Cryptocurrency markets operate at extreme speeds, with prices constantly fluctuating. This rapid movement often creates a gap between what a trader expects to pay or receive and the final executed amount. Understanding slippage provides critical insight into managing trade outcomes on both centralized and decentralized exchanges.

While understanding Slippage in Crypto is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is Slippage in Crypto? (Definition & Core Concept)

Slippage in crypto represents the deviation between the price a trader expects to pay or receive and the actual price at which their order executes. This phenomenon impacts all financial markets, but it intensifies in the high-volatility, 24/7 cryptocurrency environment. Slippage primarily arises when market prices change between order submission and final processing.

This price difference can range from minor fractions of a percentage to several percentage points. For instance, a trader attempting to buy 1 ETH at $3,000 might find their order executes at $3,003, incurring $3 of negative slippage per ETH. These deviations are particularly notable in liquid assets or during significant market events.

The Difference Between Expected Price and Executed Price

The “expected price” signifies the price displayed to the trader at the moment of order placement. Conversely, the “executed price” represents the actual average price at which all tokens within that order transact. This difference is not a fee, but a market reality. The gap widens or narrows based on specific market conditions impacting the asset.

Types of Slippage Outcomes

Slippage does not always result in a negative outcome. It presents two primary types: negative and positive. Both types impact a trader’s final token count or fiat value but with opposing results. Recognizing these outcomes allows for a more nuanced trading strategy.

Negative Slippage (Buying High / Selling Low)

Negative slippage occurs when a trade executes at a price less favorable than the initial quote. For buyers, this means acquiring an asset at a higher price than expected. For sellers, it translates to receiving a lower price than anticipated. This scenario typically arises when market prices move unfavorably during the order processing window.

Negative slippage directly reduces a trade’s profitability. A large sell order for a low-liquidity token might clear multiple price levels, pushing the average executed price significantly down. Traders commonly experience this when market orders hit thin order books.

Positive Slippage (Buying Low / Selling High)

Positive slippage occurs when a trade executes at a price more favorable than the initial quote. Buyers receive their assets at a lower price than anticipated, or sellers achieve a higher sale price. This outcome benefits the trader and typically happens during sudden market shifts. For example, if a buy order is placed and the asset’s price drops significantly before execution, the order may fill at the new, lower price.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesPrimary Causes of Trade Slippage

Several factors contribute to the occurrence and magnitude of trade slippage in cryptocurrency markets. These causes intertwine, creating complex market dynamics that affect execution prices. Understanding them enables traders to mitigate potential risks.

Market Volatility and Price Fluctuation

Market volatility represents the most significant driver of slippage. Highly volatile assets, such as new altcoins or tokens during major news events, experience rapid price swings. If an asset’s price changes drastically between the moment a trader clicks “buy” and the transaction’s confirmation, slippage occurs. A rapid 5% price drop during order processing directly causes slippage.

Bitcoin (BTC) and Ethereum (ETH), while generally more stable, also incur slippage during periods of high market flux. For instance, a 10% price movement within an hour for Bitcoin increases the probability of higher slippage values. This correlation indicates that higher volatility directly causes greater slippage.

Low Liquidity and Large Order Sizes

Liquidity describes the ease with which an asset can be bought or sold without significantly impacting its price. Low-liquidity assets often have sparse order books or shallow AMM pools. Submitting a large order for such an asset consumes multiple available orders (or a significant portion of an AMM pool), moving the price against the trader. This action is known as “price impact.”

This interaction with low liquidity means large orders incur higher slippage. A trade for $100,000 worth of a token with only $50,000 in its liquidity pool forces the order to execute at progressively worse prices. Major decentralized exchanges (DEXs) like Uniswap and PancakeSwap rely on liquidity pools; smaller pools amplify slippage effects.

