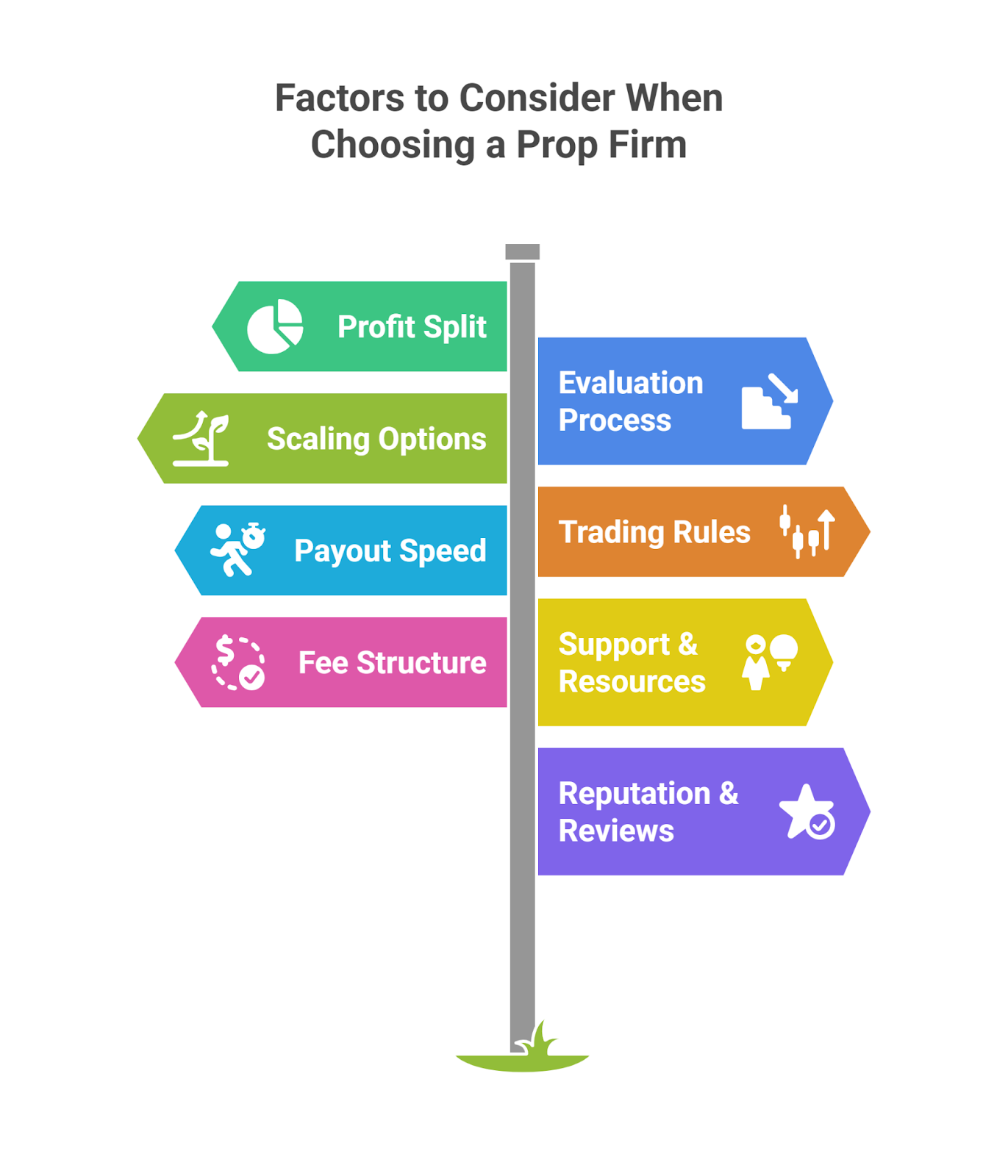

The key factors when choosing a forex prop firm include profit split percentage, evaluation difficulty, scaling plans, trading instruments offered, platform options, risk rules, and payout frequency.

Matching these factors to your trading style ensures you can perform effectively and grow within the firm’s structure.

- Profit Split: This is the percentage of trading profits a firm pays to the trader. Top firms like AquaFunded offer payouts of up to 95%.

- Evaluation Process: The evaluation affects your ability to secure funding. Some firms use a two-phase challenge, while single-phase evaluations can increase success rates by up to 35%.

