Profit and loss shape every outcome in forex. Each trade either adds to your account or takes away from it. Traders measure this outcome through P/L—short for profit and loss.

There are two types of profit and loss: realized and unrealized P/L.

But there’s another term many traders use—floating P/L. It appears next to unrealized values, often showing the same numbers. The platform updates it live. The price keeps changing. So, are they just two names for the same thing? Or do they serve different purposes depending on the platform or context?

Let’s find out.

What Does Unrealized P/L and Floating P/L Mean in Trading?

Unrealized P/L means profit or loss from an open trade. The value reflects what a trader could gain or lose if they closed the position at the current price. The amount updates with market movement but does not affect the account balance yet (BabyPips, 2025).

Floating P/L shows the same value. Many platforms use the term interchangeably with unrealized P/L. The number rises or falls as price shifts in real time (FundYourFX, 2025).

You need to understand that floating or unrealized values help traders measure performance during the trade. Yes, you can use these figures to assess exposure before a final decision.

In fact, FundedNext (2025) explains that floating P/L plays a role in equity and margin level. If unrealized losses grow too large, the account may breach risk thresholds.

Both metrics “Unrealized P/L” and “Floating P/L” reflect unrealized outcomes. Because real profit enters the account only after trade closure.

Is Unrealized P/L Same as Floating P/L?

Unrealized P/L and Floating P/L reflect the same trading concept—the current profit or loss from open positions. However, some platforms or educators apply subtle context-based distinctions.

What are similarities between unrealized profit/loss and floating profit/loss?

- Both represent the value of open trades

- Both update continuously with market price

- Both stay separate from the account balance

- Both help traders evaluate live trade performance.

What’s the difference between unrealized profit/loss and floating profit/loss?

FundedNext (2025) links Floating P/L directly to live equity and margin ratios. Unrealized P/L, in contrast, often appears in static reports or account overviews to reflect a trade’s current but unsettled value.

| Aspect | Unrealized P/L | Floating P/L |

| Usage Emphasis | Theoretical outcome if closed now | Real-time fluctuation |

| Platform Context | Often shown in account summaries | Displayed in live chart interfaces |

| Margin Impact Display | May influence reports indirectly | Directly affects margin and equity view |

| Terminology Preference | Used in financial statements | Used in prop firm dashboards |

In short, both point to unrealized performance. The only variation arises from how platforms present the data—either as a real-time tracker (Floating) or theoretical summary (Unrealized). Neither reflects actual gains or losses until the trade closes.

How to Calculate Floating and Unrealized P/L?

