This sector injected $4.8 billion into 446 deals during Q1 2026, marking a significant 54% quarter-over-quarter investment surge. It operates with distinct token-based financial models, differentiating it from traditional investment strategies.

While understanding Crypto Venture Capital (VC) is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What Is Crypto Venture Capital (VC)?

Crypto Venture Capital (VC) refers to funds specifically established to invest in blockchain and cryptocurrency-related startups. This investment branch, often abbreviated as BCVC (Blockchain and Crypto-focused Venture Capital), provides capital to early-stage companies and projects operating within the Web3 ecosystem. BCVCs fund a range of innovations, including new Layer 1 protocols, decentralized finance (DeFi) applications, non-fungible token (NFT) platforms, and metaverse infrastructure.

BCVCs differ from traditional venture capital firms by their asset class focus and investment structures. They primarily target ventures developing transformative technology in a rapidly evolving digital landscape. Their goal extends beyond mere capital provision; they actively participate in shaping the nascent blockchain industry through strategic guidance and resource allocation.

Core Mechanics of Crypto VC Funding

Crypto VC funding involves distinct mechanisms designed for the blockchain industry. These mechanisms provide capital while aligning incentives between investors and projects. Investors navigate a landscape marked by both traditional equity stakes and novel token-based agreements.

Equity Funding vs. Token Warrants

Crypto VCs utilize two primary funding structures: traditional equity stakes and token warrants. Equity funding involves purchasing company shares, granting investors ownership in the startup. This mirrors conventional VC investments.

Token warrants, however, represent a unique blockchain-native approach. Investors acquire SAFTs (Simple Agreements for Future Tokens), which grant them the right to receive a predetermined number of native tokens at a future date.

This model offers direct exposure to the project’s tokenomics and future network value. Token-based investments provide earlier liquidity opportunities compared to traditional equity exits.

The Role of Decentralized Finance (DeFi) Protocols

Crypto VCs strategically invest in decentralized finance (DeFi) protocols and their underlying infrastructure. DeFi encompasses financial applications built on blockchain technology, operating without central intermediaries. Examples of DeFi protocols include lending platforms like Aave, decentralized exchanges (DEXs) such as Uniswap, and yield aggregators like Yearn Finance.

VCs inject capital into these protocols to accelerate their development, enhance security, and expand user adoption. Investments in DeFi often involve acquiring governance tokens, enabling VCs to participate in the protocol’s decision-making process. A significant portion of the $4.8 billion injected in Q1 2026 specifically targeted advancements in DeFi infrastructure, validating the sector’s rapid growth.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMarket Analysis: Crypto VC Investment Trends

The Crypto VC market demonstrates robust growth and strategic shifts in 2026. Investment activity reflects increased confidence in blockchain technology’s long-term potential. Detailed analysis of capital inflow and sector focus provides a clear picture of market dynamics.

Capital Inflow and Deal Volume

The first quarter of 2026 witnessed a substantial resurgence in Crypto VC investments. Global investment volume reached $4.8 billion, representing a significant 54% increase quarter-over-quarter. This capital influx spread across 446 distinct deals, indicating broad market participation and diverse investment opportunities.

This data highlights a recovery trend following previous market corrections. Investors now focus on projects with clear utility, strong teams, and sustainable tokenomics.The average deal size also increased by 15% to $10.7 million compared to Q4 2024, demonstrating larger commitments per transaction.

Sector Focus and Innovation Drivers

Investments in Q1 2026 primarily targeted foundational blockchain innovation and infrastructure projects. These include Layer 1 and Layer 2 scaling solutions, interoperability protocols, and advanced security infrastructure. Web3 gaming and metaverse-related projects also attracted significant capital. Decentralized AI applications emerged as a new frontier for investment, drawing 8% of total capital.

BCVC firms, such as CV VC, actively seek projects that demonstrate potential for widespread adoption and offer disruptive solutions to existing market challenges. They also look for projects that offer robust tokenomics, a critical component often supported by the VC firms themselves through specialized tokenomics consulting.

Crypto VC vs. Traditional Finance Models

Understanding the distinctions between Crypto VC and traditional finance models is crucial for both investors and entrepreneurs. These differences impact investment strategies, liquidity horizons, and regulatory considerations.