Network Congestion and Transaction Speed

Blockchain network congestion directly contributes to slippage by increasing transaction processing times. When a network like Ethereum experiences high demand, transaction fees rise, and confirmation times extend. A trade submitted during congestion waits longer to process. During this delay, the asset’s market price can move significantly, creating slippage.

For example, a transaction taking 30 seconds to confirm during high congestion risks greater price movement than one confirming in 5 seconds. This delay allows for more market fluctuation. This factor is more prevalent on decentralized exchanges (DEXs) where transaction finality depends on block confirmation.

How To Use a DEX: Order Books vs. AMMs (Automated Market Makers)

Slippage mechanisms differ between centralized exchanges (CEXs) and decentralized exchanges (DEXs) due to their underlying infrastructure. CEXs utilize traditional order books, while DEXs predominantly use Automated Market Makers (AMMs). Each model presents distinct slippage characteristics.

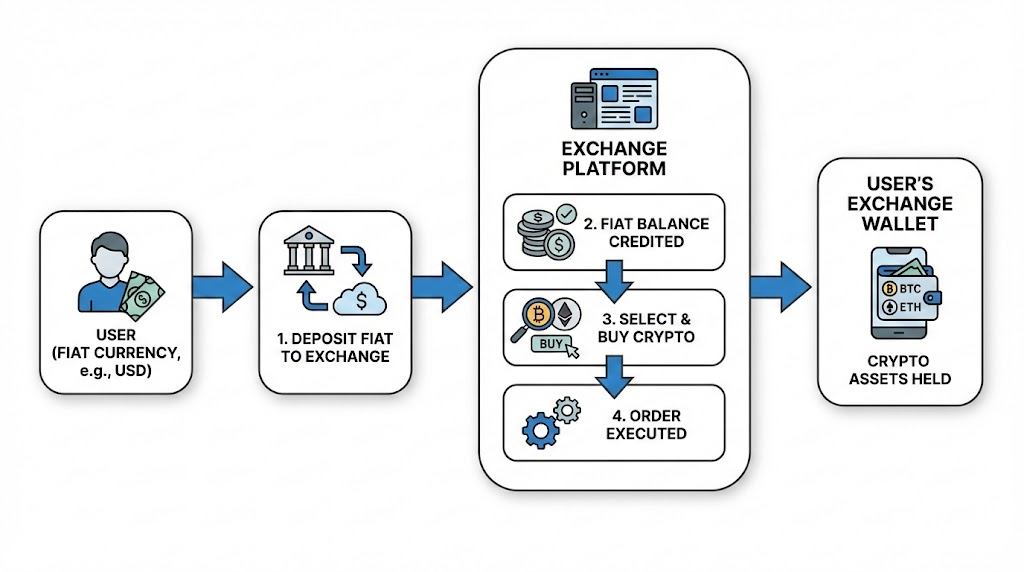

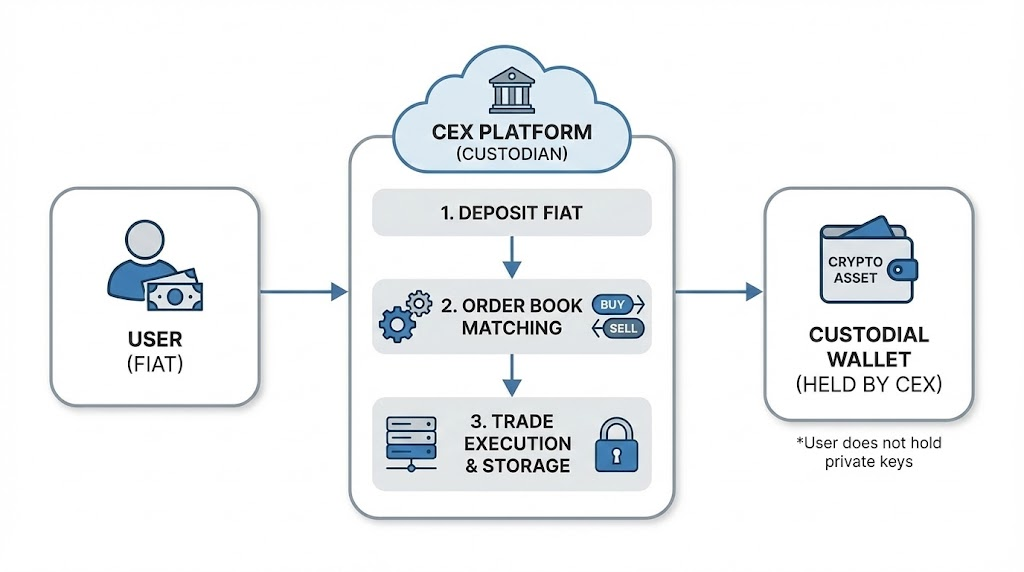

Slippage on Centralized Exchanges (CEX)

Centralized exchanges like Binance and Coinbase employ traditional order books. These books display buy and sell orders at various prices. Slippage occurs here when a market order is too large for the available liquidity at the best price. The order fills by consuming subsequent orders at progressively worse prices until it completes.

For example, a large market buy order for an altcoin might clear all available sell orders at $1.00, then $1.01, and finally $1.02. The average executed price becomes higher than the initial best bid. This “sweeping” of the order book directly generates slippage. The depth of the order book indicates its liquidity and thus its resistance to slippage.

Slippage on Decentralized Exchanges (DEX)

Decentralized exchanges, such as Uniswap and PancakeSwap, primarily utilize Automated Market Makers (AMMs). AMMs manage liquidity through smart contracts and liquidity pools instead of order books. The Constant Product Formula (x * y = k) governs most AMMs, where ‘x’ and ‘y’ represent the quantities of two tokens in a pool, and ‘k’ is a constant.