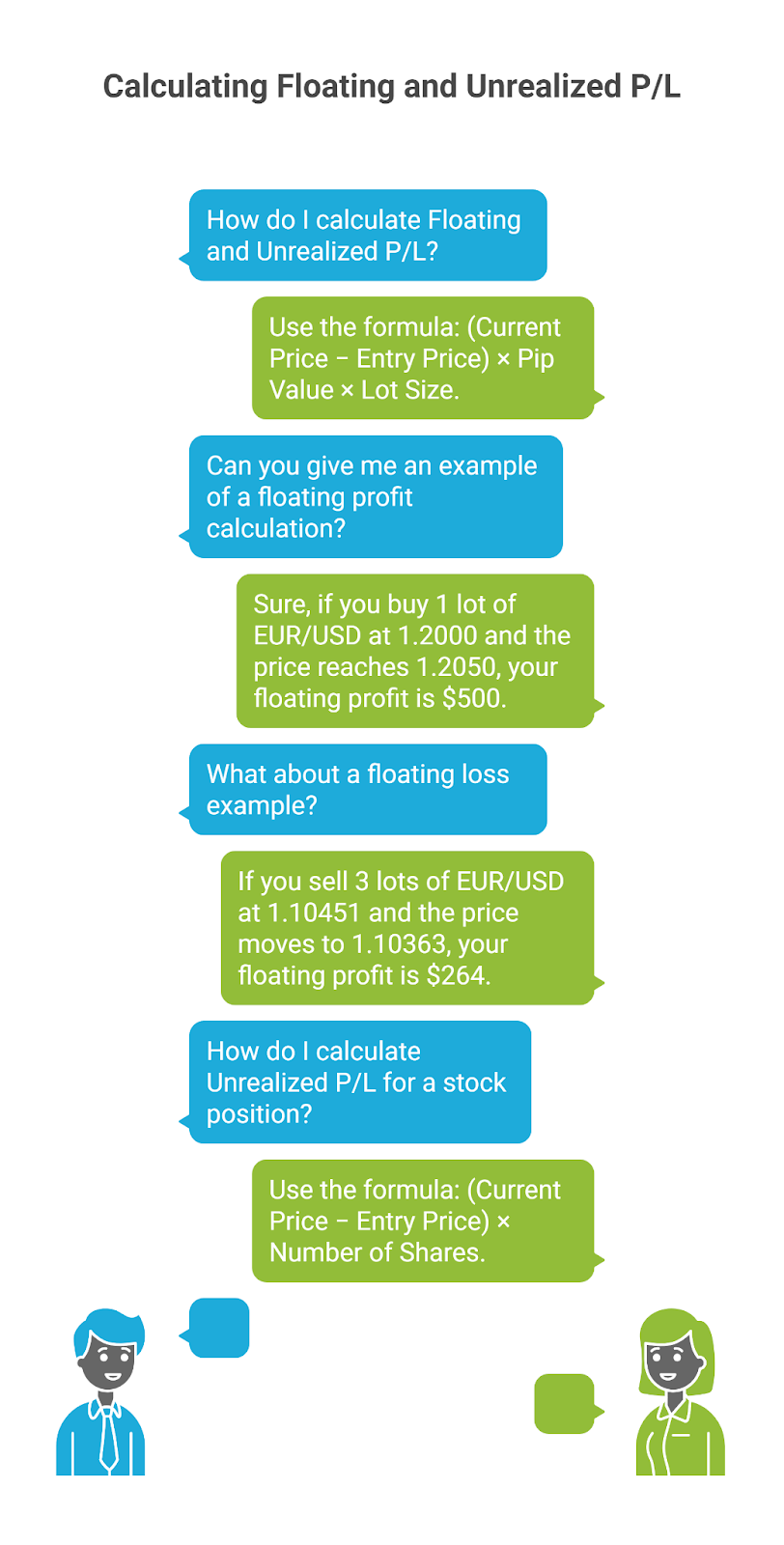

Floating and Unrealized P/L follow the same formula and calculation method. The formula uses the entry price, current market price, position size, and pip value.

Floating or Unrealized P/L = (Current Price − Entry Price) × Pip Value × Lot Size

So, now if you aim to measure your trade’s current performance before closing, apply the following calculation:

Example: Floating Profit

Suppose you buy 1 standard lot of EUR/USD at 1.2000. The current market price reaches 1.2050.

- Entry Price: 1.2000

- Current Price: 1.2050

- Pip Difference: 50 pips

- Lot Size: 1 standard lot (100,000 units)

- Pip Value: $10

Floating P/L = (1.2050 − 1.2000) × $10 × 1 = $500

You now hold a floating profit of $500. The gain remains unrealized until you close the trade (BabyPips, 2025).

Example: Floating Loss

For instance, you sell 3 standard lots of EUR/USD at 1.10451. The current market price moves to 1.10363.

- Entry Price: 1.10451

- Current Price: 1.10363

- Pip Difference: 8.8 pips (or 0.00088)

- Lot Size: 3

- Pip Value: $10

Floating P/L = (1.10451 − 1.10363) × $10 × 3 = $264

The trade shows a floating profit of $264. The result still qualifies as unrealized until exit (FundedNext, 2025).

Example: Stock Position

Let’s suppose you purchase 100 shares of a stock at $150. The current price rises to $170. Here’s the stock trade formula you need to apply:

Unrealized P/L = (Current Price − Entry Price) × Number of Shares

It means that:

Unrealized P/L = ($170 − $150) × 100 = $2,000

The stock position now holds an unrealized profit of $2,000. The account balance does not change until you sell the shares (FundYourFX, 2025).

Why Your Floating P/L May Show a Loss Despite Market Gains?

Let’s say you enter a trade, and the market starts moving in your favor. You feel confident. But when you look at your trading platform, you see a floating loss.

Basically, even when the market supports your trade, floating loss can appear because:

- The spread hasn’t cleared

- Swap charges apply overnight

- You faced slippage during entry

- The platform lags for a second or two

Confusing, right? Let’s break down why this happens.

The Spread Comes First

Every trade opens with a small cost called the spread. That’s the difference between the price you buy at (ask) and the price you sell at (bid).

So even if the market moves in your direction, it needs to move far enough to cover that spread. Until it does, your floating P/L shows a small loss.

For example, you buy EUR/USD at 1.1050 with a 2-pip spread. The market rises to 1.1051. But you’ll be still down 1 pip—because the move hasn’t covered the spread yet.

Swap Fees Can Sneak In

If you hold your trade overnight, your broker may charge you a swap fee. This depends on interest rates between the two currencies you’re trading. Sometimes, even a strong move in your favor can’t cancel out those extra costs. So your trade looks like a loss—until price goes further or the fee clears.

Slippage Plays a Role

When the market moves quickly, your trade may execute at a slightly different price than expected. This is called slippage. If your position starts off a few pips behind, you’ll see a loss even before the market moves.

