This pattern suggests a temporary pause in selling pressure before the continued downtrend resumes, making it a valuable tool for traders.

Understanding candlestick patterns is fundamental for technical analysis, offering insights into price action and market sentiment. The On Neck pattern, despite its minor bullish second candle, is a potent indicator of impending bearish continuation. This guide will delve into its identification, implications, and actionable strategies, providing a holistic view for effective trading.

What is an On Neck candlestick pattern?

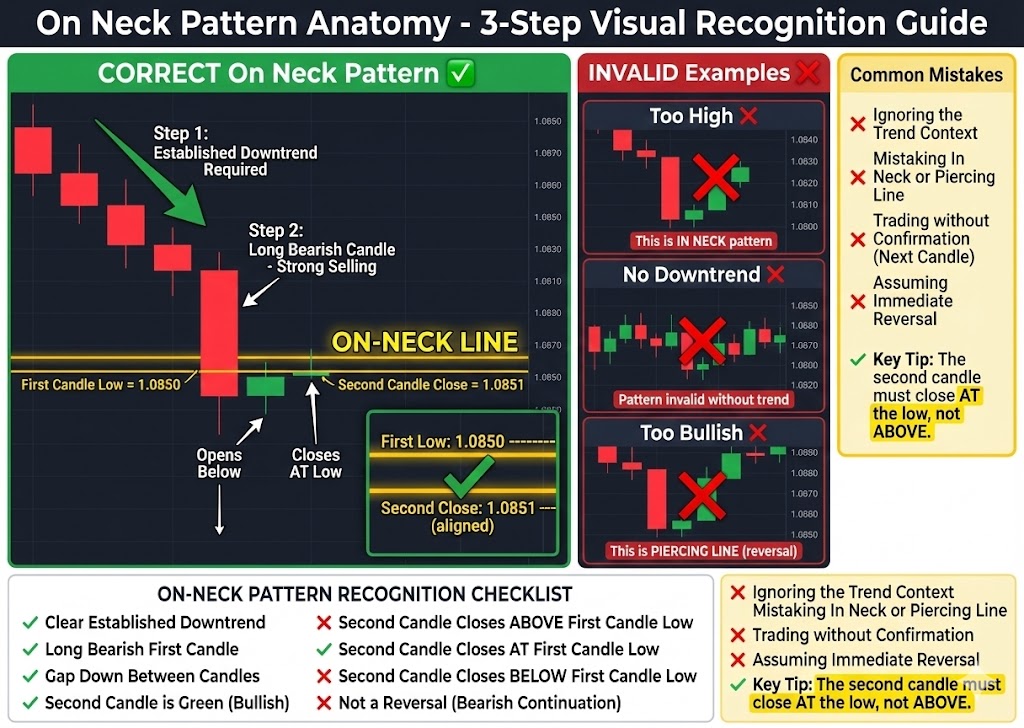

The On Neck candlestick pattern is a bearish continuation pattern that forms during an existing downtrend. It consists of two candles: a long bearish (red or black) candle, followed by a smaller bullish (green or white) candle. This second candle opens below the first but closes at or near the low of the first candle, creating a horizontal “on-neck line” at the prior low.

How do you identify an On Neck pattern?

Identifying an On Neck candlestick pattern requires keen observation of specific visual cues within a downtrend. First, there must be an established downtrend preceding the pattern. The first candle is a long bearish candlestick with a substantial body, indicating strong selling pressure.

The second candle is a smaller bullish candle that gaps down confirmation on opening, but its closing price aligns horizontally with the low of the first bearish candle. This alignment forms the crucial on-neck line, signifying a temporary halt in the price decline at a specific support level.

The pattern’s price action shows the bulls attempting a rally, but failing to push the price above the prior low.

What does an On Neck pattern signify?

The On Neck pattern signifies the likely continued downtrend after a brief attempt by buyers to push prices higher. Despite the second candle being bullish, its inability to close above the previous candle’s low indicates a lack of buying strength. The market tried to rally but was rejected at the prior low, reinforcing the bearish sentiment.