When a trader swaps tokens on an AMM, they remove one token from the pool and add another. This action changes the ratio of x and y, which in turn alters the implied price. Large swaps significantly shift the ratio, causing the executed price to deviate from the initial quote. This deviation is AMM slippage.

What is a Normal Slippage Percentage? (Benchmarks & Settings)

Determining a “normal” slippage percentage depends heavily on the asset’s characteristics and market conditions. Traders often configure a specific slippage tolerance. This setting dictates the maximum percentage of price deviation they are willing to accept for a trade to execute.

Setting an appropriate tolerance balances trade execution speed against potential price losses. Too low, and trades may fail; too high, and unexpected costs occur. This crucial setting requires careful consideration.

Low Slippage Tolerance (0.1% – 0.5%)

Low slippage tolerance settings, typically between 0.1% to 0.5%, are common for stablecoins or highly liquid assets. Stablecoins like USDT or USDC exhibit minimal price volatility due to their pegging mechanisms. Their deep liquidity pools allow for large trades with negligible price impact. Setting a tight tolerance ensures execution only occurs near the quoted price.

This range is ideal for assets with high trading volume and established markets. Trades involving Bitcoin (BTC) or Ethereum (ETH) on major exchanges often succeed with tolerances in this lower range. It prioritizes price certainty over guaranteed execution.

High Slippage Tolerance (1.0% – 5.0%+)

High slippage tolerance, ranging from 1.0% to 5.0% or even higher, is necessary for highly volatile assets or tokens with low liquidity. New altcoins, meme coins, or tokens with small market caps frequently require higher tolerances. These assets experience rapid price swings and possess shallow liquidity pools. A high tolerance ensures the trade actually processes, even if the price moves significantly.

The Risk of Front-Running (MEV Bots) with High Slippage

Setting slippage tolerance excessively high, particularly above 2-3% on DEXs, attracts MEV (Maximal Extractable Value) bots. These automated programs monitor the mempool for pending transactions with high slippage tolerance. They identify a target transaction and then execute a “sandwich attack.”