Crypto VC vs. Traditional Venture Capital

Crypto VC and Traditional Venture Capital (Trad VC) share the goal of funding early-stage companies but differ fundamentally in asset classes, liquidity, and regulatory frameworks.

| Feature | Crypto Venture Capital | Traditional Venture Capital |

| Primary Asset | Equity + Tokens (Hybrid) | Equity (Shares) |

| Liquidity Timeline | 2–5 Years (via Token Markets) | 7–10 Years (via IPO/M&A) |

| Key Instrument | SAFT / Token Warrant | SAFE / Convertible Note |

| Regulatory Body | Evolving (SEC / Global) | Established Securities Law |

Traditional equity investments are typically governed by established securities laws, as discussed on SEC.gov. Token investments face an evolving landscape, with utility tokens sometimes falling outside traditional securities classifications.

Is VC Better Than Private Equity (PE)?

Venture Capital (VC) and Private Equity (PE) serve different purposes. VC focuses on funding very early-stage startups with high growth potential and significant risk. Private Equity, on the other hand, typically involves investing in more mature, established private companies.

PE firms often acquire controlling stakes to improve operational efficiency. Crypto VC caters to the nascent, high-risk, high-reward blockchain sector, whereas PE focuses on companies with a proven track record.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountHow to Secure Funding from Crypto VCs

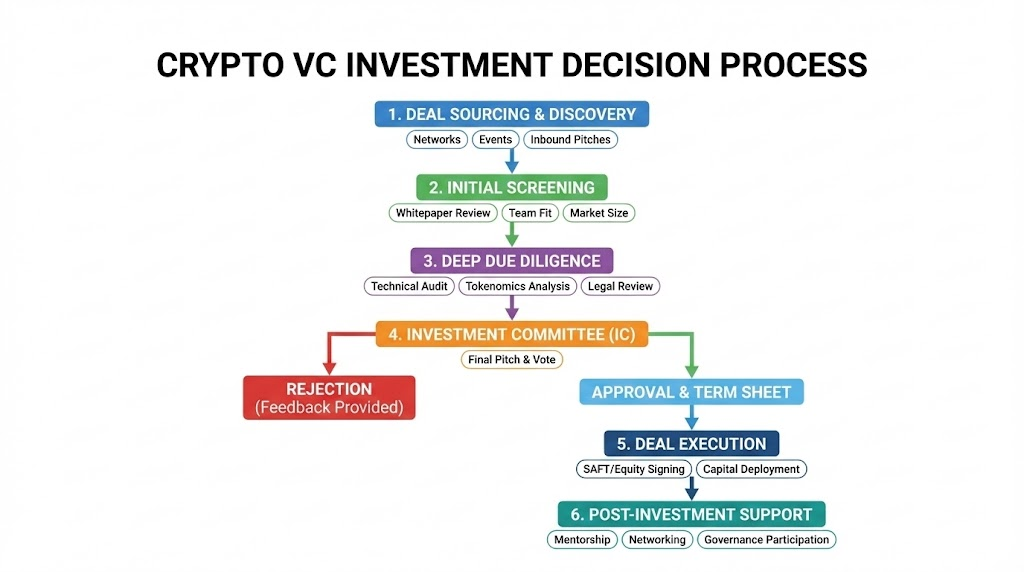

Securing funding from Crypto VCs requires a strategic approach focused on demonstrating innovation, market fit, and strong execution capabilities. Projects must articulate their value proposition clearly and understand the unique support VCs offer.

