SMT divergence gives you a tool to see behind price symmetry. In forex, it compares two correlated pairs—like EUR/USD and GBP/USD. One makes a new high or low. The other fails. That mismatch signals imbalance. It shows where liquidity flows and where it dries up.

But surface divergence is only step one. The real confirmation comes from slope analysis as slope shows momentum. Steep slopes reflect urgency. Shallow slopes reflect hesitation. Two assets may diverge—but only the slope reveals who drives price and who reacts late.

So you must ask:

- Which slope leads the structure?

- Where does pressure build or decay?

- What slope confirms real intent?

So, let’s discuss in detail what do the slopes mean in SMT divergence. So, it is clear for you to understand: how slopes reveal strength, timing, and risk inside every SMT setup.

While understanding Slopes in SMT Divergences is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

What is SMT Divergence in Forex Trading?

SMT divergence stands for Smart Money Technique divergence. You spot it when two highly correlated assets stop moving together. One makes a new high or low. The other fails. That disagreement signals something deeper.

Institutional traders typically create this pattern. Basically, it marks the difference between real strength and manufactured price moves. Many call it a sign of manipulation. But smart traders leverage it as a clue.

So, you may compare EUR/USD with GBP/USD. If EUR/USD forms a higher high and GBP/USD does not, SMT divergence has appeared. That moment tells you buyers may lose control. Price may reverse or pause.

It is worth noting that Forex traders prefer SMT Divergences because of how clean it looks on lower timeframes. M1 to M15 charts reveal clear SMT shifts—often before retail indicators react. You gain early insight into potential turning points.

In short, Smart Money Techniques give retail traders an edge whereas the divergence helps you see who is really in control. The price slope, structure, and divergence confirm where big players act.

Now, ready to see how slopes make it all clear?

Slopes Reveal Real Momentum Behind SMT Divergence

SMT divergence signals price disagreement between two correlated assets. But the slope between key highs or lows reveals the force behind the move.

A sharp upward slope on one asset means buyers acted with urgency. A flatter slope on the second shows weaker follow-through. See, this mismatch uncovers the imbalance. It tells you where smart money may be exiting or hesitating. SMT slope analysis is often grouped under broader Forex indicators since it adds confluence to traditional momentum and divergence studies.

You can’t rely on price structure alone. Two assets might both show higher highs. But if one does it fast and steep while the other grinds slowly, momentum is not equal. The slope shows who leads and who lags. That difference often predicts the real move.

Flux Charts explains that in bullish SMT divergence, the leading index forms a higher low. But the trailing one breaks its prior low. If that breakdown is slow, and the leading asset slopes upward fast, you get confirmation of strong buying underneath.

Steep slopes carry conviction. Shallow ones suggest hesitation or fakeouts.

So, we can clearly state that in SMT setups, slope analysis helps confirm who controls the move—and who gets left behind.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhat the Slopes Show in Bullish SMT Divergence?

When you find a bullish SMT divergence, spotting the higher low and lower low is just the first step. That’s the surface. Skilled traders go further.

You need to look at the slope. Why? Because the slope reveals the intent behind the price move.

Here’s what you need to look for:

Take two positively correlated assets. Let’s say S&P 500 (ES) and Nasdaq 100 (NQ). You draw the lows:

- ES breaks to a new lower low

- NQ holds a higher low

That’s a bullish SMT divergence, right?

Now pay attention to the angle of the move into those lows.

- If ES crashes hard (steep downward slope), it’s panic or stop-runs.

- But if NQ dips slowly and forms a rounded base (gentle slope), you’re seeing smart money accumulation.

That slope difference is your signal. It tells you where institutions are defending price and where they’re not stepping in yet.

Now, let’s consider an example.

EUR/USD drops sharply — long red candles, strong slope.

GBP/USD holds a shallow dip — smaller candles, higher low.

What’s happening here?

Banks are dumping EUR aggressively. But GBP is being bought quietly. So GBP/USD becomes your leading pair.

The slope in GBP/USD tells you that downside momentum is dying.

The slope in EUR/USD tells you that sellers are overextended.

