Forex trading is legal in the US, but it must be done through a broker that is properly regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Choosing a regulated broker is a crucial step for US traders to avoid forex scams. The legal framework created by the Dodd-Frank Act in 2010 has made the US forex market one of the most strictly regulated in the world.

While understanding Regulated Forex Brokers is important, applying that knowledge is where the real growth happens. Create Your Free Forex Trading Account to practice with a free demo account and put your strategy to the test.

Key Takeaways

- Forex trading is legal in the US, but only through brokers regulated by the CFTC and NFA — this strict framework protects traders from scams.

- The Dodd-Frank Act reduced the number of approved brokers, so only a few platforms are legally authorized to serve US residents.

- US forex rules impose strict limits: maximum leverage of 50:1 on majors and 20:1 on minors, no hedging, and the FIFO rule on positions.

- Regulated brokers must hold at least $20 million in regulatory capital, ensuring greater stability and fund security for clients.

- To verify a broker’s legitimacy, traders should always check the NFA’s BASIC tool before opening an account.

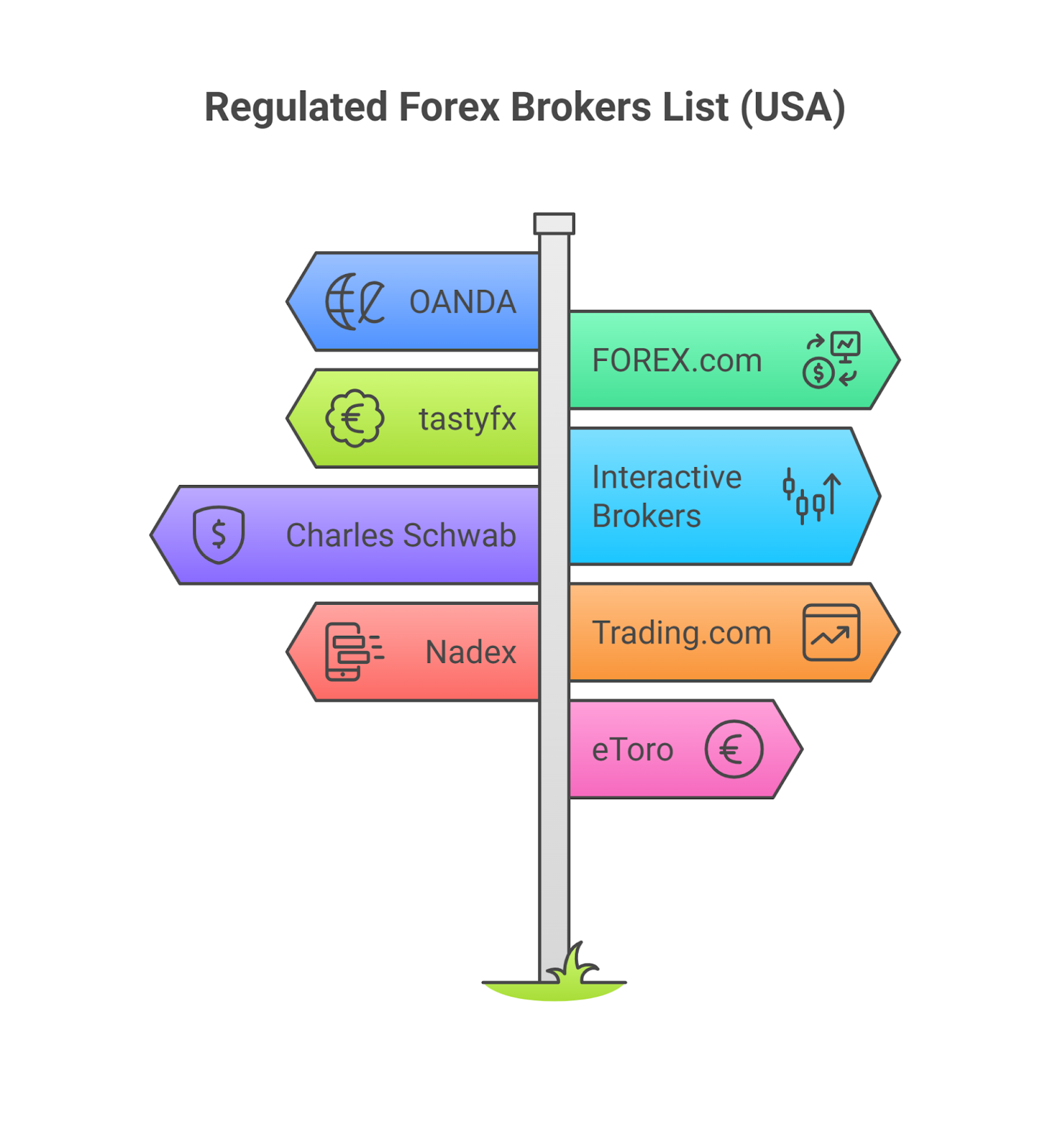

Best Regulated Forex Brokers in USA (2026)

