The Exponential Moving Average (EMA) is a crucial tool in technical analysis that helps traders identify market trends and generate trading signals. Unlike a Simple Moving Average (SMA), the EMA gives more weight to recent prices, making it more responsive to new information. According to Perry J. Kaufman’s text, “Trading Systems and Methods,” this responsiveness is vital for traders operating in fast-moving financial markets like stocks, forex, and crypto.

While understanding Exponential Moving Average (EMA) is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- The Exponential Moving Average (EMA) is a moving average that emphasizes recent price data.

- Its formula applies a weighting multiplier: EMA = (Current Price × K) + (Previous EMA × (1 − K)), with K = 2 ÷ (N+1).

- EMA reacts faster to price changes than the Simple Moving Average (SMA).

- Common EMA periods include 9, 12, 20, 26, 50, 100, and 200 days.

- Traders use EMA for identifying trends, dynamic support/resistance, and crossover signals.

- Golden Cross (bullish) and Death Cross (bearish) are the most recognized crossover patterns.

- Short-term traders use 5–26 EMAs, swing traders prefer the 50 EMA, and long-term investors rely on the 100–200 EMA.

- EMA is often combined with indicators like RSI or MACD for confirmation.

- It is widely used in algorithmic trading, backtesting with Python or Excel, and statistical smoothing.

- EMA has limitations, including lag, false signals in volatile or sideways markets, and overreaction to noise.

What Is an Exponential Moving Average (EMA)?

An Exponential Moving Average (EMA) is a technical indicator that smooths price data by giving more weight to recent prices. It reacts faster to market changes than a Simple Moving Average (SMA) and is widely used in trading to identify trends and generate buy or sell signals.

The main difference between EMA and SMA lies in their sensitivity to price changes. The EMA’s formula is designed to reduce the lag found in the SMA, providing an earlier signal for trend changes. This makes it a preferred tool for many short-term traders and momentum-based trading systems.

EMA vs. SMA: Which Is Better?

Neither indicator is definitively “better”; they serve different purposes based on a trader’s strategy.

The EMA is better for traders who need a responsive indicator that provides early signals, while the SMA is better for those who prefer a smoother line that filters out market noise.

Here is a comparison of EMA vs. SMA:

| Feature | Exponential Moving Average (EMA) | Simple Moving Average (SMA) |

| Weighting | Exponential (more weight on recent prices) | Equal (same weight on all prices) |

| Responsiveness | High | Low |

| Price Lag | Reduced | Significant |

| Best Use Case | Short-term trend identification and momentum strategies | Long-term trend confirmation and filtering market noise |

If you want a deeper head-to-head breakdown, check the dedicated guide on the exponential vs simple moving average, which expands on use-cases, pros, and limitations for each.

What Is the Exponential Moving Average Formula?

The formula to calculate the Exponential Moving Average has three components: the current price, the previous period’s EMA, and a smoothing constant known as the weighting multiplier (K).

The standard formula for the EMA is as follows:

EMAtoday=(Current Price×K)+(EMAyesterday×(1−K))

Where:

- EMAtoday is the current EMA value.

- Current Price is the asset’s closing price for the current period.

- EMAyesterday is the EMA value from the previous period.

- K is the weighting multiplier.

The weighting multiplier (K) is what gives more significance to recent prices. It is calculated using the following formula:

K=N+12

Where:

- N is the number of periods for the EMA (e.g., 20 for a 20-day EMA).

Is EMA the Same as EWMA?

Yes, the Exponential Moving Average (EMA) is a specific type of Exponentially Weighted Moving Average (EWMA). The term EWMA is more common in statistics for time-series analysis, while EMA is the standard term used in financial technical analysis. Both refer to a moving average calculated with an exponential weighting factor.

