This distinction profoundly impacts a trader’s risk exposure, capital requirements, and regulatory landscape. Understanding these fundamental divergences allows traders to align their strategies with specific market conditions and personal investment goals.

While understanding Crypto Spot and CFD is important, applying that knowledge is where the real growth happens. Create Your Free Crypto Trading Account to practice with a free demo account and put your strategy to the test.

What Is the Main Difference Between Crypto Spot and CFD?

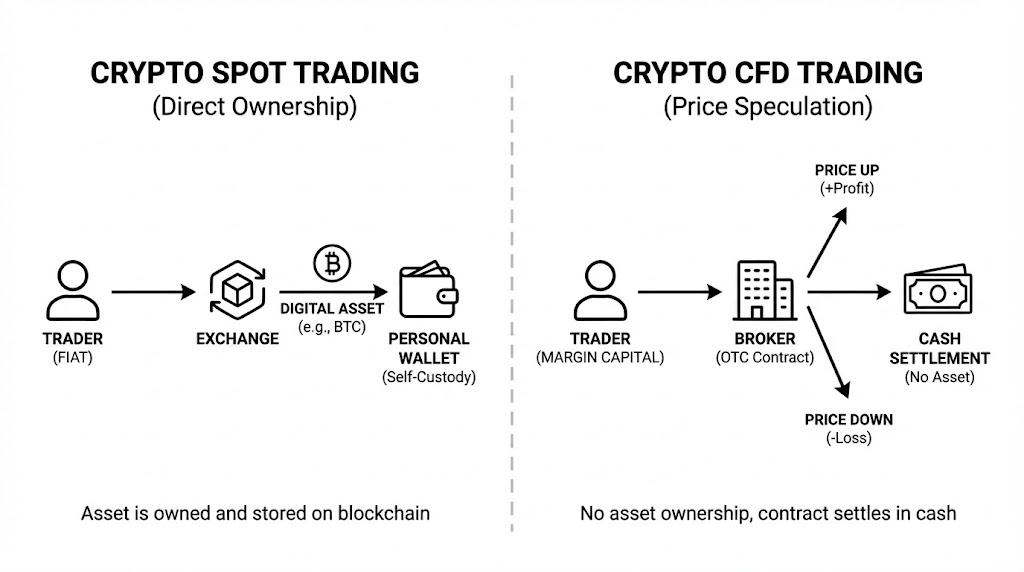

The fundamental difference centers on asset ownership and the instrument’s nature. Spot trading provides direct ownership of cryptocurrencies like Bitcoin or Ethereum. Traders acquire these digital assets and hold them in a personal wallet, interacting directly with the blockchain.

Conversely, Crypto CFD trading involves a derivative contract. This contract allows speculation on the price movement of an underlying cryptocurrency without ever owning the actual asset. The agreement is made directly between a trader and a broker, representing an Over-The-Counter (OTC) transaction.

This core distinction affects several operational aspects. Spot traders manage their own digital assets, bearing responsibility for wallet security. CFD traders manage a contract, eliminating the need for crypto wallets and blockchain interactions. Each method provides unique advantages and disadvantages, catering to different trading objectives.

Mechanics of Crypto Spot Trading

Crypto Spot trading functions similarly to traditional stock or commodity markets. Traders purchase cryptocurrencies at their current market price and take direct possession of the assets. This process involves a direct transfer of digital assets from a seller to a buyer.

Asset Ownership and Blockchain Interaction

Direct asset ownership defines Spot trading. When a trader executes a Spot purchase, they acquire the actual cryptocurrency tokens. These tokens are recorded on their respective blockchain, confirming the transaction and ownership change. This interaction with the blockchain is transparent and immutable.

Ownership provides full control over the asset. Traders can move their cryptocurrency to a personal hardware wallet for enhanced security. They can also use it for purchases, staking, or other decentralized finance (DeFi) activities. This direct control is a significant appeal for long-term investors.

Wallet Management and Security Keys

Managing digital assets necessitates a crypto wallet. Wallets are software or hardware devices that store the private keys required to access and control cryptocurrencies. Common types include hot wallets (connected to the internet) and cold wallets (offline hardware devices).

Security becomes a direct responsibility for the Spot trader. Safeguarding private keys against theft or loss is paramount. The industry recommends robust practices like two-factor authentication (2FA) and cold storage for substantial holdings. Bitcoin, for instance, has seen over 20% of its total supply lost due to forgotten or compromised keys.

Ready to Elevate Your Trading?

You have the information. Now, get the platform. Join thousands of successful traders who use Volity for its powerful tools, fast execution, and dedicated support.