This suggests that the bears remain in control, and the market is poised to continue its downward trajectory. It serves as a warning to traders that the existing downtrend is likely to persist.

How reliable is the On Neck candlestick pattern?

The On Neck candlestick pattern offers insights into market direction, but its reliability significantly increases when observed within the correct market context. It is a continuation pattern, meaning its strength is derived from the prevailing trend. Trading it against the established trend can lead to false signals and reduced accuracy.

The Importance of the Preceding Downtrend

The On Neck candlestick pattern is a continuation pattern, meaning it is only truly valid when it appears within an existing downtrend. This pattern signals that the bearish momentum is likely to persist, not reverse. If the pattern forms during an uptrend or in a sideways market, its implications are severely weakened, often leading to false signals.

Traders should always confirm the presence of a clear downtrend before considering a trade based on the On Neck pattern. Ignoring the preceding trend dramatically reduces the pattern’s reliability and increases trading risk.

Support & Resistance Levels: Key to Validation

The interaction of the On Neck candlestick pattern with support and resistance levels plays a crucial role in its validation. If the pattern forms near a strong resistance level, it can reinforce the bearish outlook, as the market is struggling to break above a known ceiling.

Conversely, if the pattern forms right at a support level, it can sometimes indicate a temporary pause before continuation, or a failed reversal attempt. Understanding these support resistance dynamics helps traders gauge the pattern’s strength and potential for follow-through. A confirmed break below the “on-neck line” after the pattern, especially below a historical support, strengthens the bearish conviction.

How to confirm an On Neck pattern with other indicators?

To improve the reliability of the On Neck candlestick pattern, confirmation with other technical indicators is essential. Traders often use:

- Volume: Increasing volume on the first bearish candle and decreasing volume on the second, smaller bullish candle can confirm the pattern’s strength. This indicates that the brief bullish attempt lacked conviction.

- Moving Averages: If the pattern forms below declining Moving Averages (e.g., 20-period, 50-period), it reinforces the existing downtrend and the bearish bias.

- RSI (Relative Strength Index): An RSI (Relative Strength Index) reading below 50, especially if showing continued downward momentum, can confirm bearish pressure. An RSI in oversold territory might suggest a temporary bounce, but if the On Neck forms and RSI doesn’t show a strong reversal, the downtrend is likely to continue.

Recognizing False Signals and When to Avoid Trades

Even with confirmation, false signals are a reality in trading. The On Neck candlestick pattern can sometimes appear to be forming but then fails to follow through with bearish continuation. Traders should avoid taking trades if:

- The preceding trend is not a clear downtrend.

- The second candle closes significantly above the first candle’s low, invalidating the “on-neck line.”

- There is no confirmation from technical indicators like volume or momentum.

- The pattern forms at a strong support level without a subsequent break, indicating potential reversal.

Always wait for subsequent price action to confirm the pattern’s implications before committing to a trade.

How to trade the On Neck pattern effectively?

Trading the On Neck candlestick pattern effectively requires a structured trading strategy that includes precise entry point, stop loss, and target price management. These elements are crucial for managing risk and maximizing potential profits.

Optimal Entry Points After Confirmation

Identifying optimal entry points after the On Neck candlestick pattern forms and is confirmed is critical for successful trading. A common strategy is to enter a short position after the candle following the On Neck pattern closes below the low of the second candle, confirming the continuation of the downtrend.

Some aggressive traders might enter immediately after the second candle closes, especially if strong confirmation from other indicators is present. Another approach is to wait for a retest of the “on-neck line” as resistance before entering, which provides an additional layer of confirmation. Always make sure your entry aligns with the overall trading strategy.

Crucial Stop Loss Placement for Capital Protection

Proper stop-loss placement reduces potential losses making it a non-negotiable component of any trading strategy. For the On Neck candlestick pattern, a common stop loss placement is just above the high of the second, smaller bullish candle. This level represents where the bearish thesis would be invalidated if the price were to move above it.