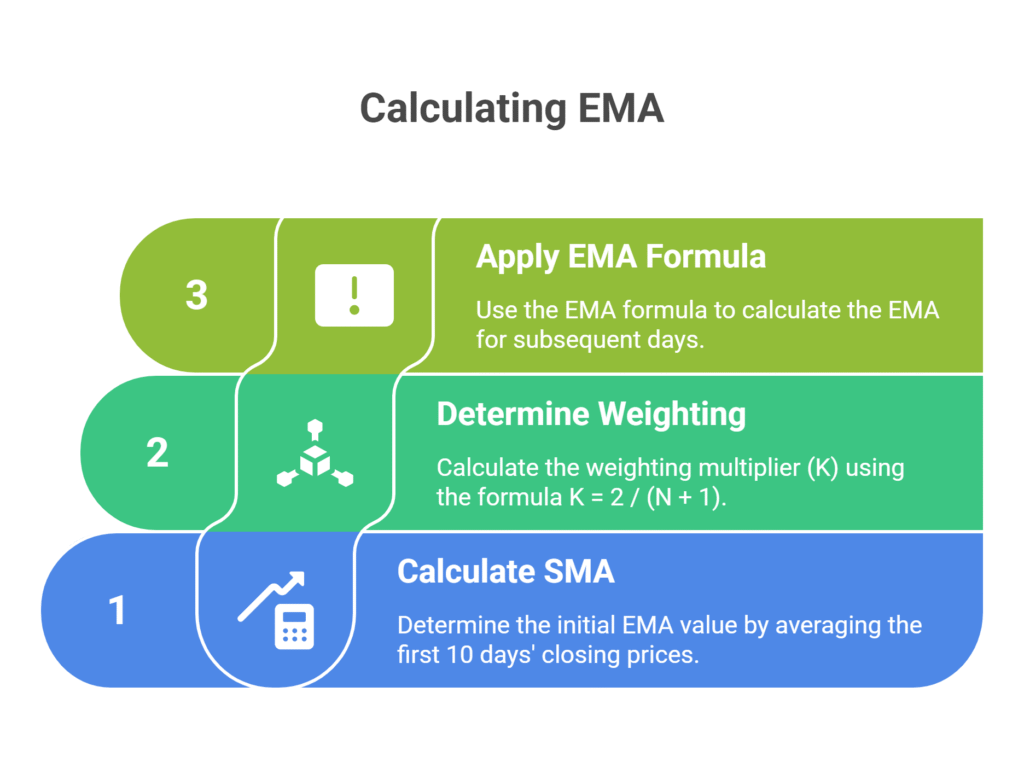

How Do You Calculate the EMA Step-by-Step?

To calculate an EMA, first find the initial SMA (Simple Moving Average) value. Then, calculate the weighting multiplier using the formula (2 ÷ (N+1)). Finally, apply this multiplier to the current price and add it to the previous day’s EMA value multiplied by one minus the multiplier.

Here are the detailed steps to calculate an EMA with a worked example for a 10-day EMA.

Step 1: Calculate the Initial SMA (Seed Value)

The first EMA value in a series is the SMA of the initial period. For a 10-day EMA, you sum the closing prices of the first 10 days and divide by 10.

- Example Data (10 Days of Closing Prices): 22,23,24,23,25,26,27,28,27,29

- SMA Calculation: (22+23+24+23+25+26+27+28+27+29)÷10=25.4

- The initial EMA value for Day 10 is 25.4.

Step 2: Calculate the Weighting Multiplier (K)

Use the formula K=2÷(N+1).

- For a 10-day EMA (N=10): K=2÷(10+1)=0.1818

Step 3: Apply the EMA Formula for the Next Period

Use the formula EMAtoday=(Current Price×K)+(EMAyesterday×(1−K)) for Day 11 and onwards.

- Assume the closing price for Day 11 is 30.

- EMAyesterday is the Day 10 value of 25.4.

- EMA Calculation for Day 11: (30×0.1818)+(25.4×(1−0.1818))=5.454+20.782=26.236

This process continues, with each new day’s EMA value depending on the previous day’s calculation.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesWhat Are EMA Crossovers and Trading Signals?

An EMA crossover occurs when a shorter-term EMA line crosses above or below a longer-term EMA line, generating a trading signal. This event suggests a potential shift in market momentum and trend direction. Crossovers form the basis of many trend-following and momentum trading systems. The two most recognized crossover patterns are the Golden Cross and the Death Cross.

What Is a Golden Cross?

A Golden Cross is a bullish signal that occurs when a shorter-term moving average, typically the 50-day EMA, crosses above a longer-term moving average, such as the 200-day EMA. This pattern suggests that a new uptrend may be starting and is often used to trigger buy orders in automated trend-following strategies.

What Is a Death Cross?

A Death Cross is a bearish signal that occurs when the 50-day EMA crosses below the 200-day EMA. This pattern indicates that a downtrend may be underway and is often used as a signal to sell an asset or as a trigger for risk-management protocols to exit long positions.

3 Common EMA Period Categories Used in Trading

The EMA periods traders use depend on their strategy, timeframe, and the market they are analyzing. Different periods are suited for different trading styles, from short-term scalping to long-term investing.