Create Your Account in Under 3 MinutesMechanics of Crypto CFD Trading

Crypto CFD trading offers an alternative to direct asset ownership. It involves a financial derivative that allows traders to speculate on cryptocurrency price movements. This happens without buying or selling the actual underlying asset.

Derivative Contract Structure and Counterparties

A CFD is a contract between two parties: the trader and the broker. This agreement stipulates that the difference in the cryptocurrency’s price between the contract’s opening and closing will be exchanged. The trader never owns the Bitcoin, Ethereum, or other crypto directly. This OTC structure means the broker acts as the market maker.

CFD contracts are flexible, enabling traders to profit from both rising and falling markets. A trader predicts whether the price will increase (going long) or decrease (going short). The contract settles in cash, reflecting the price difference at closure.

Leverage and Margin Requirements

A key feature of Crypto CFD trading is the availability of leverage. Leverage allows traders to control a larger position with a smaller amount of capital. Brokers offer leverage ratios ranging from 2:1 to 100:1, depending on the asset and regulatory jurisdiction. For example, a 50:1 leverage ratio means a trader can control a $5,000 position with just $100 of their own capital.

Leverage amplifies both potential profits and potential losses. To open a leveraged position, traders must deposit a ‘margin’ with their broker. This margin acts as collateral. If market movements are unfavorable, the broker may issue a margin call, requiring additional funds to maintain the position.

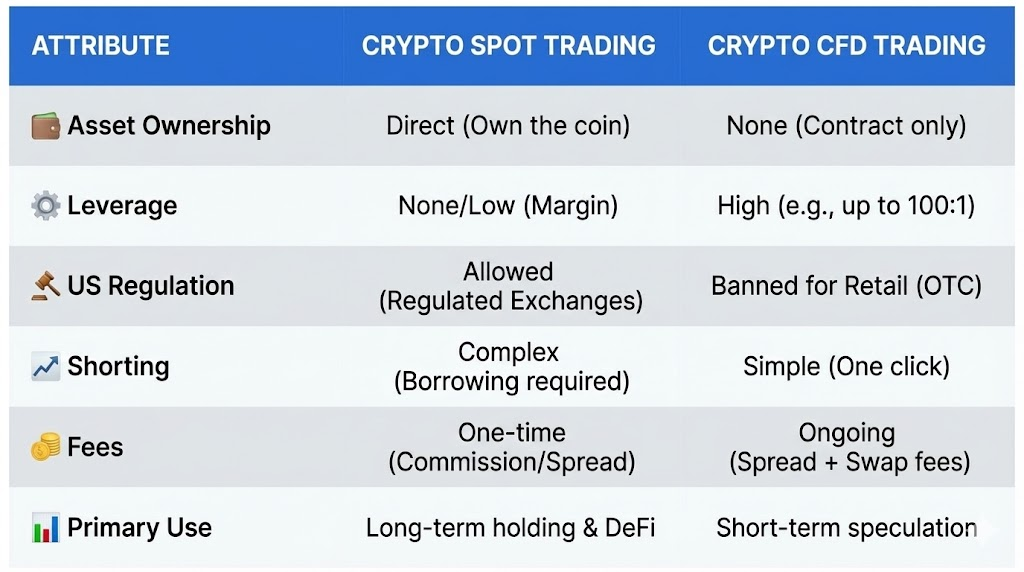

Comparative Analysis: Spot vs. CFD Attributes

Spot and CFD trading present distinct attributes that appeal to different trading strategies. Understanding these comparisons is crucial for informed decision-making. Key areas include profit potential, fee structures, and execution speed.

Profit Potential in Bull vs. Bear Markets (Long vs. Short)

Spot trading primarily benefits from rising prices in a bull market. Traders buy low and sell high, capitalizing on upward price movements. While shorting is possible in Spot markets via margin trading, it often involves borrowing assets and higher complexity. The primary profit mechanism for Spot traders is asset appreciation.

CFD trading offers simpler mechanisms for both bull and bear markets. Traders can ‘go long’ (buy) if they expect a price increase. They can ‘go short’ (sell) if they expect a price decrease. This inherent flexibility allows CFDs to be easily used in volatile or declining markets. This reduces complexity for short selling compared to Spot.

Fee Structures: Spreads, Commissions, and Overnight Swaps

Fee structures vary significantly between the two methods. Spot trading typically involves a one-time transaction fee or commission charged by the exchange. This fee is incurred when buying or selling the cryptocurrency. Some exchanges also charge withdrawal fees when moving assets to a personal wallet.