Only a handful of forex brokers are legally regulated in the US by the CFTC and NFA. This strict regulatory environment is designed to keep consumers and traders safe.

[red_note]Disclaimer: This article is for informational purposes only and does not constitute financial advice. Forex and leveraged trading involve significant risk of loss and may not be suitable for all investors. Always assess your financial situation and risk tolerance before trading.[/red_note]

Here’s the updated list for 2026:

- OANDA: A CFTC-regulated and NFA-approved broker with a wide range of currency pairs.

- FOREX.com: Registered as an FCM and RFED with the CFTC and is a member of the NFA.

- tastyfx: A regulated retail foreign exchange dealer with the CFTC and NFA.

- Interactive Brokers: Regulated by the SEC, NFA, and FINRA.

- Charles Schwab: Regulated by the SEC, NFA, and FINRA.

- Trading.com: Regulated by the NFA and CFTC.

- Nadex: A US-regulated platform for options trading.

- eToro: Regulated by the SEC and FINRA for its offerings.

Regulated Forex Brokers Features Comparison – [USA 2026]

The Dodd-Frank Act of 2010 significantly narrowed the number of brokers legally operating in the US, but traders still have a number of strong, regulated options.

| Broker | Regulated By | Max Leverage (Forex Majors) | Spreads (Typical) | Minimum Deposit | Platforms |

| OANDA | CFTC, NFA, etc. | 50:1 | Competitive, with spreads as low as 1.1 pips on AUD/USD | $0 | MT4, OANDA Trade, TradingView |

| FOREX.com | CFTC, NFA, etc. | 50:1 | Raw account spreads from 0.0 pips + commission | $100 | MT4, MT5, TradingView, proprietary |

| tastyfx | CFTC, NFA, etc. | 50:1 | Low, with some spreads up to 20% tighter than competitors | $100 | MT4, tastyfx Web Platform |

| Interactive Brokers | SEC, NFA, CFTC, FINRA | 50:1 | Starts from 0.1 pips + commission | $0 | IBKR Workstation, IBKR Mobile |

| Charles Schwab | SEC, NFA, CFTC | 50:1 | Average spreads around 1.40 pips | $0 | thinkorswim |

| Nadex | CFTC | N/A | No spreads, commissions starting at $2 per contract | $0 | Nadex Trading Platform |

| Trading.com | CFTC, NFA, etc. | 50:1 | Competitive spreads, no commission | $50 | MT5, proprietary platform |

| eToro | SEC, FINRA | Varies by asset | Average spreads starting at 1.0 pips | $50 | eToro Trading Platform |

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesTop 8 Regulated Forex Brokers in USA (Mini Reviews)

Let’s show you some of the top regulated forex brokers in the USA that follow strict guidelines and offer you a secure trading environment:

1. OANDA

OANDA is one of the most established US forex brokers, offering $0 minimum deposit, strong CFTC/NFA regulation, and multiple platform options. It’s user-friendly for beginners but also trusted by experienced traders thanks to its transparent pricing and integration with TradingView.

Key Features:

- $0 minimum deposit with flexible lot sizes.

- Regulated by CFTC and NFA.

- Trade forex, commodities, and indices.

- Supports MT4, OANDA Trade, and TradingView.

- In-depth research tools and market analysis.

- Transparent pricing, no hidden fees.

- Wide platform choice (including TradingView).

- Great for beginners with strong educational content.

- Regulated by US authorities.

- Spreads can be higher than some rivals.

- Limited pro-level niche tools.

2. FOREX.com

FOREX.com is a leading US broker for traders who want tight spreads and professional-grade tools. It offers access to over 80 pairs, plus futures and commodities. With both beginner resources and advanced trading features, it serves a wide range of traders.

Key Features:

- Regulated by CFTC and NFA (FCM & RFED).

- Over 80 forex pairs plus commodities.

