In 2010, someone paid 10,000 Bitcoin for two pizzas. Today, that stack would be worth over $650 million. Meanwhile, gold has done exactly what gold always does—held steady, predictable, and unsurprising. This tale of two assets captures the central tension facing every modern investor: explosive potential versus time-tested reliability.

Decision Framework for Bitcoin vs Gold

| If You… | Consider… |

| Prioritize proven stability | Heavier gold allocation |

| Have 10+ year horizon | Both, with Bitcoin for growth |

| Can’t stomach 50% drops | Minimize or avoid Bitcoin |

| Want asymmetric upside | Include meaningful Bitcoin position |

| Seek crisis protection | Gold as core holding |

| Distrust institutions | Both (self-custody Bitcoin, physical gold) |

Why Do People Compare Bitcoin and Gold?

The Bitcoin vs Gold debate intensified as economic uncertainty reshaped how we think about wealth preservation. Both assets exist outside traditional financial systems, offering alternatives when faith in government-issued currency wavers.

People compare these assets because they share core characteristics: scarcity, independence from central banks, and perceived protection against inflation. Gold earned this reputation over millennia. Bitcoin claims it through mathematical certainty.

But beyond surface-level similarities lies a more nuanced question: which asset—or combination of assets—aligns with your specific investment goals, risk tolerance, and time horizon?

This guide goes deeper than typical comparisons. We’ll examine practical ownership realities, unique supply mechanics, psychological factors driving investment decisions, and the broader monetary policy landscape affecting both assets.

What Is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by an anonymous entity known as Satoshi Nakamoto. Unlike traditional currencies controlled by central banks, Bitcoin operates on a peer-to-peer network where transactions occur directly between users without intermediaries.

The technology underpinning Bitcoin—blockchain—provides transparency and security through a computational process called Proof of Work. Perhaps most critically, Bitcoin has a mathematically enforced supply cap: only 21 million coins will ever exist. This programmatic scarcity cannot be altered by any government, corporation, or individual.

This decentralization distinguishes Bitcoin from traditional assets and fiat currencies. No single authority controls its issuance, network rules, or transaction validation. The network runs on thousands of computers worldwide, making it resistant to censorship and seizure.

Think of Bitcoin as a digital property with absolute scarcity—something that never existed before in human history.

What Is Gold?

Gold is a precious metal that has served as a global medium of exchange and wealth preservation tool for over 5,000 years. It predates every existing government, currency, and financial institution.

The yellow metal derives its value from a combination of factors: physical rarity, resistance to corrosion, malleability, density, and—perhaps most importantly—millennia of accumulated human trust. Gold has industrial applications in electronics and jewelry, but its primary value comes from its role as a monetary metal.

While gold’s supply is geologically finite, new discoveries and advancing extraction technology mean the total above-ground supply continues to grow at roughly 1.5% annually. This contrasts sharply with Bitcoin’s hard mathematical ceiling.

Central banks worldwide still hold gold as reserve assets—a testament to its enduring role in the global financial system. Learn more about how central banks influence gold prices.

What Are the Basic Differences Between Bitcoin and Gold?

The fundamental distinction is physical versus digital. Gold exists as atoms you can hold; Bitcoin exists as entries on a distributed ledger.

| Characteristic | Bitcoin | Gold |

| Form | Digital (code on blockchain) | Physical (metal you can touch) |

| Age | 15 years | 5,000+ years |

| Supply mechanism | Mathematical protocol | Geological discovery + mining |

| Storage | Digital wallet (or exchange) | Vault, safe, or custodian |

| Portability | Unlimited (memorize 12 words) | Limited by weight |

| Divisibility | 100 million units per coin | Practically limited |

Gold’s value comes from historical trust and physical properties. Bitcoin’s value derives from cryptographic security, network effects, and enforced digital scarcity.

These aren’t merely technical differences—they shape everything from how you store these assets to how governments can regulate them.

Is Bitcoin Better Than Gold as a Store of Value?

This question sparks the most heated debates. Let’s examine both sides with evidence.

Gold’s Case: 5,000 Years of Proof

Gold has earned its reputation as a safe haven asset through centuries of consistent performance during crises. When currencies collapse, governments fall, and markets crash, gold tends to hold its purchasing power.