Price Update Delays

Some platforms update floating P/L every second or two. It sometimes doesn’t happen instantly. But unfortunately, that delay creates a short mismatch between what the chart shows and what your P/L shows.

Does Floating P/L Affect Margin and Equity?

Yes, it does. Floating P/L directly affects your equity, and equity plays a key role in determining your margin level.

Let’s walk through it step by step.

First, what is equity and how margin works with it?

Equity is your account balance plus floating P/L.

- If your trade is in profit, equity increases.

- If your trade is in loss, equity decreases.

So, every time the market moves, your equity changes—even if your balance stays the same.

Your broker sets aside a portion of your funds as used margin to keep trades open. Now, your free margin depends on how much equity remains after that.

Free Margin = Equity − Used Margin

Your equity basically drops when your floating loss grows, which means your free margin shrinks.

Now, take a look at margin level and stop-out risk

Margin level tells your broker how healthy your account looks.

Margin Level = (Equity ÷ Used Margin) × 100

If equity keeps falling due to floating losses, your margin level drops. If it falls below a set threshold, your broker may trigger a stop-out—automatically closing your biggest losing trades.

Let’s consider an example for more clarity:

- Balance = $5,000

- Used Margin = $1,000

- Floating Loss = −$1,200

Now your equity = $3,800 and Margin level = (3,800 ÷ 1,000) × 100 = 380%

If that floating loss worsens to −$3,000, equity drops to $2,000. Margin level becomes 200%. Too low—and the system may intervene.

Just to be clear…

Floating P/L does not change your account balance, but it controls your equity. Equity then controls your margin level. That’s why floating P/L directly impacts your risk, free margin, and account safety.

Managing these shifts falls under disciplined risk management, where equity and margin monitoring guide survival during volatility.

How Unrealized P/L Impacts Prop Trading Accounts?

In prop trading accounts, unrealized P/L carries real consequences. Even though the position stays open, the floating loss can affect account rules the same way a closed loss would.

Most prop firms set strict daily loss limits. These limits include unrealized losses. So if your floating P/L dips below the allowed threshold—even for a moment—the system can flag your account. The trade might recover later, but the breach already occurred.

For example, on a $15,000 prop account with a 5% daily loss limit, the allowed drawdown is $750. If your open position hits a −$751 floating loss, the account fails that day, even if you never closed the trade.

Some firms also monitor maximum drawdown based on equity, not just closed trades. This shows how unrealized losses contribute to realized drawdown over time, shrinking equity until recovery becomes unlikely. Unrealized losses lower your equity. When equity drops below the firm’s threshold, the risk control system may trigger an account shutdown—even if you plan to hold long-term.

Unrealized P/L also affects your margin level. If the floating loss grows large, equity shrinks. That pulls down the margin level. If it drops too far, the platform may close your trades automatically to limit further damage.

Basically, when you attempt to pass a funded challenge or request a payout, prop firms often review both realized profit and equity consistency. That means even strong trades must stay within floating loss limits to protect your progress.

So while unrealized P/L does not touch your balance directly, it still shapes your prop trading journey. The rules treat floating losses as real exposure. If the number goes too low—even for a few minutes—it can stop your progress or end your account. That’s why floating P/L must stay under control at all times.

Risk Management Tips for Handling Unrealized P/L and Floating P/L

- Use a stop-loss on every trade to control potential floating loss.

- Size your positions based on account equity, not balance alone.

- Track your margin level regularly to avoid unexpected stop-outs.

- Monitor equity, especially during volatile sessions or news events.

- Close or reduce positions when floating loss approaches account limits.

- Set daily drawdown caps that include both realized and floating loss.

- Avoid overleveraging, even if the market moves in your favor.

- Use trailing stops to secure gains and limit emotional holding.

- Log floating P/L daily to spot patterns and improve timing.

- Pause trading after sharp equity drops to reassess strategy.

- Follow prop firm rules closely to avoid breaches from floating loss.

- Keep swap fees in mind when holding overnight positions.

- Treat unrealized profit as potential, not guaranteed income.

- Use alerts to track equity thresholds before risk rules trigger.

Final Thoughts

Unrealized and floating P/L help you understand where your trades stand right now. The values change with every tick, but the insight they give you matters just as much as your final result.

There’s no doubt that trades move fast in Forex. You can see a floating profit one minute and a floating loss the next. That’s why it’s important to treat unrealized P/L as part of your trading process. It is certainly not something you ignore until the end.

So, watch how your equity reacts, keep an eye on margin, and respect floating loss the same way you respect closed loss. You’ll see how this mindset helps you protect your account and meet the rules in any funded challenge or live setup.

After all, your trade doesn’t end when you open it, but in fact, it begins right there. And floating P/L tells you what the market thinks of that decision so far. Be smart and use that information wisely.