- Short-Term EMAs (5, 9, 12, 20, 26): These are best for intraday traders and scalpers who need to react quickly to price changes. The 9-EMA and 20-EMA are popular for identifying short-term momentum.

- Medium-Term EMAs (50): The 50-EMA is widely used by swing traders to identify the intermediate trend. A price above the 50-EMA is generally considered to be in an uptrend, while a price below it is considered in a downtrend.

- Long-Term EMAs (100, 200): The 100-EMA and 200-EMA are used by long-term investors and institutional traders to gauge the primary market trend. The 200-EMA is a critical level of support or resistance on daily charts.

3 Key Applications of EMA in Trading

Traders use the Exponential Moving Average in several practical ways to analyze markets and make trading decisions. Its versatility makes it a foundational tool in many trading systems.

- Identifying market trends: The slope of the EMA line helps identify the direction of the trend. An upward-sloping EMA suggests an uptrend, while a downward-sloping EMA indicates a downtrend.

- Acting as dynamic support and resistance: In a trending market, the EMA line can act as a dynamic level of support or resistance. In an uptrend, price may pull back and bounce off the EMA line (support). In a downtrend, price may rally and find resistance at the EMA line.

- Generating entry and exit signals: Crossovers provide clear, rules-based entry and exit signals. A bullish crossover (e.g., 9-EMA crossing above 21-EMA) can be an entry signal for a long position, while a bearish crossover can trigger a stop-loss or an entry for a short position.

How Is EMA Used with Other Indicators?

To improve signal accuracy, the EMA is best used with other technical indicators for confirmation. A 2011 study in the Journal of Banking & Finance confirmed that strategies combining moving averages with filters like momentum oscillators can enhance performance.

- EMA + RSI (Relative Strength Index): This combination confirms momentum. A trader might see a bullish EMA crossover and wait for the RSI to cross above 50 to confirm upward momentum before entering a long trade. This helps avoid entries into overbought conditions.

- EMA + MACD (Moving Average Convergence Divergence): Since the MACD is constructed using EMAs, these two indicators work well together. A trader can use an EMA crossover for a potential entry and confirm it with a MACD line crossover above its signal line.

| Combination | Primary Signal Type | Best For |

| EMA + RSI | Momentum Confirmation | Avoiding overbought/oversold entries and confirming trend strength. |

| EMA + MACD | Trend & Momentum Crossover | Confirming a shift in trend direction with a secondary crossover signal. |

3 Advanced EMA Applications

Beyond standard chart analysis, the EMA is a fundamental component in more complex and automated trading systems.

- Algorithmic Trading: EMA crossovers are one of the most common strategies coded into trading algorithms due to their clear, rule-based signals. Automated systems can execute trades based on EMA signals across stocks, forex, and crypto markets without manual intervention. Beyond these standard applications, the Guppy Multiple Moving Average (GMMA) evolves the EMA concept by stacking multiple EMAs to track both short-term momentum and long-term investor sentiment, giving traders a layered perspective on trend strength.

- EMA in Python or Excel: Traders and analysts frequently use software to backtest EMA strategies.

- In Python, the pandas library calculates EMA with one line of code: df[‘EMA_20’] = df[‘Close’].ewm(span=20, adjust=False).mean().

- In Excel, after an initial SMA value in cell C11, the EMA formula is: =(B12 * (2/(A12+1))) + (C11 * (1-(2/(A12+1)))).

- EWMA in Statistics: In data science, the EWMA is used for smoothing time-series data to identify underlying patterns or trends, filtering out short-term noise and volatility.

Limitations of the EMA

The EMA is a powerful tool, but it has limitations that traders must understand to use it effectively.

- It is a lagging indicator, reflecting past price action rather than predicting future moves.

- Can overreact to short-term volatility, producing false signals in choppy markets.

- Generates frequent whipsaws in sideways or ranging conditions.

- Requires confirmation from other indicators to avoid misleading entries and exits.

- Different timeframes can produce conflicting signals, making interpretation harder.

- Effectiveness depends heavily on chosen period settings (e.g., 9, 20, 50, 200).

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountBottom Line

The Exponential Moving Average (EMA) is a responsive tool that highlights recent price action, making it more timely than the SMA. While powerful, it works best when combined with other indicators like RSI, MACD, or Bollinger Bands. Used correctly, EMA helps traders across scalping, swing, and long-term strategies make more informed decisions.