Another strategy is to place the stop loss above a nearby resistance level or a key Moving Average. Setting an appropriate stop loss is vital for capital protection, especially given the inherent risks of trading patterns.

Setting Realistic Target Prices: Taking Profit

Setting realistic target prices is essential for taking profits and managing trades effectively. For the On Neck candlestick pattern, potential targets can be identified using various methods:

- Previous Support Levels: Look for prior support levels where the price has reacted in the past.

- Fibonacci Extensions: Use Fibonacci extension levels from a preceding swing to project potential downside targets.

- Measured Move: Project the distance of the initial bearish move before the On Neck pattern downwards from the “on-neck line.”

Traders can also use trailing stops to capture more of a prolonged move. Always consider the risk-reward ratio when setting targets to make sure favorable trading opportunities.

Mastering the Risk-Reward Ratio for Consistent Trading

Mastering the risk-reward ratio is fundamental for consistent profitability in trading, particularly when using patterns like the On Neck candlestick pattern. This ratio compares the potential profit of a trade (target price minus entry price) to its potential loss (entry price minus stop loss).

A favorable risk-reward ratio, typically 1:2 or higher, means you risk one unit to potentially gain two or more units. For example, if you risk $100, you aim to make at least $200. Calculating this ratio before entering a trade makes sure that even if not every trade is a winner, your winning trades compensate for your losing ones, contributing to long-term success.

On Neck vs. In Neck Pattern: A Critical Comparison

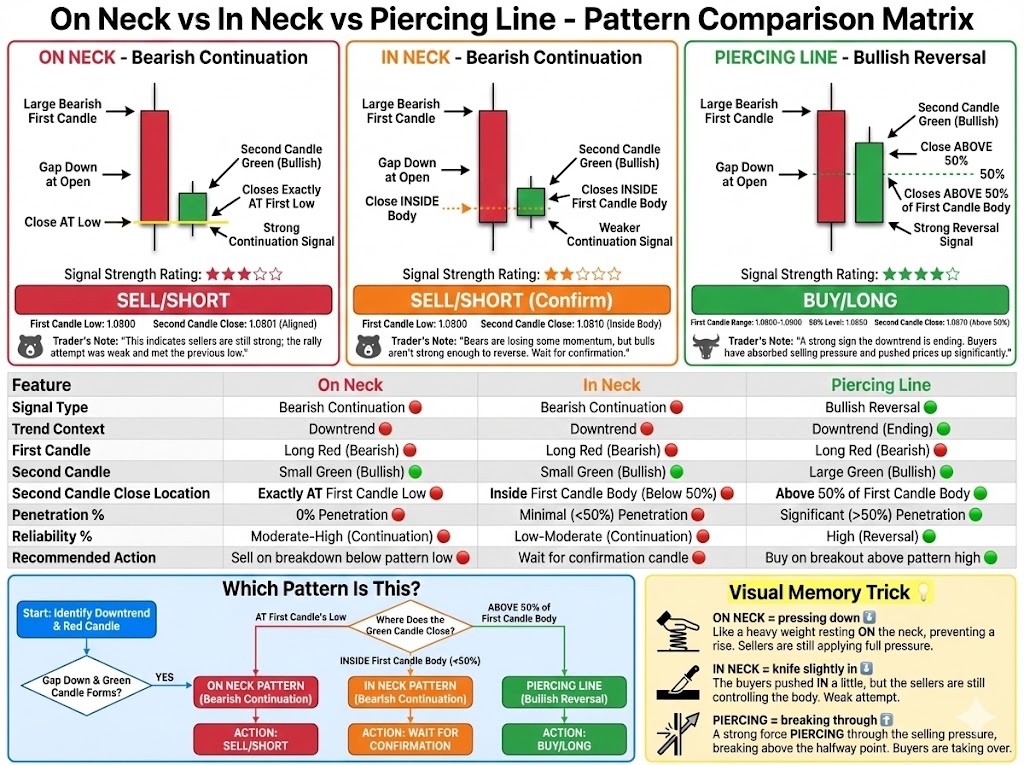

Understanding the nuances between similar candlestick patterns is crucial for accurate interpretation. The On Neck candlestick pattern is often confused with the In Neck and Piercing Line patterns due to their similar two-candle formations. However, key differences in their closing prices and implications distinguish them.