The reasons are practical:

- Gold doesn’t rust or degrade

- It can’t be printed or digitally created

- It’s universally recognized across cultures

- It has no counterparty risk when held physically

An ounce of gold bought a fine men’s suit in 1920, and it still does today. This purchasing power stability across generations is precisely what “store of value” means.

Bitcoin’s Case: Digital Scarcity Revolution

The concept of Bitcoin as “digital gold” remains hotly debated—similar to earlier attempts like BitGold that never gained traction. The Wharton Business School has examined Bitcoin’s unique properties in the context of the post-financial-crisis world, noting that its emergence directly responded to concerns about currency debasement and institutional trust.

Bitcoin’s fixed supply of 21 million coins creates what proponents call “absolute scarcity.” According to River Financial analysis, this supply cap is enforced by mathematical protocol, not mining economics or geological limits. No amount of price increase can create more Bitcoin.

The Honest Answer

The counterarguments to Bitcoin are substantial: it’s only 15 years old, has experienced multiple 80%+ drawdowns, and hasn’t been tested through a major global financial crisis as a mature asset. Gold weathered the fall of Rome, two World Wars, and countless currency collapses.

Should I Invest in Bitcoin or Gold for Inflation Hedging?

Both assets are perceived as inflation hedges, but their mechanisms and track records differ significantly.

How Gold Protects Against Inflation?

Gold’s inflation protection comes from its finite supply relative to expanding monetary bases. When central banks print money, each dollar buys less gold. Historical data confirms gold generally maintains purchasing power during inflationary periods.

During the 1970s inflation surge, gold rose from $35 to $850 per ounce. More recently, gold appreciated significantly during the 2020-2021 monetary expansion.

However, gold isn’t a perfect hedge. During the 1980s and 1990s, gold declined in real terms despite moderate inflation.

How Bitcoin Might Protect Against Inflation?

Bitcoin’s case as an inflation hedge rests primarily on its programmatic scarcity. With a fixed supply and predictable issuance schedule, Bitcoin cannot be “printed” like fiat currency.

JPMorgan analysts have noted that Bitcoin is becoming a more attractive inflation hedge than gold, particularly among younger investors who view it as the scarce asset for the digital age.

Which Actually Protects Savings Better?

Bitcoin’s real-world performance during inflationary periods has been mixed. During the 2021-2022 inflation surge, Bitcoin initially rose but subsequently fell over 70% while inflation remained elevated. This suggests Bitcoin’s price may be driven more by liquidity conditions and risk appetite than by inflation expectations alone.

The nuanced reality:

- For pure inflation protection with highest confidence → Gold has centuries of evidence

- For potentially superior long-term returns with inflation protection as secondary benefit → Bitcoin offers an argument, but with substantially higher risk

Your choice depends on your time horizon and risk tolerance.

Which Is More Volatile, Bitcoin or Gold?

Bitcoin has historically exhibited significantly higher price volatility compared to Gold, often experiencing 50%+ swings in short periods according to data from LongtermTrends and Curvo.eu.

Bitcoin’s Volatility Profile

Bitcoin’s volatility isn’t a bug—it’s a feature of its position in the adoption curve. As a younger, smaller market with 24/7 global trading and no circuit breakers, Bitcoin responds dramatically to:

- News and regulatory announcements

- Sentiment shifts on social media

- Liquidity changes in broader markets

- Whale movements (large holder transactions)

A single Elon Musk tweet has moved Bitcoin’s price by billions of dollars. Drawdowns of 30-50% occur regularly, even in bull markets.

Gold’s Volatility Profile

Gold’s comparative stability reflects its mature, institutionalized gold trading market. Central banks hold gold reserves. Pension funds allocate to gold. The gold market has had centuries to develop deep liquidity and sophisticated price discovery mechanisms.

Typical gold volatility runs in single-digit percentages annually. Even during major crises, gold rarely moves more than 20-30% in a year.

What Does This Means for Investors?

| Investor Profile | Better Fit |

| Can’t stomach 50% drawdowns | Gold |

| Long time horizon (10+ years) | Either/both |

| Needs stability for near-term goals | Gold |

| Seeking asymmetric upside | Bitcoin |

| Retired or near retirement | Gold-heavy |

Volatility cuts both ways. Bitcoin’s swings create opportunities for substantial gains but also risk of devastating losses. Gold’s stability provides portfolio ballast but limits upside potential.