In a sandwich attack, an MEV bot places a buy order immediately before the target transaction and a sell order immediately after. This action drives up the price for the target buy and then profits from the resulting price increase. The target transaction executes at a worse price, while the bot captures the profit. This risk emphasizes the need for careful slippage tolerance configuration, especially in DeFi.

How to Minimize Slippage Impact

Minimizing slippage impact involves strategic trading decisions and judicious use of exchange features. Traders implement specific methods to protect their capital from unexpected price deviations. These strategies prioritize control over execution price.

Using Limit Orders Instead of Market Orders

The most effective method to prevent negative slippage is using limit orders instead of market orders. A limit order allows a trader to specify the exact price at which they are willing to buy or sell an asset. The order only executes at that price or better. If the market price moves beyond the specified limit, the order remains unfulfilled until conditions match.

This approach guarantees the execution price, eliminating negative slippage. However, limit orders carry the risk of non-execution if the market never reaches the specified price. This trade-off balances price certainty against guaranteed transaction completion.

Adjusting Slippage Tolerance Settings

Configuring appropriate slippage tolerance directly controls the maximum acceptable price deviation. Traders should adjust this setting based on the asset’s liquidity and volatility. For highly liquid, stable assets, a tolerance of 0.1% to 0.5% is usually sufficient. For volatile or illiquid assets, a higher tolerance like 1% to 3% might be necessary for execution.

Regularly reviewing and adapting slippage tolerance to current market conditions is a critical practice. This proactive adjustment prevents unnecessary losses and ensures timely trade execution.

Trading During High Liquidity Hours

Trading during periods of high market liquidity minimizes slippage. High liquidity hours typically coincide with peak trading activity on major exchanges. More participants and larger order books or liquidity pools reduce the impact of individual large orders. This environment ensures trades clear with minimal price deviation.

For most cryptocurrencies, liquidity often increases during overlap hours of major global financial markets. Conducting research on an asset’s typical trading volume and depth before executing a significant trade helps identify optimal times.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountSlippage vs. Related Trading Fees

Slippage is often confused with other costs associated with cryptocurrency trading. It is crucial to distinguish slippage from gas fees and exchange fees, as they represent distinct charges. Understanding these differences clarifies a trade’s true cost.

Slippage vs. Gas Fees vs. Exchange Fees

- Slippage represents a price deviation from the initial quote. It is a market phenomenon, not a direct fee charged by an exchange or network. It impacts the quantity of tokens received or the fiat value.

- Gas Fees are transaction fees paid to blockchain validators for processing and confirming transactions. These are inherent to decentralized networks like Ethereum and vary based on network congestion. They ensure transactions are prioritized and recorded on the blockchain.

- Exchange Fees are service charges levied by centralized or decentralized exchanges for facilitating trades. These include trading fees (e.g., 0.1% per trade) and withdrawal fees. They are a direct cost for using the platform’s services.

📌 REMEMBER: Slippage affects the executed price, gas fees pay for network resources, and exchange fees compensate the platform. All three contribute to the total cost of a cryptocurrency trade.

Key Takeaways

- Slippage defines the price difference between an expected quote and an executed trade.

- Volatility and low liquidity are primary drivers, increasing slippage risk.

- Positive and negative slippage both occur, impacting trade outcomes.

- Limit orders offer a direct solution to prevent negative slippage.

- Slippage tolerance settings require careful adjustment based on asset type and market conditions.

- MEV bots exploit high slippage tolerance on DEXs, leading to front-running.

Bottom Line

Slippage is an inherent characteristic of the crypto markets, serving as a reminder that the price you see is not always the price you get in a high-velocity environment. While it can occasionally work in your favor through positive price shifts, the key to successful trading lies in active risk management—specifically through the use of limit orders and calibrated slippage tolerance settings. By understanding the mechanics of AMMs and order book depth, you can transform slippage from an unpredictable cost into a manageable variable in your digital investment strategy.