- Scaling Options: These plans allow you to grow your capital. Many firms, such as

The Funded Trader allows accounts to scale to over $600,000 after reaching profit targets. - Trading Rules: These rules impact your strategic flexibility. Some firms ban news trading or scalping, while others like

FundingPips allows them. - Payout Speed: This determines how quickly you receive your earnings.

True Forex Funds processes withdrawals in under 24 hours, which is much faster than the industry standard. - Support & Resources: Some firms provide mentorship and educational resources, which can improve trading performance by up to 40%.

- Fee Structure: Evaluation fees typically range from $100 to $1,000. Around 60% of traders prefer firms that offer refundable challenge fees upon passing.

- Reputation & Reviews: A firm’s credibility is confirmed by its reputation. Firms with a TrustPilot rating of 4.5 stars or higher retain 80% of their traders.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesBest Forex Prop Firms in 2026— Comparison

The best forex prop firms in 2026 stand out for competitive payout structures, fast funding, and flexible trading rules. Leading firms excel in areas like high profit splits, quick evaluations, or diverse market access. The comparison table below highlights each firm’s strengths, making it easier to match a firm to your trading goals.

| Firm Name | Profit Split | Max Funding | Evaluation Type | Payout Speed | Best For |

| FTMO | 90% | $400,000 | 2-phase, refundable fee | 14 days | Consistent traders seeking high splits |

| The Funded Trader | 90% | $600,000 | Single-phase | Weekly | Fast scaling with big capital |

| SurgeTrader | 90% | $1,000,000 | Single-phase | Within 24h | Quick funding access |

| True Forex Funds | 80% | $200,000 | Single-phase | <24h | Fast, reliable payouts |

| Maverick Currencies | 70% | $300,000 | Real capital, no demo | Bi-weekly | Professional traders & mentorship |

| E8 Funding | 80% | $250,000 | 2-phase, 8% target | 14 days | Beginners needing simple targets |

| The 5%ers | 70% | $4,000,000 | Instant funding | Bi-weekly | Traders wanting no evaluation |

| AquaFunded | 95% | $200,000 | 1-phase, 8% target | Bi-weekly | Traders maximizing earnings |

How do you pass a prop firm evaluation?

Success in a prop firm evaluation depends on a disciplined, strategic approach. FTMO reports that only 10% of traders pass on their first attempt. Here are the steps to improve your chances:

- Create a tested trading plan. Use a strategy that has been validated with backtesting and has clear, non-negotiable rules for entry and exit.

- Follow all firm rules. Carefully read and adhere to all guidelines on maximum drawdown, daily loss limits, and leverage.

- Risk only 1-2% per trade. Professional traders maintain small position sizes to ensure that no single loss can derail their challenge.

- Focus on steady profits. Prop firms prefer consistent, stable returns over large, volatile gains. Aim for gradual growth.

- Maintain emotional control. Avoid revenge trading after a loss. If you feel stressed, take a break to reset your focus.

- Manage trades effectively. Use stop-loss orders to protect your capital and consider taking partial profits to secure gains.

What are the risks of prop trading?

The risks of prop trading include losing the firm’s funded account due to breaching risk limits, paying non-refundable evaluation fees, and facing strict trading rules that limit strategy flexibility. Traders may also experience performance pressure, inconsistent payouts, or termination if targets are not consistently met.

| Risk/Challenge | Description & Impact | Solution |

| Strict Trading Rules | Firms enforce rules on drawdowns (e.g., 5% daily loss) and leverage. Violations lead to immediate disqualification. | Read and follow all firm guidelines meticulously. |

| High Evaluation Costs | Most firms charge $100 to $1,000 per challenge. Traders who fail multiple times can lose over $2,000 in fees. | Perfect your strategy on a demo account before paying for a challenge. |

| Emotional Trading | The pressure to pass can trigger impulsive decisions and revenge trading, increasing the risk of failure. | Stick to a disciplined, pre-defined trading plan without deviation. |

| Market Volatility | Unexpected price swings can cause you to hit drawdown limits even with a good strategy. | Always use stop-loss orders and avoid trading around major news events. |

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

Forex prop firms provide skilled traders with access to large capital, but success is entirely dependent on discipline, strategy, and risk control. According to data from MyFXBook, traders who passed evaluations and consistently maintained less than 2% risk per trade achieved an average account growth of 18% per quarter in 2024. Choosing a firm with rules that match your trading style is the critical first step toward achieving these results.