Accurately calculating your crypto profit is fundamental to managing your investments and fulfilling tax responsibilities. This guide will walk you through the essential methods, hidden costs, and tax considerations, making sure you have a clear picture of your financial standing in the dynamic cryptocurrency market.

While understanding Crypto is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What is crypto profit?

Crypto profit is the positive financial gain achieved when you sell, trade, or spend cryptocurrency for a value higher than its original cost basis. It represents the net gain on your initial investment amount after accounting for all associated expenses. This calculation is essential for investors to assess their trading success and determine their tax liabilities.

Why is it important to calculate crypto profit?

Calculating your crypto profit is essential for several reasons, primarily for tax compliance, performance tracking, and making informed investment decisions. Accurate calculations help you understand the true profitability of your strategies and avoid potential legal issues with tax authorities. It provides a clear financial overview of your crypto activities.

What is ROI in crypto?

Return on Investment (ROI) in crypto measures the profitability of an investment relative to its initial cost. It is expressed as a percentage, indicating the efficiency of your investment. While absolute crypto profit shows the dollar amount gained, ROI provides a standardized metric to compare the performance of different investments, regardless of their size. The formula is:

$$text{ROI} = left( frac{text{Current Value} – text{Initial Investment}}{text{Initial Investment}} right) times 100%$$

How do I know if I made a profit on my crypto?

You know you have made a profit on your crypto when the value of your assets at the time of sale, exchange, or spending exceeds their cost basis. This is specifically known as a realized profit.

Manual Crypto Profit Calculation

The core principle behind calculating crypto profit is simple: Selling Price - Buying Price = Gross Profit. For instance, if you bought 1 Ethereum (ETH) for $1,500 and later sold it for $2,000, your gross profit would be $500. This basic calculation forms the foundation for understanding your gains before considering fees and other complexities.

Cost basis is the original value of an asset for tax purposes, adjusted for commissions, fees, and other expenses. For crypto, it includes the purchase price of the asset plus any transaction fees incurred during acquisition. A precise cost basis calculation is fundamental because it directly impacts your net profit and subsequent capital gains tax liability.

Choosing a Cost Basis Method: FIFO, LIFO, or Average Cost?

Selecting the correct cost basis method is crucial for accurate crypto profit calculation, especially when you make multiple purchases at different prices. In 2025, a major shift occurred for US taxpayers: you must now use wallet-by-wallet accounting rather than universal accounting across all platforms.

- FIFO (First-In, First-Out): Assumes the first assets you bought are the first sold. This is the default IRS method.

- Specific ID: Allows you to choose which specific units you are selling to optimize taxes, provided you have meticulous records.

- HIFO (Highest-In, First-Out): Sells the most expensive assets first to minimize capital gains.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesHow Fees Impact Your Crypto Profit?

Transaction fees are often overlooked but significantly reduce your net crypto profit. Every time you buy, sell, or transfer cryptocurrency, various fees apply. Accurately tracking these buy and sell fees is essential for determining your true profitability.

Key Types of Transaction Fees to Track

Several types of transaction fees can impact your crypto profit:

- Gas Fees: Payments to miners/validators on decentralized networks.

- Exchange Fees: “Maker” or “taker” fees charged by platforms like Binance or Coinbase.

- Withdrawal Fees: Costs associated with moving crypto to a hardware wallet.