What Role Does Scarcity Play in Bitcoin vs Gold?

Scarcity drives value for both assets, but the mechanisms differ profoundly—and this difference may be the most important factor for long-term investors.

Bitcoin’s Absolute Scarcity

Bitcoin has a hard cap of 21 million coins—programmatic scarcity enforced by code that thousands of nodes verify independently. This supply cannot change regardless of:

- Price increases (unlike commodities where high prices incentivize more production)

- Technological advances

- Political pressure

- Market demand

As River Financial notes, this makes Bitcoin the first asset in human history with a truly fixed supply that anyone can independently verify.

Currently, about 19.5 million Bitcoin have been mined. The remaining 1.5 million will be released gradually through 2140, with the rate cut in half every four years (the “halving”).

Gold’s Geological Scarcity

Gold’s scarcity is geological rather than mathematical. The total above-ground gold supply is estimated at 200,000 metric tons, with approximately 3,000 tons added annually through mining.

While gold is rare, its supply can and does expand. High prices incentivize:

- Exploration of new deposits

- Development of previously uneconomical mines

- Advanced extraction technologies

- Deep-sea and asteroid mining (eventually)

Why This Distinction Matters?

Bitcoin’s scarcity intensifies over time through halving events. Gold’s supply grows predictably but indefinitely.

For supply and demand dynamics, this means:

- Bitcoin becomes mathematically scarcer each year

- Gold becomes relatively scarcer only if demand growth exceeds supply growth

How Has Bitcoin Performed Against Gold Historically?

Market capitalization reveals the scale difference between these assets. As of Q1 2024:

- Gold’s market cap: approximately $13.5 trillion (MacroMicro, Ingoldwetrust.report)

- Bitcoin’s market cap: approximately $1.3 trillion

This 10x gap tells different stories to different investors.

Bitcoin’s Growth Trajectory

Over the past decade, Bitcoin has significantly outperformed Gold and the S&P 500 according to Curvo.eu and Yahoo Finance data.

| Investment (2014) | Value Today | Return |

| $1,000 in Bitcoin | ~$100,000+ | 10,000%+ |

| $1,000 in Gold | ~$1,300 | 30% |

| $1,000 in S&P 500 | ~$3,500 | 250% |

This historical performance demonstrates Bitcoin’s potential as a long-term investment for growth-oriented portfolios—but with a critical caveat: past performance doesn’t guarantee future results, and Bitcoin’s journey included multiple 80%+ crashes.

Gold’s Steady Appreciation

Gold has appreciated approximately 500% since 2000, outpacing the S&P 500 in certain periods while providing stability during crises. During the 2008 financial crisis and 2020 pandemic crash, gold held value while equities plummeted.

What Market Cap Suggests About Future Potential?

For gold bulls, the 10x market cap gap reflects centuries of established trust and institutional adoption.

For Bitcoin advocates, it represents massive growth potential. If Bitcoin captures even 10% of gold’s market share, that implies roughly 100% appreciation from current levels—mathematically.

Bitcoin vs Gold: Comprehensive Side-by-Side Comparison

| Feature | Bitcoin | Gold | Investment Implication |

| Asset Type | Digital | Physical | Different storage and security needs |

| Supply Cap | 21 Million (absolute) | Geologically finite (~1.5%/year growth) | Bitcoin’s scarcity intensifies; gold’s expands |

| Age | 15 years | 5,000+ years | Gold proven; Bitcoin theoretical |

| Volatility | High (50%+ swings) | Low (single digits) | Bitcoin: higher risk/reward |

| Custody Options | Self-custody or exchanges | Physical, ETFs, allocated accounts | Self-custody Bitcoin = true ownership |

| Inflation Hedge | Emerging, theoretical | Traditional, proven | Gold has track record; Bitcoin has logic |

| Market Cap | ~$1.3 Trillion | ~$13.5 Trillion | Bitcoin has 10x growth potential to match |

| Divisibility | 100M satoshis/coin | Practically limited | Bitcoin enables micro-transactions |

| Portability | Unlimited (12-word seed) | Weight-constrained | Bitcoin crosses borders effortlessly |

| Counterparty Risk | None (self-custody) | Varies by storage | Depends on how held |

| 24/7 Trading | Yes | Limited | Bitcoin more liquid globally |

| Seizure Resistance | High (if self-custody) | Moderate | Bitcoin harder to confiscate |

Who Truly Owns Your Wealth? (Custody and Security)

How you hold an asset determines whether you truly own it—or merely have a claim against someone who does.