- Raw spreads from 0.0 pips (commission-based).

- Supports MT4, MT5, TradingView, and proprietary platforms.

- Market insights and educational tools.

- Strong US regulatory backing.

- Wide selection of trading platforms.

- Competitive pricing with Raw account option.

- Extensive research and education resources.

- $100 minimum deposit.

- The platform may feel complex for beginners.

3. tastyfx

tastyfx (part of IG Group) is a regulated US broker designed with beginner traders in mind. It combines simplicity with strong regulatory oversight, offering educational resources and solid platform options.

Key Features:

- Registered RFED and Forex Dealer Member with the NFA.

- Strong education library for new traders.

- Intuitive mobile and web-based platforms.

- Variety of currency pairs with transparent pricing.

- Backed by IG Group’s global reputation.

- Strong regulation from CFTC and NFA.

- Excellent customer support (24/5).

- Great learning resources for beginners.

- Spreads may be higher than some competitors.

- Limited advanced tools for professionals.

4. Interactive Brokers

Interactive Brokers is ideal for experienced traders who want low commissions and access to multiple asset classes. Its powerful platforms support algorithmic trading and advanced charting, making it a go-to choice for active investors.

Key Features:

- Regulated by CFTC, NFA, and FINRA.

- Access to forex, stocks, options, futures, and more.

- Very low commissions (from $2 per lot).

- Advanced charting, APIs, and algo trading support.

- Platforms: Trader Workstation, IBKR Mobile.

- Extremely low fees for active traders.

- Huge range of markets and products.

- Advanced features for professionals.

- Strong regulation and reliability.

- The platform is complex for beginners.

- Best suited for experienced traders, not casual ones.

5. Charles Schwab

Charles Schwab is a trusted US broker offering forex trading via the thinkorswim platform. Its strength lies in customer support and platform reliability, making it a solid choice for traders who value security and service.

Key Features:

- Regulated by SEC, CFTC, and NFA.

- Access to forex and other markets.

- thinkorswim platform with robust charting tools.

- Extensive market research and education.

- 24/7 customer support.

- Strong regulation and reputation.

- thinkorswim is one of the best analysis platforms.

- Excellent customer service.

- Wide range of educational resources.

- Average spreads compared to forex specialists.

- Limited forex pair selection.

6. Nadex

Nadex is a US-regulated exchange offering binary options and spreads, providing a simpler way to trade forex and other markets with built-in risk limits. It’s not a traditional spot forex broker but appeals to traders seeking limited-risk products.

Key Features:

- Fully regulated by the CFTC.

- Trade forex, stock indices, and commodities.

- Fixed-risk products (maximum loss known upfront).

- Simple, easy-to-use proprietary platform.

- $0 minimum deposit.

- Strong CFTC regulation.

- Transparent, capped-risk trading.

- Great for traders with smaller capital.

- Only offers binaries and spreads (not spot forex).

- Limited product range and platforms.

7. Trading.com

Trading.com focuses on US retail forex traders, offering over 70 pairs, competitive spreads, and modern platform choices. It combines simplicity with CFTC/NFA regulation, making it a solid choice for everyday traders.

Key Features:

- Registered RFED and NFA member.

- Over 70 currency pairs.

- Competitive spreads with zero commission accounts.

- Platforms: WebTrader, mobile app, and MT5.

- Educational tools and analytics.

- Regulated by CFTC and NFA.

- Tight spreads and no commissions on T1 account.

- Modern platforms including MT5.

- Affordable entry with $50 minimum.

- No MT4 support.

- Limited customer support availability on weekends.

8. eToro

eToro is a social trading platform that allows US users to copy the strategies of successful traders. While not a traditional spot forex broker, it is regulated by SEC and FINRA and offers a wide selection of assets for diversification.

Key Features:

- CopyTrader system to mirror top traders.

- Supports stocks, ETFs, crypto, and forex.

- Regulated by the SEC and FINRA in the US.

- User-friendly web and mobile platforms.

- Large community for social trading.

- Strong regulation in the US.

- Easy-to-use platform with social features.

- Great for portfolio diversification.

- Active copy-trading community.

- Not a traditional forex broker (different regulatory scope).

- Limited advanced tools for pro traders.

Who Regulates Forex Brokers in the USA?

The forex market in the US is overseen by two primary regulatory bodies: the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The CFTC is the federal agency responsible for regulating the derivatives markets, including foreign exchange trading. The NFA is a self-regulatory organization that issues licenses and conducts audits on behalf of the CFTC to enforce compliance.