You don’t buy randomly. In fact, you wait for GBP/USD to reclaim structure, maybe a fair value gap. Then you long. EUR/USD? That’s your decoy.

Anyone can see divergence. But slope analysis tells you who is strong and who is pretending. Sharp, V-shaped lows? Likely manipulation. Smooth, U-shaped recoveries? Likely accumulation.

So, it is clear that Bullish SMT Slopes:

- gives you context

- tells you where smart money is loading up

- helps you understand who’s really in control here

Pro Tip: Use a trendline tool. Draw from previous low to the current low on both charts. Compare angles. Faster fall = weaker market. Shallower fall = hidden strength.

So next time you see a bullish SMT setup, don’t rush in. Ask yourself: “Which slope looks controlled? Where would the smart money prefer to enter?” That’s the chart you follow. Not the one with drama. The one with structure.

How Slopes Break Structure in Bearish SMT Divergence?

Bearish SMT divergence shows up when one correlated asset forms a higher high, while the other creates a lower high. That’s your first clue. But the real signal lies in the slopes—the angle and direction of each price swing.

You need to focus on the structure that each slope creates.

- On the stronger chart (the one with the higher high), the upward slope shows buyers still trying to push the trend.

- On the weaker chart (the one with the lower high), the downward slope reveals fading momentum and early signs of reversal.

When slopes disagree like this, structure breaks start forming on the weaker chart first. For example:

- A lower high followed by a lower low on that chart breaks bullish structure.

- Meanwhile, the stronger chart still looks bullish, tricking surface-level traders.

This is where you need to take charge. Once you spot the slope divergence, you wait for confirmation—like a break of structure or a bearish order block forming near the lower high. Then you target the imbalance or liquidity zone below.

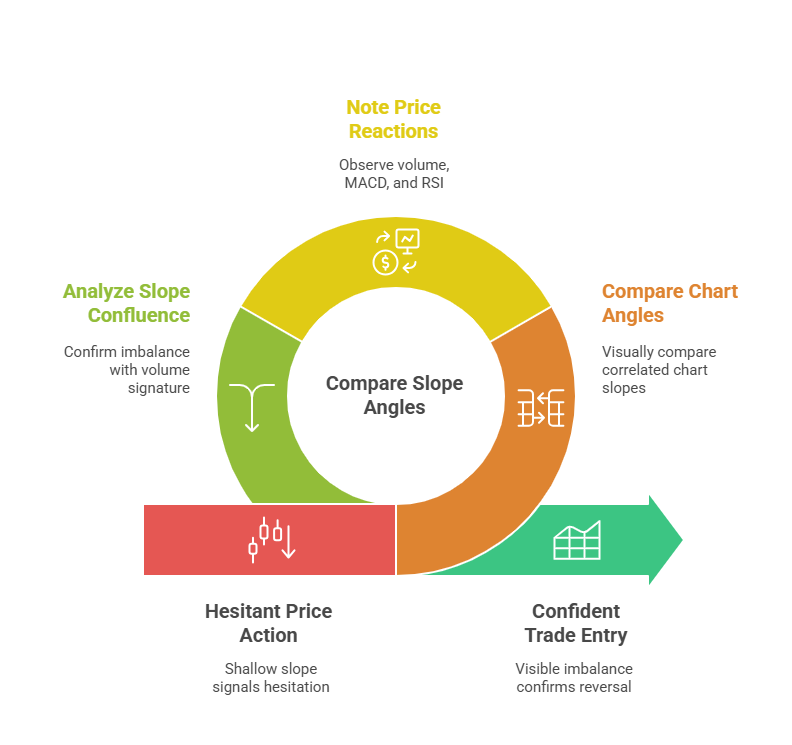

How to Spot Diverging Slopes Before the Reversal?

Start from two correlated charts. EUR/USD and GBP/USD offer reliable SMT readings. FundYourFX confirms this pair frequently reveals early divergences when used on the 5M or 15M chart.

One price leg rises quickly from a low. Large candles form with minimal wicks. That structure shows speed and strength. Another chart shows a similar move but slower. Smaller candles, visible pauses, and wide wicks shape a shallow slope. That slope signals hesitation.