Including Fees in Your Cost Basis

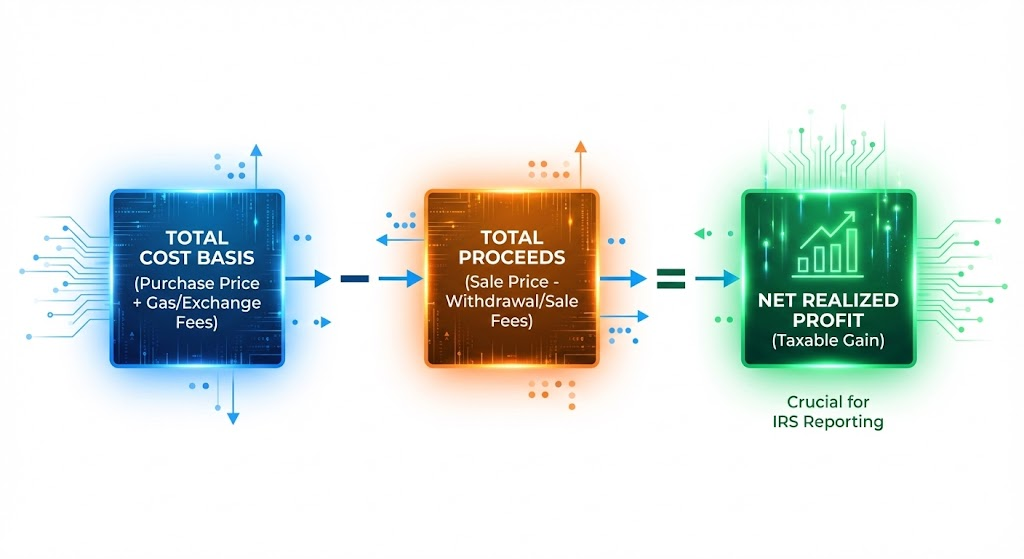

For accurate profit calculation, transaction fees incurred during acquisition should be added to the buying price. Conversely, fees incurred during a sale reduce your proceeds.

$$text{Net Profit} = (text{Sale Price} – text{Sale Fees}) – (text{Purchase Price} + text{Purchase Fees})$$

Is Crypto Profit Always Taxable?

Yes, crypto profit is generally taxable. The IRS treats crypto as property, meaning every swap (e.g., BTC to ETH) or spend is a taxable event. Starting in 2025, brokers are required to issue Form 1099-DA to report your gross proceeds to the IRS.

Short-term vs. Long-term Capital Gains

The duration you hold a cryptocurrency determines your tax rate. Assets held for one year or less are taxed as short-term capital gains (10–37% ordinary income). Assets held for more than one year qualify for long-term rates (0%, 15%, or 20%), which are significantly lower.

Crypto Profit Calculators for Accuracy

Using a crypto profit calculator is essential for any investor with more than a few trades. Manual spreadsheets quickly become unmanageable when dealing with transfers across multiple exchanges and wallets. In 2025, software tools like Koinly, CoinLedger, and TokenTax are the gold standard for generating IRS-ready Form 8949 and Schedule D reports.

How to Effectively Use a Profit Calculator

To get accurate results, connect your exchanges via read-only API keys or upload CSV files. The software will automatically match transfers between your own wallets to ensure you aren’t taxed on simple moves and will correctly identify “income” events like staking.

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountCalculating Profit for DeFi, Staking, & NFTs

Calculating profit from advanced crypto activities requires moving beyond the simple capital gains bucket.

- Staking & Airdrops: These are treated as ordinary income based on their Fair Market Value (FMV) at the moment you have “dominion and control” over them.

- DeFi & Liquidity Pools: These can be complex due to impermanent loss, where the value of your deposited assets changes relative to each other.

- NFT Sales: Profit is calculated the same as crypto trades, but be aware that some jurisdictions may tax NFTs as “collectibles” at a higher rate.

BOTTOM LINE

Calculating crypto profit is no longer just a matter of “selling high”; it is a mandatory exercise in precise financial record-keeping. In the 2025 landscape of Form 1099-DA and wallet-specific accounting, the difference between a successful investor and an audited one often comes down to tracking every gas fee and cost-basis adjustment. By treating your transaction history as a professional ledger—and utilizing automated tools to handle the heavy lifting—you can protect your gains from both market volatility and avoidable tax penalties.

Key Takeaways

- The Profit Formula: Your profit is (Sale Price – Sale Fees) minus (Purchase Price + Purchase Fees).

- 2025 Reporting Rules: IRS Form 1099-DA is now standard, and investors must track cost basis on a per-wallet basis.

- Income vs. Gains: Staking, mining, and airdrops are taxed as ordinary income upon receipt, whereas selling assets triggers capital gains tax.

- Holding Period Matters: Holding crypto for over 12 months can slash your tax rate from 37% down to as low as 0% for long-term gains.

- Hidden Costs: Always include exchange, withdrawal, and gas fees in your calculations to avoid overpaying on your taxes.