Pitching Strategies for Blockchain Projects

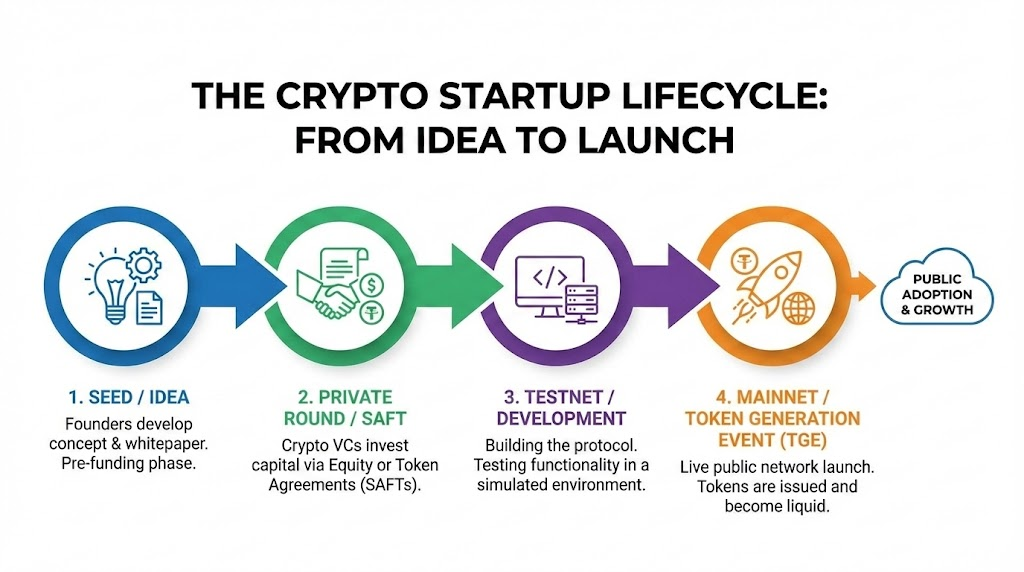

Effective pitching strategies for blockchain projects prioritize highlighting transformative technology and clear utility. Founders must present a detailed whitepaper, a robust technical roadmap, and a comprehensive tokenomics model. VCs seek projects that display significant potential for disruption and scalable user adoption. Providing a working prototype or a testnet demonstration significantly strengthens a pitch.

Crypto VCs also evaluate the team’s expertise and ability to execute. They invest in founders who possess a deep understanding of blockchain technology. Beyond the core technology, projects should articulate their go-to-market strategy and competitive advantages. Many successful pitches emphasize a clear problem-solution fit within the existing crypto landscape.

Understanding Acceleration Programs

Many Crypto VCs operate or partner with acceleration programs designed to nurture early-stage blockchain projects. These programs offer more than just capital; they provide invaluable value-add services. Examples include mentorship from industry experts, access to a network of developers and strategic partners, and technical support.

Firms like CV VC are known for their comprehensive ecosystem support, helping projects refine their business models. Founders benefit from structured guidance, increasing their chances of long-term success. This holistic support distinguishes specialized crypto VCs from purely financial investors.

Disambiguation: What Does VC Mean in Trading?

The term “VC” holds different meanings depending on its context. While it predominantly refers to Venture Capital in startup funding, its usage in trading and technical analysis is entirely distinct.

In trading, “VC” often refers to Volume Control or Volume Candles. Volume Control relates to technical indicators that allow traders to analyze trading volume data. Volume Candles are graphical representations on a chart that show trading activity within a specific period. These trading-centric meanings have no connection to the investment activities of Venture Capital firms.

Key Takeaways

- Hybrid Investment Models: Crypto VCs use a mix of traditional equity and token-based agreements like SAFTs to align with blockchain project goals.

- Resurgent Capital: A 54% surge in Q1 2025 funding indicates renewed institutional confidence in Web3 and DeFi scaling solutions.

- Ecosystem Architects: Specialized firms provide “more than money,” offering technical audits, tokenomics design, and acceleration mentorship.

- Shortened Liquidity: Token investments can offer liquidity in 2–5 years, significantly faster than the 7–10 years typical of traditional IPO-focused VCs.

- Risk & Diligence: High failure rates in early-stage tech make rigorous due diligence on team and technology mandatory for both VCs and individual investors.

Bottom Line

In 2026, Crypto Venture Capital has evolved from a speculative experimental niche into a mature pillar of the global digital economy. By providing not just capital, but technical guidance and tokenomic expertise, these firms are the primary architects behind the next generation of decentralized infrastructure. For founders, securing VC backing is often the defining factor in surviving the “valley of death” between a whitepaper concept and a live, scalable mainnet.

FAQ