Next, compare the angles visually. A steep slope often ends near liquidity zones. TradingView divergence scripts suggest using slope comparison across swing highs to detect imbalance in momentum. A shallow move into resistance often lacks follow-through.

Then, note how the price reacts before the structure confirms. When one slope curves upward but lacks volume, MACD or RSI flatlines. No strong cross appears. That weakness often precedes the real reversal.

Moreover, divergence appears before classic entry signals. Slope comparison offers a preemptive edge. Price does not reverse randomly. Traders with slope awareness prepare near key imbalance zones.

According to FundYourFX, institutional divergence often reflects in shallow, controlled price legs. A steep leg, on the other hand, reflects emotional flow from retail clusters. That contrast highlights where the trap builds.

End the analysis with slope confluence and RSI separation. Use both to build conviction. Avoid entry without visible imbalance between slopes and volume signature.

Which Slope Leads: Leader vs. Lagger Price Action

In Smart Money Trading (SMT) divergence, one price feed always moves first. This is the leader slope—the pair or index that breaks structure or sweeps liquidity ahead of others. The second lags behind. It forms a shallower move or stalls at the same level. This is the lagger slope.

According to Equiti (2024), “leading indicators react faster and anticipate shifts before confirmation.” In SMT, the leader slope acts like RSI or OBV on a responsive chart—it shows intent early. The price pushes through a key level, signaling divergence. Blueberry Markets (2024) adds that “lagging indicators confirm trends after price action occurs.” This aligns with the lagger slope, which holds range highs or lows, delaying confirmation.

A leader slope usually forms:

- A clean break of structure

- A steep move with wide-bodied candles

- A liquidity sweep ahead of time

The lagger slope shows:

- Shallower movement

- No break or sweep

- Confirmation after the move begins

Traders use this slope relationship to identify reversal zones. If the leader makes a move that the lagger doesn’t confirm, a divergence setup forms. Price then often returns to rebalance the difference.

Equiti describes this risk-reward split clearly: “Leading signals may be early but risk false entry; laggers are slow but validate the trend.” SMT uses both. The leader gives the signal. The lagger offers confirmation or rejection.

You spot divergence when:

- US30 sweeps the high

- NASDAQ fails to break that same level

The slope that leads the sweep leads the setup. The slope that lags confirms the imbalance. So, follow the slope that moves first—but trade the return to balance.

Adding RSI or MACD to Validate Diverging Slopes

Diverging slopes often hint at market imbalance. But slope alone lacks context. Momentum indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) help confirm if the divergence signals a true reversal or just noise.

Start with RSI. This indicator measures the speed and magnitude of price changes. A rising slope in one asset while RSI weakens indicates exhaustion. For example, if the Nasdaq climbs but RSI stalls near 68, the price slope may overstate bullish strength. RSI under 30 or over 70 adds stronger reversal pressure when divergence appears.

MACD offers confirmation in trend strength. It tracks two moving averages — the MACD line and the signal line. If price makes a higher high but MACD prints a lower high, the uptrend lacks follow-through. This weakening momentum behind rising prices creates classic bearish divergence. On the other hand, if both slope and MACD rise in sync, the trend likely remains intact.

Combining slope divergence with RSI or MACD helps refine timing. Look for three elements:

- A divergence between price slopes (e.g., EUR/USD vs GBP/USD).

- RSI near exhaustion levels or flattening during slope divergence.

- MACD histogram shrinking or lines crossing against the trend.

See, when these align, the probability of reversal rises. Without momentum breakdown, the divergence lacks conviction.

You should know that this technique strengthens SMT (Smart Money Technique) setups by filtering false positives. RSI offers early warning. MACD confirms the shift in underlying pressure. Use both to validate what the eye sees on sloping price lines.

