A pip, short for “percentage in point,” is the smallest price movement in a currency pair in forex trading. Traders use pips to measure spreads, calculate profits or losses, and set risk controls like stop-loss and take-profit orders. Understanding pips is essential for accurate trade analysis and market precision.

Key Takeaways

- A pip is the standardized unit for measuring price movement in forex.

- The monetary value of a pip depends on the lot size, currency pair, and your account currency.

- For most currency pairs, a pip is the fourth decimal place, but for JPY pairs, it’s the second.

- Pipettes are fractional pips, offering more precise price quotes from brokers.

- Pips are essential for risk management, helping traders set stop-loss and take-profit orders.

- The spread between the bid and ask price is the cost of a trade, measured in pips.

- Leverage can magnify the profit or loss from each pip movement.

- Pips are also used to measure price changes in commodities and crypto CFDs.

- An online pip calculator is the easiest way to determine a pip’s exact value.

What is a Pip? (Percentage in Point)

A pip, or “percentage in point,” is the standard unit for measuring price changes in foreign exchange market. For most pairs, it equals 0.0001 or the fourth decimal place. In JPY pairs, a pip equals 0.01 or the second decimal place. Pips standardize price movement measurement across all currency pairs.

Pip vs Pipette

The main difference between a pip and a pipette is precision in forex price quotes. A pip is the standard unit, usually the fourth decimal place (0.0001) or second for JPY pairs (0.01). A pipette is one-tenth of a pip, adding a fifth decimal place or third for JPY pairs to allow tighter spreads.

