Trading platforms are like an online shop where traders buy and sell currency and share valuable assets.

From countless online platforms, finding the right one can make your trading journey smoother.

To trade safely, traders require a good trading platform. In this article, I will discuss the best stock trading platforms in Europe so that you can select one easily for your trading journey.

What is a Trading Platform?

A trading platform is a mobile application that enables individuals to trade in financial markets. It gives real-time price updates and tools.

As a result, traders can buy and sell assets quickly after noticing the updates.

Through a trading platform, people can trade valuable assets like foreign currencies, stocks, gold, oil, and cryptocurrencies.

The platform also shows price charts and basic tools. As a result, traders can understand the market, place trades, and manage their investment safely.

Why Is a Trading Platform Important?

A trading platform is crucial for various reasons. First of all, it is the path to enter into the financial arena.

Then, traders can maintain financial things, sample work, and can gain the access to tools that are needed to analyze the critical data.

Secondly, the investors can keep connection to the global markets from any place. Thirdly, it provides real-time data.

Fourthly, comprehensive tools are available to the investors. Finally, trading platforms are cost-effective.

Best Stock Trading Platforms In Europe

Choosing a trading platform is hard, especially if you’re just starting. Who can you trust with investing your money? How to avoid expensive fees and how to choose the best trading platforms to make your Investments worth it.

I will guide you through how to choose the best trading platforms in Europe. Firstly, prioritize safety.

Keep in mind that investing is a long-term game. So, it’s best to choose a provider that you can trust as the years go by.

Volity.io। Best Overall Choice For All

Volity.io is one of the best European stock trading platforms for investors. Because it provides fast execution. This is such a platform that cooperates with MetaTrader 4 and MetaTrader 5.

So, you can use it without any worries. As this platform is in fast, it’s easy to use in all devices. At the time of trading in higher volume, you will be able to gain cashback and rewards for your performance.

In other platforms, we notice that the investors can not enter into various markets from a single place. But we provide you this advantage.

You can get access to multiple markets such as crypto, forex, and CFDs. Besides, we provide you mobile app which is very easy to use.

We have given you such tools that will increase the speed of your work. One thing keep in mind is that Volity.io is not available if you stay in the U.S or the UK.

Overall, you will get the best trading experience from us.