For example, Fidelity operates as a regulated Fidelity broker under SEC and FINRA oversight, though it does not provide direct forex trading.

The legal framework is defined by several key US forex rules designed to protect retail traders. These include:

- Leverage Caps: A leverage cap of 50:1 is imposed on major currency pairs, while a 20:1 leverage limit applies to minor pairs. This is meant to protect unsophisticated investors from overexposing their capital.

- FIFO Rule: The First-In, First-Out (FIFO) rule requires that if a trader has more than one open position of the same currency pair and size, the oldest position must be closed first.

- Hedging Ban: Retail traders cannot open simultaneous long and short positions on the same currency pair. This effectively bans hedging, a strategy that is not restricted in most other countries.

To verify a broker’s legitimacy and regulatory status, the best method is to use the NFA’s Background Affiliation Status Information Center (BASIC) tool. A firm or person must register as a Retail Foreign Exchange Dealer (RFED) with the CFTC and as a Forex Dealer Member (FDM) with the NFA. This process requires meeting financial requirements, including maintaining a minimum of $20 million in regulatory capital, and submitting to background checks and regulatory supervision.

How to Choose a Safe Forex Broker in the USA

Choosing a safe and reputable forex broker is a crucial step for US traders. To make a confident choice, follow these steps:

- Check Regulation First: Always verify that the broker is licensed by the NFA and regulated by the CFTC.

- Compare Fees: Analyze the broker’s trading costs, including spreads, commissions, and other potential fees.

- Evaluate Platforms & Apps: Select a broker that offers your preferred trading platform, whether it’s MetaTrader 4, MetaTrader 5, TradingView, or a proprietary platform.

- Customer Service Reliability: Choose a broker with reliable customer support. Many top brokers offer 24/7 support during the trading week, which can be very helpful for urgent inquiries.

Is Forex Trading Legal in the USA?

Yes, forex trading is perfectly legal in the US, provided you trade through a properly regulated broker. The CFTC requires all brokers that serve US residents to register as Retail Foreign Exchange Dealers (RFEDs) and also to be regulated by the NFA.

Many international brokers do not accept US clients due to these strict regulatory requirements, tax reporting obligations, and the high cost of meeting the regulations, such as maintaining at least $20 million in regulatory capital. While some offshore brokers may accept US citizens, trading with them comes with increased risk as CFTC protections do not apply.

A direct contrast can be seen in Webull vs US brokers, where app-based platforms operate under SEC/FINRA rules but lack the CFTC/NFA forex approval required for true currency trading.

Best Trading Platforms & Mobile Apps in the USA

In the US, the most popular trading platforms are MetaTrader 4, TradingView, and MT5, in that order.

- MetaTrader 4 (MT4) is a global favorite due to its user-friendly interface and robust charting tools. It offers 9 timeframes and 30 built-in indicators. The platform is highly customizable with the MQL4 programming language, which allows for the creation of Expert Advisors (EAs) for automated trading. OANDA and tastyfx are among the US brokers that offer MT4.

- MetaTrader 5 (MT5) is a more versatile, multi-asset platform that supports stocks, futures, options, and bonds in addition to forex. It is faster and has more indicators than MT4. It is supported by brokers like FOREX.com and Trading.com.

- TradingView stands out as a modern platform that balances a slick interface with a huge range of features. It is one of the best for technical analysis, offering a growing library of over 100 indicators and a Pine Script language for creating custom indicators. It is offered by US brokers such as OANDA and FOREX.com.

- Proprietary Apps, such as those from OANDA and FOREX.com, are known for a smoother user experience and seamless integration with the broker’s specific services. They often offer advanced charting tools, integrated research, and streamlined order execution, providing a strong alternative for traders who value a cohesive ecosystem.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountFinal Thoughts – Safest US Forex Brokers (2026)

US traders must choose a broker regulated by the CFTC and NFA to ensure compliance, transparency, and fund protection. OANDA delivers the best balance of trust, pricing, and usability. FOREX.com appeals to traders seeking ultra-low spreads. Tastyfx supports beginners with education, while Interactive Brokers equips professionals with advanced tools and low commissions.

Before funding any account, always double-check the broker’s registration using the NFA BASIC tool. Trading only with regulated brokers gives you peace of mind and keeps you aligned with US trading laws.