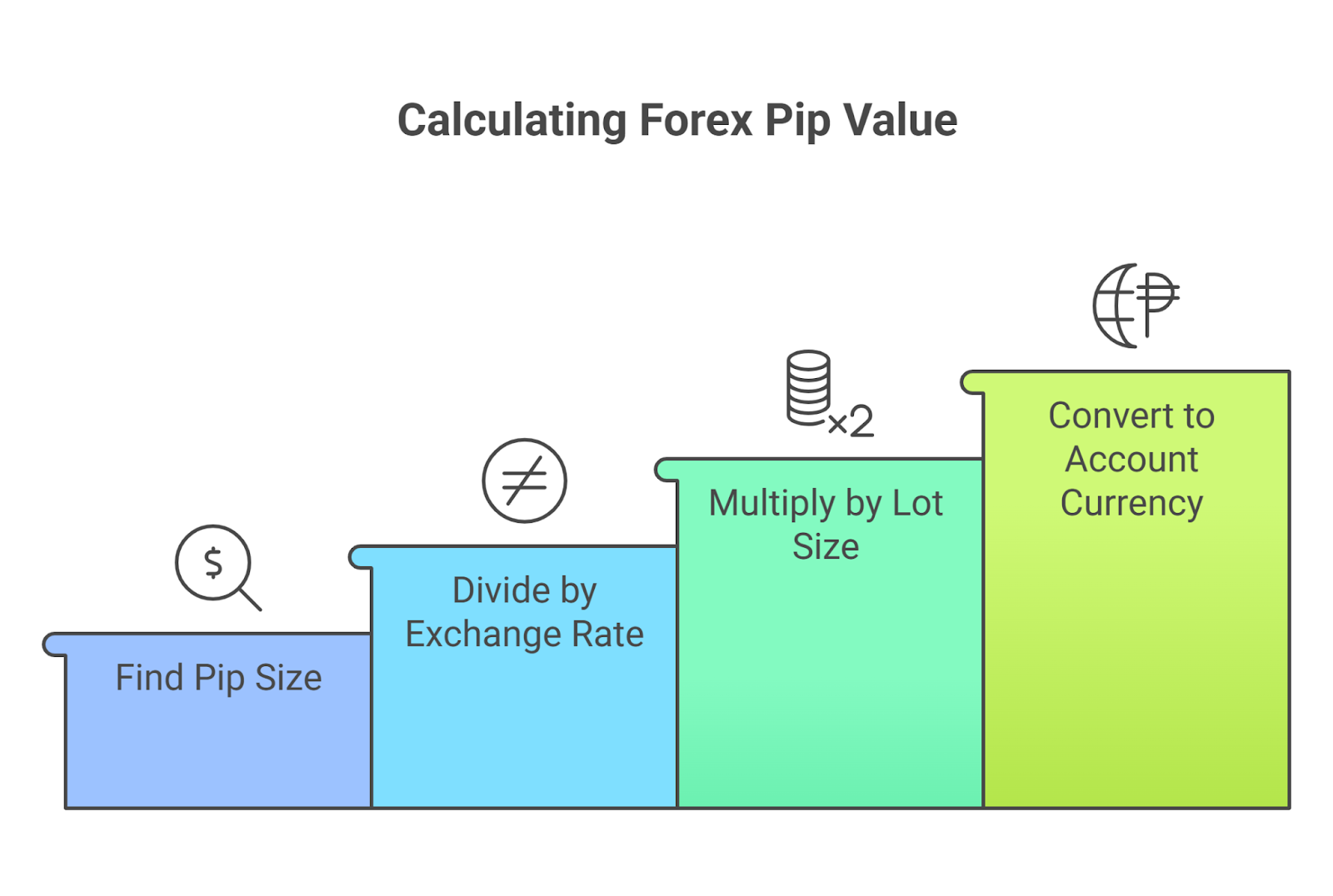

Forex Pip Value: How to Calculate Pips

The forex pip value is the monetary worth of a single pip. Calculating this is crucial for managing risk and understanding profit and loss. The pip value is dependent on three factors: the lot size of the trade, the currency pair, and your account currency.

Here are the steps to calculate a pip’s value:

- Find the pip size: The pip size is 0.0001 for most pairs, and 0.01 for JPY pairs.

- Divide by the exchange rate: Divide the pip size by the current exchange rate of the currency pair.

- Multiply by the lot size: Multiply the result by the lot size (e.g., 100,000 for a standard lot).

- Convert to account currency: If the result is not in your account currency, you must perform a final conversion.

This is why lot size calculation is inseparable from pip value, since it defines how much risk a single movement carries.

Pip Value Table for Common Currency Pairs

The following table provides the approximate pip value for common currency pairs in a USD-denominated account, demonstrating how the lot size directly impacts the monetary value of a single pip.

| Currency Pair | Standard Lot (100,000 units) | Mini Lot (10,000 units) | Micro Lot (1,000 units) |

| EUR/USD | $10.00 | $1.00 | $0.10 |

| USD/JPY | $6.90 | $0.69 | $0.069 |

| GBP/USD | $10.00 | $1.00 | $0.10 |

| USD/CAD | $7.30 | $0.73 | $0.073 |

| AUD/USD | $10.00 | $1.00 | $0.10 |

How to Count Pips in Forex

Knowing how to count pips is a fundamental skill for every trader. The method depends on the currency pair’s quotation format.

Here is a step-by-step guide to counting pips:

- Identify the pip decimal place: For most pairs, this is the fourth decimal place. For JPY pairs, it is the second decimal place.

- Subtract the entry price from the exit price: For example, if you buy EUR/USD at 1.1000 and sell at 1.1050.

- Calculate the difference: 1.1050 – 1.1000 = 0.0050.

- Convert the difference to pips: 0.0050 is a 50-pip change.

How Much is 100 Pips Worth?

The worth of 100 pips depends entirely on your lot size and the currency pair.

- Standard Lot: With a standard lot (100,000 units) in a pair like EUR/USD, 100 pips would be worth approximately $1,000 (100 pips * $10 per pip).

- Mini Lot: With a mini lot (10,000 units), 100 pips would be worth about $100.

- Micro Lot: With a micro lot (1,000 units), 100 pips would be worth around $10.

Traders ultimately convert pips to profit by multiplying their pip gains with lot size and trade volume.

Factors That Influence Forex Pip Value

Several factors influence the precise monetary value and movement of pips:

- Currency Pair: The specific pair being traded, such as majors or minors, affects the pip’s value due to different exchange rates.

- Account Currency: If your trading account is in a currency other than the quote currency of a pair, the pip value must be converted, which impacts its final worth.

- Trade Size: The lot size you choose (standard, mini, or micro) directly scales the value of each pip.

- Market Volatility: During high-impact news events like a Non-Farm Payrolls report, market volatility can cause price spikes of many pips in a short period. For example, an unexpected interest rate decision could cause the GBP/USD pair to move 150 pips in a matter of minutes, significantly increasing a trade’s profit or loss.