| Pattern | Formation | Implication | Reliability | Best Use |

| On Neck Candlestick Pattern | Long bearish candle, followed by a smaller bullish candle that closes at the low of the first candle. | Bearish continuation (downtrend continues). Bulls failed to push prices above the prior low. | Moderate (requires confirmation) | Confirming existing downtrends for short entries. |

| In Neck Pattern | Long bearish candle, followed by a smaller bullish candle that closes slightly into the body of the first candle. | Bearish continuation, but with a slightly stronger bullish attempt than On Neck. Still favors downtrend. | Moderate (requires confirmation) | Confirming existing downtrends, similar to On Neck but with less conviction. |

| Piercing Line Pattern | Long bearish candle, followed by a long bullish candle that opens lower but closes above the midpoint of the first candle. | Bullish reversal (uptrend likely to begin). Strong buying pressure overcomes prior selling. | High (especially with confirmation and volume) | Signaling potential trend reversals from downtrend to uptrend. |

Beyond the Charts: Psychological Discipline & Quantitative Edge

Successful trading of patterns like the On Neck candlestick pattern requires not just chart knowledge, but also a disciplined mindset and a data-backed understanding of its true reliability. Most competitors focus solely on technical identification and basic trading rules, overlooking the human element and data-driven validation.

Our guide differentiates by integrating psychological aspects of trading and quantitative backtesting insights, which are largely missed by competitors.

The Trader’s Mindset: Overcoming Emotional Biases

Overcoming emotional biases is paramount for consistent trading success, especially when interpreting patterns like the On Neck candlestick pattern. Common psychological pitfalls include:

- Confirmation Bias: Seeing only signals that support a preconceived notion, ignoring contradictory evidence.

- Fear of Missing Out (FOMO): Rushing into trades without proper confirmation, leading to poor entry points.

- Overconfidence: Believing a pattern will work every time, leading to neglecting stop loss orders.

Maintaining discipline, sticking to a predefined trading strategy, and acknowledging the possibility of false signals are crucial for mitigating these biases. Developing a strong trading psychology means accepting losses as part of the game and focusing on long-term consistency over short-term wins.

The Power of Backtesting: Validating Your Strategy

Backtesting is the process of testing a trading strategy using historical data to determine its viability. It helps quantify a pattern’s reliability and refine trading rules, directly addressing the common pain point: “I keep seeing On Neck candlestick patterns, but they don’t always work out.” By backtesting, traders can:

- Determine the historical accuracy rate of the On Neck pattern under different market conditions.

- Optimize entry points, stop loss placements, and target prices.

- Understand the pattern’s performance on various timeframes and assets.

This data-driven approach moves beyond anecdotal evidence, providing objective insights into the pattern’s effectiveness and building confidence in your trading strategy. It’s a critical step in turning theoretical knowledge into practical, validated trading decisions.

Are On Neck Patterns Still Relevant?

The relevance of traditional candlestick patterns like the On Neck candlestick pattern in today’s volatile and algorithm-driven markets is a frequent question among traders. While market dynamics have evolved with increased algorithmic trading and faster information flow, fundamental price action principles remain.

Candlestick patterns, including the On Neck, are still relevant because they represent the basic forces of supply and demand. However, their effectiveness is improved when combined with modern tools and a deeper understanding of market microstructure. Adapting means:

- Prioritizing confirmation from multiple indicators.

- Respecting higher timeframes for stronger signals.