Bitcoin Custody Options:

| Type | You Control Keys? | Risk Profile |

| Non-custodial wallet | ✅ Yes | You’re responsible; lose keys = lose Bitcoin |

| Hardware wallet | ✅ Yes | Most secure; offline storage |

| Exchange custody | ❌ No | Convenient but counterparty risk (Mt. Gox, FTX) |

| Bitcoin ETF | ❌ No | Traditional brokerage; institutional custody |

Gold Custody Options:

| Type | Physical Possession? | Risk Profile |

| Physical coins/bars | ✅ Yes | No counterparty risk; requires security |

| Allocated storage | ⚠️ Specific bars assigned | Custodian risk; audited |

| Unallocated accounts | ❌ No | Claim on pool; higher counterparty risk |

| Gold ETF | ❌ No | Paper claim; convenient but not physical |

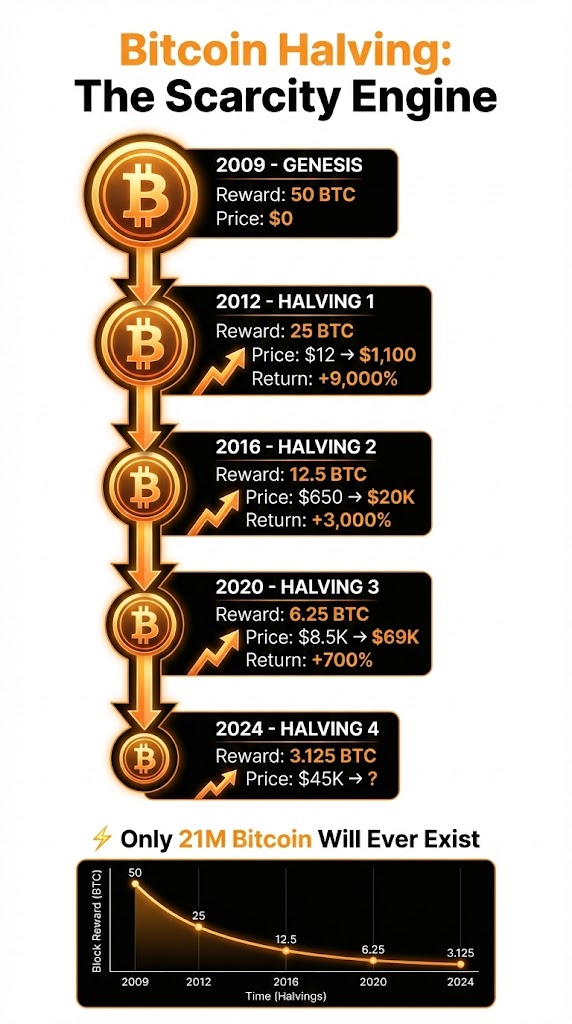

How Does Bitcoin’s Halving Compare to Gold’s Supply?

Bitcoin’s halving is a programmed reduction in mining rewards occurring approximately every four years—creating predictable supply shocks unlike anything in traditional commodities.

| Halving Event | Block Reward | Price Before | Price 18 Months Later |

| 2012 | 50 → 25 BTC | $12 | $1,100 |

| 2016 | 25 → 12.5 BTC | $650 | $20,000 |

| 2020 | 12.5 → 6.25 BTC | $8,500 | $69,000 |

| 2024 (April) | 6.25 → 3.125 BTC | ~$45,000 | ? |

Each halving cuts new Bitcoin issuance by 50%, historically preceding significant price appreciation in the 12-18 months following.

Gold’s supply dynamics are more gradual. Annual mine production responds to price—higher prices incentivize more mining—but changes occur over years, not in sudden protocol-mandated reductions. There are no “gold halvings.”

This supply and demand distinction matters for long-term value accrual:

- Bitcoin becomes mathematically scarcer at a predictable, accelerating rate

- Gold becomes relatively scarcer only if demand outpaces the ~1.5% annual supply growth

Why Does Your Financial Advisor Disagree With Your Friend?