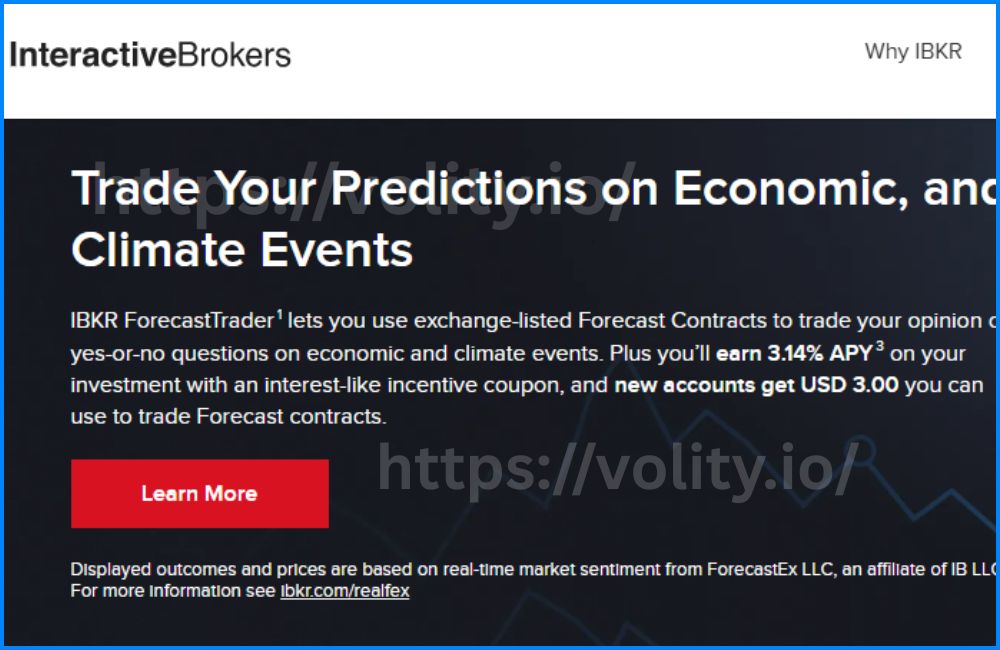

Interactive Brokers Review

The Minimum deposit is €0, and the FX conversion fee is 0.002%. They have some regulations, which are FCA, CBI, IIROC, AFSL, SFC, SEBI, MAS, MNB, FINRA, SEC, SIPC, and CFTC. This platform was established in 1978.

It was openly traded on NASDAQ. Interactive Brokers is one of the most well-known platforms for stock trading in Europe.€1.25 This is one of the popular choices for investors.

The fees and trading costs are quite ultra from other platforms. For example, U.S. stocks require $0.005 per share with a minimum $0.35 per trade commission.

For European ETFs, the trade value is 0.05%. The minimum commission is €1.25, and the cap is €29. Currency exchange is very low on this platform which attracts the investors especially.

Interactive Brokers Ireland Limited, which is overseen by the Central Bank of Ireland, is responsible for onboarding European clients.

Under relevant investor compensation plans, client funds and assets are protected up to €20,000.

Furthermore, Interactive Brokers uses sophisticated risk controls and stringent asset segregation, offering a high degree of protection even in times of market volatility.

It is exceptionally low fees for US stocks. Investors get unrivaled access to international instruments and markets. For practice, you can create a free sample account. It is a reputable and long-standing broker.

Good instructional materials and market analysis are done by this. You will get an easy-to-use smartphone application and Interest is paid on idle cash holdings.

As though it’s entirely online, setting up an account may seem complicated and time-consuming.

The learning curve of the platform might be too much for new investors. The navigation on websites is not very user-friendly.

In other words, it can be an excellent option for European investors due to it’s flexible features.

Trade Republic Overview

Trade Republic is a reasonable priced online dealer from Berlin Germany, began in 2015.It’s activities are authorized by BaFin, the German budgetary control that forms it as a secured and faith-able stage.

You can finance in 5 primary strong points such as Bonds, Cryptocurrencies, ETFs, Stocks, Derivatives.

Zero Euro can be initial deposit, Trade Republic insists to be free of cost although one Euro costs per deal in surface level (excluding funding plans). Consequently, trading at one time will be cost two Euro entirely.

Costing this less amount, however it is lower in price comparing other long-established dealers.

Trade Republic pays interest 2 in percentage in an annual way on that money which is not funded in your account.

Interest is paid as monthly based and this was a revolutionary stand as European banks paid at minor level in earlier

Trade Republic also offers cards to consume money. For example Virtual Cards are free of cost, Classic cards cost 5 Euro and Mirror cards cost 50 Euro.

Withdrawing money from an ATM is costly but above hundred Euro withdrawal is free of cost. The genuine market’s rate of exchange is used, if you fund money in another currency (excluding additional markup)

There is a great attraction for beginners as Trade Republic is the introductory European dealer that commands the consumers fund in government and Corporate bonds beginning from only one euro and from start to finish it will be divisible funding.

Benefits

Automated economy plans, rate of interest can be gained on unused money, initial finding begins at only less than one euro, without finding it can be begun, simple and straightforward ways for secured plans .

One euro is a permanent cost for each deal, without showing any account, just EUR is accepted, Straight trading on U.S. stock exchange is not done.

Trade Republic is a strong and easy to use stage for prolonged dealers who are interested in less cost, suitable funding’s and rate of interest on static cash. Although it creates a great value, it is not totally free of cost.

XTB Broker। Best Crypto Trading Platforms in Europe

XTB is a well-known European broker that started in 2002 and is listed on the Warsaw Stock Exchange, and when you use it, you can start investing with no minimum deposit at all.

You trade through the xStation 5 platform or the mobile app, where you can invest in stocks, ETFs, Forex, indices, commodities, and cryptocurrencies. For stocks and ETFs up to €100,000 per month, you receive 0% commission; after that, you pay a nominal 0.2% cost with a €10 minimum.