CFD trading usually involves a different set of costs. These often include a spread, which is the difference between the bid and ask price. Additionally, overnight swap fees apply for positions held open beyond a single trading day. This can significantly increase the cost of long-term CFD positions.

Liquidity and Execution Speed

Liquidity refers to how easily an asset can be bought or sold without impacting its price. Both Spot and CFD crypto markets offer high liquidity for major cryptocurrencies. Execution speed can differ based on the platform and underlying technology.

Spot trading involves actual blockchain transactions, which have varying confirmation times depending on network congestion. While exchange matching is instant, moving assets off-exchange takes time. CFD trades, being OTC contracts, do not involve blockchain interaction. This can lead to theoretically faster execution speeds directly through the broker’s system. However, this also introduces counterparty risk with the broker.

Regulatory Constraints and Regional Availability

Regulatory environments profoundly impact the availability and legality of both Spot and CFD crypto trading. Jurisdictions adopt different approaches to protect investors and maintain financial stability. This creates significant variations globally.

Why Are Crypto CFDs Banned in the US?

Crypto CFDs are banned for retail investors in the United States. This restriction stems from US regulatory frameworks, particularly those enforced by the Commodity Futures Trading Commission (CFTC). The CFTC classifies CFDs as off-exchange retail commodity transactions.

US law dictates that retail commodity transactions must occur on regulated exchanges. CFDs, being Over-The-Counter (OTC) products, bypass these regulated exchanges. This lack of centralized oversight raises concerns about consumer protection, price manipulation, and transparency for US regulators. The Dodd-Frank Act, enacted in 2010, reinforces these regulations.

Retail investors in the US can trade regulated crypto futures contracts on exchanges like the Chicago Mercantile Exchange (CME). However, direct retail access to crypto CFDs is prohibited. This legal stance aims to mitigate risks associated with unregulated derivatives. It protects retail investors from potential broker insolvency or unfair trading practices.

| Attribute | Crypto Spot | Crypto CFD |

| Ownership | Direct ownership of the actual asset | No asset ownership; derivative contract |

| Leverage | Generally none, or limited via margin trading | Available, often 2:1 to 100:1 |

| Regulation (US) | Generally allowed | Banned for retail investors |

| Shorting | Possible via margin accounts (more complex) | Easily accessible |

| Fee Structure | One-time transaction fees or commissions | Spreads and ongoing overnight swap fees |

| Risk | Market volatility, wallet security | Market volatility, leverage amplification, margin calls, counterparty risk |

Turn Knowledge into Profit

You've done the reading, now it's time to act. The best way to learn is by doing. Open a free, no-risk demo account and practice your strategy with virtual funds today.

Open a Free Demo AccountChoosing Between Spot and CFD Based on Trading Goals

The decision between Crypto Spot and CFD trading depends significantly on individual trading goals, risk tolerance, and investment horizon. Each method caters to distinct strategies and preferences.

Traders prioritizing direct asset ownership, long-term holding, and self-custody typically opt for Spot trading. This approach provides true decentralization and the ability to use cryptocurrencies within the broader DeFi ecosystem. It involves managing wallets and understanding blockchain mechanics.

CFD trading attracts traders focused on short-term price speculation and leveraging capital. The ability to easily short the market and use significant leverage appeals to those seeking amplified returns. However, this also comes with amplified risks, including margin calls and overnight swap fees.

Consider your primary objective: do you wish to own the digital asset itself, or simply speculate on its price movements? Your answer guides the appropriate trading vehicle. Regulatory considerations, especially for US residents, also play a critical role in this choice.

Bottom Line

The choice between Crypto Spot and CFD trading is essentially a choice between long-term security and short-term agility. For the investor who values financial sovereignty, Spot trading offers the undeniable peace of mind that comes with direct asset ownership and self-custody. Meanwhile, CFDs serve as a high-octane tool for seasoned speculators, providing the leverage and two-way market access needed to capitalize on volatility without the technical overhead of wallets. Ultimately, in 2025’s sophisticated market, success lies in matching the right instrument to your personal risk profile and local regulatory boundaries.

Key Takeaways

- Ownership vs Speculation: Spot trading grants you full ownership of the digital coins, while CFDs are purely for betting on price movement.

- Leverage Dynamics: CFDs offer high leverage (up to 100:1), which can amplify profits but also accelerate total capital loss.

- Regulatory Barriers: Retail CFDs remain illegal in the United States due to CFTC protections against unregulated OTC trading.

- Fee Impact: Spot trading is cost-efficient for long-term holding, whereas CFDs incur daily swap fees that can erode profits over time.