Investment decisions aren’t purely rational. Understanding the emotional and generational dynamics affecting each asset explains why advice varies so wildly.

Traditional Investor Psychology:

- Prefers tangible assets (“I can hold gold”)

- Values centuries of precedent

- Suspicious of technology they don’t fully understand

- Risk-averse; prioritizes capital preservation

- Influenced by mainstream financial media

Crypto-Native Investor Psychology:

- Comfortable with digital-first assets

- Values technological innovation

- Skeptical of traditional financial institutions

- Higher risk tolerance; prioritizes growth

- Influenced by social media and peer networks

This explains the common scenario: your financial advisor recommends gold, while your tech-savvy friend insists Bitcoin is the only rational long-term hold.

Who’s right? Both have valid points. The answer depends on your personal values, risk tolerance, and investment timeline—not on who argues more convincingly.

How Does Monetary Policy Affect Bitcoin vs Gold Differently?

Global monetary policy affects both assets, but through different mechanisms that sophisticated investors should understand.

Gold and Central Banks:

- Gold rises when real interest rates (rates minus inflation) are low or negative

- Quantitative easing supports gold by devaluing currencies relative to hard assets

- Central bank gold purchases directly affect demand (record buying in recent years)

- Gold has inverse correlation with US dollar strength

Bitcoin and Monetary Policy:

- Loose monetary policy has correlated with Bitcoin appreciation

- However, Bitcoin also shows sensitivity to interest rate expectations

- Rising rates in 2022 coincided with 70%+ Bitcoin declines

- Bitcoin may trade partially as a “risk asset” rather than pure inflation hedge.

The CBDC Factor:

The emergence of Central Bank Digital Currencies (CBDCs) adds another dimension. CBDCs could enable unprecedented monetary control—programmable money that expires, restricts purchases, or tracks all transactions.

Some view this as bullish for Bitcoin as a censorship-resistant alternative. Others argue CBDCs could lead to cryptocurrency restrictions.

Understanding this broader context of governmental financial control helps explain why both Bitcoin and gold attract those seeking alternatives to state-controlled monetary systems.

What Are the Environmental Impacts of Bitcoin vs Gold?

Environmental concerns increasingly influence investment decisions—especially for ESG-conscious investors.

Digiconomist’s research suggests Bitcoin mining has a higher energy consumption per transaction than gold mining. Bitcoin’s network currently consumes electricity comparable to a medium-sized country.

But this comparison has important nuances:

Bitcoin’s Environmental Profile

| Factor | Reality |

| Total energy use | ~120 TWh/year (comparable to Norway) |

| Renewable mix | 50-60% (Bitcoin Mining Council estimates) |

| Trend | Increasingly renewable as miners seek cheap power |

| Waste | E-waste from mining hardware |

Gold Mining’s Environmental Profile

| Factor | Reality |

| Energy use | Significant but distributed across mines globally |

| Chemical use | Cyanide leaching, mercury in artisanal mining |

| Land impact | Deforestation, habitat destruction, massive pit mines |

| Water use | Enormous; 1 oz gold requires ~18,000+ gallons |

| Waste | ~20 tons of mine waste per gold ring |

The Honest Assessment

Neither asset offers environmental purity. Bitcoin’s energy consumption is visible and measurable. Gold mining’s environmental damage is less visible but arguably more permanently destructive—poisoned watersheds, deforested landscapes, and displaced communities.

Investors prioritizing environmental impact must weigh visible energy consumption against less visible ecological destruction. Both industries face pressure to improve.

How Much Bitcoin vs Gold Should I Have in My Portfolio?

Rather than viewing Bitcoin and Gold as competitors, sophisticated investors consider how each contributes to overall portfolio diversification.

Why Combining Them Makes Sense?