If you’re a newbie, you can utilize the demo account for practicing. You can discover how everything operates. You can also gain the access of learning resources that simplify the process.

If you have some prior experience, you can improve your trade planning by using analytical tools.

XTB also gives interest on your uninvested cash and provides you an eWallet with a multi-currency card so that you can make payments without maintenance fees.

On the other hand, the platform looks like a bit complex. At first, the product range is not very broad.

Secondly, withdrawals under €100 have fees. And you need to pay €10 per month if your account stays inactive for over a year with no recent deposits.

Thirdly, you need to know that XTB still focuses a lot on CFDs, which might be risky and may not suit permanent for buy-and-hold investors.

Lightyear Overview

Lightyear is a simple and modern investment platform. If you want to invest in your first project, you may go with this.

For opening an account, you only need €1. At the time of trading in another currency, you must pay a 0.35% currency conversion fee.

This platform is reliable. Because it is run by the Estonian Financial Supervision Authority. Besides, your funds will be protected up to €20,000.

You do not need to provide any execution fees when you trade ETFs. Besides, stock trades cost no more than €1 per order.

You can reduce currency fees by using the multi-currency account in euros, pounds, or U.S. dollars.

You will be able to earn strong interest on uninvested cash, with competitive rates for EUR, USD, and GBP and can see it as beginner-friendly. Because you can purchase fractional shares and will be able to use a clean, easy app. ,

You can reach more than 5,000 stocks from U.S., UK, European, and Asian markets. At the same time, there are some limits in this platform.

As you do not trade options, commodities, or Forex, you will not have any demo account.

Trading 212। Best Online Trading Platforms in Europe

Trading 212 is a London-based investment platform. It started in 2006. Upto 5 million users are available on this platform.

When you use Trading 212, you can invest in over 10,000 stocks and ETFs. As well as, you can also trade CFDs on stocks, ETFs, indices, forex, commodities, and even in cryptocurrencies.

You must require a minimum deposit of €10 to get started. Making an account is quick and easy.

You can select between three account types. They are Invest for commission-free stocks and ETFs, CFD for leveraged trading, and Crypto for digital assets.

You can pay no commission on stock and ETF trades. But there is a small 0.15% fee when you exchange currencies in the Invest account while the CFD account charges 0.50%.

You can also purchase fractional shares and prepare automatic investing using AutoInvest.

Trading 212 does not provide bonds or options which may limit your choices.

There are no charges for bank deposits and withdrawals. Card payments are also supported. If you use the Trading 212 debit card, you pay no currency conversion fees on purchases. You will earn 0.5% cashback, up to €23 per month.

CySEC, ASIC, FCA, and BaFin run this platform which increases a strong level of trust.

You also receive a free fractional share worth up to €100 at the time of signing up with a promo code. Then, you will be able to gain interest on uninvested cash.

DEGIRO Overview

DEGIRO is a simple and low-cost platform that works well if you want to keep your trading fees low.

You do not require a minimum deposit. There are no fees for inactivity, deposits, or withdrawals.

Provide a 0.25% currency conversion fee, and trading costs are higher than some newer platforms, such as €1 for U.S. stocks, from €3.90 for European stocks, up to €2 for ETFs, and 0.50% per crypto trade.

You also see a €1 handling fee on most trades and a €2.50 yearly connectivity fee per exchange.

You can finance stocks, ETFs, funds, crypto, bonds, futures, options, and warrants. Besides, you can trade in pre-market and after-hours sessions.

You see the web and mobile platforms are easy to use, modern, and regularly updated, with useful features like favorites and portfolio news.

You will love the broad range of products and learning tools. Maybe, you will not be happy with the poor customer support and also the currency conversion fee.

Frankly, you will not be able to generate interest on unused cash.

In conclusion, it can be said that these are the best stock trading platforms in Europe where you may choose to invest in your dream project.

If you are a beginner, you can select Volity.io. Because this is very affordable for newbies. Overall, it will be the best choice if you stay in Europe.