Understanding APY is crucial for maximizing earnings and evaluating risk in the dynamic cryptocurrency market. This metric directly impacts your investment’s growth potential.

While understanding Annual Percentage Yield (APY) is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What Is Annual Percentage Yield (APY) in Cryptocurrency?

Annual Percentage Yield (APY) in cryptocurrency measures the total amount of interest earned on an investment over one year, taking compounding into account. This means APY includes interest earned on the initial principal and on the previously accumulated interest. It provides a more accurate representation of actual earnings compared to simple interest rates. APY is a key metric for evaluating investment opportunities across decentralized finance (DeFi) platforms.

The Role of Compound Interest in Digital Assets

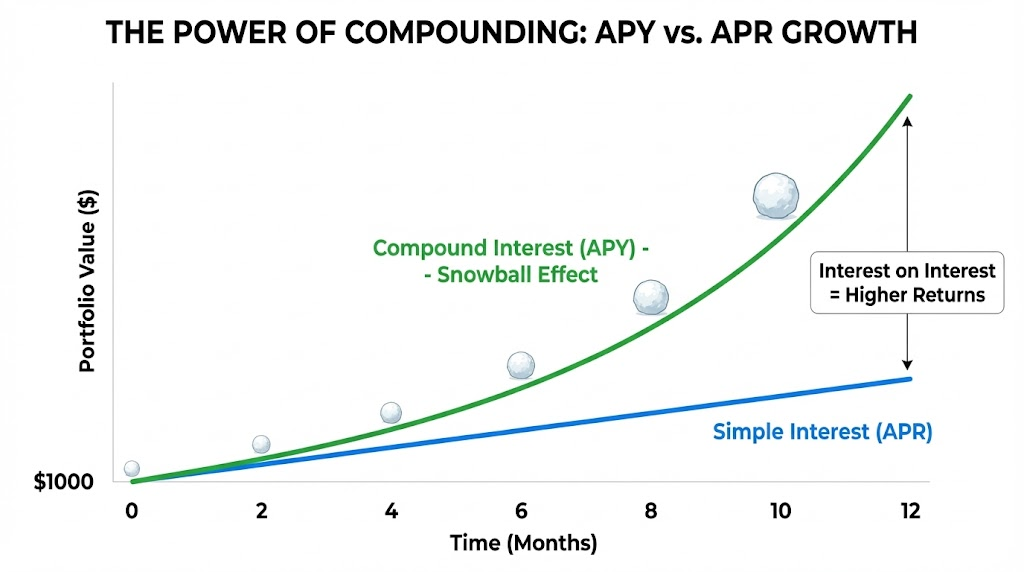

Compound interest forms the fundamental basis of APY calculations. It involves earning interest not just on the initial capital, but also on the interest that has already been added to the principal. This “interest on interest” effect accelerates investment growth significantly over time. For a deeper understanding of compound interest principles, consult resources like Investor.gov.

Digital assets, through mechanisms like staking and lending, facilitate compound interest. These platforms automatically re-invest earnings back into the principal. This process increases the total capital, leading to higher interest accrual in subsequent periods.

Compounding Frequency in Crypto vs. Traditional Finance

Compounding frequency defines how often earned interest is added to the principal. In traditional finance, banks typically compound interest monthly or annually. This means interest is calculated and added to the principal at these fixed intervals.

Cryptocurrency platforms, however, often offer much more frequent compounding. Some protocols compound interest hourly, or even per blockchain block (every few seconds). This aggressive compounding frequency drastically increases the effective APY, generating returns faster than conventional financial products. For example, daily compounding yields significantly more than monthly compounding at the same nominal rate.

How Is Crypto APY Calculated?

Crypto APY is calculated using the compound interest formula, which quantifies the impact of earning interest on previously accumulated interest. This formula ensures that the total annual return reflects all compounding periods. Understanding its components is essential for precise yield evaluation.

The general formula for APY is:

$$APY = \left(1 + \frac{r}{n}\right)^n – 1$$

Understanding the APY Formula Variables (r, n)

The APY formula relies on two primary variables:

- r: This represents the stated annual interest rate (as a decimal). For example, a 5% interest rate becomes 0.05 in the formula.

- n: This denotes the number of compounding periods within one year. For instance, if interest compounds monthly, $n = 12$; if daily, $n = 365$.

This formula calculates the effective annual return by factoring in how often interest is added to the principal. A higher ‘n’ value, or more frequent compounding, always results in a higher APY for the same ‘r’.

Calculation Example: 5% APY on $1,000 Investment

Consider an initial investment of $1,000 at a nominal annual interest rate of 5% ($r = 0.05$), compounded monthly ($n = 12$).