Bitcoin and Gold have shown periods of low or even inverse correlation, according to Newhedge.io analysis. When assets move independently, combining them can reduce overall portfolio volatility while maintaining return potential.

| Scenario | Bitcoin | Gold | Combined Portfolio |

| Crypto crash | ⬇️ -50% | ➡️ Stable | Cushioned |

| Inflation surge | ⬆️ Variable | ⬆️ Up | Protected |

| Risk-off environment | ⬇️ Down | ⬆️ Up | Balanced |

| Dollar weakness | ⬆️ Up | ⬆️ Up | Amplified gains |

Allocation Framework by Investor Profile

| Profile | Bitcoin | Gold | Rationale |

| Aggressive (under 35) | 5-15% | 5-10% | Long horizon absorbs volatility |

| Moderate (35-55) | 2-8% | 5-15% | Balance growth and stability |

| Conservative (55+) | 1-5% | 10-20% | Emphasize preservation |

| Crypto-native | 10-30% | 2-5% | Comfortable with volatility |

Risk Management Principles

Effective risk management recognizes that Bitcoin’s volatility means position sizing matters enormously:

- 50% Bitcoin allocation that drops 70% = devastating portfolio damage

- 5% Bitcoin allocation that drops 70% = barely noticeable

There is no universally correct investment choice. Your allocation should reflect your honest assessment of how you’d react to severe drawdowns.

Is Bitcoin a Safe Investment?

Bitcoin’s safety depends entirely on individual risk tolerance and investment horizon.

Potential Benefits:

- Substantial return potential (historically 100%+ annual returns in bull markets)

- True ownership possible through self-custody

- Uncorrelated to traditional financial system

- Fixed supply protects against monetary debasement

Real Risks:

- Extreme volatility (80%+ drawdowns have occurred multiple times)

- Regulatory uncertainty (could face restrictions)

- Technical risks (lost keys, exchange hacks)

- No intrinsic cash flows or earnings

Bottom Line: For those who can hold through extreme volatility and understand the technology, Bitcoin has rewarded patience. For those who need stability or may need to sell during downturns, Bitcoin’s risks may outweigh its potential.

Is Gold a Safe Investment?

Gold is generally considered safer and more stable than Bitcoin, but no investment is risk-free.

Potential Benefits:

- 5,000+ year track record as store of value

- Lower volatility than Bitcoin or stocks

- Traditional safe haven during crises

- Central bank backing validates its role

Real Risks:

- Can decline significantly (fell 45% from 1980 peak, took 28 years to recover)

- Produces no income (opportunity cost during bull markets)

- Storage and insurance costs for physical gold

- Counterparty risk with paper gold products

Bottom Line: For long-term wealth preservation with moderate expectations, gold has historically delivered. Don’t expect explosive returns, but do expect relative stability.

Can Bitcoin Replace Gold as a Safe Haven Asset?

This debate continues without resolution.

Arguments For Bitcoin Replacing Gold:

- Superior scarcity (mathematically fixed vs. geologically limited)

- Better portability (cross borders with 12 words)

- Easier divisibility (buy $10 worth easily)

- Younger generations prefer digital assets

- Network effects growing exponentially

Arguments Against:

- Only 15 years of history vs. 5,000+

- Volatility precludes “safe haven” designation currently

- Unproven during major financial crisis as mature asset

- Regulatory risks remain uncertain

- Technology barriers for older investors

The Likely Reality: Institutional investors increasingly allocate to both rather than choosing one. Bitcoin may eventually achieve safe haven status as it matures, but likely complements rather than replaces gold.

Different investors will reach different conclusions based on their assessment of technological versus historical confidence.

Where Can I Buy Bitcoin vs Gold?

Acquiring Bitcoin

| Method | Pros | Cons |

| Exchanges (Coinbase, Kraken) | Easy, quick | Custodial risk |

| Bitcoin ETFs | Traditional brokerage, regulated | Annual fees, no self-custody |

| Peer-to-peer | Private, direct | More complex, scam risk |

| Bitcoin ATMs | Anonymous, cash | High fees (5-10%) |

After purchase: Consider transferring to a hardware wallet (Ledger, Trezor) for secure non-custodial storage.

Acquiring Gold

| Method | Pros | Cons |

| Physical dealers (APMEX, JM Bullion) | True ownership | Storage, insurance needed |

| Gold ETFs (GLD, IAU) | Convenient, liquid | Annual fees, paper claim |

| Allocated storage (BullionVault) | Professional security | Custodian fees |

| Coin shops | Local, immediate | Premiums vary |

Acquiring Gold offers multiple pathways. Here’s how to buy gold step-by-step.

What Are the Tax Implications of Bitcoin vs Gold?

Tax implications vary by jurisdiction but share common features in most countries.