- Integrating risk-reward ratio and proper stop loss management to account for increased volatility.

The patterns themselves are timeless, but their application requires a nuanced and adaptive approach to current market conditions.

Common Pitfalls & Expert Tips for On Neck Pattern Traders

Even experienced traders can fall prey to common mistakes when using patterns like the On Neck candlestick pattern. Recognizing and avoiding these pitfalls, coupled with applying advanced techniques, can significantly improve trading outcomes.

Why On Neck Patterns Fail: Common Mistakes to Avoid

Many beginners struggle with why On Neck candlestick patterns sometimes fail, leading to losses. Common mistakes include:

- Ignoring the Trend: Trading the pattern without confirming a preceding downtrend is a primary cause of false signals. The On Neck is a continuation pattern, not a reversal.

- Lack of Confirmation: Relying solely on the two-candle formation without additional confirmation from volume, Moving Averages, or RSI (Relative Strength Index) significantly reduces its reliability.

- Poor Risk Management: Failing to set a proper stop loss or ignoring the risk-reward ratio can turn a small loss into a substantial one, even if the pattern eventually works.

- Emotional Trading: Allowing fear or greed to dictate entry points or exits, overriding a well-planned trading strategy.

- Misidentification: Confusing the On Neck with similar patterns like the In Neck or Piercing Line, leading to incorrect bearish or bullish biases.

Addressing these common errors is crucial for improving the success rate of On Neck candlestick pattern trades.

Advanced Confirmation Techniques & Filters

To move beyond basic confirmation, traders can employ advanced techniques and filters for the On Neck candlestick pattern:

- Multi-Timeframe Analysis: Confirm the downtrend on a higher timeframe (e.g., daily chart) before looking for the On Neck pattern on a lower timeframe (e.g., 4-hour chart). This provides a stronger contextual bias.

- Momentum Indicators: Beyond RSI (Relative Strength Index), consider Stochastic Oscillators or MACD for confirming bearish momentum or divergence.

- Volume Analysis: Look for specific Volume spikes or divergences. A surge in selling volume on the first candle, followed by lower volume on the second, and then another surge on the confirmation candle, adds conviction.

- Market Structure: Confirm that the pattern is forming within a clear bearish market structure, such as lower highs and lower lows, rather than choppy or consolidating price action.

Combining multiple, non-correlated technical indicators provides a robust filtering mechanism, significantly reducing false signals.

Integrating On Neck into a Broader Trading Strategy

The On Neck candlestick pattern should never be a standalone signal but rather an integral part of a broader trading strategy. This involves:

- Defining Your Trading Plan: Clearly outline your entry criteria, stop loss placement, target price calculation, and risk-reward ratio for every trade.

- Portfolio Management: Consider how the On Neck pattern fits within your overall portfolio. Avoid over-leveraging or concentrating too much capital on a single pattern.

- Combining with Other Tools: Integrate the On Neck pattern with other forms of technical analysis, such as chart patterns (e.g., head and shoulders), trend lines, or fundamental analysis, for a more comprehensive view.

- Continuous Learning: Markets evolve. Regularly review your trading strategy, backtesting results, and adapt to new market conditions.

By integrating the On Neck pattern into a well-defined and robust trading strategy, traders can leverage its insights more effectively while managing inherent risks.

BOTTOM LINE

The On Neck candlestick pattern serves as a vital bearish continuation signal for traders, appearing during established downtrends. It is characterized by a long bearish candle followed by a smaller bullish candle that closes at the low of the first, forming an “on-neck line.”

While it suggests a temporary pause, it ultimately indicates the likely resumption of the downward price movement. Effective trading requires a meticulous approach to identification, rigorous confirmation with technical indicators like volume and Moving Averages, and a disciplined trading strategy encompassing precise entry point, stop loss, and target price management.

Incorporating psychology of trading and backtesting further refines its application, allowing traders to navigate market conditions with greater confidence and reduce false signals.