Using the formula $A = P\left(1 + \frac{r}{n}\right)^{nt}$ where $P$ is the principal, and $t$ is time in years:

- Monthly Interest Rate: $0.05 / 12 = 0.00416667$

- Factor per period: $1 + 0.00416667 = 1.00416667$

- Total periods: 12 (for one year)

- Final Amount: $1,000 \times (1.00416667)^{12} \approx 1,051.27$

After one year, your $1,000 investment grows to approximately **$1,051.27**. This yields a profit of $51.27. If the interest was simple, your profit would be exactly $50 ($1,000 \times 0.05$). The $1.27 difference highlights the power of monthly compounding.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhere Does Crypto APY Come From?

Crypto APY does not magically appear; it originates from specific activities within decentralized networks. These yield sources provide value to the network or other participants, who in turn reward the providers of capital. Primary sources include staking, yield farming, and crypto lending platforms.

Staking Rewards and Network Validation

Staking involves locking up cryptocurrency to support the operations of a blockchain network. This mechanism is primarily used by Proof of Stake (PoS) blockchains to secure the network and validate transactions. Participants “stake” their tokens as collateral, which makes them eligible to be selected as validators. When chosen, validators earn newly minted tokens or transaction fees as rewards.

Ethereum, for instance, transitioned to a Proof of Stake model with Ethereum 2.0. Users stake ETH to participate in network validation and earn rewards. The official Ethereum.org website provides extensive details on how staking contributes to network security and generates yield. Staking rewards typically represent a predictable source of APY.

Yield Farming and Liquidity Provision

Yield farming involves strategically moving crypto assets across various DeFi protocols to maximize returns. This complex activity often includes providing liquidity to decentralized exchanges (DEXs) or lending protocols. Liquidity providers (LPs) deposit pairs of tokens into liquidity pools, enabling trades to occur. In return for providing this essential service, LPs earn a share of the trading fees.

Many yield farming protocols also distribute additional “governance tokens” as incentives. These tokens are designed to attract more liquidity to the platform. Examples include Uniswap, PancakeSwap, and Aave. Yield farming APYs can be highly variable and frequently change due to market conditions.

Crypto Lending Platforms

Crypto lending platforms allow users to lend out their digital assets to borrowers in exchange for interest payments. These platforms act as intermediaries, connecting lenders with borrowers who require capital for trading, margin positions, or other purposes. The interest rates and APY offered vary based on the specific asset, demand from borrowers, and platform policies.

Lending can occur on both centralized finance (CeFi) platforms like Binance and decentralized finance (DeFi) protocols such as Compound and Aave. Stablecoins like USDT, USDC, and DAI are frequently lent due to their price stability, often generating consistent APY. Borrowers provide collateral, typically in excess of the loan amount, to mitigate default risk for lenders.

What Is the Difference Between APY and APR in Crypto?

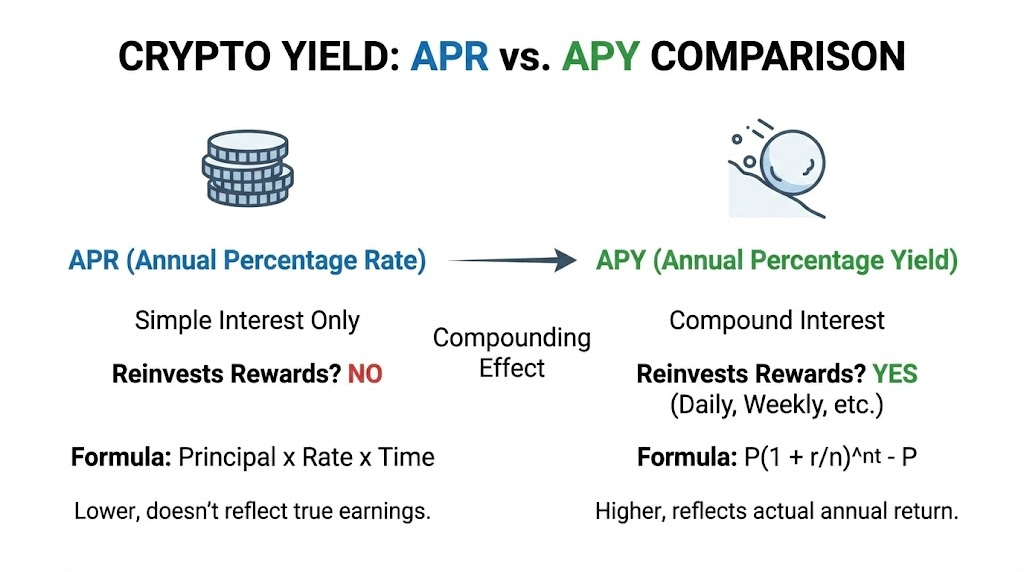

Understanding the distinction between APY (Annual Percentage Yield) and APR (Annual Percentage Rate) is critical for accurately assessing crypto investment returns. While both indicate annual rates, their calculation methods differ significantly. The core difference lies in the inclusion of compound interest.