General Principles

| Aspect | Bitcoin | Gold |

| Classification | Property (most jurisdictions) | Property/collectible |

| Capital gains | Taxable on sale | Taxable on sale |

| Holding period matters | Yes (long-term vs short-term rates) | Yes |

| Cost basis tracking | Complex (multiple purchases) | Simpler |

| Reporting requirements | Increasingly strict | Well-established |

Key Considerations

- Both assets trigger capital gains taxes when sold for profit. Consider a gold IRA for tax-advantaged gold investing.

- In the US, assets held over one year qualify for lower long-term rates

- Crypto-specific rules around staking, forks, and airdrops add complexity

- Gold collectibles (coins) may face higher tax rates than bullion in some jurisdictions

📌 REMEMBER: Keep meticulous records of all transactions—purchase dates, prices, fees, and sale proceeds. Crypto tax software (CoinTracker, Koinly) can help track cost basis across multiple exchanges.

Always consult a qualified tax professional for advice tailored to your specific situation and jurisdiction.

What Do Experts Say About Bitcoin vs Gold in 2026?

Predicting asset prices is notoriously unreliable, but several factors will influence both assets’ trajectories.

Bitcoin’s Key Drivers

- Halving effect: April 2024 halving reduced new supply; historically bullish 12-18 months after

- ETF flows: Institutional adoption through spot Bitcoin ETFs

- Regulatory clarity: Evolving rules in US, EU, and Asia

- Technological development: Layer 2 scaling, privacy features

- Macro environment: Interest rates, dollar strength

Gold’s Key Drivers

- Central bank buying: Record purchases continuing

- Real interest rates: Negative real rates support gold

- Geopolitical risk: Wars, tensions favor safe havens

- Dollar trajectory: Dollar weakness supports gold

- Industrial demand: Electronics, renewable energy

Expert Perspectives

| Source | Bitcoin View | Gold View |

| JPMorgan | Increasingly attractive inflation hedge | Traditional allocation remains valid |

| BlackRock | Approved ETF; sees institutional role | Maintains significant gold ETF offerings |

| Ray Dalio | Small allocation reasonable | Core portfolio holding |

| Cathie Wood | $1M+ price targets | Less emphasis |

The future of finance likely includes both assets. Gold’s 5,000-year track record suggests continued relevance. Bitcoin’s unique properties suggest it won’t disappear. The ratio between them may shift over decades as Bitcoin matures.

Key Takeaways

- Gold offers proven stability with 5,000+ years as a store of value, lower volatility, and a $13.5 trillion market cap.

- Bitcoin provides programmatic scarcity (21 million cap), higher growth potential, and superior portability—but with 50%+ price swings.

- Both assets show periods of low correlation, making them complementary rather than competing portfolio holdings.

- Your choice depends on risk tolerance, time horizon, and whether you prioritize stability or growth potential.

Bottom Line

The Bitcoin vs Gold comparison reveals not a winner but two distinct tools for different purposes within a thoughtful investment approach.

Gold offers what 5,000 years of history have proven: reliable wealth preservation across generations, civilizations, and crises. It lacks excitement but delivers consistency.

Bitcoin offers what the digital age uniquely enables: mathematically enforced scarcity, borderless transferability, and potential for substantial appreciation as adoption grows. It carries genuine risks but also genuine innovation.

Many sophisticated investors conclude the answer isn’t either/or—it’s both, in proportions matching individual circumstances.

The ultimate investment showdown has no single winner—only the investor who chooses wisely for their own situation.

References

- MacroMicro: Gold vs. Bitcoin Market Capitalization

- Ingoldwetrust.report: Market Capitalization Comparison

- LongtermTrends: Bitcoin vs. Gold Historical Chart

- Curvo.eu: Bitcoin vs Gold vs S&P 500 Performance

- River Financial: Bitcoin vs. Gold Analysis

- Coinmetro: Bitcoin vs. Gold Comparative Analysis

- Bitcoin Magazine: JPMorgan on Bitcoin vs Gold

- Digiconomist: Environmental Impact Comparison

- Newhedge.io: Bitcoin-Gold Correlation Analysis

- Wharton Knowledge: Bitcoin vs Gold Comparison

- Yahoo Finance: Bitcoin vs Gold 2026 Analysis