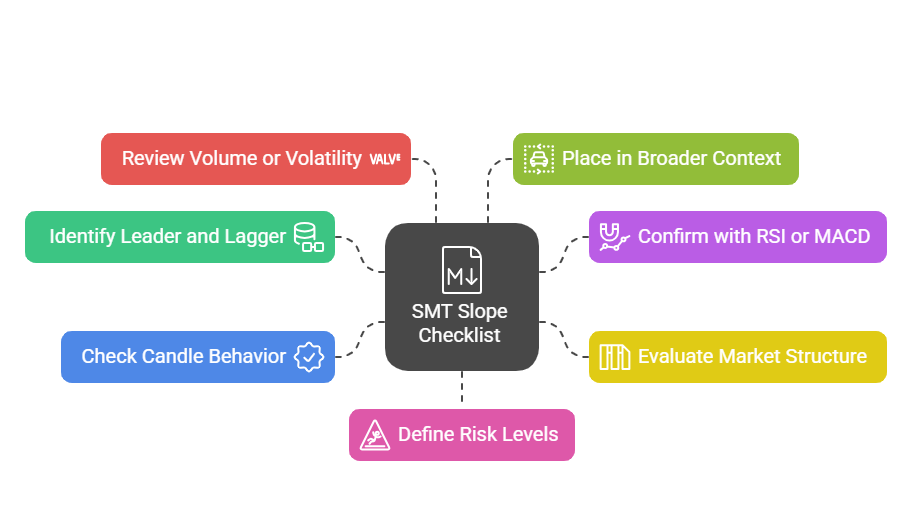

SMT Slope Checklist: Before You Enter the Trade

Every SMT divergence starts with a shift in slope. But slope alone cannot confirm institutional intent. Use this checklist to evaluate divergence strength before taking a position.

- 1. Identify the Leader and Lagger Clearly – Examine which asset moved first. A true leader forms a new high or low before the correlated pair reacts. If one market creates a higher high while the other holds flat or forms a lower high, the leader is applying pressure. The lagging pair reveals hesitation. Directional slope difference between them builds the divergence case.

- 2. Confirm with RSI or MACD – Support the price slope with internal momentum. RSI should show exhaustion on the leading asset—ideally divergence from price near a key level. MACD helps reveal slope weakening through flattening histograms or early crossovers. These signals confirm that slope momentum aligns with market fatigue.

- 3. Evaluate Market Structure at the Divergence Point – Assess where the divergence occurs. Structure provides the boundary conditions for slope reliability. If the divergence forms near a significant order block, supply/demand zone, or long-standing trendline, the slope carries more meaning. A flat slope at resistance suggests failure. A rising slope from support suggests strength.

- 4. Check Candle Behavior for Confirmation – Read the candles, not just the lines. Momentum slope requires visual backing. Clean rejection wicks, inside bars, or strong directional closes on the leader reinforce the slope’s validity. Unclear candle behavior introduces noise. Wait for decisive structure if candles remain mixed.

- 5. Review Volume or Volatility Support – Check if the leader’s slope builds with strong volume or clear range expansion. If price extends with minimal effort, the slope may lack conviction. Confirm slope intent by measuring whether volume accelerates at inflection points.

- 6. Place the Divergence Within Broader Context – A divergence forming at the open of a New York or London session carries more force than one during low liquidity. Confirm if macro drivers align—news releases, sentiment shifts, or volatility breakouts. Slopes show action, but context explains motive.

- Define Risk Through Invalidation Levels – Mark the exact price level that invalidates the slope-based divergence. If price breaches that level, the divergence breaks. Pre-defining this level protects you from slope traps or late entries. Every trade must include a clear invalidation threshold.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountFinal Take

In summary, slope comparison within SMT divergence provides a deeper layer of price action context. While divergence itself highlights potential imbalance, the angle of displacement between instruments often reveals the strength and timing of that imbalance.

More specifically, steeper slopes in the leading market can indicate accelerated intent, whereas flatter responses from the lagging instrument may suggest hesitation or delay. By measuring the slope before confirmation, traders can better understand whether momentum is building or stalling.

You should integrate slope analysis into your SMT framework, as it strengthens trade readiness. See, when paired with RSI, MACD, or clear structural breaks, slope alignment improves both timing and conviction. So, rather than relying on a single signal, you must view the slope as part of a multi-factor confluence.

Ultimately, successful SMT execution relies on preparation, structure, and repetition. Slope is not a standalone trigger—but when used with purpose, it sharpens your ability to act before the market fully reacts.