APR represents the simple annual interest rate, not accounting for the effects of compounding. It only applies to the initial principal amount. For example, a loan with 10% APR means you pay 10% of the principal in interest over a year, regardless of how often payments are made.

APY, conversely, includes the effect of compound interest. It reflects the true rate of return earned on an investment over a year, considering that interest earned is reinvested and also earns interest. APY provides a more holistic view of potential gains for investors.

| Feature | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

| Interest Type | Simple interest | Compound interest |

| Calculation Basis | Initial principal only | Initial principal + accumulated interest |

| Real Return | Does not reflect actual earnings | Reflects true annual return |

| Common Use | Loans, credit cards | Investments, savings accounts |

When evaluating crypto investments, APY provides a more accurate picture of the total profit potential. APR is typically used for loans or credit products where the borrower pays simple interest. For earning interest on crypto, APY is the relevant metric.

What Is a Good APY for Crypto Assets?

Determining a “good” APY for crypto assets depends heavily on the type of asset, the underlying platform, and the associated risks. What might be an excellent APY for a stablecoin could be a dangerously low return for a highly volatile altcoin. There is no single universal “good” APY. Instead, a realistic range exists depending on risk profile.

Historically, traditional bank savings accounts offer APYs typically less than 1%. In contrast, crypto APYs often range from 3% to over 100% or even higher. This vast difference highlights the higher risks inherent in digital assets. Factors like market volatility, smart contract risks, and impermanent loss all influence what constitutes an acceptable APY.

Stablecoin APY vs. Volatile Asset APY Rates

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar. Because of their price stability (volatility typically < 1%), stablecoin APYs are generally lower and more predictable. A “good” APY for stablecoins might range from 5% to 20%. Anything significantly higher could indicate increased risk.

Volatile assets, like Bitcoin, Ethereum, or newer altcoins, experience significant price swings. Earning 50% APY on a volatile asset might seem attractive, but if the asset’s price drops by 70% during the year, the investor incurs a net loss. Therefore, a “good” APY for volatile assets needs to compensate for this inherent price risk. It must significantly exceed potential depreciation to be truly profitable.

Risks Associated with High APY (Impermanent Loss & Volatility)

High APYs in crypto frequently correlate with higher risks. One prominent risk in liquidity provision is impermanent loss. This occurs when the price of your deposited assets changes relative to each other after you provide them to a liquidity pool. The larger the price divergence, the greater the impermanent loss. This loss can sometimes outweigh the earned APY.

Volatility presents another major risk. A high APY on an asset that depreciates rapidly can lead to a net negative return. Investors must consider the “real yield” – the APY adjusted for asset price changes – rather than just the nominal APY. Unlike traditional bank deposits, which the FDIC insures up to $250,000, crypto assets lack such government-backed insurance.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountIs Crypto APY Worth It?

Evaluating whether crypto APY is “worth it” involves balancing potential high returns against inherent risks. For many investors, the opportunity to generate significantly higher yields than traditional finance makes crypto APY attractive. However, this profitability comes with distinct considerations that demand careful analysis. Real profitability depends on more than just the advertised APY.

High APYs often reflect market inefficiencies or the high demand for specific liquidity. Early participants in emerging protocols can secure substantial gains. Successful long-term APY strategies focus on sustainable projects with strong fundamentals. They prioritize assets with less volatility or those providing essential network services.

The true worth of crypto APY also ties into one’s risk tolerance. Aggressive yield farming strategies might deliver immense returns, but they also carry elevated risks of impermanent loss, smart contract vulnerabilities, or protocol failures. Conservative approaches, such as staking established assets or stablecoin lending, typically offer lower but more stable APYs. Ultimately, crypto APY is worth it for investors who conduct thorough research, understand the associated risks, and align their investments with a clear financial strategy.

Key Takeaways

- APY accounts for compound interest, providing a comprehensive view of annual returns.

- Crypto compounding frequency often exceeds traditional finance, accelerating growth.

- Yield sources include staking, lending, and yield farming, each with distinct risk profiles.

- APY differs from APR by including the effect of reinvested earnings.

- High APYs demand scrutiny due to risks like impermanent loss and asset volatility.

Bottom Line

In the world of decentralized finance, APY is the pulse of your portfolio’s growth, transforming idle assets into active income streams through the sheer force of compounding. While the allure of triple-digit yields is undeniable, true profitability lies in balancing these rewards against the stark realities of market volatility and protocol risk. By mastering the distinction between APY and APR, investors can move beyond the hype to build a resilient, yield-bearing digital strategy that actually delivers on its promises.