Pips and Spread in Forex

The spread is the difference between the bid and ask prices, which is the transaction cost of a trade. Spreads are measured in pips. The spread is the difference between the bid and ask prices, which is the transaction cost of a trade. Spreads are measured in pips, and grasping them properly requires reading forex quotes with accuracy to avoid costly missteps.

A broker’s spread can be fixed or variable, and its size is influenced by the pair’s liquidity. Tight spreads are considered one of the core advantages of forex trading.

Leverage, Margin, and Position Sizing: Using Pips for Risk Management

Pips are a core component of a trader’s risk management strategy, particularly in conjunction with forex leverage and margin.

- Pip-Based Risk Control: A common principle is to risk no more than 1% to 2% of your account on a single trade. Using pips, you can determine your position size by calculating the number of pips to your stop-loss and then sizing your lot so that the total risk does not exceed your limit.

- Pip-Based Leverage Example: A trader with a $1,000 account and 100:1 leverage risks $20 (2%). They want to set a 50-pip stop-loss on EUR/USD. To find the correct lot size, they calculate: $20 / (50 pips * $10/pip) = 0.04 lots. This shows how pips, leverage, and lot size are all interconnected in managing risk.

- Forex Margin: The pip value, along with the position size, determines the amount of forex margin required to open and maintain a trade.

Pip Value in Commodities, Crypto Pairs, and Tick Size

The concept of a pip extends beyond traditional forex to other popular trading instruments. For these markets, the term tick size is often used interchangeably or alongside pips to denote the minimum price increment.

- Gold (XAU/USD): Gold is often traded as a CFD with price quotes that use two decimal places (e.g., 1950.00). A 1-pip movement is a change of 0.01. The pip value is based on the lot size and the USD exchange rate.

- Silver (XAG/USD): Similar to gold, silver is quoted with two decimal places. A move of 0.01 is considered a 1-pip movement.

- Oil (WTI/Brent): Oil CFDs are typically quoted to two decimal places, with a pip being a 0.01 change.

- Crypto Pairs: Pip value in cryptocurrencies like BTC/USD can be different, often referring to a 1-unit movement (e.g., a move from 60,000 to 60,001). For these high-value pairs, the term “point” is often used instead of “pip” to avoid confusion.

Real-World Pip Examples

- USD/CAD Trade: A trader with a EUR account buys one standard lot of USD/CAD at 1.3700 and sells it at 1.3750. The price moved 50 pips. The pip value for a standard lot of USD/CAD is approximately $7.30 USD. The profit is $365 USD (50 pips * $7.30). To convert this to their EUR account, they divide by the EUR/USD exchange rate (e.g., 1.0800), resulting in a profit of about €337.96.

- Leveraged USD/JPY Trade: A trader buys one standard lot of USD/JPY at 145.00 with 50:1 leverage. The price moves to 145.50. The price moved 50 pips, and the profit with a pip value of $6.90 is $345 (50 pips * $6.90). The use of leverage meant they only needed to put up a fraction of the total position size to secure this profit.

Common Pip Calculation Mistakes

A few common mistakes in pip calculation can lead to errors in risk management:

- Incorrect JPY Pip Value: Treating JPY pairs like other pairs and counting the fourth decimal place instead of the second.

- Ignoring Account Currency Conversion: Failing to convert the pip value into the account’s base currency when the quote currency is different.

- Miscalculating with Pipettes: Confusing pips and pipettes, which can lead to a tenfold error in your calculations.

Pip Calculators & Tools

Pip calculators are widely available online to simplify the process of determining a pip’s monetary value. These tools automatically factor in the currency pair, lot size, and account currency, providing an instant calculation. Most forex brokers offer a built-in pip calculator to help traders manage their positions effectively.

The Bottom Line

Understanding what a pip is and how to calculate its value is the foundation of successful forex trading. A pip is the smallest measure of price movement, and its monetary value is a function of your trade’s lot size, the specific currency pair, and your account currency. By mastering pips, you can effectively measure trading costs (spreads), accurately calculate potential profits and losses, and, most importantly, implement sound risk management strategies like setting precise stop-loss and take-profit levels.